Online Payment Gateway Market Size, Share, And Growth Report 2032

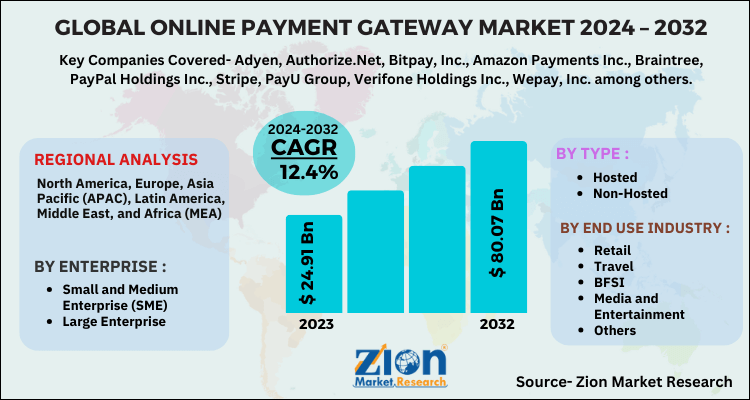

Online Payment Gateway Market By Type (Hosted and Non-Hosted), By Enterprise Type (Small and Medium Enterprise (SME) and Large Enterprise), By End User Industry (Retail, Travel, BFSI, Media and Entertainment and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

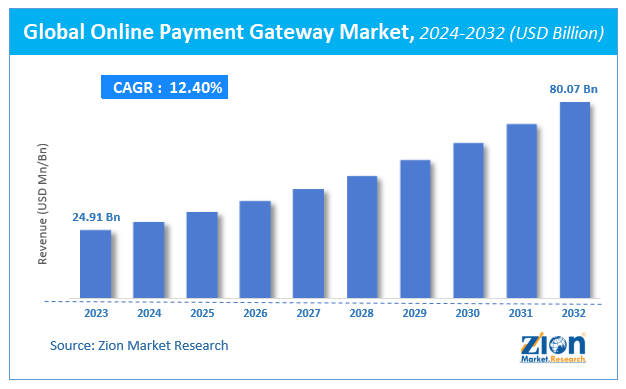

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 24.91 Billion | USD 80.07 Billion | 12.4% | 2023 |

Online Payment Gateway Market Size

Zion Market Research has published a report on the global Online Payment Gateway Market, estimating its value at USD 24.91 Billion in 2023, with projections indicating that it will reach USD 80.07 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 12.4% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Online Payment Gateway Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Online Payment Gateway Market: Overview

The payment gateway is a system that gathers and sends payment data from the client to the acquirer. These systems allow companies and businesses, like the online retail platforms or physical storefronts, to receive cash from customers from a bank of their choice without jeopardizing sensitive information. Payment gateway systems, which feature efficient alert mechanisms that identify suspicious offline and online occurrences, are frequently utilized in cashless transactions. Some of the key factors driving market growth are the rapidly rising internet prevalence throughout the world, advances in mobile payment technology, an increase in the usage of smart phones and mobile wallets for variety of operations. Market participants are placing a premium on customer retention by forming agreements with credit/debit card firms like MasterCard, Inc. and Visa, Inc. to streamline the payment process and reduce processing fees.

COVID-19 Impact Analysis

The pandemic of COVID-19 has had a favorable influence on online payment gateway market growth. This is due to the increased use of the internet, which has promoted the use of payment gateways. Furthermore, because mobile and internet services connect people to payment gateways and other online platforms, people's reliance on these services has grown throughout this period.

In addition, with millions of people under quarantine throughout the world purchasing for products, entertainment, and services online, the COVID-19 epidemic fueled worldwide e-commerce boom.

Online Payment Gateway Market: Growth Factors

Mobile payments are utilized for diverse operations, including ordering takeaway food, movie tickets, and smart phone game upgrades, which is expected to propel the growth of the market studied, during the forecast period. Also, the usage of debit or credit card across the developed and developing countries, to make these payments, is increasing. This factor is expected to further bolster the growth of the market studied. This is because card details can be saved on mobile phones, and payment can be processed easily, via smart phones.

Over the projected period, the rapidly rising internet penetration around the world is expected to fuel market growth. Customers are increasingly adopting online payment options to pay their bills these days. Furthermore, rising consumer knowledge of the convenience of online purchases, along with shifting payment preferences, has resulted in the fast acceptance of online payment options are propelling the market growth.

Online Payment Gateway Market: Segmentation

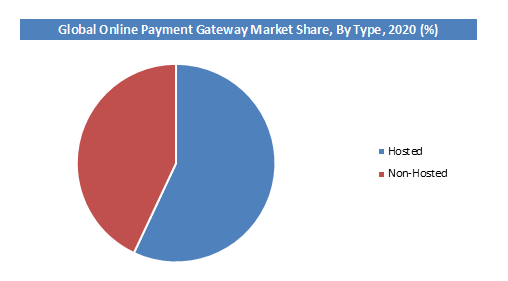

Type Segment Analysis Preview

The hosted segment held a share of around 55% in 2020. This is attributable to the benefits of hosted payment gateways, such as enhanced security, decreased merchant liability, and ready-to-use payment setups, are driving growing demand among merchants. This model is normally used by merchants since it allows them to decrease fraudulent activity and focus on their main products. In addition, hosted payment gateways comply with a lot of standards and regulations making them a safer option for processing of payments.

End User Industry Segment Analysis Preview

Retail segment will grow at a CAGR of over 25% from 2021 to 2028. This is due to an increase in online transactions processed in e-commerce and retail businesses all around the world. Mobile banking, faster payments, government initiatives to promote cashless economy, digital commerce are few of the factors that are propelling the use of online payment gateways in the retail segment. In addition to these factors, consumers benefit from the payments made via online payment gateways as they make the entire payment process hassle free and easier. Online payment gateways cater to those consumers who find convenience in elimination of cash-on-hand issue and faster and shorter moving queues.

Online Payment Gateway Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Online Payment Gateway Market |

| Market Size in 2023 | USD 24.91 Billion |

| Market Forecast in 2032 | USD 80.07 Billion |

| Growth Rate | CAGR of 12.4% |

| Number of Pages | 160 |

| Key Companies Covered | Adyen, Authorize.Net, Bitpay, Inc., Amazon Payments Inc., Braintree, PayPal Holdings Inc., Stripe, PayU Group, Verifone Holdings Inc., Wepay, Inc. among others |

| Segments Covered | By Type, By Enterprise, By End Use Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Online Payment Gateway Market: Regional Analysis

The North American region held a share of around 35% in 2020. This is attributable to the technological advancements and the widespread usage of payment gateways across a variety of end-use segments in this region. At the same time, the presence of major key players like BluePay, Mastercard, and Amazon Payments Inc. are fueling regional market expansion. Furthermore, the region's burgeoning e-commerce sector is fueling the market growth.

The Asia Pacific region is projected to grow at a CAGR of around 20% over the forecast period. This surge is due to the increase can be linked to a number of government efforts aimed at improving the online payment infrastructure of the various nations in the Asia Pacific region. For instance, the Reserve Bank of India (RBI) has regulated many gateways to allow successful digital payments in India. In addition, the government of China is concentrating its efforts on boosting internet connectivity in rural regions, resulting in increased potential for the online payment gateways market growth in this region.

Online Payment Gateway Market: Competitive Players

Some of key players in Online Payment Gateway Market are:

- Adyen

- Authorize.Net

- Bitpay Inc.

- Amazon Payments Inc.

- Braintree

- PayPal Holdings Inc.

- Stripe

- PayU Group

- Verifone Holdings Inc.

- Wepay Inc.

- Among Others

Market participants are placing a premium on customer retention by forming agreements with credit/debit card firms like MasterCard, Inc. and Visa, Inc. to streamline the payment process and reduce processing fees. In addition to this, they key players are attempting to expand their market share through mergers and acquisitions in order to attract more customers.

The Online Payment Gateway Market is segmented as follows:

By Type

- Hosted

- Non-Hosted

By Enterprise

- Small and Medium Enterprise (SME)

- Large Enterprise

By End Use Industry

- Retail

- Travel

- BFSI

- Media and Entertainment

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An online payment gateway is a secure platform that facilitates electronic transactions between customers and merchants. It encrypts payment information, verifies card details, and processes payments for online purchases, ensuring a seamless and secure checkout experience.

According to study, the Online Payment Gateway Market size was worth around USD 24.91 billion in 2023 and is predicted to grow to around USD 80.07 billion by 2032.

The CAGR value of Online Payment Gateway Market is expected to be around 12.4% during 2024-2032.

North America has been leading the Online Payment Gateway Market and is anticipated to continue on the dominant position in the years to come.

The Online Payment Gateway Market is led by players like Adyen, Authorize.Net, Bitpay, Inc., Amazon Payments Inc., Braintree, PayPal Holdings Inc., Stripe, PayU Group, Verifone Holdings Inc., Wepay Inc. among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed