Long Term Care Insurance Market Size, Share, Trends, Growth 2032

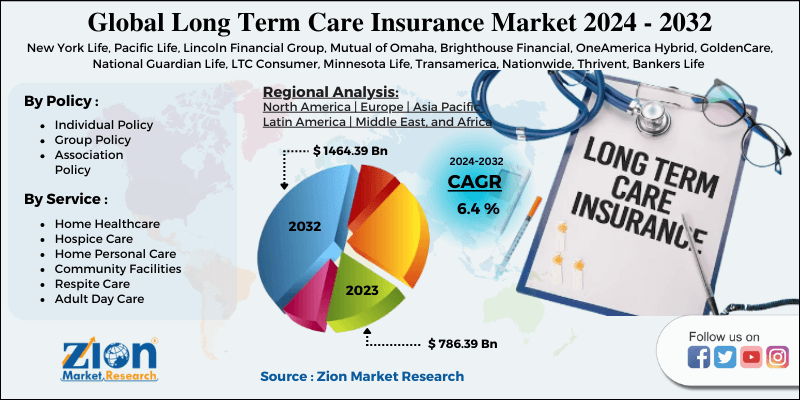

Long Term Care Insurance Market By Service (Home Healthcare, Hospice Care, Home Personal Care, Community Facilities, Respite Care, Adult Day Care, and Services Offered in Assisted Living Facilities); By Policy (Individual Policy, Group Policy, and Association Policy); and by Region - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 786.39 Billion | USD 1464.39 Billion | 6.4% | 2023 |

Long Term Care Insurance Market Insights

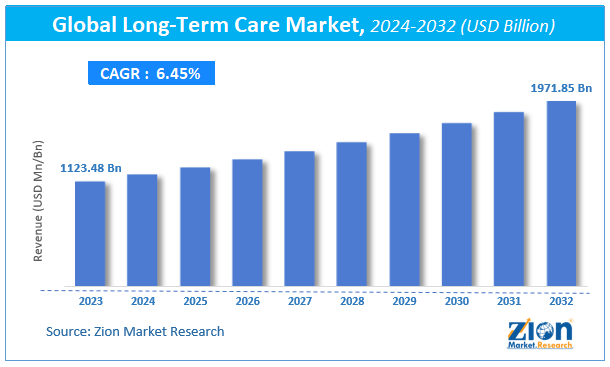

Zion Market Research has published a report on the global Long Term Care Insurance Market, estimating its value at USD 786.39 Billion in 2023, with projections indicating that it will reach USD 1464.39 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 6.4% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Long Term Care Insurance Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Long Term Care Insurance Industry: Overview

Long term care insurance is focusing on the customer demand. Moreover, rapidly growing geriatric populace and increase in population dependent on others will creative lucrative demand for long term care insurance industry over the upcoming years. In addition to this, reduction in family care, rise in special needs of individuals, and dementia care requirements will prompt the expansion of long term care insurance market over the assessment timeline. Apparently, surge in life-expectancy and exponentiation witnessed in the baby boomer population will translate into increase in the number of persons at risk requiring long term care, thereby elevating the expansion of long term care insurance industry in the upcoming years.

Thriving health insurance market will further contribute towards the expansion of long term care insurance industry over the upcoming timespan. Furthermore, premium charges of long term insurance care policy are based on life expectancy & age, family conditions, gender, income & assets, and family conditions.

Long Term Care Insurance Market: Growth Factors

Rise in the opportunities for serving aging population will result in humungous surge in long term care insurance market expansion over 2024-2032. With spread of pandemic such as COVID -19 and steep rise in the patient population base with moderate & severe conditions will lead to increase in the size of long term care insurance market over forthcoming years. Rise in the funding, huge demand, and government support in the developing and underdeveloped countries will help in building a strong platform for growth of long term care insurance industry in the forthcoming years.

However, lower interest rates and long duration can pose a threat towards the growth of long term care insurance market size in the years ahead. Though spending on long term insurance is lesser in the countries such as the U.S., it is expected to increase by 2050 due to onset of COVID cases as well as threat of more life-threatening diseases. This will drive the business trends.

Long Term Care Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Long Term Care Insurance Market |

| Market Size in 2023 | USD 786.39 Billion |

| Market Forecast in 2032 | USD 1464.39 Billion |

| Growth Rate | CAGR of 6.4% |

| Number of Pages | 130 |

| Key Companies Covered | New York Life, Pacific Life, Lincoln Financial Group, Mutual of Omaha, Brighthouse Financial, OneAmerica Hybrid, GoldenCare, National Guardian Life, LTC Consumer, Minnesota Life, Transamerica, Nationwide, Thrivent, Bankers Life and Casualty, Prudential, UNUM, John Hancock, CNA, Genworth, AXA, State Life, and MassMutual. |

| Segments Covered | By Policy, By Service and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Asia Pacific Market Size To Expound Exponentially Over 2024-2032

The expansion of long term care insurance in the Asia Pacific zone over the forecast timeline is due to thriving insurance sector in the countries such as India. Reportedly, the insurance industry in India is slated to earn revenue worth nearly USD 285 billion by 2021. This factor will further assist in increasing the earnings from long term care insurance business in Asia Pacific zone. Apart from this, governments in the region are focusing on providing insuring to the uninsured sectors, thereby encouraging the growth of insurance sector in the region. This will open new vistas of growth for regional market over the upcoming years. With insurers reporting a swift increase in the purchase of life insurance policy in 2020 in India, the market for long term care insurance market in Asia Pacific region is projected to witness a geometric expansion over 2024-2032.

Long Term Care Insurance Market: Competitive Analysis

The global long term care insurance market is dominated by players like:

- New York Life

- Pacific Life

- Lincoln Financial Group

- Mutual of Omaha

- Brighthouse Financial

- OneAmerica Hybrid

- GoldenCare

- National Guardian Life

- LTC Consumer

- Minnesota Life

- Transamerica

- Nationwide

- Thrivent

- Bankers Life and Casualty

- Prudential

- UNUM

- John Hancock

- CNA

- Genworth

- AXA

- State Life

- MassMutual

The global Long Term Care Insurance Market is segmented as follows:

By Policy

- Individual Policy

- Group Policy

- Association Policy

By Service

- Home Healthcare

- Hospice Care

- Home Personal Care

- Community Facilities

- Respite Care

- Adult Day Care

- Services Offered in Assisted Living Facilities Cloud-Based

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Usually not covered by standard health insurance or Medicare, long-term care insurance is a kind of insurance meant to pay for the expenses of long-term care services. Long-term care is a spectrum of services designed to assist people with disabilities, chronic diseases, or aging-related ailments manage everyday activities including bathing, dressing, feeding, and mobility. Nursing homes, assisted living homes, or even a house could all be locations for this care.

One of the most important forces behind the long-term care insurance business is the worldwide aging population. The demand for long-term care services rises as people live longer, which motivates more people to think about long-term care insurance to pay for upcoming medical needs.

Zion Market Research has published a report on the global Long Term Care Insurance Market, estimating its value at USD 786.39 Billion in 2023, with projections indicating that it will reach USD 1464.39 Billion by 2032.

The market is expected to expand at a compound annual growth rate (CAGR) of 6.4% over the forecast period 2024-2032.

The expansion of long term care insurance in the Asia Pacific zone over the forecast timeline is due to thriving insurance sector in the countries such as India.

Key players profiled in the report include New York Life, Pacific Life, Lincoln Financial Group, Mutual of Omaha, Brighthouse Financial, OneAmerica Hybrid, GoldenCare, National Guardian Life, LTC Consumer, Minnesota Life, Transamerica, Nationwide, Thrivent, Bankers Life and Casualty, Prudential, UNUM, John Hancock, CNA, Genworth, AXA, State Life, and MassMutual.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed