ATM Market Size, Share, Growth Analysis Report, 2032

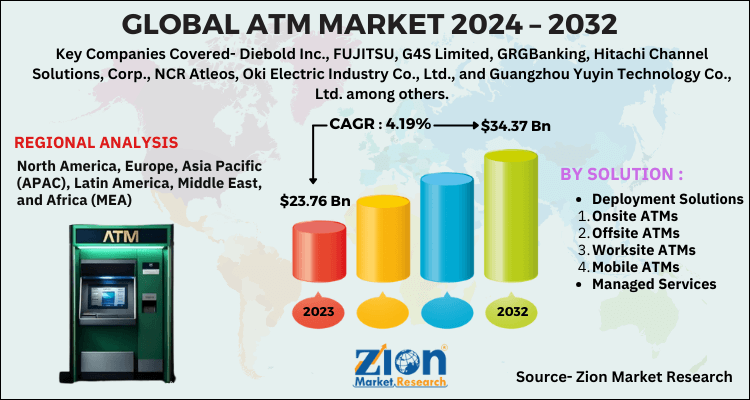

ATM Market By Solution (Deployment Solutions [Onsite ATMs, Offsite ATMs, Worksite ATMs, Mobile ATMs] and Managed Services), and BY Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

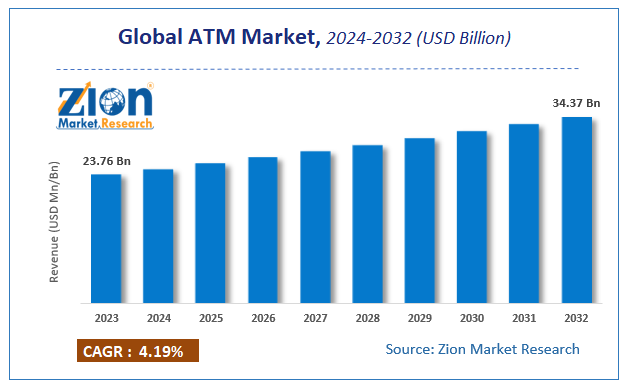

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 23.76 Billion | USD 34.37 Billion | 4.19% | 2023 |

ATM Market Insights

According to a report from Zion Market Research, the global ATM Market was valued at USD 23.76 Billion in 2023 and is projected to hit USD 34.37 Billion by 2032, with a compound annual growth rate (CAGR) of 4.19% during the forecast period 2024-2032.

This report explores market strengths, weaknesses, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and future prospects that may emerge in the ATM Market industry over the next decade.

ATM Market: Overview

The increasing demand for automation within the banking sector in numerous developing and developed countries is boosting the ATM market progress. The worldwide banking sector has observed quite a few high-tech developments over the last decade. It's observing mounting security threats, regulatory requirements, and changing consumer demands. The machine provides a chance for banks to travel for cost-effective and competent models. With the coming of those machines, banks can serve a decent customer base even outside the banking institute. These cards help to exchange hassles of bank transactions, paper-based validations, bank hour constraints, and private attendance of consumers, providing enhanced banking experience for patrons also as bankers. They permit banks to succeed in customers at a lower initial and transaction cost, leading to higher adoption of these machines.

Improved security mechanisms, like fingerprints, biometrics, and two-factor authentication services, to stop fraudulent communications are being executed to supply a further layer of security to individuals. Banks are introducing new security measures for verifying whether the physical card may be fake or duplicate. For instance, in January 2019, the Federal Reserve Bank of India mandated banks to upgrade their older magstripe cards to EMV chip cards as they provided improved authentication, avoiding scams/fraudulent doings. Banks also specialize in developing additional security measures, like intelligent anti-ATM skimming devices, that help to watch the system for illegally mounted intrusion mechanisms and help in safeguarding card & PIN data theft.

Increasing digitization in emerging countries may unfavorably affect the ATM market revenue within the coming years. The evolution of digital payment solutions, like mobile banking & online and digital wallets & Bitcoin transactions, is being seen within the payment industry. Consumers are increasingly preferring online banking networks as they supply convenient, fast, and secure transactions. The growing inclination toward mobile payments and therefore the adoption of online channels may change the competitive landscape across various regions, challenging industry growth. Stringent government regulations to mandate the hardware & software upgrades for security purposes in these machines may result in high maintenance costs for operators.

COVID-19 Impact Analysis

The COVID-19 pandemic has resulted in the imposition of social distancing measures that have limited the movement of persons. Also, the increasing consumer demand for cash has compelled many banks to launch mobile ATMs to satisfy the banking needs of consumers.

For instance, in March 2020, the Indian Bank launched a mobile ATM initiative in India (Chennai) to assist people who were facing difficulties in withdrawing money thanks to the COVID-19 outbreak. Such initiatives are driving the expansion of the worldwide ATM market during the forecast period.

ATM Market: Growth Factors

Changing lifestyles and high standards of individuals are the major factors boosting the expansion of the worldwide ATM market. The introduction of niche sorts of ATMs like solar ATMs and smart ATMs within the emerging markets is additionally another key factor boosting the expansion of the worldwide ATM market. Moreover, innovations within ATM technology also are influencing the expansion of the market due to the increasing demand from consumers.

Furthermore, advantages provided by ATM cards like no hassles of bank transactions, banking hour constraints, personal attendance of the purchasers, and paper-based validations are additionally attributed to the increasing demand for ATMs by consumers. On the other hand, a number of the main risks related to ATMs like online fraud, thefts, connectivity, and operational issues may hamper the expansion of the worldwide ATM market to some extent.

ATM Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | ATM Market |

| Market Size in 2023 | USD 23.76 Billion |

| Market Forecast in 2032 | USD 34.37 Billion |

| Growth Rate | CAGR of 4.19% |

| Number of Pages | 210 |

| Key Companies Covered | Diebold Inc., FUJITSU, G4S Limited, GRGBanking, Hitachi Channel Solutions, Corp., NCR Atleos, Oki Electric Industry Co., Ltd., and Guangzhou Yuyin Technology Co., Ltd. among others |

| Segments Covered | By Solution and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

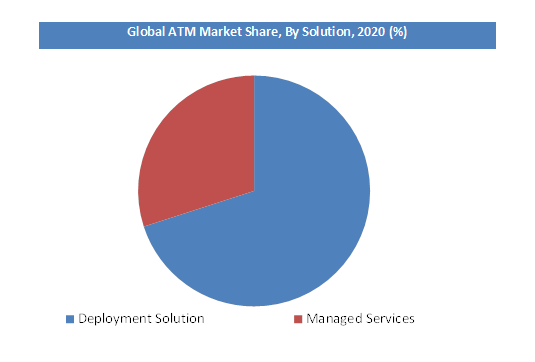

ATM Market: Segmentation Analysis

Deployment solutions will witness a growth of more than 5% over the forecast timespan. Onsite ATMs are being widely deployed in bank premises to help customers avoid long queues for deposits, cash transfers, and withdrawals. They provide advantages like the flexibility of money withdrawals & deposits, privacy in quicker, transactions, and efficient services.

These ATMs reduce the frequency of errors, helping banks in making smooth financial transactions. The evolving banking infrastructure and increasing installation of onsite systems to reinforce customer satisfaction will provide several growth opportunities to the market.

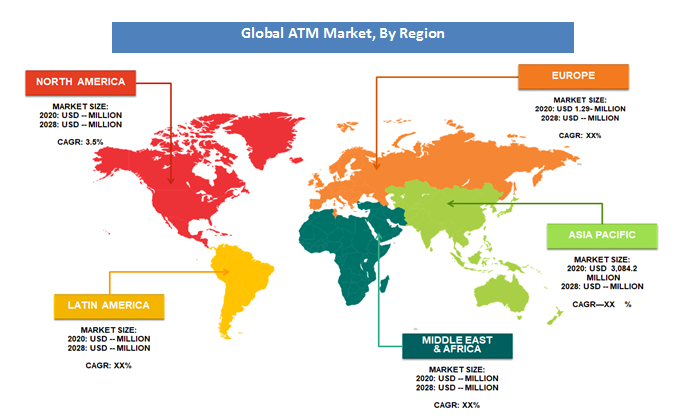

ATM Market: Regional Analysis

Asia-Pacific region is anticipated to witness the highest growth owing to new technological advancements in ATMs. Singapore is one of the Asian countries that offer smart gold ATMs dispensing gold bars, coins, and ingots. In addition, North America is the biggest market for ATMs, followed by Europe.

ATM Market: Competitive Analysis

Some of the major players in the global ATM market include:

- Diebold Inc.

- FUJITSU

- G4S Limited

- GRGBanking

- Hitachi Channel Solutions, Corp.

- NCR Atleos

- Oki Electric Industry Co., Ltd.

- Guangzhou Yuyin Technology Co., Ltd.

The global ATM Market is segmented as follows:

By Solution

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Worksite ATMs

- Mobile ATMs

- Managed Services

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global ATM market size was worth around USD 23.76 billion in 2023 and is expected to reach USD 34.37 billion by 2032.

The global ATM market is expected to grow at a CAGR of 4.19% during the forecast period.

Changing lifestyles and high standard of people is the major factor boosting the growth of the global ATM market.

Asia Pacific region is expected to dominate the ATM market over the forecast period.

Some major players dominating the global ATM market are Diebold Inc., FUJITSU, G4S Limited, GRGBanking, Hitachi Channel Solutions, Corp., NCR Atleos, Oki Electric Industry Co., Ltd., and Guangzhou Yuyin Technology Co., Ltd..

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed