Global Gynecology Devices Market Size, Share, Growth Analysis Report - Forecast 2034

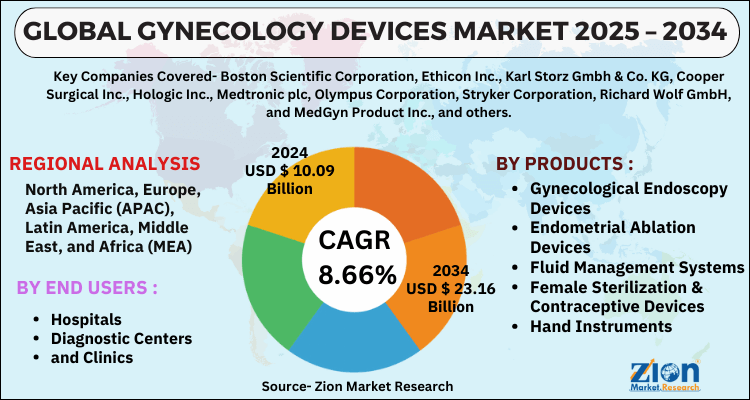

Gynecology Devices Market By Products (Gynecological Endoscopy Devices, Endometrial Ablation Devices, Fluid Management Systems, Female Sterilization & Contraceptive Devices, Hand Instruments, and Diagnostic Imaging Systems), By End Users (Hospitals, Diagnostic Centers, and Clinics), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

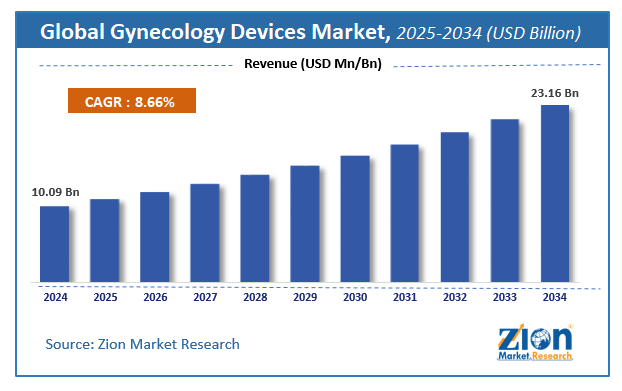

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 10.09 Billion | USD 23.16 Billion | 8.66% | 2024 |

Gynecology Devices Market Size

The global gynecology devices market size was worth around USD 10.09 Billion in 2024 and is predicted to grow to around USD 23.16 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.66% between 2025 and 2034.

The report analyzes the global gynecology devices market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the gynecology devices industry.

Gynecology Devices Market: Overview

Gynecology is a study that deals with health problems related to the female reproductive system, such as the vagina, ovaries, and uterus, as well as the female breast. Increasing women's population and lifestyle lead to an increase in various gynecological-related illnesses. The devices used to treat and diagnose these diseases are called gynecological devices. The growth of the global gynecological device market is driven by an increase in the number of gynecological diseases and the number of advanced women's medical devices. However, restricted access to contraceptives and the strict regulatory approval process is hampering the market growth.

In addition, robotics is one example of a computer system that assists in surgery. The incorporation of robotics by trained gynecologists increases the demand for a variety of surgical instruments. Cancer and other gynecological disorders can be successfully treated with innovative robotic technology. In addition, medical device manufacturers are committed to harnessing the power of robotic operations to increase profits. Therefore, the rapid driving force of automation technologies such as robotics in the treatment of gynecological diseases is expected to drive the growth of the gynecology device market.

Key Insights

- As per the analysis shared by our research analyst, the global gynecology devices market is estimated to grow annually at a CAGR of around 8.66% over the forecast period (2025-2034).

- Regarding revenue, the global gynecology devices market size was valued at around USD 10.09 Billion in 2024 and is projected to reach USD 23.16 Billion by 2034.

- The gynecology devices market is projected to grow at a significant rate due to increasing prevalence of gynecological disorders, advancements in minimally invasive procedures, and rising healthcare investments.

- Based on Products, the Gynecological Endoscopy Devices segment is expected to lead the global market.

- On the basis of End Users, the Hospitals segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Gynecology Devices Market: Growth Drivers

Rise in Incidence of Gynecological Diseases

Gynecological disorders include a variety of disorders, including uterine cancer, cervical cancer, polycystic ovary syndrome, and ovarian cancer. According to research data from the Institute for Health Metrics and Evaluation (IHME), about 8,640 deaths were caused by gynecological diseases in 2019, with 37% of the female population living with these diseases worldwide. For example, endometrial cancer is the most common cancer of the female reproductive system in the United States. Uterine cancer is the sixth most common cancer in women in the United States. Thus, the rising cases of gynecological disorders is likely to boost the global gynecology devices market growth.

Gynecology Devices Market: Restraints

Concerns about the safety of pelvic organs to hamper the market growth

Concerns about the safety of pelvic organ prolapse are expected to impede market growth over the forecast period. In Europe, it is advisable to use the vaginal mesh only in complex cases with no other alternative treatments. The general bad reputation surrounding litigation, regulatory scrutiny, and the use of meshes can limit the growth of the pelvic organ prolapse and the market as a whole.

Gynecology Devices Market: Segmentation Analysis

The global gynecology devices market is segregated on the basis of products, end-users, and region.

By products, the market is divided into gynecological endoscopy devices, endometrial ablation devices, fluid management systems, female sterilization & contraceptive devices, hand instruments, and diagnostic imaging systems. Among these, the gynecological endoscopy devices segment dominates the market, accounting for more than 45 percent of global sales.

By end-use, the market is classified into hospitals, diagnostic centers, and clinics. The hospital segment will dominate the market during the forecast period due to the development of medical institutions. Hospitals have been upgraded to the latest equipment and equipped with digital pathology and artificial intelligence. These technologies support communication between departments and enable cross-domain data exchange.

Gynecology Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Gynecology Devices Market |

| Market Size in 2024 | USD 10.09 Billion |

| Market Forecast in 2034 | USD 23.16 Billion |

| Growth Rate | CAGR of 8.66% |

| Number of Pages | 255 |

| Key Companies Covered | Boston Scientific Corporation, Ethicon Inc., Karl Storz Gmbh & Co. KG, Cooper Surgical Inc., Hologic Inc., Medtronic plc, Olympus Corporation, Stryker Corporation, Richard Wolf GmbH, and MedGyn Product Inc., and others. |

| Segments Covered | By Products, By End Users, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In September 2021, Ethicon unveiled the industry's first electric circular stapler for colorectal, gynecological, gastric, and chest surgery. Helps treat serious complications associated with bowel and stomach surgery. In addition, the Echelon Circular Powered Stapler reduces staple line leaks by 61% compared to Medtronic's DST series Eea Stapler.

- In May 2021, Hologic Inc. acquired Biotheranostics, the developer of two highly differentiated molecular diagnostic tests for breast and metastatic cancers. Breast cancer index (BCI) and Cancer TYPE ID (CTID). The Breast Cancer Index predicts which early-stage hormone receptor-positive (HR +) breast cancer patients are likely to benefit from long-term endocrine therapy, the National Cancer Network (NCCN) and the American Society of Clinical Oncology (ASCO).

Gynecology Devices Market: Regional Analysis

Increasing demand for gynecological surgeries shows largest market share.

The North American region holds the largest share of the global gynecology devices market due to increasing demand for gynecological surgery, increasing prevalence of female reproductive disorders, and growing technological advances in gynecological equipment. Cancer is one of the biggest health problems for women in the United States. According to the Centers for Disease Control and Prevention (CDC), breast, colon, endometrial, lung, cervical, skin, and ovarian cancers are the most common cancers that affect women. More than 270,000 women are dying from cancer.

Gynecology Devices Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the gynecology devices market on a global and regional basis.

The global gynecology devices market is dominated by players like:

- Boston Scientific Corporation

- Ethicon Inc.

- Karl Storz Gmbh & Co. KG

- Cooper Surgical Inc.

- Hologic Inc.

- Medtronic plc

- Olympus Corporation

- Stryker Corporation

- Richard Wolf GmbH

- and MedGyn Product Inc.

The global gynecology devices market is segmented as follows;

By Products

- Gynecological Endoscopy Devices

- Endometrial Ablation Devices

- Fluid Management Systems

- Female Sterilization & Contraceptive Devices

- Hand Instruments

- and Diagnostic Imaging Systems

By End Users

- Hospitals

- Diagnostic Centers

- and Clinics

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global gynecology devices market is expected to grow due to increasing prevalence of gynecological disorders, rising demand for minimally invasive procedures, and advancements in diagnostic and surgical equipment.

According to a study, the global gynecology devices market size was worth around USD 10.09 Billion in 2024 and is expected to reach USD 23.16 Billion by 2034.

The global gynecology devices market is expected to grow at a CAGR of 8.66% during the forecast period.

North America is expected to dominate the gynecology devices market over the forecast period.

Leading players in the global gynecology devices market include Boston Scientific Corporation, Ethicon Inc., Karl Storz Gmbh & Co. KG, Cooper Surgical Inc., Hologic Inc., Medtronic plc, Olympus Corporation, Stryker Corporation, Richard Wolf GmbH, and MedGyn Product Inc., among others.

The report explores crucial aspects of the gynecology devices market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed