Packaged Food Color Market Size, Share, Trends, Growth & Forecast 2034

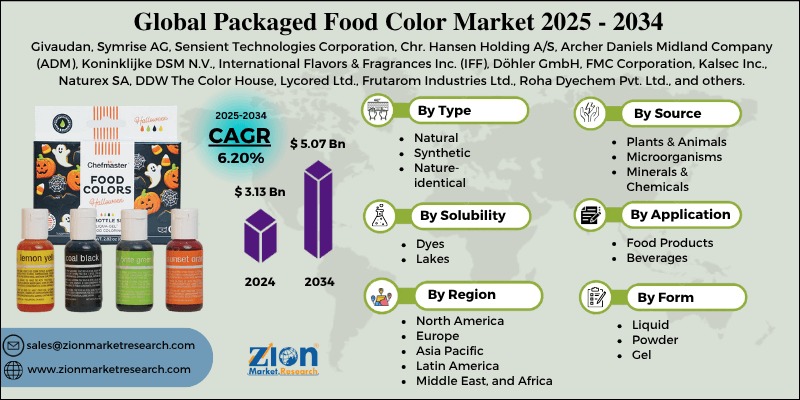

Packaged Food Color Market By Type (Natural, Synthetic, Nature-identical), By Source (Plants & Animals, Microorganisms, Minerals & Chemicals), By Form (Liquid, Powder, Gel), By Solubility (Dyes, Lakes), By Application (Food Products, Beverages), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

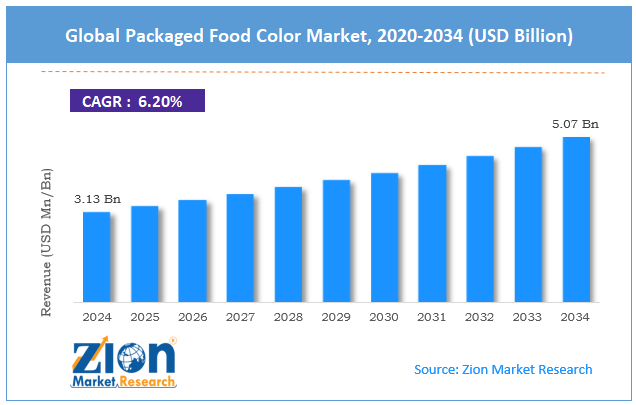

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.13 Billion | USD 5.07 Billion | 6.20% | 2024 |

Packaged Food Color Industry Perspective:

The global packaged food color market size was approximately USD 3.13 billion in 2024 and is projected to reach around USD 5.07 billion by 2034, with a compound annual growth rate (CAGR) of approximately 6.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global packaged food color market is estimated to grow annually at a CAGR of around 6.20% over the forecast period (2025-2034)

- In terms of revenue, the global packaged food color market size was valued at around USD 3.13 billion in 2024 and is projected to reach USD 5.07 billion by 2034.

- The packaged food color market is projected to grow significantly due to the expansion of the processed and convenience food industry, the growth of the global bakery and confectionery sector, and changing lifestyles and rising disposable incomes.

- Based on type, the natural segment is expected to lead the market, while the synthetic segment is expected to grow considerably.

- Based on the source, the plants & animals segment is the dominant segment, while the minerals & chemicals segment is projected to witness sizable revenue growth over the forecast period.

- Based on form, the liquid segment is expected to lead the market compared to the powder segment.

- Based on solubility, the dyes segment is the largest, while the lakes segment is projected to experience significant revenue growth over the forecast period.

- Based on application, the food products segment is expected to lead the market compared to the beverages segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Packaged Food Color Market: Overview

Packaged food colors are the synthetic or natural additives used to improve or restore the visual appeal of packaged and processed food products. These colors are widely used in confectionery, bakery items, beverages, snacks, and dairy products to maintain consistency and appeal to a broader range of consumers. The global packaged food color market is expected to expand rapidly, driven by the growing preference for clean-label and natural products, technological advancements in color extraction and stabilization, and increasing awareness of food aesthetics and branding. Consumers are increasingly demanding natural ingredients due to concerns about environmental and health impacts. The shift from synthetic to natural colors, such as anthocyanins, carotenoids, and chlorophylls, is transforming the industry. This trend supports regulatory encouragement for clean-label transparency in food formulations.

Moreover, advancements in microemulsion, encapsulation, and pH-stable pigment solutions have expanded the application range and enhanced the stability of natural colors. These improvements help manufacturers overcome challenges such as heat degradation and light sensitivity, thereby broadening the industry's potential. Furthermore, color plays a vital role in influencing purchasing decisions, since it impacts consumer perception of quality and taste. Food and beverage brands utilize consistent coloring to strengthen consumer loyalty and identity, thereby enhancing the need for standardized color systems.

Despite the growth, the global market is hindered by factors such as the high cost of natural color production and issues related to low shelf life and stability. Extracting natural pigments from vegetables, plants, and fruits requires complex processes and high raw material costs. These factors make natural colors significantly more expensive than synthetic ones, limiting their adoption among budget-conscious manufacturers. Likewise, natural colors often face challenges such as fading under heat, exposure to oxygen, and light. Their instability in various pH conditions makes them less suitable for specific formulations, limiting their large-scale commercial use.

Nonetheless, the global packaged food color industry stands to gain from several key opportunities, including innovation in plant-based and microbial color extraction, as well as the growing prominence of organic and functional foods. Improvements in biotechnology are facilitating the extraction of pigments from microalgae, bacteria, and fungi. These sources offer more sustainable, consistent, and scalable color solutions than traditional plant-based methods. The rising consumer preference for vegan, organic, and nutritionally enriched products presents an opportunity for natural food colors derived from superfoods such as beetroot and spirulina. This trend is witnessed mainly in North America and Europe.

Packaged Food Color Market Dynamics

Growth Drivers

How is the expansion of processed and convenience food consumption driving the packaged food color market?

The surging demand for bakery, ready-to-eat meals, and confectionery directly propels the worldwide packaged food color market. According to Statista 2024, the worldwide packaged food industry exceeded USD 3.2 trillion, driven by robust product appearance and visual appeal. Food colors improve perceived flavor and freshness, making them vital for brand differentiation in a crowded retail landscape. As more users incline towards convenience foods, the demand for color additives continues to grow correspondingly.

How is the packaged food color market fueled by the rising emphasis on sustainability and traceable sourcing?

Sustainability trends are transforming the food color supply chain, with brands demanding eco-friendly and ethically sourced ingredients. Color producers are moving towards vertically integrated farming and renewable extraction processes to assure quality and transparency. Leading companies, such as Naturex and Oterra, have introduced sustainability programs to monitor their botanical supply bases. This focus on traceability not only improves brand credibility but also aligns with consumer expectations for responsible production.

Restraints

The fluctuating availability of natural raw materials adversely impacts the market progress

The supply of natural pigments depends on climatic stability and agricultural yields, both of which have become increasingly unpredictable due to global weather disturbances. This volatility results in short-term spikes of nearly 20-30% in natural color markets, as per studies. Furthermore, geopolitical factors and logistical barriers, such as increasing freight costs, further disrupted pigment supply chains. These inconsistencies increase the challenges for food processors in obtaining long-term contracts at stable prices, thereby limiting the broader adoption of natural colors.

Opportunities

How do technological advancements in bio-based color production open lucrative opportunities for the development of the packaged food color market?

Emerging solutions, such as precision biomanufacturing and fermentation, are enabling the scalable production of high-purity and stable natural colors. Startups like Phytolon and Michroma utilize genetically engineered microbes to produce continuous pigments, reducing agricultural dependency. A 2024 Ingredion report highlighted that these bio-based techniques may reduce production costs by nearly 25% over the next five years. These solutions also overcome stability challenges, increasing color applications to bakery, beverages, and frozen foods. As investment flows into biotech-driven pigment synthesis, advancements are poised to redefine the competitive landscape, impacting the packaged food color industry.t

Challenges

Intense market competition and price pressure among suppliers restrict the market growth

The global food color industry is fragmented, with several regional suppliers competing against multinational giants such as Oterra, Givaudan, and Sensient. Price-based competition is extreme in the blended and synthetic pigment categories. Smaller companies struggle to match the R&D budgets and worldwide distribution networks of leading corporations. Furthermore, customers' rising preference for cost-efficient yet sustainable colors exerts downward pressure on profit margins. The challenge for players is striking a balance between innovative, competitive pricing and investment without eroding profitability.

Packaged Food Color Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Packaged Food Color Market |

| Market Size in 2024 | USD 3.13 Billion |

| Market Forecast in 2034 | USD 5.07 Billion |

| Growth Rate | CAGR of 6.20% |

| Number of Pages | 213 |

| Key Companies Covered | Givaudan, Symrise AG, Sensient Technologies Corporation, Chr. Hansen Holding A/S, Archer Daniels Midland Company (ADM), Koninklijke DSM N.V., International Flavors & Fragrances Inc. (IFF), Döhler GmbH, FMC Corporation, Kalsec Inc., Naturex SA, DDW The Color House, Lycored Ltd., Frutarom Industries Ltd., Roha Dyechem Pvt. Ltd., and others. |

| Segments Covered | By Type, By Source, By Form, By Solubility, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Packaged Food Color Market: Segmentation

The global packaged food color market is segmented based on type, source, form, solubility, application, and region.

Based on type, the global packaged food color industry is divided into natural, synthetic, and nature-identical. The natural color segment registers a leading share, driven by surging consumer preferences for plant-based, clean-label, and chemical-free food products.

On the other hand, the synthetic color segment holds a second-leading share due to its affordability, excellent stability, and wide color range in mass-produced packaged foods.

Based on the source, the global market is segmented into plants & animals, microorganisms, and minerals & chemicals. The plants & animals segment dominates the market due to the high demand for natural pigments sourced from vegetables, fruits, and animal-based sources, such as carmine.

Conversely, the minerals & chemicals segment holds a second rank, backed by its broader use in synthetic color formulations for cost efficiency and improved stability.

Based on form, the global packaged food color market is segmented into liquid, powder, and gel. The liquid segment holds the dominant share, as it offers easy blending, broad applicability, and uniform dispersion in dairy and beverage products.

However, the powder segment holds a secondary position, as it is favored mainly for its longer shelf life, suitability, and cost efficiency in dry food applications, such as confectionery and bakery.

Based on solubility, the global market is segmented into dyes and lakes. The dyes segment holds a significant market share due to its high solubility in water and its broad applications in confectionery, beverages, and processed foods.

Yet, the lakes segment grows considerably after dyes, owing to its preference for stability in fat-based products and its broader application in bakery items, coated products, and snacks.

Based on application, the global market is segmented into food products and beverages. The food products segment holds the largest share, fueled by its broader use in confectionery, dairy, and processed food items to enhance visual appeal and brand differentiation.

Nonetheless, the beverages segment ranks second, backed by the growing demand for natural and vibrant coloring in juices, soft drinks, and functional beverages.

Packaged Food Color Market: Regional Analysis

Why is Asia Pacific outperforming other regions in the global Packaged Food Color Market?

The Asia Pacific is expected to maintain its leading position in the global packaged food color market, driven by its large consumer base, increasing disposable incomes, abundant natural pigment sources, and expanding local manufacturing and foreign investment. With a population exceeding 4.7 billion, the APAC region boasts the most extensive consumer base for packaged foods. Growing disposable incomes and changing dietary preferences are driving the demand for visually appealing and vibrant products. This boosts the adoption of synthetic and natural food colors in different applications.

Moreover, the region is rich in raw materials such as beetroot, turmeric, and spirulina, which are used in color extraction. China and India are forerunners in supplying plant-derived pigments, offering cost-efficient production benefits. This abundance of resources augments the region's dominance in sustainable and natural food coloring manufacturing.

Furthermore, the APAC region is experiencing heightened awareness from global color manufacturers, such as Givaudan and Sensient Technologies, which is leading to increased local production capacities. Governments in China and India are supporting export initiatives and food processing infrastructure. This growth in regional manufacturing enhances supply chain efficiency and global competitiveness.

Europe ranks as the second-largest region in the global packaged food color industry, driven by strong consumer demand for clean-label and natural products, a well-developed food and beverage industry, and the growing prominence of functional and organic foods. Europe holds a second-leading position worldwide because of its high consumer awareness and preference for natural and clean-label ingredients. Consumers in nations like the UK, Germany, and France are progressively avoiding synthetic additives in packaged foods.

Europe’s well-developed food and beverage industry continues to demand advanced coloring solutions for quality differentiation. The sector generated over €1.2 trillion in turnover in 2024, underscoring its significant global influence. The broader use of colors in dairy, bakery, beverages, and confectionery supports steady regional industry growth. European consumers are shifting towards vegan, organic, and functional packaged foods enriched with natural pigments, such as anthocyanins and carotenoids. This preference for eco-friendly and health-oriented products drives the demand for natural coloring solutions.

Packaged Food Color Market: Competitive Analysis

The leading players in the global packaged food color market are:

- Givaudan

- Symrise AG

- Sensient Technologies Corporation

- Chr. Hansen Holding A/S

- Archer Daniels Midland Company (ADM)

- Koninklijke DSM N.V.

- International Flavors & Fragrances Inc. (IFF)

- Döhler GmbH

- FMC Corporation

- Kalsec Inc.

- Naturex SA

- DDW The Color House

- Lycored Ltd.

- Frutarom Industries Ltd.

- Roha Dyechem Pvt. Ltd.

Packaged Food Color Market: Key Market Trends

Technological advancements in color stability and extraction:

Innovations such as nanotechnology, microencapsulation, and pH-stable formulations are enhancing the durability of natural pigments. These solutions help colors resist heat, oxidation, and light, enhancing their application range. Hence, natural colors are increasingly used in dairy products, beverages, and baked goods.

Growing demand for functional and nutrient-rich pigments:

Manufacturers are incorporating colorants such as anthocyanins and carotenoids, which offer health benefits and enhance visual appeal. These bioactive pigments provide antioxidant properties, aligning with the growing trend of functional foods. The incorporation of aesthetics and nutrition is fueling advancements in packaged food.

The global packaged food color market is segmented as follows:

By Type

- Natural

- Synthetic

- Nature-identical

By Source

- Plants & Animals

- Microorganisms

- Minerals & Chemicals

By Form

- Liquid

- Powder

- Gel

By Solubility

- Dyes

- Lakes

By Application

- Food Products

- Beverages

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Packaged food colors are the synthetic or natural additives used to improve or restore the visual appeal of packaged and processed food products. These colors are widely used in confectionery, bakery items, beverages, snacks, and dairy products to maintain consistency and appeal to a broader range of consumers.

The global packaged food color market is projected to grow due to rising demand for visually appealing packaged foods, technological advancements in food color formulation, and increasing regulatory approvals for natural colorants.

According to study, the global packaged food color market size was worth around USD 3.13 billion in 2024 and is predicted to grow to around USD 5.07 billion by 2034.

The CAGR value of the packaged food color market is expected to be approximately 6.20% from 2025 to 2034.

Emerging trends and innovations in the packaged food color market include advancements in color stabilization technologies, the rise of natural pigments, functional bioactive colors, sustainable sourcing, and digital color formulation systems.

Significant opportunities in the market include the expansion of natural color extraction technologies, sustainable production practices, the growing demand for clean-label and functional foods, and increasing applications across the dairy, beverage, and confectionery segments.

Investment and partnership opportunities in the packaged food color market lie in collaborations for natural pigment extraction, sustainable sourcing ventures, biotechnology-driven color development, and regional manufacturing expansions in emerging economies.

Asia Pacific is expected to lead the global packaged food color market during the forecast period.

The key players profiled in the global packaged food color market include Givaudan, Symrise AG, Sensient Technologies Corporation, Chr. Hansen Holding A/S, Archer Daniels Midland Company (ADM), Koninklijke DSM N.V., International Flavors & Fragrances Inc. (IFF), Döhler GmbH, FMC Corporation, Kalsec Inc., Naturex SA, DDW The Color House, Lycored Ltd., Frutarom Industries Ltd., and Roha Dyechem Pvt. Ltd.

The report examines key aspects of the packaged food color market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed