Mobile Payments Market Size, Share, Trends, Growth and Forecast 2034

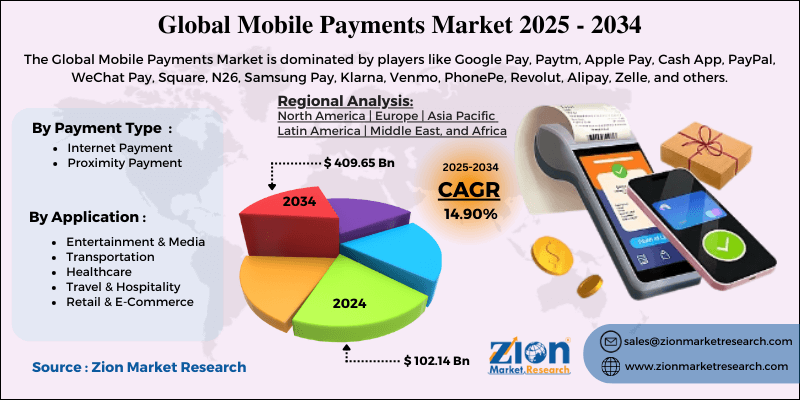

Mobile Payments Market By Payment Type (Internet Payment and Proximity Payment), By Application (Entertainment & Media, Transportation, Healthcare, Travel & Hospitality, and Retail & E-Commerce), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

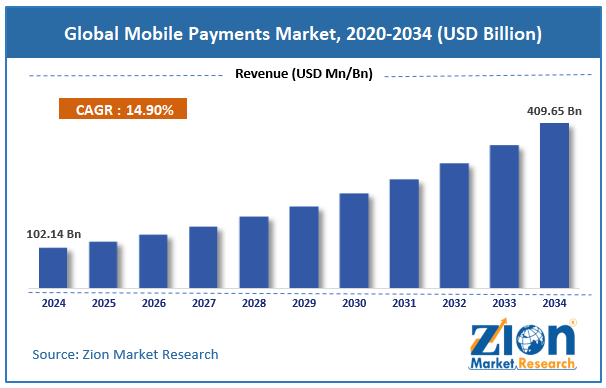

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 102.14 Billion | USD 409.65 Billion | 14.90% | 2024 |

Mobile Payments Industry Perspective:

The global mobile payments market size was worth around USD 102.14 billion in 2024 and is predicted to grow to around USD 409.65 billion by 2034, with a compound annual growth rate (CAGR) of roughly 14.90% between 2025 and 2034.

Mobile Payments Market: Overview

Mobile payments refer to the transfer of monetary funds using a mobile device such as a tablet or a smartphone. It typically deals with a person making mobile payments to a business or a merchant for the sale of goods, services, groceries, food, accommodation, and other services. The payment tools can be of different types, such as digital wallets, applications, or mobile browsers. According to industry research, mobile payments are a part of the broader mobile financial services (MFS) available to the common man, including mobile banking, credit/lending, and investment products. Mobile payments can be recorded between a person-to-person, business-to-consumer, business-to-business, or consumer-to-business. The industry is currently categorized into two main types: remote payments and proximity payments. Remote payments are not affected by the location of the sender or receiver.

However, in proximity payments, the merchant's point of sale (POS) and the customer’s mobile device are in the same location and close proximity to each other. Mobile payments often employ the use of quick response (QR) codes or near-field communication (NFC). During the forecast period, demand for mobile payments is expected to continue growing with rising consumer awareness about the benefits of digital payments. Moreover, increasing the launch of new and secure mobile payment applications or tools will facilitate higher revenue within the industry during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global mobile payments market is estimated to grow annually at a CAGR of around 14.90% over the forecast period (2025-2034)

- In terms of revenue, the global mobile payments market size was valued at around USD 102.14 billion in 2024 and is projected to reach USD 409.65 billion by 2034.

- The mobile payments market is projected to grow at a significant rate due to the increased use of mobile consumer electronics and access to reliable internet connections.

- Based on the payment type, the Internet payment segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the retail & e-commerce segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Mobile Payments Market: Growth Drivers

How does increased use of mobile consumer electronics and access to a reliable internet connection fuel the mobile payments market revenue?

The global mobile payments market is expected to be driven by the rising use of mobile consumer electronics worldwide. According to the latest statistics, more than 5 billion people worldwide have access to smartphones. In addition to this, digital literacy worldwide has been improving at a steady pace, irrespective of age groups. The growing access to reliable and stable internet connections, driven by increased investments in telecommunication infrastructure, is contributing to higher use of mobile devices such as smartphones. In May 2025, reports emerged suggesting that Africa’s telecommunication companies, South Africa’s MTN Group and Airtel Africa Plc, are seeking expansion opportunities in Zambia, Congo-Brazzaville, and Rwanda. Such expansion strategies by telecommunication companies can create a higher growth scope for mobile payment companies worldwide.

Furthermore, modern wearables are equipped to handle several tasks, such as facilitating mobile payments. As the number of mobile consumer electronics users grows worldwide, the mobile payments industry can expect higher revenue.

Surge in consumer awareness and the benefits of mobile payments to attract more revenue in the industry

Mobile payments offer several benefits to customers as well as businesses. The majority of the advantages associated with mobile payments are related to higher cost-effectiveness, improved security, and enhanced convenience. Businesses can better streamline transactions by accepting mobile payments as the money transfer medium reduces the need to secure cash.

Moreover, awareness regarding several aspects of mobile payments has improved in the last few years. The global mobile payments industry is experiencing increased acceptance in person-to-person (P2P) transactions worldwide. Market players must focus on improving services to ensure improved revenue in the coming years.

Mobile Payments Market: Restraints

Will growing privacy concerns and security threats limit the mobile payments market expansion in the long run?

The global mobile payments industry is expected to be restricted due to the rising privacy concerns associated with the use of digital wallets. The increasing rate of cybercrime and data breaches has created doubts among potential users of mobile payments. According to the latest reports, more than 300 individual hacking incidents have been reported in the cryptocurrency industry, resulting in USD 2 billion in losses for the market. In addition to this, mobile payment applications store the confidential personal information of the users. Security threats can jeopardize user privacy, further restricting the market adoption rate.

Mobile Payments Market: Opportunities

Does the increasing launch of new and improved payment gateways generate growth opportunities for the mobile payments industry?

The global mobile payments market is expected to generate growth opportunities due to the increasing launch of novel payment gateways with enhanced features. In May 2025, Apple, one of the world’s leading technology companies and producers of consumer electronics, announced the launch of the Tap to Pay on iPhone feature in 8 more European nations. The new attribute allows merchants to leverage an iPhone for accepting in-person contactless payments and was launched in Croatia, Belgium, Cyprus, Denmark, Greece, Iceland, Malta, and Luxembourg. The merchants will not require any additional payment terminal or hardware, improving the smoothness of the transactions.

In May 2025, Paytm, an Indian fintech company, announced the launch of India’s first Paytm NFC Card Soundbox™. It is a next-generation device that works as a combination of QR payments and NFC technology. The device will facilitate access to affordable card payment devices.

In May 2025, Samsung Wallet launched Visa Tap technology in the US market, simplifying peer-to-peer payments. The company has also launched a Visa Direct money movement solution. Customers in the US using Samsung Wallet can now tap their card on a device with an NFC feature and make contactless payments. Market players are also focusing on improving the security of digital wallets to mitigate concerns related to cyber threats.

Mobile Payments Market: Challenges

Regulatory complexities and limited digital literacy challenge market growth

The global mobile payments industry is expected to be challenged by the presence of a complex regulatory environment worldwide. Regional legal frameworks concerning the use of mobile payment tools and their features continue to evolve, making it difficult for industry players to conduct smooth operations. Moreover, limited digital literacy in some parts of the world, especially remote areas, may further challenge market expansion in the long run.

Mobile Payments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mobile Payments Market |

| Market Size in 2024 | USD 102.14 Billion |

| Market Forecast in 2034 | USD 409.65 Billion |

| Growth Rate | CAGR of 14.90% |

| Number of Pages | 213 |

| Key Companies Covered | Google Pay, Paytm, Apple Pay, Cash App, PayPal, WeChat Pay, Square, N26, Samsung Pay, Klarna, Venmo, PhonePe, Revolut, Alipay, Zelle, and others. |

| Segments Covered | By Payment Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mobile Payments Market: Segmentation

The global mobile payments market is segmented based on payment type, application, and region.

Based on the payment type, the global market segments are internet payment and proximity payment. In 2024, the internet payment segment experienced the highest growth, driven by the increasing use of this method across e-commerce channels. Furthermore, a large number of the world population is moving toward digital money transfer tools for bill and subscription payments, further helping the segment thrive. According to official data, India witnessed a total of more than 18,500 crore digital payment transfers in the financial year 2023-2024.

Based on the application, the global market divisions are entertainment & media, transportation, healthcare, travel & hospitality, and retail & e-commerce. In 2024, the highest revenue was registered in the retail & e-commerce segment. The rising expansion of major online sales platforms such as Amazon and Alibaba, along with other regional e-commerce companies, is facilitating segmental expansion. In 2024, Amazon generated net sales of more than USD 630 billion, according to research findings.

Mobile Payments Market: Regional Analysis

What factors will help Asia-Pacific lead the mobile payments market during the forecast period?

The global mobile payments market will be led by Asia-Pacific during the projection period. India is anticipated to dominate the regional market in the coming years due to the increasing adoption of mobile payments in the country’s economy. India has been at the forefront of launching convenient and high-performance mobile payment gateways. The regional population has also shown positive feedback on popular mobile payment tools such as Apple Wallet, Google Pay, Paytm, and others. According to the latest reports from the Reserve Bank of India, mobile payments account for nearly 99.9% of all non-cash payments in the country. The country has a well-regulated mobile payment segment, which further strengthens the regional economy.

In April 2025, India’s Kerala state announced that the government hospitals in the region will accept mobile payments while also offering other online services. The regional market will be further driven by rapid growth in the number of consumers across the Asia-Pacific. China and India are considered some of the largest consumer markets, creating growth opportunities for mobile payment technology developers. Moreover, the rising expansion of the regional e-commerce industry and increasing revenue in the retail segment will further facilitate higher growth in the Asia-Pacific.

Mobile Payments Market: Competitive Analysis

The global mobile payments market is led by players like:

- Google Pay

- Paytm

- Apple Pay

- Cash App

- PayPal

- WeChat Pay

- Square

- N26

- Samsung Pay

- Klarna

- Venmo

- PhonePe

- Revolut

- Alipay

- Zelle

The global mobile payments market is segmented as follows:

By Payment Type

- Internet Payment

- Proximity Payment

By Application

- Entertainment & Media

- Transportation

- Healthcare

- Travel & Hospitality

- Retail & E-Commerce

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Mobile payments refer to the transfer of monetary funds using a mobile device such as a tablet or a smartphone.

The global mobile payments market is expected to be driven by the rising use of mobile consumer electronics worldwide.

According to study, the global mobile payments market size was worth around USD 102.14 billion in 2024 and is predicted to grow to around USD 409.65 billion by 2034.

The CAGR value of the mobile payments market is expected to be around 14.90% during 2025-2034.

The global mobile payments market will be led by Asia-Pacific during the projection period.

The global mobile payments market is led by players like Google Pay, Paytm, Apple Pay, Cash App, PayPal, WeChat Pay, Square, N26, Samsung Pay, Klarna, Venmo, PhonePe, Revolut, Alipay, and Zelle.

The report explores crucial aspects of the mobile payments market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed