Global Hyperautomation Market Size, Share, Growth Analysis Report - Forecast 2034

Hyperautomation Market By Component (Hardware, Software, Services), By Technology (Robotic Process Automation (RPA), Artificial Intelligence (AI), Machine Learning (ML), Natural Language Processing (NLP), Others), Function (Marketing & Sales, Finance & Accounting, Human Resources (HR), Operations & Supply Chain, Information Technology (IT)), End User (Manufacturing, Automotive, BFSI, Healthcare, IT & Telecommunication, Retail, Transportation & Logistics, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

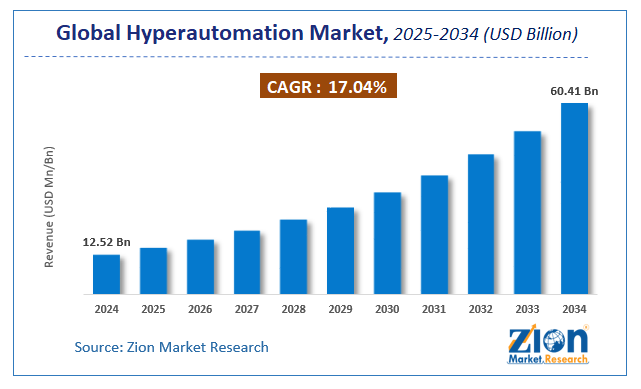

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.52 Billion | USD 60.41 Billion | 17.04% | 2024 |

Hyperautomation Market: Industry Perspective

The global hyperautomation market size was worth around USD 12.52 Billion in 2024 and is predicted to grow to around USD 60.41 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 17.04% between 2025 and 2034.

The report analyzes the global hyperautomation market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the hyperautomation industry.

The report analyzes the global hyperautomation market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the hyperautomation market.

Hyperautomation Market: Overview

Hyperautomation goes one step beyond automation by divulging into technologies like Artificial Intelligence (AI) and Robotic Process Automation (RPA) which enables any complex task to be carried out with absolute ease. With the help of such advanced technology processes, an organization can automate its automated tasks with the help of dynamically created bots by automatically discovering business processes. Gartner, a USA-based technological research and consulting firm rated hyperautomation as one of the top 10 strategic technology-related trends.

A combination of RPA and AI allows for the power and flexibility to automate any process that was deemed impossible to automate until a few years ago. By investing in hyperautomation, a company may benefit by accelerating complex work since the advanced technology provides support by automating complex tasks and engaging everyone associated with business transformation.

For developing an excellent hyperautomation process, it is important to have a strong automation procedure that forms the building base. Smaller automated programs and tools are used to conduct smaller tasks. This is then followed by the process of orchestration, which involves bringing together all the individually automated segments in line with one another. The final step in developing a hyperautomated protocol involves optimization which means adding an extra coating of intelligence and optimizing the entire process to deliver the most efficient output.

Key Insights

- As per the analysis shared by our research analyst, the global hyperautomation market is estimated to grow annually at a CAGR of around 17.04% over the forecast period (2025-2034).

- Regarding revenue, the global hyperautomation market size was valued at around USD 12.52 Billion in 2024 and is projected to reach USD 60.41 Billion by 2034.

- The hyperautomation market is projected to grow at a significant rate due to rising need for business process automation, integration of AI and machine learning, digital transformation initiatives, and demand for operational efficiency.

- Based on Component, the Hardware segment is expected to lead the global market.

- On the basis of Technology, the Robotic Process Automation (RPA) segment is growing at a high rate and will continue to dominate the global market.

- Based on the Function, the Marketing & Sales segment is projected to swipe the largest market share.

- By End User, the Manufacturing segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Hyperautomation Market: Growth Drivers

Growing applications of RPA and AI to drive market growth during the forecast period.

The global hyperautomation market cap may grow owing to the rising trend of using robotic process automation and artificial intelligence technology in advanced technologies. RPA simply means using computer programming languages to carry out a set of complex and repetitive tasks within a certain set of rules. RPA market value was estimated to be around USD 1 billion in 2019 and may grow more than 33.5% by 2028 because of rising adoption. RPA is not a complex process to be automated and its ease corresponding with the quality output is what seems to attract investors or organizations to the technology. In 2018, more than USD 2 billion was invested in RPA. As per Deloitte, robotic process automation technology is heading towards universal adoption in the coming few years. At the same time, Artificial Intelligence technology has managed to carve a name for itself in the technical market. Processes like Image Recognition, Natural Language Processing, Speech Analysis, etc. have become extremely popular in the last decade. AI has allowed software to not just carry out certain tasks and with the ability to make decisions as well.

Hyperautomation Market: Restraints

High initial cost of adoption to restrict market expansion

Setting up hyperautomated processes may be expensive or a high-cost investment for many enterprises owing to the advanced technologies used along with the added cost of training or hiring trained professionals capable of handling such technologies. As per estimates, SMEs may have to invest between USD 4,000 to USD 15,000 for a single bot, and in the case of larger organizations, the amount may go up to USD 20 million. This is the approximate value of using the technology. The training cost of employees and other relevant expenses may increase this final cost to an even higher number. It will take time for businesses to reap the actual benefits of hyperautomation since the result will not be seen overnight which restricts global market size owing to a reluctance amongst organizations about the actual benefit of hyperautomation processes.

Hyperautomation Market: Opportunities

Applications in raising security standards to provide growth opportunities

RPA and AI have used applications in raising security standards at national as well as regional levels. Hyperautomation is widely used to detect any safety violations thus preventing serious accidents. The defense sector of many advanced economies has started considering using hyperautomation to upgrade their security systems and procedures. Aerospace is expected to benefit the highest in case of the adoption of RPA and AI in its protocols. Higher global market growth opportunities can be expected due to the increasing number of strategic collaborations witnessed amongst market players. Many enterprises can be witnessed tying up with other organizations in order to enhance their global footprint thus benefiting the global market expansion.

Hyperautomation Market: Challenges

Lack of skilled personnel to challenge market cap growth

Since hyperautomation is a relatively newer concept, there is a lack of sufficient institutes offering quality education in such advanced technologies. There is a significant gap between the demand and the actual number of skilled professionals present. This may considerably impact global market growth because more time will be utilized to train professionals before they can practically and efficiently execute hyperautomation. The global market needs more investors in the educational field to provide learning opportunities that will aid the creation of qualified and skilled professionals in the hyperautomation field.

Hyperautomation Market: Segmentation

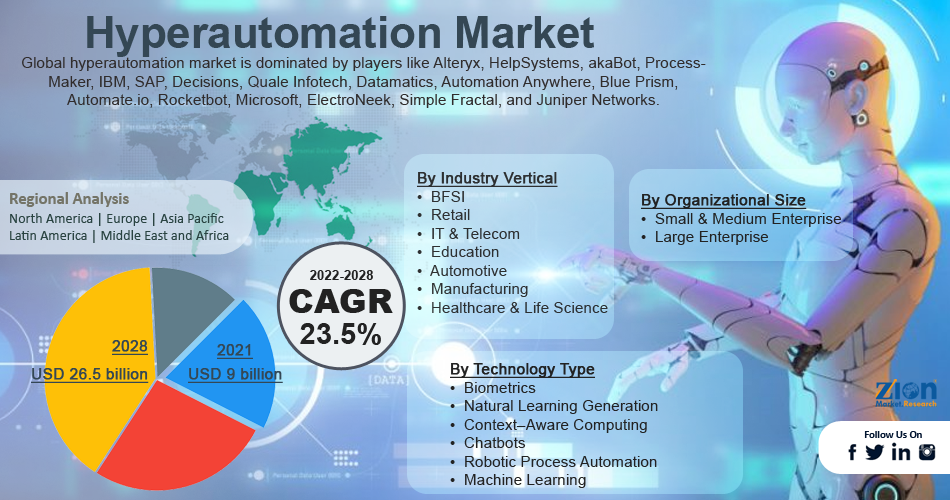

The global hyperautomation market is segmented based on organization size, technology type, industry vertical, and region.

Based on organization size, the global market segments are small & medium enterprise and large enterprise. Currently, the global market is dominated by large enterprises however there is a significant increase in the adoption rate amongst SMEs as well, even though they are at a smaller scale. In a 2021 survey conducted by Gartner, which comprised respondents from large-scale to small-scale organizations, over 85% of the responses stated that they will either continue or increase their investment in hyperautomation in the coming years.

Based on technology type, the global market is segmented into biometrics, natural learning generation, context-aware computing, chatbots, robotic process automation, and machine learning. Chatbots, machine learning, and robotic process automation are currently the go-to technologies for many organizations. Com100 published a report in 2022, saying that chatbots were able to manage more than 69% of chats from start to finish on their own, in the year 2019.

Based on industry vertical, the global market segments are BFSI, retail, IT & telecom, education, automotive, manufacturing, and healthcare & life sciences. Currently, the global market is dominated by the BFSI segment. As per the 2017 Mckinsey report, more than 10 to 15% of the banking tasks can be efficiently executed by hyperautomating processes. This number has significantly increased as of 2022 with the emergence of 24*7 availability of chatbots, payment gateways, query resolution, etc.

Hyperautomation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Hyperautomation Market |

| Market Size in 2024 | USD 12.52 Billion |

| Market Forecast in 2034 | USD 60.41 Billion |

| Growth Rate | CAGR of 17.04% |

| Number of Pages | 240 |

| Key Companies Covered | UiPath, Automation Anywhere, Blue Prism, Pegasystems, Appian, IBM, Microsoft, SAP, ServiceNow, Oracle, and others. |

| Segments Covered | By Component, By Technology, By Function, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments:

- In January 2022, Alteryx agreed to acquire Trifacta for a value of USD 400 million. The acquisition was closed in the 1st QN of 2022, adding cloud-native technologies to the Alteryx portfolio while aiming to accelerate the company’s move towards the cloud. With the acquisition of Trifacta, a cloud data management, and machine learning platform provider, Alteryx will also benefit by expanding its presence to include customers in large to very large enterprises.

- In February 2022, IBM and SAP announced a strong partnership intended to help customers move workloads from SAP solutions. IBM will be receiving technological and consulting services from SAP which will help the clients transition smoothly towards a hybrid cloud approach.

Hyperautomation Market: Regional Analysis

North America to lead owing to higher technology adoption rate during the forecast period

The global hyperautomation market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market owing to the presence of key players in the USA. Some of the players include companies like Uipath and Automation Anywhere Inc. The regional market cap may also benefit owing to the higher adoption rate of advanced technologies in Canada, and the USA. The North American market is full of immense amounts of data which is a result of technological growth. This has propelled the need of adopting hyperautomation in order to process as well secure the information available.

Europe is expected to generate significant revenues owing to the increasing demand for efficient organizational outputs. The growth is projected to be highest in Germany since there is an increase in investments toward hyperautomating supply chain processes.

Hyperautomation Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the hyperautomation market on a global and regional basis.

The global hyperautomation market is dominated by players like:

- UiPath

- Automation Anywhere

- Blue Prism

- Pegasystems

- Appian

- IBM

- Microsoft

- SAP

- ServiceNow

- Oracle

The global hyperautomation market is segmented as follows;

By Component

- Hardware

- Software

- Services

By Technology

- Robotic Process Automation (RPA)

- Artificial Intelligence (AI)

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Others

By Function

- Marketing & Sales

- Finance & Accounting

- Human Resources (HR)

- Operations & Supply Chain

- Information Technology (IT)

By End User

- Manufacturing

- Automotive

- BFSI

- Healthcare

- IT & Telecommunication

- Retail

- Transportation & Logistics

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global hyperautomation market is expected to grow due to the need to enhance operational efficiency, reduce human error, and integrate AI, RPA, and analytics across business processes.

According to a study, the global hyperautomation market size was worth around USD 12.52 Billion in 2024 and is expected to reach USD 60.41 Billion by 2034.

The global hyperautomation market is expected to grow at a CAGR of 17.04% during the forecast period.

North America is expected to dominate the hyperautomation market over the forecast period.

Leading players in the global hyperautomation market include UiPath, Automation Anywhere, Blue Prism, Pegasystems, Appian, IBM, Microsoft, SAP, ServiceNow, Oracle, among others.

The report explores crucial aspects of the hyperautomation market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed