Microcellular Plastics Market Size, Share, Growth Report 2034

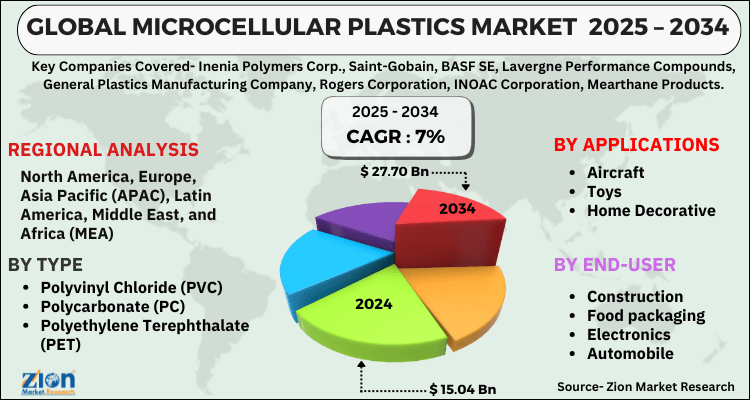

Microcellular Plastics Market By Type (Polyvinyl Chloride (PVC), Polycarbonate (PC), and Polyethylene Terephthalate (PET)). By Applications (Aircraft, Toys, Home decorative, and Others). By End User (Construction, Food packaging, Electronics, Automobile, and Others), And By Region: Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.04 Billion | USD 27.70 Billion | 7% | 2024 |

Microcellular Plastics Industry Perspective:

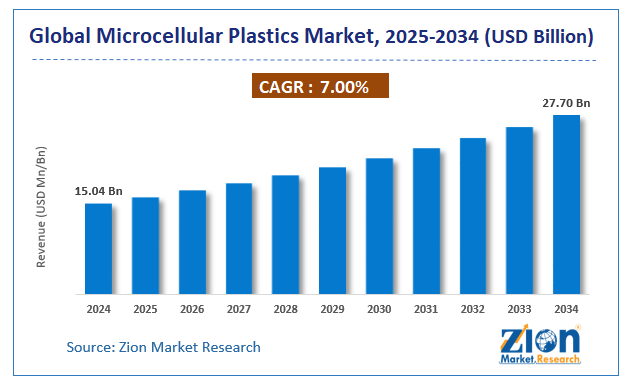

The global microcellular plastics market size was worth around USD 15.04 Billion in 2024 and is predicted to grow to around USD 27.70 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7% between 2025 and 2034. The report analyzes the Microcellular Plastics Market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Microcellular Plastics Market.

Microcellular Plastics Market: Overview

Microcellular plastic is made up of micropores in the polymer matrix that are smaller than 100 micrometers in size. Microcellular plastics have distinct features that set them apart from traditional plastics. They have reduced residual stress, shorter cycle durations, and consume less material. Superior impact strength, fatigue life, durability, insulation strength, thermal stability, heat, sound insulation performance, and optical qualities drive the microplastics market. Improving one's standard of living and upgrading is a critical aspect driving the market's growth. In addition to increased urbanization and the widespread use of microplastics in the building industry, the cell phone industry and sports manufacturing are important factors driving the microcellular plastics market, among others.

Diversification into the end-user industry would open up new chances for the microcellular plastics market during the projected period. Increasing plastics demand in the food packaging and healthcare sectors is expected to fuel demand for microcellular plastics throughout the projected period. Plastic consumption in the electronics industry has increased significantly in recent years. The market for microcellular plastics is projected to benefit from this.

Key Insights

- As per the analysis shared by our research analyst, the global microcellular plastics market is estimated to grow annually at a CAGR of around 7% over the forecast period (2025-2034).

- Regarding revenue, the global microcellular plastics market size was valued at around USD 15.04 Billion in 2024 and is projected to reach USD 27.70 Billion by 2034.

- The microcellular plastics market is projected to grow at a significant rate due to growing emphasis on sustainability, increasing demand for lightweight and high-strength materials, rising adoption in automotive and packaging industries, and advancements in foam processing technologies.

- Based on Type, the Polyvinyl Chloride (PVC) segment is expected to lead the global market.

- On the basis of Applications, the Aircraft segment is growing at a high rate and will continue to dominate the global market.

- Based on the End User, the Construction segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Microcellular Plastics Market: Driver

The increasing desire for lightweight automobiles

The automotive industry is one of the most important industries for composite materials. The automobile industry is constantly on the lookout for new materials that can help reduce vehicle weight while also meeting fuel economy and carbon emission objectives. The segment's primary growth drivers are predicted to be increased demand for lightweight materials from the automobile industry and a growing emphasis on fuel economy. Consumers demand greater miles per gallon (mpg) as fuel costs and distance traveled rise, and they frequently view gas mileage as a crucial issue when purchasing a vehicle.

As a result, automobile manufacturers are changing from steel or aluminium to composite materials such as Microcellular plastic, which are critical to achieving the cost-effectiveness of these highly automated manufacturing cycles, which lower vehicle weight. Over the projected period, demand is expected to be driven by an increase in demand for lightweight automotive vehicles, as well as an increase in the use of microcellular polymers in the manufacturing of car parts.

Microcellular Plastics Market: Restraint

Despite its ecological and biodegradable qualities, it has very little commercial application due to the high material cost. Furthermore, because of its porous structure, Microcellular plastic has a relatively limited range of applicability when compared to standard plastics. Moreover, due to the intricate nature of manufacture, the restricted number of Microcellular plastic processing units accessible has produced a scarcity of the product in the market. As a result, product demand is hampered.

Microcellular Plastics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Microcellular Plastics Market |

| Market Size in 2024 | USD 15.04 Billion |

| Market Forecast in 2034 | USD 27.70 Billion |

| Growth Rate | CAGR of 7% |

| Number of Pages | 177 |

| Key Companies Covered | Inenia Polymers Corp., Saint-Gobain, BASF SE, Lavergne Performance Compounds, General Plastics Manufacturing Company, Rogers Corporation, INOAC Corporation, Mearthane Products,, and others. |

| Segments Covered | By Type, By Applications, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Microcellular Plastics Market: Segmentation

The Microcellular Plastic Market is segregated based on Type, Applications, and End User.

By Type, the market is classified into Polyvinyl Chloride (PVC), Polycarbonate (PC), and Polyethylene Terephthalate (PET). In the forecast period, the PVC category dominated the market, with a market the largest share. This expansion can be attributed to PVC (Polyvinyl Chloride), which is a high-strength thermoplastic polymer. It is the world's third-most widely produced synthetic plastic polymer due to its strong demand in the end-use industries of medical devices, pipe production, wires, and cable insulation.

Based on Applications the market is segmented into construction, healthcare, food packaging, transportation, electronics and others. Healthcare and food packaging segments are expected to grow at a higher rate as compared to other segments.

By End User, the market is classified into Construction, Food packaging, Electronics, Automobile, and Others. In the forecast period, the food packaging segment dominated the market, with a market the largest share. This expansion might be attributed to their recyclable nature as well as the rapid rate of industrialization. Because of the global growth of the automotive industry, transportation is expected to be another significant element driving the microcellular plastic market.

Microcellular Plastics Market: Regional Landscape

North America is predicted to show continuous growth in the microcellular plastics market throughout the forecast period owing to the recovery of the industrial sector as well as increased expenditure on building restoration and maintenance. In addition, because of the presence of automobile manufacturers, as well as increased investment in R&D and innovation activities in this industry, will boost the market growth. The United States and Canada are among the top contributors to North American regional market growth, which is expected to be moderate due to increased utilization in food packaging and continued growth in the healthcare sector.

The Asia Pacific area is predicted to grow rapidly over the assessment period, owing to the continued growth of many end-use industries, including electrical & electronics, building & construction, and automotive & transportation. Demand for microcellular plastics is expected to rise in several Asia Pacific countries, including the Philippines, Australia, Taiwan, South Korea, China, India, Japan, Thailand, Malaysia, Bangladesh, and Vietnam, due to rising automotive vehicle production and sales, as well as a strong manufacturing base in the electrical and electronics sector. Furthermore, cheap labor and land costs, rising buying power, low production set-up costs, and a fairly severe regulatory environment are some of the key drivers driving regional market expansion.

Microcellular Plastics Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the microcellular plastics market on a global and regional basis.

Some of the main competitors dominating the Microcellular Plastics Market include -

- Inenia Polymers Corp.

- Saint-Gobain

- BASF SE

- Lavergne Performance Compounds

- General Plastics Manufacturing Company

- Rogers Corporation

- INOAC Corporation

- Mearthane Products

The Microcellular Plastics Market is segmented as follows:

By Type

- Polyvinyl Chloride (PVC)

- Polycarbonate (PC)

- Polyethylene Terephthalate (PET)

By Applications

- Aircraft

- Toys

- Home Decorative

- Others

By End-User

- Construction

- Food packaging

- Electronics

- Automobile

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global microcellular plastics market is expected to grow due to increasing demand for lightweight materials, improved thermal insulation, and sustainable manufacturing practices across industries like automotive, packaging, and construction.

According to a study, the global microcellular plastics market size was worth around USD 15.04 Billion in 2024 and is expected to reach USD 27.70 Billion by 2034.

The global microcellular plastics market is expected to grow at a CAGR of 7% during the forecast period.

Asia-Pacific is expected to dominate the microcellular plastics market over the forecast period.

Leading players in the global microcellular plastics market include Inenia Polymers Corp., Saint-Gobain, BASF SE, Lavergne Performance Compounds, General Plastics Manufacturing Company, Rogers Corporation, INOAC Corporation, Mearthane Products,, among others.

The report explores crucial aspects of the microcellular plastics market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed