Medical Device Coatings Market Trend, Share, Growth, Size, and Forecast 2032

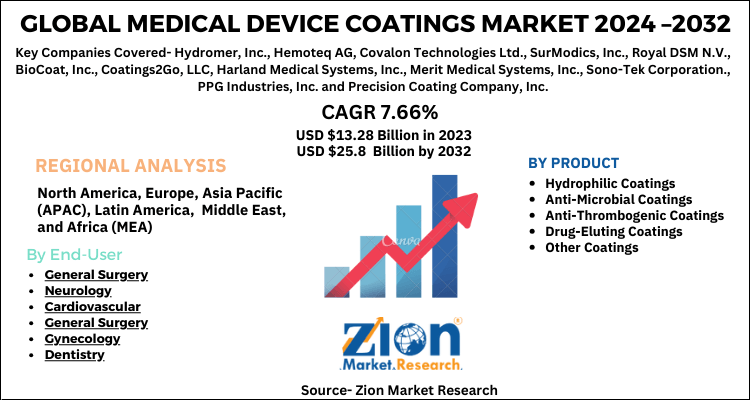

Medical Device Coatings Market By Product (Hydrophilic Coatings, Anti-Microbial Coatings, Anti-Thrombogenic Coatings, Drug-Eluting Coatings And Other Coatings) By End-User (General Surgerys, Neurology, Cardiovascular, General Surgery, Gynecology, Dentistry And Other End-Users), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

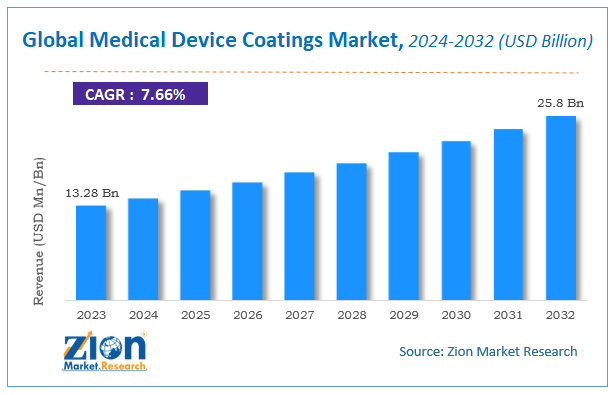

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 13.28 Billion | USD 25.8 Billion | 7.66% | 2023 |

Medical Device Coatings Market Size

Zion Market Research has published a report on the global Medical Device Coatings Market, estimating its value at USD 13.28 Billion in 2023, with projections indicating that it will reach USD 25.8 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 7.66% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Medical Device Coatings Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Medical Device Coatings Market: Overview

Medical device coatings are typically utilized in the healthcare industry; it helps to switch the surfaces of devices, equipment, and implants. Medical device coating helps to enhance the surface properties of medical devices. the rise in the spread of contact diseases, especially in the medical building providing sites has resulted in a rise in demand for medical device coating. As, medical devices are constantly used and are available in constant contact with a physical body, after a specific period of use these devices can act as a medium for the spread of varied diseases. Medical device coatings help to extend the general utility of medical devices.

COVID-19 Impact Analysis:

The global medical device coatings market has witnessed a slight decline in growth for the short term due to the lockdown endorsement placed by governments to contain COVID spreading. The medical device coatings market includes major (Tier I and II) manufacturers like DSM, Hydromer, Biocoat, and AST Products. These suppliers have their manufacturing facilities spread across various countries. COVID-19 has impacted their businesses as well. Considering the emergency government has revised its norms, for instance, FDA has issued Emergency Use Authorizations (EUA) for medical devices, including IVD test kits to diagnose COVID-19 and PPE needed to protect healthcare workers interacting with patients. Similarly, the European Commission has recently approved revised harmonized standards to expedite the production of medical face masks, gloves, and sterilization devices & disinfectants, and alter particular requirements for emergency and transport ventilators.

Medical Device Coatings Market: Growth Factors

The global medical device coatings market is primarily driven by the expansion of the medical device industry in the Asia Pacific region, especially in China. Another major driving factor is the increasing demand for minimally invasive procedures coupled with technological innovations. However, volatile staple prices and strict government regulations implied in this industry are major restraints that will limit the expansion of the market. Nonetheless, the growing demand for nanocoatings because the medical device coating material is probably going to disclose new avenues for the medical device coatings market within the near future.

Medical Device Coatings Market: Segmentation

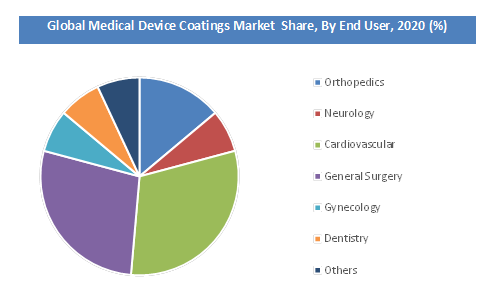

End-User Segment Analysis Preview

Orthopedics, neurology, cardiovascular, general surgery, gynecology, dentistry, and others are the key end-user segment of the worldwide medical device coatings market. the overall surgery end-user segment dominated the market in terms of revenue while the orthopedics and cardiovascular devices segment followed the general surgery segment. The cardiovascular device is probably going to possess a big growth within the forecast period.

Product Segment Analysis Preview

The medical device coatings market is segmented on the idea of various products including hydrophilic coatings, anti-microbial coatings, anti-thrombogenic coatings, drug-eluting coatings, and other coatings. In 2015, the anti-microbial coating was the most important segment in the medical device coatings market and accounted for the largest share of the entire market. Additionally, it's expected to continue its dominance and be the fastest-growing segment within the global market over the forecast period.

The hydrophilic coatings segment is predicted to witness the fastest growth thanks to the adequate wetting ability provided by them which helps in smooth lubrication and successively helps in its usage within the broad range of medical devices.

Medical Device Coatings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Device Coatings Market |

| Market Size in 2023 | USD 13.28 Billion |

| Market Forecast in 2032 | USD 25.8 Billion |

| Growth Rate | CAGR of 7.66% |

| Number of Pages | 150 |

| Key Companies Covered | Hydromer, Inc., Hemoteq AG, Covalon Technologies Ltd., SurModics, Inc., Royal DSM N.V., BioCoat, Inc., Coatings2Go, LLC, Harland Medical Systems, Inc., Merit Medical Systems, Inc., Sono-Tek Corporation., PPG Industries, Inc. and Precision Coating Company, Inc |

| Segments Covered | By End-User, By Product and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medical Device Coatings Market: Regional Analysis Preview

Globally, North America is expected to remain the dominant region over the forecast period in 2018. Europe was the second-largest market for medical device coating in 2018. The Asia Pacific is expected to be the fastest-growing and the largest revenue-contributing region in the medical device coatings market during the forecast period. Moreover, Latin America is also expected to show noticeable growth in this market in the years to come.

Medical Device Coatings Market: Key Players & Competitive Landscape

Some of the key players in the medical device coatings market include:

- Hydromer Inc.

- Hemoteq AG

- Covalon Technologies Ltd.

- SurModics Inc.

- Royal DSM N.V.

- BioCoat Inc.

- Coatings2Go LLC

- Harland Medical Systems Inc.

- Merit Medical Systems Inc.

- Sono-Tek Corporation.

- PPG Industries Inc.

- Precision Coating Company Inc.

The global Medical Device Coatings Market is segmented as follows:

By End-User

- General Surgery

- Neurology

- Cardiovascular

- General Surgery

- Gynecology

- Dentistry

- Others

By Product

- Hydrophilic Coatings

- Anti-Microbial Coatings

- Anti-Thrombogenic Coatings

- Drug-Eluting Coatings

- Other Coatings

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Medical device coatings are specialized surface treatments applied to medical instruments and implants to enhance their performance and biocompatibility. These coatings provide benefits such as reduced friction, improved durability, antimicrobial properties, and resistance to corrosion or wear.

According to study, the Medical Device Coatings Market size was worth around USD 13.28 billion in 2023 and is predicted to grow to around USD 25.8 billion by 2032.

The CAGR value of Medical Device Coatings Market is expected to be around 7.66% during 2024-2032.

North America has been leading the Medical Device Coatings Market and is anticipated to continue on the dominant position in the years to come.

The Medical Device Coatings Market is led by players like BostonScientific Corporation, Medtronic Plc, Abbott Laboratories, NihonKohden Corporation, Koninklijke Philips N.V., Biotronik, LivaNovaPlc, Mediana Co. Ltd., BPL Medical Technologies and Schiller among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed