IoT in Banking And Financial Services Market Size, Share, Trends, Growth and Forecast 2034

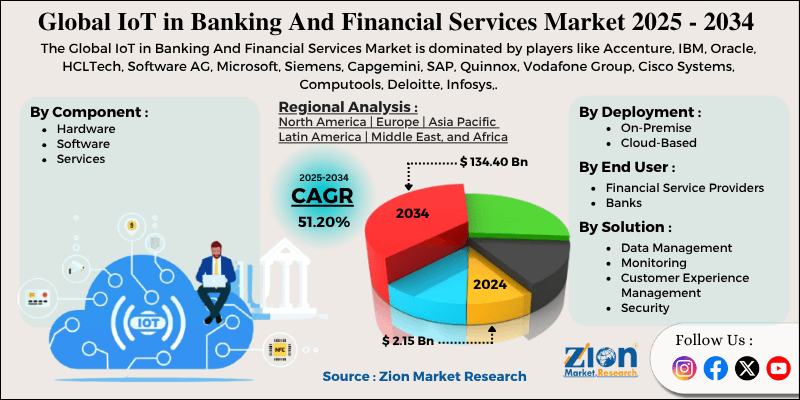

IoT in Banking And Financial Services Market By Component (Hardware, Software, and Services), By Deployment (On-Premise and Cloud-Based), By Solution (Data Management, Monitoring, Customer Experience Management, Security, and Others), By End-User Verticals (Financial Service Providers and Banks), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

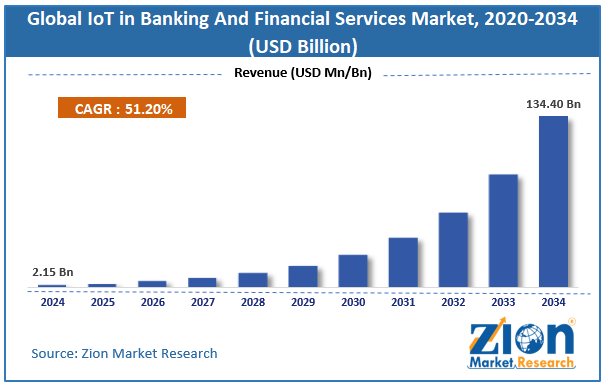

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.15 Billion | USD 134.40 Billion | 51.20% | 2024 |

IoT in Banking and Financial Services Industry Perspective:

The global IoT in banking and financial services market size was worth around USD 2.15 billion in 2024 and is predicted to grow to around USD 134.40 billion by 2034, with a compound annual growth rate (CAGR) of roughly 51.20% between 2025 and 2034.

IoT in Banking and Financial Services Market: Overview

Internet of Things (IoT) in banking and financial services refers to the use of advanced smart technologies such as sensors and intelligent devices in banks. These solutions gather and process real-time information on banking and financial services operations. The output thus obtained is used by banks and financial service providers to make informed decisions in regard to business operations.

Some of the main applications of IoT in banking & financial services include customer experience management, fraud detection & prevention, and asset management, among others. Financial service providers can significantly reduce business risks by leveraging the offerings of IoT solutions specially designed for banks.

During the forecast period, the demand for Internet of Things in banking and financial offices is expected to grow due to the growing fraud rate across such institutions.

In addition, rising demand for contactless payments, smart Automated Teller Machines (ATMs), and asset management will fuel market revenue in the coming years. The top challenges for IoT in the banking and financial services industry include security-related risks and data management across multiple IoT channels.

Key Insights:

- As per the analysis shared by our research analyst, the global IoT in banking and financial services market is estimated to grow annually at a CAGR of around 51.20% over the forecast period (2025-2034)

- In terms of revenue, the global IoT in banking and financial services market size was valued at around USD 2.15 billion in 2024 and is projected to reach USD 134.40 billion by 2034.

- The IoT in banking and financial services market is projected to grow at a significant rate due to the growing cases of fraud across financial institutions.

- Based on the component, the hardware segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the solution, the customer experience management segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

IoT in Banking and Financial Services Market: Growth Drivers

Growing cases of fraud across financial institutions to propel market expansion

The global IoT in banking and financial services market is expected to grow due to the rising number of fraud cases across such facilities. According to official reports, Indian banks reported more than 18,000 fraud cases in the first half of fiscal year 2024-2025. Similar statistics have been reported worldwide, including developed nations and emerging economies.

Every year, financial institutions report millions of dollars in losses due to banking fraud. The crime rate has increased due to the higher adoption of digital payment methods such as contactless transactions and payments through digital portals such as Amazon Pay. Internet of Things solutions adopted by banks or financial companies can help curb the number of monetary frauds.

Most IoT devices are equipped to undertake behavioral pattern analysis, which allows the technology to track and detect any anomaly in user habits or transaction patterns.

Furthermore, the real-time anomaly detection feature of advanced IoTs has led to increased demand for the technology across banking facilities.

In December 2024, the Reserve Bank of India (RBI) announced the launch of Mule Hunter.ai. The Artificial Intelligence (AI)-based model is expected to help curb the growing rate of digital fraud nationwide.

Growing investments in smart ATMs and contactless transactions to generate higher market penetration

Banks and financial services organizations worldwide are focusing on developing and deploying smart Automated Teller Machines (ATMs) to improve customer experience.

In November 2024, Revolut, a London-based fintech unicorn, announced its plans for 2025, including the launch of advanced branded ATMs with cutting-edge facial recognition technology. The ATMs are expected to launch in Spain in 2025, expanding the presence of Revolut across the global landscape.

In addition, consumers worldwide have shown increasing acceptance of contactless or voice-based payments. Such advancements are expected to work in favor of the global IoT in banking and financial services industry during the projection period.

IoT in Banking and Financial Services Market: Restraints

Concerns over security and data privacy to limit market expansion, according to research

The global IoT in banking and financial services industry is expected to be restricted by the growing concerns over security and data privacy. IoT channels are vulnerable to cyberattacks, compromising customer information integrity and business operations.

In 2022, more than 53 million US citizens encountered some form of cybercrime, according to market research. Since IoT devices are connected to the internet, they pose a significant threat to privacy invasion and data loss for companies.

IoT in Banking and Financial Services Market: Opportunities

Introduction of blockchain and AI-powered IoT solutions to create growth opportunities

The global IoT in banking and financial services market is expected to generate growth opportunities due to the rising introduction of AI-powered and blockchain solutions.

In October 2024, Infosys Finacle announced the launch of the Financial Data and AI Suite. It is a set of solutions designed to encourage banks to integrate AI into their digital operations. Banks can now build low-code, generative, and predictive AI solutions from scratch with high explainability and transparency.

Market experts are betting high on blockchain and cryptocurrencies for cross-border transactions in the coming years. Blockchain-based financial transactions are considered safer and more transparent than other methods of monetary and nonmonetary exchange between customers and financial organizations.

Personalized insurance and predictive loan approvals to emerge as the future of IoT in banks

The Internet of Things in banks and financial companies can gain by increasing focus on developing programs aiming to deliver personalized insurance. IoT can be leveraged to use health information and other personal traits of an individual, such as driving habits, to create customized insurance programs.

In addition, launching predictive loan approval programs using IoT can help financial companies generate higher customer loyalty and enhance user experience.

IoT in Banking and Financial Services Market: Challenges

Lack of universal standards in terms of IoT to challenge market growth trends

The global IoT in banking and financial services industry is expected to be challenged by the lack of universal standards surrounding IoT. Various Internet of Things providers use diverse approaches to manufacture IoT devices, leading to a risk of technology malfunction and incompatibility with existing infrastructure.

Moreover, challenges associated with gathering large-scale information across IoT mediums and processing the data further contribute to industry growth inhibitions.

IoT in Banking And Financial Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | IoT in Banking And Financial Services Market |

| Market Size in 2024 | USD 2.15 Billion |

| Market Forecast in 2034 | USD 134.40 Billion |

| Growth Rate | CAGR of 51.20% |

| Number of Pages | 212 |

| Key Companies Covered | Accenture, IBM, Oracle, HCLTech, Software AG, Microsoft, Siemens, Capgemini, SAP, Quinnox, Vodafone Group, Cisco Systems, Computools, Deloitte, Infosys, and others. |

| Segments Covered | By Component, By Deployment, By Solution, By End-User Verticals, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

IoT in Banking and Financial Services Market: Segmentation

The global IoT in banking and financial services market is segmented based on component, deployment, solution, end-user verticals, and others.

Based on the components, the global market segments are hardware, software, and services. In 2024, the highest growth was listed in the hardware segment. It dominated nearly 57.9% of the total revenue. The increasing application and demand for smart ATMs, smart cards, and other connected devices is fueling the segmental revenue. During the projection period, the services segment is projected to grow at a CAGR of more than 15%.

Based on deployment, the global IoT in banking and financial services industry is divided into on-premise and cloud-based.

Based on the solution, the global market segments are data management, monitoring, customer experience management, security, and others. In 2024, the higher revenue-generating segment was customer experience management. The increasing number of customers across banks and financial service providers is propelling the segmental growth rate. Moreover, financial organizations continue to invest in enhancing customer experience to ensure long-term relationships with consumers.

Based on end-user verticals, the global market segments are financial service providers and banks.

IoT in Banking and Financial Services Market: Regional Analysis

North America to hold control of the highest stake in the market during the projection period

The global IoT in banking and financial services market will be led by North America during the forecast period. In 2024, it dominated nearly 37% of the global revenue, with the US emerging as the highest revenue generator.

During the projection period, the US is expected to deliver a CAGR of 9% and dominate the regional market share. The presence of a technologically advanced banking sector has helped the region thrive in the last few years.

In a recent event, J.P. Morgan, one of the world’s biggest financial services companies, tested the world’s first bank-led tokenized value transfer in space. The transaction was completed using smart contracts on a blockchain network established between satellites around the planet.

Europe is expected to continue acting as a crucial global revenue generator in the IoT in banking and financial services industry. Countries like the UK, France, Germany, and others will emerge as highly valued economies within the regional market. The changing consumer preferences and growing adoption of digital systems across banks and financial organizations throughout Europe will fuel regional revenue.

In November 2024, GlobalFoundries announced a novel partnership with IDEMIA Secure Transactions (IST). The collaboration will ensure the delivery of IST’s new smart card IC on GF’s 28ESF3 process technology platform.

IoT in Banking and Financial Services Market: Competitive Analysis

The global IoT in banking and financial services market is led by players like:

- Accenture

- IBM

- Oracle

- HCLTech

- Software AG

- Microsoft

- Siemens

- Capgemini

- SAP

- Quinnox

- Vodafone Group

- Cisco Systems

- Computools

- Deloitte

- Infosys

The global IoT in banking and financial services market is segmented as follows:

By Component

- Hardware

- Software

- Services

By Deployment

- On-Premise

- Cloud-Based

By Solution

- Data Management

- Monitoring

- Customer Experience Management

- Security

- Others

By End-User Verticals

- Financial Service Providers

- Banks

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Internet of Things (IoT) in banking and financial services refers to the use of advanced smart technologies such as sensors and intelligent devices in banks.

Which key factors will influence IoT in banking and financial services market growth over 2025-2034?

The global IoT in banking and financial services market is expected to grow due to the rising fraud cases across such facilities.

According to a study, the global IoT in banking and financial services market size was worth around USD 2.15 billion in 2024 and is predicted to grow to around USD 134.40 billion by 2034.

The CAGR value of IoT in banking and financial services market is expected to be around 51.20% during 2025-2034.

Which region will contribute notably towards the IoT in banking and financial services market value?

The global IoT in banking and financial services market will be led by North America during the forecast period.

The global IoT in banking and financial services market is led by players like Accenture, IBM, Oracle, HCLTech, Software AG, Microsoft, Siemens, Capgemini, SAP, Quinnox, Vodafone Group, Cisco Systems, Computools, Deloitte, and Infosys.

The report explores crucial aspects of the IoT in banking and financial services market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

List of Contents

IoT in Banking and Financial ServicesIndustry Perspective:IoT in Banking and Financial Services OverviewKey Insights:IoT in Banking and Financial Services Growth DriversIoT in Banking and Financial Services RestraintsIoT in Banking and Financial Services OpportunitiesIoT in Banking and Financial Services ChallengesReport ScopeIoT in Banking and Financial Services SegmentationIoT in Banking and Financial Services Regional AnalysisIoT in Banking and Financial Services Competitive AnalysisThe global IoT in banking and financial services market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed