Mobile Wallet Market Size, Share & Growth Report 2032

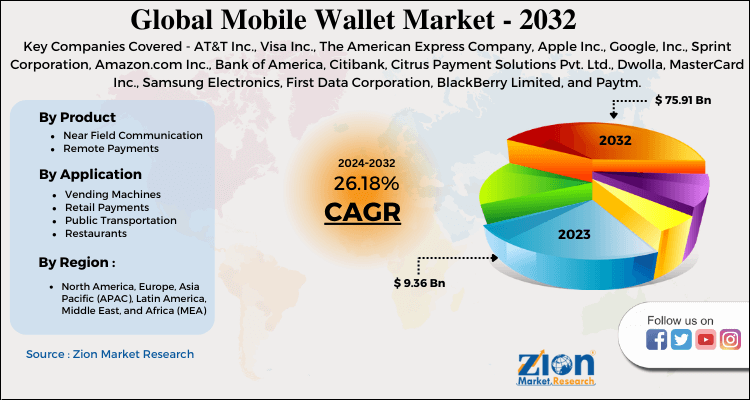

Mobile Wallet Market By Product (Near Field Communication (NFC) and Remote Payments), By Application (Vending Machines, Retail Payments, Public Transportation, and Restaurants), And By Region - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

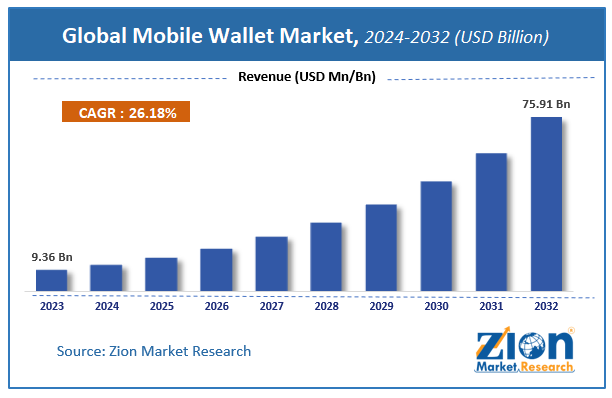

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.36 Billion | USD 75.91 Billion | 26.18% | 2023 |

Mobile Wallet Market Insights

Zion Market Research has published a report on the global Mobile Wallet Market, estimating its value at USD 9.36 Billion in 2023, with projections indicating that it will reach USD 75.91 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 26.18% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Mobile Wallet Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

The mobile wallet also is known as m-wallet is an innovative technological feature. It is an online interface that offers ease of carrying the money or cash like the physical wallet. This is the simple way to carry credit card or debit card information in a digital form on a mobile device. Instead of using a physical plastic card to make payment, payment can be easily done by smartphone, tablet, or smart watch.

Mobile Wallet Market: Overview

A mobile wallet is a digital mode of storing credit card ID, gift card ID, loyalty card number, and debit card ID. Moreover, mobile wallets can be accessed through apps that are installed or downloaded on smartphones, laptops, and tablets. Additionally, consumers use mobile wallets for making in-store payments. It is also a convenient payment mode in comparison to physical credit cards.

Reportedly, these digital modes of payment are listed with smartphone solution providers. For the record, data stored in a mobile wallet is encoded, thereby preventing hackers & cyber terrorists from carrying out frauds.

Mobile Wallet Market: Growth Drivers

Beneficial features such as secured & quick access and end-user convenience will boost mobile wallet market trends. In addition to this, the rise in smartphone usage across the globe will proliferate the size of the mobile wallet market in the near future. The thriving e-commerce sector and supportive government policies about the use of mobile wallets will promulgate the growth of the mobile wallet industry.

Apparently, changing consumer preference towards online payments will pave a way for lucrative growth of mobile wallet industry over forthcoming years. Huge discounts and attractive cash-back offers provided by mobile wallet service providers are projected to enhance market revenue.

Furthermore, swiftly changing consumer behavior towards online mode of payments owing to trends of digitization will spur business growth. Furthermore, rampant spread of the COVID-19 pandemic resulting into lockdowns and less physical contacts has created numerous growth opportunities for mobile wallet market. The rise in mobile banking activities with large-scale establishment of fintech institutions and online banks will prop up the expansion of the mobile wallet industry over forecasting timeframe.

Mobile Wallet Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mobile Wallet Market |

| Market Size in 2023 | USD 9.36 Billion |

| Market Forecast in 2032 | USD 75.91 Billion |

| Growth Rate | CAGR of 26.18% |

| Number of Pages | 210 |

| Key Companies Covered | AT&T Inc., Visa Inc., The American Express Company, Apple Inc., Google, Inc., Sprint Corporation, Amazon.com Inc., Bank of America, Citibank, Citrus Payment Solutions Pvt. Ltd., Dwolla, MasterCard Inc., Samsung Electronics, First Data Corporation, BlackBerry Limited, and Paytm. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mobile Wallet Market: Regional Landscape

- Europe To Make Notable Contributions Towards Regional Market Size By 2032

The growth of the mobile wallet market in Europe over the forecast timespan is subject to smartphone banking activities gaining prominence in European countries. Moreover, less use of physical cash in countries such as Germany will account substantially for regional market proceeds in the coming years.

Apparently, mobile banking has become one of the most popular modes of performing financial transactions in Europe enabling banks to develop a range of payment websites. This, in turn, will steer regional market growth.

Mobile Wallet Market: Competitive Analysis

Some of the major players in the global Mobile Wallet market include:

- AT&T, Inc.

- Visa, Inc.

- The American Express Company

- Apple, Inc.

- Google, Inc.

- Sprint Corporation

- Amazon.com, Inc.

- Bank of America

- Citibank

- Citrus Payment Solutions Pvt. Ltd.

- Dwolla

- MasterCard, Inc.

- Samsung Electronics

- First Data Corporation

- BlackBerry Limited

- Paytm

The global Mobile Wallet Market is segmented as follows:

By Product

- Near Field Communication (NFC)

- Remote Payments

By Application

- Vending Machines

- Retail Payments

- Public Transportation

- Restaurants

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the Global Mobile Wallet market size was worth around USD 9.36 billion in 2023 and is expected to reach USD 75.91 billion by 2032.

The Global Mobile Wallet market is expected to grow at a CAGR of 26.18% during the forecast period.

Beneficial features such as secured & quick access and end-user convenience will boost mobile wallet market trends. In addition to this, rise in smartphone usage across globe will proliferate size of mobile wallet market in near future. Thriving e-commerce sector and supportive government policies pertaining to use of mobile wallets will promulgate growth of mobile wallet industry. Apparently, changing consumer preference towards online payments will pave a way for lucrative growth of mobile wallet industry over forthcoming years. Huge discounts and attractive cash back offers provided by mobile wallet service providers are projected to enhance market revenue.

Europe is expected to dominate the Mobile Wallet market over the forecast period.

The key market participants include AT&T Inc., Visa Inc., The American Express Company, Apple Inc., Google, Inc., Sprint Corporation, Amazon.com Inc., Bank of America, Citibank, Citrus Payment Solutions Pvt. Ltd., Dwolla, MasterCard Inc., Samsung Electronics, First Data Corporation, BlackBerry Limited, and Paytm.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed