Automotive Composite Market Size, Trends, Revenue Analysis 2032

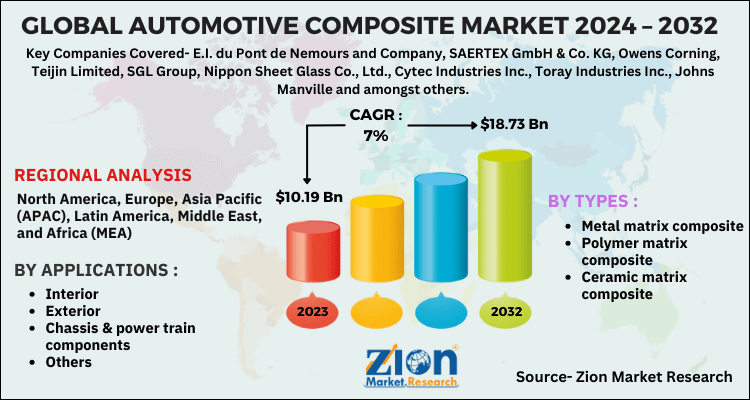

Automotive Composite Market By Type (Metal Matrix Composite, Polymer Matrix Composite And Ceramic Matrix Composite) By Application (Interior, Exterior, Chassis & Power Train Components, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

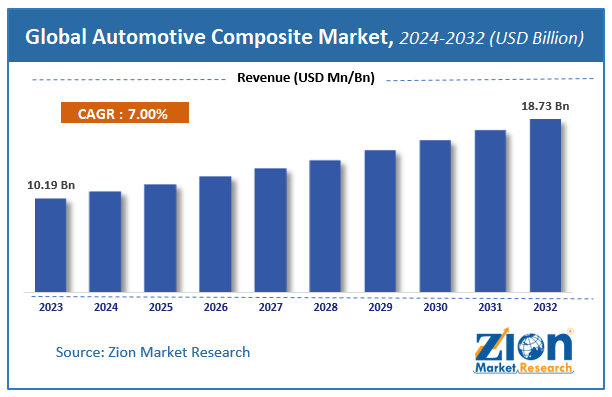

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.19 Billion | USD 18.73 Billion | 7% | 2023 |

Automotive Composite Market Insights

According to Zion Market Research, the global Automotive Composite Market was worth USD 10.19 Billion in 2023. The market is forecast to reach USD 18.73 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Automotive Composite Market industry over the next decade.

Automotive Composite Market: Overview

The global automotive composites market is majorly used for reducing the weight of components. These composites include materials that are manufactured from a combination of two or more materials. It offers various unique characteristics to the part such as high tensile strength, lightness, stiffness, and material strength, therefore, considering this parameter the automotive composites market has wide scope in the near future in various applications including automotive, aerospace, electronics, defense, and marine amongst others.

Increasing environmental concerns, with rising fuel prices among emerging nations, are resorting manufacturers to incorporate lightweight materials in vehicles. This factor is likely to increase the demand for the automotive composite market.

COVID-19 Impact Analysis

The global automotive composites market has witnessed a slight decline in sales for the short term to the lockdown enforcement placed by governments to contain COVID-19 spreading. Retail sales of vehicles across the region are also likely to suffer due to subdued consumer sentiment because of the rising infections and curbs. The automotive industry in the U.S remains fragile, vehicles sales decline by 5-10%, whereas China's vehicle sales continue their fast recovery. Europe automotive shows a decline of 8- 12% Y-o-Y.

The restrictions imposed by various nations to contain COVID had stopped production resulting in disruption across the whole supply chain. However, the global markets are slowly opening to their full potential, and theirs a surge in demand for auto parts for vehicles. The market will remain bullish in the upcoming year. The significant decrease in the global automotive composites market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Automotive Composite Market: Growth Factors

Increasing demand for automotive composites in the automotive and aerospace industries is one of the major driving factors for the growth of the automotive composites market. Moreover, stringent norms and regulations specific to CO2 emission especially in regions such as North America and Europe are anticipated to spur the market size in the region during the forecast period.

However, the high cost of composites can lead to limit the growth of the market. In addition, the growing demand for lightweight vehicles in the Asia Pacific region due to the growing prices of fuel is likely to set new opportunities for the major players in the automotive composites market over the coming years.

Composite is a mix of two different components revealing different chemical and physical properties together come with excellent outcomes. Different composites are used in the automotive industry to functions the vehicle with great fuel efficiency. The composites help in manufacturing lightweight vehicles which increase the fuel efficiency of the vehicles. Thus, the growing trend of utilization of different composites in the automotive industry is likely to drive the composite market in the near future. The global automotive composites market is primarily driven by growing penetration of lightweight automobile across the globe. The stringent rules and regulations of CO2 emission imposed by the regulatory bodies across the globe are expected to influence positively for the automotive industry. This, in turn, is likely to propel the demand for automotive composite during the years to come. However, the high cost of composites and the growing concern about the recyclability may likely to hamper the growth of the automotive composite market. Nevertheless, growing preference for higher fuel efficiency in passenger cars, especially in Asia Pacific region, is likely to open new doors for the major players of automotive composites market in the next few years.

Automotive Composite Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Composite Market |

| Market Size in 2023 | USD 10.19 Billion |

| Market Forecast in 2032 | USD 18.73 Billion |

| Growth Rate | CAGR of 7% |

| Number of Pages | 210 |

| Key Companies Covered | E.I. du Pont de Nemours and Company, SAERTEX GmbH & Co. KG, Owens Corning, Teijin Limited, SGL Group, Nippon Sheet Glass Co., Ltd., Cytec Industries Inc., Toray Industries Inc., Johns Manville and amongst others. |

| Segments Covered | By Types, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Composite Market: Segmentation Analysis

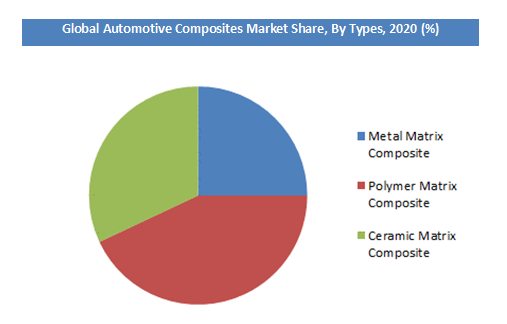

By Types Segment Analysis

The polymer matrix composite segment held the major share of more than 42.5% in the automotive composite market and is likely to remain dominant throughout the forecast period. Increasing use of polymer matrix composite in an array of industries such as aerospace, automotive, and electronics is likely to spur the market size with a growing CAGR of 9.4% from 2024-2032. Moreover, the metal matrix is also predicted to witness moderate growth in the coming years owing to growing usage in the aerospace industry.

By Applications Segment Analysis

The exterior applications segment dominated the global automotive composites market in 2023. It accounted for more than 32.1% share of the total market in 2020 and it is likely to witness major growth in the coming years. Owing to high investment in R&D, the exterior application is likely to spur the growth of the automotive composite market.

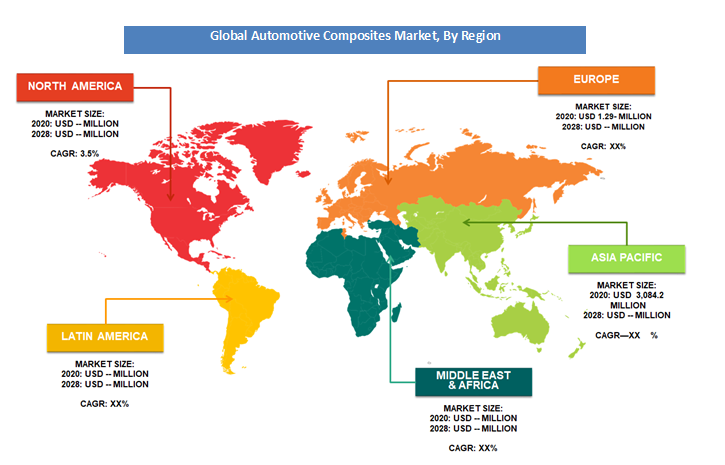

Automotive Composite Market: Regional Analysis

Asia Pacific led the global automotive composites market in 2023 with a more than 34.5% share. The increasing demand for automobiles coupled with the rising disposable incomes in Asia Pacific countries is expected to propel the demand for the automotive composites market over the years to come. Growing demand for passenger vehicles because of emerging industrialization in the region is likely to drive the demand for the automotive industry.

Moreover, increasing fuel prices is predicted to increase the demand for lightweight vehicles which in turn is expected to grow the market size of automotive composites within the forecast period. Furthermore, North America and Europe are also expected to exhibit exponential growth in the automotive composites market soon.

Automotive Composite Market: Competitive Analysis

Some of the major players in the global Automotive Composite market include:

- E.I. du Pont de Nemours and Company

- SAERTEX GmbH & Co. KG

- Owens Corning

- Teijin Limited

- SGL Group

- Nippon Sheet Glass Co., Ltd.

- Cytec Industries Inc.

- Toray Industries Inc.

- Johns Manville

The global Automotive Composites Market is segmented as follows:

By Types

- Metal matrix composite

- Polymer matrix composite

- Ceramic matrix composite

By Applications

- Interior

- Exterior

- Chassis & power train components

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the Global Automotive Composite market size was worth around USD 10.19 billion in 2023 and is expected to reach USD 18.73 billion by 2032.

The Global Automotive Composite market is expected to grow at a CAGR of 7% during the forecast period.

Some of the key factors driving the Global Automotive Composites Market growth Weight reduction trends in vehicles, Presence of major vehicle manufacturers, and Increasing adoption of high-end and luxury vehicles.

Asia Pacific is expected to dominate the Automotive Composite market over the forecast period.

Some of the major players of Global automotive composites market includes E.I. du Pont de Nemours and Company, SAERTEX GmbH & Co. KG, Owens Corning, Teijin Limited, SGL Group, Nippon Sheet Glass Co., Ltd., Cytec Industries Inc., Toray Industries Inc., Johns Manville and amongst others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed