Global Clinical Oncology Next Generation Sequencing Market Size, Share - Forecast 2034

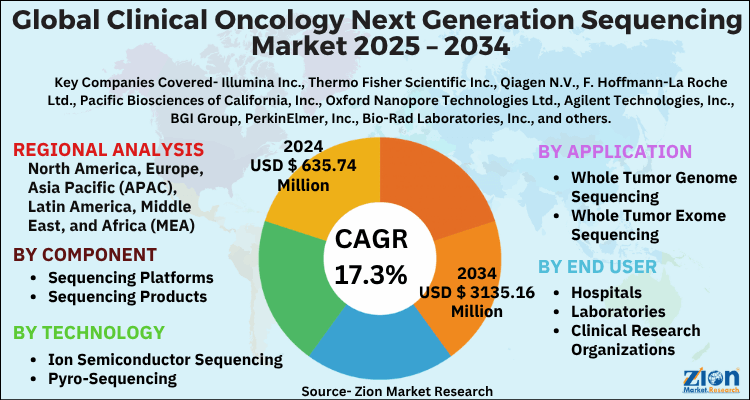

Clinical Oncology Next Generation Sequencing Market By Component (Sequencing Platforms, Sequencing Products, Kits And Reagents, Services), By Technology (Ion Semiconductor Sequencing, Pyro-Sequencing, Synthesis Sequencing (Sbs), Real Time Sequencing (Smrt), Ligation Sequencing, Reversible Dye Termination Sequencing, Nano-Pore Sequencing), By Application (Whole Tumor Genome Sequencing, Whole Tumor Exome Sequencing, Targeted Tumor Genome Profiling, Tumor Transcriptome Sequencing, Tumor-Normal Comparisons, Others), By End User (Hospitals, Laboratories, Clinical Research Organizations, Diagnostic Laboratories, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

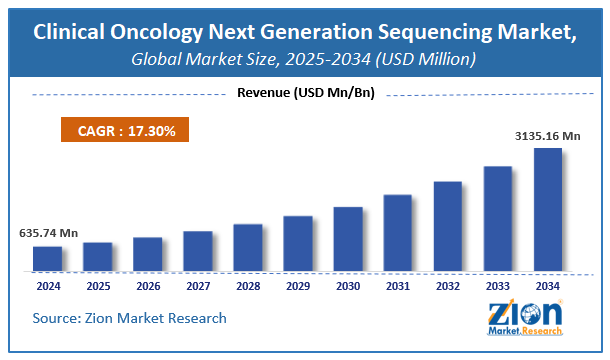

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 635.74 Million | USD 3135.16 Million | 17.3% | 2024 |

Clinical Oncology Next Generation Sequencing Market: Industry Perspective

The global clinical oncology next generation sequencing market size was worth around USD 635.74 Million in 2024 and is predicted to grow to around USD 3135.16 Million by 2034 with a compound annual growth rate (CAGR) of roughly 17.3% between 2025 and 2034.

The report analyzes the global clinical oncology next generation sequencing market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the clinical oncology next generation sequencing industry.

Clinical Oncology Next Generation Sequencing Market: Overview

With genomics-focused pharmacology beginning to play a major role in cancer therapy, clinical next-generation sequencing (NGS) is emerging as a valuable method for obtaining an in-depth and accurate look into individual tumor molecular backgrounds. Furthermore, tailored therapies are rapidly emerging as the latest oncology standards of healthcare treatments. In addition to this, clinical NGS-driven companion diagnostics are widely viewed as enhanced treatment alternatives for improving patient outcomes in the near future.

Key Insights

- As per the analysis shared by our research analyst, the global clinical oncology next generation sequencing market is estimated to grow annually at a CAGR of around 17.3% over the forecast period (2025-2034).

- Regarding revenue, the global clinical oncology next generation sequencing market size was valued at around USD 635.74 Million in 2024 and is projected to reach USD 3135.16 Million by 2034.

- The clinical oncology next generation sequencing market is projected to grow at a significant rate due to increasing adoption of precision medicine and companion diagnostics, rising prevalence of cancer worldwide, continuous technological advancements in NGS platforms, and growing demand for comprehensive genomic profiling for personalized treatment.

- Based on Component, the Sequencing Platforms segment is expected to lead the global market.

- On the basis of Technology, the Ion Semiconductor Sequencing segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Whole Tumor Genome Sequencing segment is projected to swipe the largest market share.

- By End User, the Hospitals segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Clinical Oncology Next Generation Sequencing Market: Growth Factors

Surge in healthcare spending will steer the global market surge over the forecast period

Technological innovations and a rise in healthcare expenditure will prop up the expansion of the clinical oncology next generation sequencing market across the globe. Increase in cancer incidences across the globe will pave the way for a humungous surge in the global market in the years ahead. In addition to this, increasing use of next-generation sequencing for developing personalized medicine for treating cancer will prompt the expansion of the market globally. Additionally, surging acceptance of companion diagnostics will proliferate the size of the global market.

Furthermore, a prominent increase in the use of next generation sequencing techniques for liquid biopsy will embellish the global market trends. Launching of new technologies is likely to contribute sizably towards the surge in the earnings of the global market. For instance, in the second half of 2022, Thermo Fisher Scientific Corporation introduced next-generation sequencing analysis and test software referred to as CE-IVD for enabling precision oncology testing of biomolecules. These initiatives are likely to spearhead the growth of the market globally.

Clinical Oncology Next Generation Sequencing Market: Restraints

Massive costs related to NGS systems can put brakes on the global industry expansion by 2034

High expenditure associated with clinical oncology next generation sequencing processes will curtail the growth of the clinical oncology next generation sequencing industry across the globe.

Clinical Oncology Next Generation Sequencing Market: Opportunities

Reduced prices of NGS systems can help market explore new domains of growth globally

Low costs of NGS tools and the introduction of new clinical oncology techniques by market players will open new growth panoramas for the global clinical oncology next generation sequencing market. Supportive government policies will prompt the expansion of the global market in the upcoming years.

Clinical Oncology Next Generation Sequencing Market: Challenges

Escalating costs of deploying NGS tools can prove to be a huge challenge for the global industry

Rise in the cost of installing the NGS systems and the restricted availability of sequencing tools in certain countries can prove to be a huge challenge for the global clinical oncology next generation sequencing industry.

Clinical Oncology Next Generation Sequencing Market: Segmentation

The global clinical oncology next generation sequencing market is sectored into technology, workflow, application, end-user, and region.

In technology terms, the global clinical oncology next generation sequencing market is segregated into whole genome sequencing, whole exome sequencing, and targeted sequencing & re-sequencing segments. Furthermore, the targeted sequencing & re-sequencing segment, which acquired the highest share of the global market in 2022, is predicted to record the highest growth rate yearly in the upcoming years. The expansion of the segment in the forecasting period can be due to a rise in benefits offered by the targeted sequencing & re-sequencing technology that includes reduced costs, less time, and a rise in the quantity of data examined.

Based on the workflow, the global clinical oncology next generation sequencing industry is sectored into NGS pre-sequencing, NGS sequencing, and NGS data analysis segments. Moreover, the NGS sequencing segment, which amassed a key chunk of the global industry share in 2022, is expected to dominate the global industry over the analysis timeframe. The segmental expansion over the predicted timeline can be subject to the increase in the oncology sequencing projects.

Based on the application, the clinical oncology next generation sequencing market across the globe is divided into companion diagnostics, screening, and others segments. Among the application segment, the screening segment is projected to expand rapidly due to an increase in the use of NGS tools in cancer screening projects globally.

Based on the end-user, the clinical oncology next generation sequencing industry globally is divided into hospitals, clinics, laboratories, and others.

Clinical Oncology Next Generation Sequencing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Clinical Oncology Next Generation Sequencing Market |

| Market Size in 2024 | USD 635.74 Million |

| Market Forecast in 2034 | USD 3135.16 Million |

| Growth Rate | CAGR of 17.3% |

| Number of Pages | 203 |

| Key Companies Covered | Illumina Inc., Thermo Fisher Scientific Inc., Qiagen N.V., F. Hoffmann-La Roche Ltd., Pacific Biosciences of California, Inc., Oxford Nanopore Technologies Ltd., Agilent Technologies, Inc., BGI Group, PerkinElmer, Inc., Bio-Rad Laboratories, Inc., and others. |

| Segments Covered | By Component, By Technology, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Clinical Oncology Next Generation Sequencing Market: Regional Analysis

North America is prognosis to maintain leadership position in the global clinical oncology next generation sequencing market in the forecasting years

North America, which accounted for 49% of the global clinical oncology next generation sequencing market revenue in 2022, will be a dominating region over the assessment timeline. Furthermore, the regional market expansion can be due to strict measures taken by regulatory authorities pertaining to cancer screening diagnosis in countries such as the U.S. Rise in fund allocation for research activities and the huge presence of key players in the sub-continent will drive the regional market trends.

Furthermore, Asia-Pacific clinical oncology next generation sequencing industry is set to register the fastest CAGR in the upcoming years owing to low costs of sequencing and supportive government guidelines. High investments by manufacturers will further add to the regional market growth in the coming years.

Clinical Oncology Next Generation Sequencing Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the clinical oncology next generation sequencing market on a global and regional basis.

The global clinical oncology next generation sequencing market is dominated by players like:

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- Qiagen N.V.

- F. Hoffmann-La Roche Ltd.

- Pacific Biosciences of California Inc.

- Oxford Nanopore Technologies Ltd.

- Agilent Technologies Inc.

- BGI Group

- PerkinElmer Inc.

- Bio-Rad Laboratories Inc

The global clinical oncology next generation sequencing market is segmented as follows;

By Component

- Sequencing Platforms

- Sequencing Products

- Kits And Reagents

- Services

By Technology

- Ion Semiconductor Sequencing

- Pyro-Sequencing

- Synthesis Sequencing (Sbs)

- Real Time Sequencing (Smrt)

- Ligation Sequencing

- Reversible Dye Termination Sequencing

- Nano-Pore Sequencing

By Application

- Whole Tumor Genome Sequencing

- Whole Tumor Exome Sequencing

- Targeted Tumor Genome Profiling

- Tumor Transcriptome Sequencing

- Tumor-Normal Comparisons

- Others

By End User

- Hospitals

- Laboratories

- Clinical Research Organizations

- Diagnostic Laboratories

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global clinical oncology next generation sequencing market is expected to grow due to rising cancer prevalence, demand for personalized medicine, advancements in genomic technologies, and increasing investments in precision oncology research.

According to a study, the global clinical oncology next generation sequencing market size was worth around USD 635.74 Million in 2024 and is expected to reach USD 3135.16 Million by 2034.

The global clinical oncology next generation sequencing market is expected to grow at a CAGR of 17.3% during the forecast period.

North America is expected to dominate the clinical oncology next generation sequencing market over the forecast period.

Leading players in the global clinical oncology next generation sequencing market include Illumina Inc., Thermo Fisher Scientific Inc., Qiagen N.V., F. Hoffmann-La Roche Ltd., Pacific Biosciences of California, Inc., Oxford Nanopore Technologies Ltd., Agilent Technologies, Inc., BGI Group, PerkinElmer, Inc., Bio-Rad Laboratories, Inc., among others.

The report explores crucial aspects of the clinical oncology next generation sequencing market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed