Latin America Steel Rebars Market Size, Share, Forecast 2032

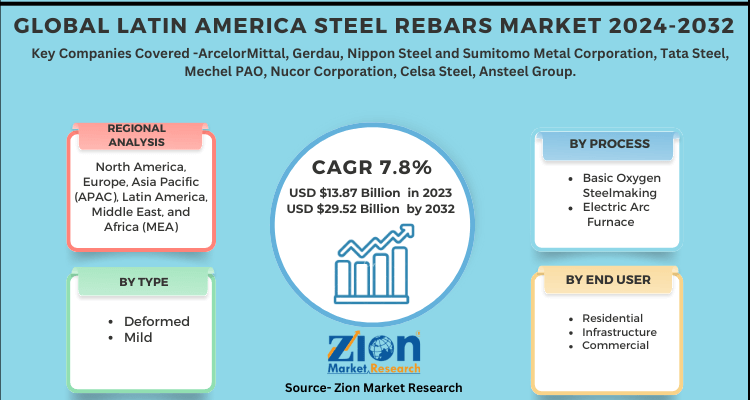

Latin America Steel Rebars Market By Type (Deformed, Mild), By Process (Basic Oxygen Steelmaking, Electric Arc Furnace, Others), and By End User (Residential, Infrastructure, Commercial): Latin America Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

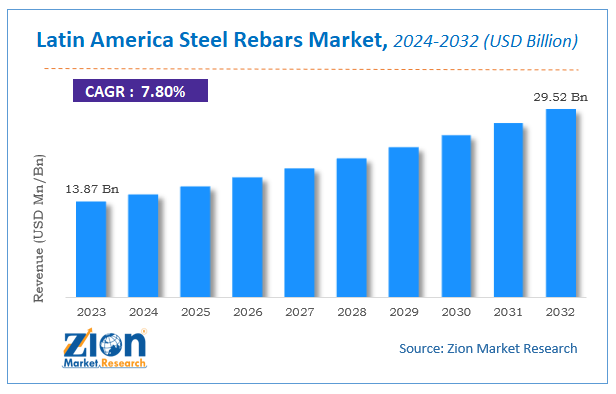

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 13.87 Billion | USD 29.52 Billion | 7.8% | 2023 |

Latin America Steel Rebars Market Insights

Zion Market Research has published a report on the global Latin America Steel Rebars Market, estimating its value at USD 13.87 Billion in 2023, with projections indicating that it will reach USD 29.52 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 7.8% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Latin America Steel Rebars Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Market Overview

Steel bars are widely used across construction sector for varied purposes. Some purposes need high tensile strength steel bars and some need low tensile strength steel bars, Commercial and government projects need twisted steel bars as they can conceive more weight as their tensile strength is highest. Increasing number of construction projects across Latin is one of the prime factors for rising demand of steel bars.

Steel reinforcement bar is also known as rebar, reinforcing bar, reinforcing steel, and reinforcement steel. It is a flexible building material commonly used to manufacture reinforced concrete in construction. Rebar is used to strengthen the tensile strength of concrete since it is very weak in tension but very powerful in compression.

The Latin American steel bar market is anticipated to rise at a healthy clip throughout the forecast period. The economies in this area have seen a small dip because of the Russia-Ukraine conflict. Several nations, like Brazil and Argentina, have been emphasizing building new ports or expanding existing ones to keep up with rising trade volume and vessel count. Belize II bridge, Cabo Rojo international airport, Los Chorros Highway, and Honduras Hospital network are some key development projects to boost steel rebar demand in the region.

It is projected that growing international trade will result from transferring low-cost manufacturing industries from China to other nearby East and South Asian nations, increasing seaborne trade flows to Latin America.

Growth Factors

Government initiatives go a long way in making a country self-sufficient and competitive in terms of export. Population growth in emerging economies has led to mass migration, exerting an enormous strain on the existing urban infrastructure. In order to deal with this, country governments have started providing soft loans to spur investment and FDI in the respective country's construction and industrial sectors. As steel bars are widely used in construction activities, increasing government investments and the rising demand for building and construction drive the demand for steel bars across Latin America.

The mining industry significantly contributes to a nation's economy. In Latin America, the mining industry had a positive outlook during 2014–2016 and is expected to flourish against a backdrop of upcoming projects in Brazil, Argentina, and other countries in Latin America. With increasing international trading activities in the last few years, Latin American seaborne trade has observed massive expansion majorly supported by the 2017 upswing in the world economy. Expanding at a rate of 4%, the fastest growth in five years, global maritime trade gathered momentum, wherein the total volume has reached 11 billion tons, as reported by United Nations Conference on Trade and Development (UNCTAD). As per to the UNCTAD, over 80% of global trade by volume and more than 70% of its value is carried on ships and handled by ports worldwide, which is expected to benefit Latin American trade routes and ports.

Latin America Steel Rebars Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Latin America Steel Rebars Market |

| Market Size in 2023 | USD 13.87 Billion |

| Market Forecast in 2032 | USD 29.52 Billion |

| Growth Rate | CAGR of 7.8% |

| Number of Pages | 180 |

| Key Companies Covered | ArcelorMittal, Gerdau, Nippon Steel and Sumitomo Metal Corporation, Tata Steel, Mechel PAO, Nucor Corporation, Celsa Steel, Ansteel Group |

| Segments Covered | By Type, By Process, By End User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Type Analysis Preview

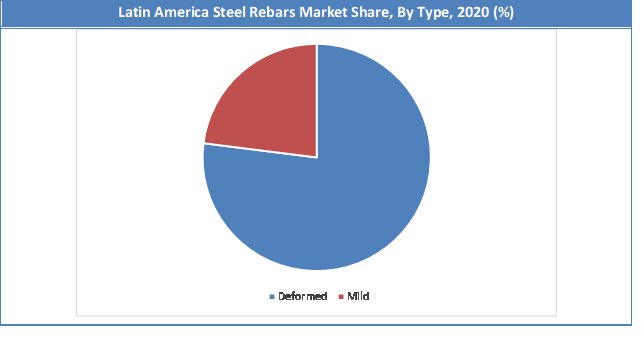

Deformed segment held a share of around 76.97% in 2020. Hot rolled deformed bars is one kind of reinforcing steel bars. Its surface commonly has ribs which has three kinds of shape: crescent, spiral, and herringbone. Hot rolled deformed bars with high strength can be directly used in reinforced concrete structure and also can be used as pre-stressed reinforcing bar after cold drawing. Because of its great flexibility, it is widely used in many construction sectors including commercial, residential, and industrial. It has minimum crack width, desired flexibility, high fatigue resistance, and high bonding strength features and has a wide array of applications including reinforced concrete slabs, refabricated beams, construction industry, residential and building structures, cages, and columns.

Process Segment Analysis Preview

Electric Arc Furnace segment is expected to grow at a CAGR of over 1.3% from 2021 to 2032. This process involves refractory lined and tiltable basic oxygen furnace (BOF) converter into which a vertically movable and water-cooled lance is inserted to blow oxygen through nozzles at supersonic velocity onto the charge. To refine 1 charge, only about 20 minutes are required per heat as the use of pure oxygen at high flow rates results in fast oxidation of elements contained in blast furnace iron. Commercial advantages of using pure oxygen instead of air in refining pig iron into steel such as less labor, steel with a low nitrogen content, and high production rates were recognized long back.

Latin America Steel Rebars Market : Segmentation

By Type (Deformed, Mild), By Process (Basic Oxygen Steelmaking, Electric Arc Furnace, Others)

By End User (Residential, Infrastructure, Commercial)

Regional Analysis Preview

Brazil held a share of 28.09% in 2020. Latin America is one of the fastest growing and revolutionizing markets across the globe. Due to fast urbanization in this modern world, raw material manufacturers, industrial manufacturers are entering the market and also moving their manufacturing hubs to Latin America. This scenario has increased demand for steel bars in the manufacturing sector of Latin America.

The Latin America steel bar market is expected to register a healthy growth rate during the forecast period. The U.S.-China trade war has led to some marginal gains for economies in this region. Argentina and Brazil are the leading economies that govern Latin America's economic outlook.

Key Market Players & Competitive Landscape

Some of key players in Latin America Steel Rebars Market are -

- ArcelorMittal

- Gerdau

- Nippon Steel and Sumitomo Metal Corporation

- Tata Steel

- Mechel PAO

- Nucor Corporation

- Celsa Steel

- Ansteel Group

- among others.

The Latin America Steel Rebars Market is segmented as follows:

By Type

- Deformed

- Mild

By Process

- Basic Oxygen Steelmaking

- Electric Arc Furnace

- Others

By End User

- Residential

- Infrastructure

- Commercial

By Region

- Latin Americas

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Latin America Steel Rebars Market market size valued at US$ 13.87 Billion in 2023

Latin America Steel Rebars Market market size valued at US$ 13.87 Billion in 2023, set to reach US$ 29.52 Billion by 2032 at a CAGR of about 7.8% from 2024 to 2032

Some of the key factors driving the Latin America Steel Rebars Market growth is Government Investments in Building & Construction Activities, Massive Mining and Port Building Projects, among others.

Some of the major companies operating in the Latin America Steel Rebars Market are ArcelorMittal, Gerdau, Nippon Steel and Sumitomo Metal Corporation, Tata Steel, Mechel PAO, Nucor Corporation, Celsa Steel, Ansteel Group, among others.

Brazil held a share of 28.09% in 2020. Latin America is one of the fastest growing and revolutionizing markets across the globe. Due to fast urbanization in this modern world, raw material manufacturers, industrial manufacturers are entering the market and also moving their manufacturing hubs to Latin America. This scenario has increased demand for steel bars in the manufacturing sector of Latin America. The Latin America steel bar market is expected to register a healthy growth rate during the forecast period. The U.S.-China trade war has led to some marginal gains for economies in this region. Argentina and Brazil are the leading economies that govern Latin America's economic outlook.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed