Construction Adhesive Market Size, Share, And Growth Report 2032

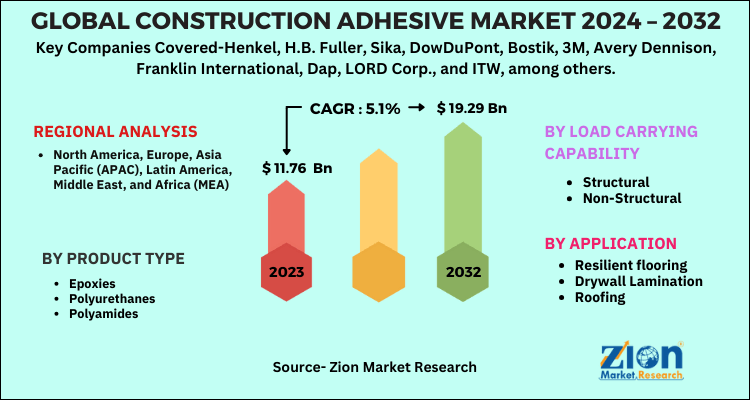

Construction Adhesive Market by Product Type (Epoxies, Polyurethanes, Polyamides and Others), By Load Carrying Capability (Structural and Non-Structural), by Application (Resilient Flooring, Drywall Lamination, Roofing, and Others), and By Region - Global and Regional Industry Overview, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.76 Billion | USD 19.29 Billion | 5.1% | 2023 |

Construction Adhesive Market Size

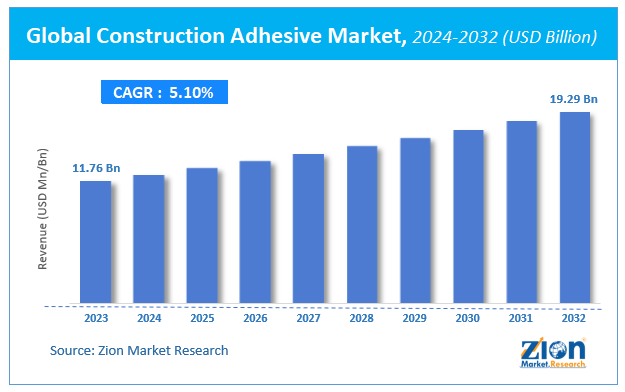

Zion Market Research has published a report on the global Construction Adhesive Market, estimating its value at USD 11.76 Billion in 2023, with projections indicating that it will reach USD 19.29 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5.1% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Construction Adhesive Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Construction Adhesive Market: Overview

Adhesives are gluing agents that are used to adhere materials which range from basic household materials to construction materials. Construction adhesive is a multipurpose adhesive that used to adhere drywall, tile, molding, and fixtures to walls, ceilings, and floors. Globally, growing construction and infrastructure activities are driving up demand for construction adhesives. Low cost and easy availability, as well as improved properties and production techniques, are driving growth. In the construction industry, advancements in adhesive technologies have encouraged the use of plastic flooring materials in the building industry, both for internal and outdoor (e.g., rubber sport courts) applications. Improvements in adhesive efficiency have also aided the growing use of luxury vinyl tile (LVT) in high-traffic areas including hospitals.

COVID-19 Impact Analysis

The outbreak of COVID-19 has had several short-term and long-term consequences in the construction industry, which are likely to affect the demand for construction adhesives. Workplace disruptions or project cancellations occurred, and demand for “non-essential” projects such as offices, entertainment, and sports facilities reduced. The demand for construction adhesives would continue to be constrained as a result of the shutdown of such projects and other construction activities.

Construction Adhesive Market: Growth Factors

The rapid growth of the construction adhesives industry has been fueled by rising demand from the non-residential and residential industries, government incentives for affordable housing to improve construction activities, and ongoing infrastructure projects.

Increase in end-use activities such as the expansion of logistic terminals, the growth and expansion of new manufacturing facilities, car assembly plants, multi-story buildings, oil pipelines, and water treatment plants have also raised demand for adhesive in construction.

Construction Adhesive Market: Segmentation

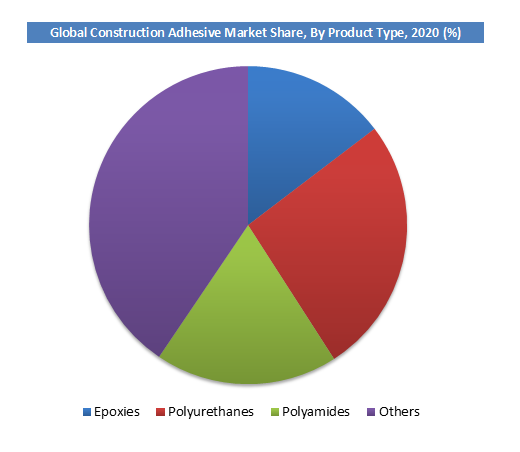

Product Type Segment Analysis Preview

Polyurethane segment will grow at a CAGR of over 4% from 2021 to 2028. This is attributable to rising demand for lightweight and durable goods in the automotive, construction, and electronics industries. Overall demand for is expected to be fueled by the end-use industries in developed countries, as well as the product's flexibility and specific physical properties. Furthermore, the growing adoption of innovative manufacturing technologies for polyurethane (PU) with advanced properties is expected to boost overall demand in the market.

Load Carrying Capacity Segment Analysis Preview

The structural adhesives segment will grow at a CAGR of around 6% from 2021 to 2028. This is attributable to rising adhesive demand caused due to increased adoption of composite, demand for non-hazardous, renewable, and sustainable structural adhesives. Structural adhesives are used to join materials that must withstand loads or pressures that could endanger the structure's integrity. Epoxy is the most commonly used structural additive because it can bind to a wide range of materials and has high strength. Epoxy structural adhesives are used to bind different substrates such as ceramics, metal, wood, concrete, composites, and rubber used in automotive, buses and trucks, and railways. Non-structural adhesives keep materials in place that are not subject to critical stress like tiles, laminates, floor coverings, millwork, and other elements.

Construction Adhesive Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Construction Adhesive Market |

| Market Size in 2023 | USD 11.76 Billion |

| Market Forecast in 2032 | USD 19.29 Billion |

| Growth Rate | CAGR of 5.1% |

| Number of Pages | 130 |

| Key Companies Covered | Henkel, H.B. Fuller, Sika, DowDuPont, Bostik, 3M, Avery Dennison, Franklin International, Dap, LORD Corp., and ITW, among others |

| Segments Covered | By Product Type, By Load Carrying Capability, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

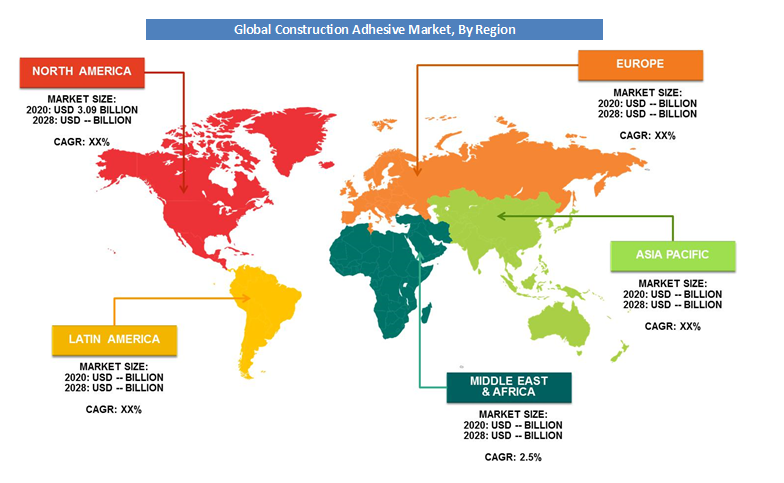

Construction Adhesive Market: Regional Analysis

North America region held a share of around 30% in 2020. This is attributable to the fact that the residential construction demand has outperformed the overall economy and recovered from the COVID-19's initial shock. This was because of the low mortgage rates and a significant shift in mode of employment (work from home), which caused many renters and first-time buyers to opt for more accessible and larger living spaces in lower density areas such as suburbs, exurbs, and rural communities while maintaining their employment and wealth.

Asia Pacific region is projected to grow at a CAGR of around 7% over the forecast period. This surge is due to fast economic growth, increasing demand from infrastructure construction in countries like India and China along with increase in activities like maintenance, and renovation. In countries like India, there has been an increase in government expenditure to boost infrastructure and development activities like power generation, bridges, dams, highways, and urban infrastructure growth, all of which serve as a foundation and support for other service sectors.

Construction Adhesive Market: Competitive Players

Some of key players in construction adhesive market:

- Henkel

- H.B. Fuller

- Sika

- DowDuPont

- Bostik

- 3M

- Avery Dennison

- Franklin International

- Dap

- LORD Corp.

- ITW

- Among others

To increase the use of adhesives and sealants, companies in this market are aggressively pursuing strategies to identify and engage specific targeted segments of end-users. They're also attempting to create additional member-led tools aimed at particular end user markets, educating them of the advantages of using adhesives and sealants in the production of their products.

The global construction adhesive market is segmented as follows:

By Product Type

- Epoxies

- Polyurethanes

- Polyamides

- Others

By Load Carrying Capability

- Structural

- Non-Structural

By Application

- Resilient flooring

- Drywall Lamination

- Roofing

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Construction adhesive is a strong, durable bonding agent used to join building materials such as wood, metal, concrete, and drywall. It provides long-lasting adhesion, reduces the need for mechanical fasteners, and is widely used in construction, renovation, and DIY projects.

According to study, the Construction Adhesive Market size was worth around USD 11.76 billion in 2023 and is predicted to grow to around USD 19.29 billion by 2032.

The CAGR value of Construction Adhesive Market is expected to be around 5.1% during 2024-2032.

North America has been leading the Construction Adhesive Market and is anticipated to continue on the dominant position in the years to come.

The Construction Adhesive Market is led by players like Henkel, H.B. Fuller, Sika, DowDuPont, Bostik, 3M, Avery Dennison, Franklin International, Dap, LORD Corp., and ITW, among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed