Low Calorie Food Market Size, Share, Analysis, Trends, Growth, 2032

Low Calorie Food Market By Substitute Type (Nutrient-based, Sweeteners, Sugar Alcohol-based), By Application (Dairy Items, Dietary Beverages, Snacks, Bakery Items): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 436.57 Million | USD 731.34 Million | 5.9% | 2023 |

Low Calorie Food Market Insights

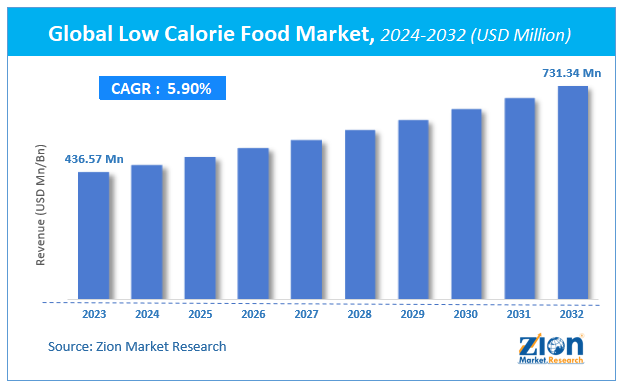

According to Zion Market Research, the global Low Calorie Food Market was worth USD 436.57 Million in 2023. The market is forecast to reach USD 731.34 Million by 2032, growing at a compound annual growth rate (CAGR) of 5.9% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Low Calorie Food Market industry over the next decade.

Low-calorie food is a standardized eating plan that limits daily caloric consumption, usually losing weight and cutting down from various health-related problems. In contrast to a conventional diet, low-calorie food contains fewer calories. A low-calorie diet entails eating between 1,200 and 1,500 calories per day, resulting in a calorie deficit leading to weight loss. Awareness among the new age generation for staying healthy and fit will drive the market's growth. Many segments in the health food industry have emerged due to recent changes in people's lifestyles and attitudes toward better health. People are becoming more aware of added sugars and how a sugary diet can increase the risk of diabetes and heart diseases, so they're looking for items with less added sugar. The Gluten-Free Diet hasn't lost its appeal, where they are getting more creative. Grain alternatives, such as almonds, and cassava flours, will continue to be among the trends during the forecast period.

Low Calorie Food Market?: COVID-19 Impact Analysis

Nutrition and hydration are essential, and people have started consuming a well-balanced diet to get healthier and less likely to contract chronic illnesses and infectious diseases. The Covid-19 crisis has positively impacted the low-calorie food market. As consumers seek to benefit from a healthy diet, the industry sees a rise in demand for low-calorie diets. With no proper treatment on COVID-19, people have become more concerned about preserving better immunity, which brings low-calorie food as one of the options to stay fit and healthy.

Low Calorie Food Market?: Growth Factors

Consumers' increasing health consciousness and changing habits pertaining to food intake are two significant factors expected to drive the low-calorie food industry's growth in the forecast years. Definitive diagnosis of diseases such as high blood pressure, weight gain, obesity, diabetes, and others are being caused by an increase in unhealthy lifestyles, high intake of fast food and soft drinks, and less regular exercise. Consumers are shifting their preferences toward low-calorie foods as a result of these health effects. Bloggers are promoting the advantages of eating a low-calorie diet, which has helped the industry gain traction in recent years as well.

In addition to growing awareness among consumers, the low-calorie food industry has benefited from the availability of functional diets, food supplements, cereal bars, and convenience diets. This is attributed to the rising popularity of sugar alternatives, combined with an ageing population, which is expected to shape the market's trajectory during forecast years.

Low Calorie Food Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Low Calorie Food Market |

| Market Size in 2023 | USD 436.57 Million |

| Market Forecast in 2032 | USD 731.34 Million |

| Growth Rate | CAGR of 5.9% |

| Number of Pages | 110 |

| Key Companies Covered | Archer Daniels Midland Company, Zydus Wellness Limited, McNeil Nutritionals LLC, Pepper Snapple Group, The Coca Cola Company, Ajinomoto Co. Inc., Bernard Food Industries Inc, PepsiCo Inc., Abbott Laboratories, Nestle |

| Segments Covered | By Type, By end-user, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Substitute Type Analysis Preview

Sweeteners Substitute Type Segment held a significant share in 2020. This is attributed to consumers watching their daily sugar intake and rise in confectionery and beverage industries. This substitute is becoming more common, and the food industry is working hard to promote them as a healthier option. Sweeteners can be found in a variety of foods, including ice cream, yogurt, cereals, iced tea, energy drinks, candy, cookies, granola bars, condiments, frozen foods, and energy bars. Diet sodas are the most common source of sweeteners in the diet. Neotame has almost 7000 to 13000 sweetness when compared to sucrose. Stevia sweeteners, which are gaining in popularity and are often advertised as a more natural substitute. All of those are sweet in taste with little to no calories. They are actually much sweeter than sucrose, so a small amount will add a lot of sweetness to a dish.

Moreover, Nutrient-based segment is gaining traction due to available high protein, low fat substitutes in the market. Alternative proteins, especially convenient plant-based foods that substitute cheese, sausages, and meat, are becoming increasingly popular among consumers. Low-calorie food which are high in protein, and fiber can keep the person fuller for longer.

Applications Segment Analysis Preview

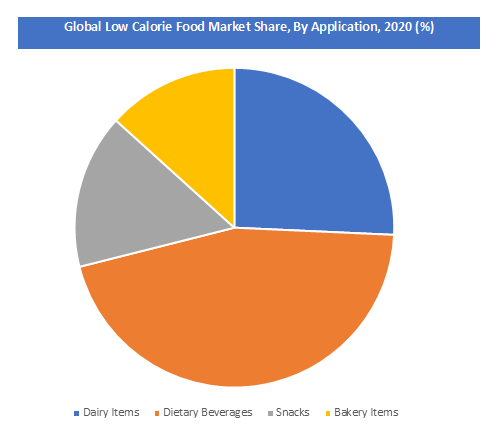

Dairy Items is the fastest growing segment due to the health benefits it has to offer. Skim or fat-free milk, as well as low-fat yoghurt and cottage cheese, are examples of low-fat dairy. Vitamin D and calcium, both of which are essential for bone health, are abundant in fortified low-fat milk. Furthermore, some low-fat yoghurts contain probiotics, which help to improve gut health. Increasing consumer awareness for plant-milk will drive the Dairy Items market significantly.

Dietary Beverages held a share of 45.34 % in 2020. Due to the market demand for various health drinks and packaged juice products, beverages are expected to be the fastest growing segment over the forecast period. It includes Diet Soda, Cola, and Healthy Juices. The best way to get nutrition and antioxidants is to eat whole fruits and vegetables, but beverages from these fruits are equally important. They are rich in antioxidants like vitamin A and C. Snacks and Bakery Items form the other application segment.

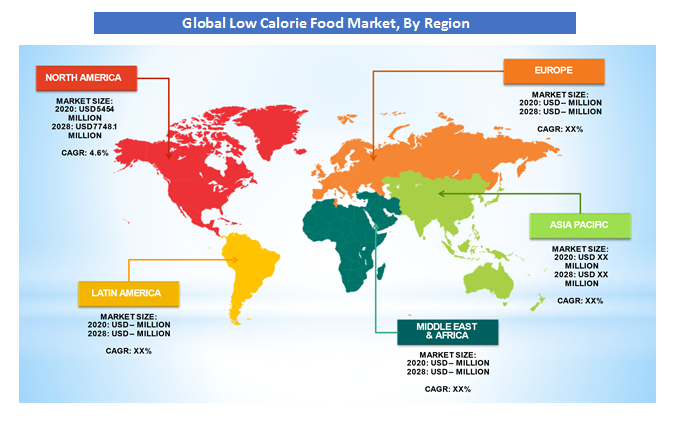

Low Calorie Food Market?: Regional Analysis Preview

North America held a significant share of 51.45% in 2020. Increasing customer understanding of health is going to accelerate the adoption of a healthier lifestyle, driving the growth of the low-calorie food industry. The demand for low-calorie food is growing due to an increase in the acceptance of healthy activities such as yoga, going to the gym, and eating healthy food. Low-calorie foods are also becoming more popular as obesity becomes more prevalent. Roughly out of three, two adults are overweight. The growing concerns of health will drive the market in North America Region. The US marketplace for low-calorie food is projected to be the largest in the world.

Europe is the second largest revenue generated region for this market. For years, health and wellness has been a defining theme in the food and beverage industry, and consumers continue to be concerned with what they eat and drink. People in UK and Germany have been following the trend of going vegan or vegetarian. But, Nutrition in Europe has followed a pattern seen in many other developed and developing countries, namely, a shift away from a complex carbohydrate-based diet toward one high in fat and added sugars.

Low Calorie Food Market?: Competitive Landscape

Some of the key players in the Low-Calorie Food Market include

- Archer Daniels Midland Company

- Zydus Wellness Limited

- McNeil Nutritionals LLC

- Pepper Snapple Group

- The Coca Cola Company

- Ajinomoto Co. Inc.

- Bernard Food Industries Inc

- PepsiCo Inc.

- Abbott Laboratories

- Nestle

- among others.

Mergers, acquisitions, growth, and investments are some of the strategy’s, companies have used to capture the evolving market. PepsiCo uses Stevia extraction. Similarly, many companies are following the same and using Stevia as sweeteners instead of artificial sweeteners. Bai Brands, which makes antioxidant-infused drinks, was purchased by Dr Pepper Snapple. This acquisition enabled the company to diversify its product offerings with a forecast of 40% to 50% volume growth, while also broadening its geographic reach.

The Global Low Calorie Food Market is segmented as follows:

By Substitute Type

- Nutrient-based

- Protein

- Carbohydrate

- Fat

- Sweeteners

- Stevia

- Saccharin

- Aspartame

- Neotame

- Others

- Sugar Alcohol-based

- Xylitol

- Lactitol

- Sorbitol

- Erythritol

- Others

By Applications

- Dairy Items

- Dietary Beverages

- Snacks

- Bakery Items

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Global Low Calorie Food Market was valued at USD 436.57 Million in 2023.

The Global Low Calorie Food Market is expected to reach USD 731.34 Million by 2032, growing at a CAGR of 5.9% between 2024 to 2032.

Some of the key factors driving the Global Low Calorie Food Market growth are consumers' increasing health consciousness and changing habits pertaining to food intake. In addition to growing awareness among consumers, the low-calorie food industry has benefited from the availability of functional diets, food supplements, cereal bars, and convenience diets.

North America held a significant share due to increasing customer understanding of health is going to accelerate the adoption of a healthier lifestyle, coupled with growing concerns of health like overweight and obesity. People in UK have been following the trend of going vegan or vegetarian. , Nutrition in Europe has followed a pattern seen in many other developed and developing countries, namely, a shift away from a complex carbohydrate-based diet.

Some of the key players in the Low-Calorie Food Market include Archer Daniels Midland Company, Zydus Wellness Limited, McNeil Nutritionals LLC, Pepper Snapple Group, The Coca Cola Company, Ajinomoto Co. Inc., Bernard Food Industries Inc, PepsiCo Inc., Abbott Laboratories, Nestle, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed