Oil Pipeline Infrastructure Market Size, Share, Trends, Growth 2032

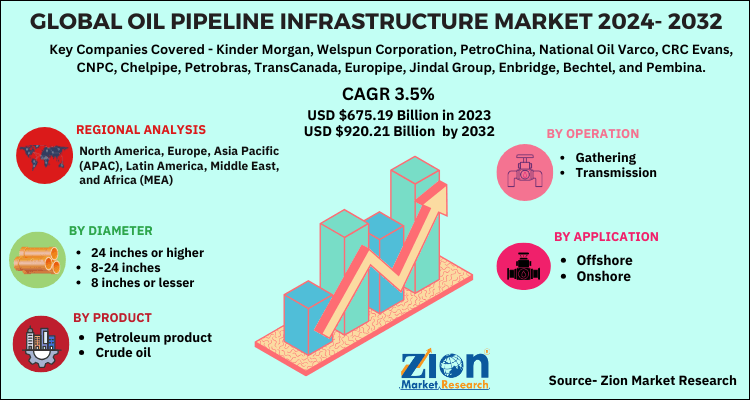

Oil Pipeline Infrastructure Market By Diameter (24 Inches Or Higher, 8-24 Inches, And 8 Inches Or Lesser), By Product (Petroleum Product And Crude Oil), By Operation (Gathering And Transmission), By Application (Offshore And Onshore), And By Region - Global Industry Perspective, Comprehensive Analysis, And Forecast, 2024 - 2032-

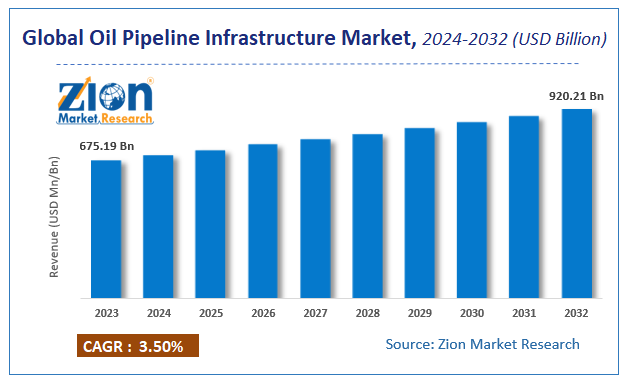

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 675.19 Billion | USD 920.21 Billion | 3.5% | 2023 |

Oil Pipeline Infrastructure Market Insights

Zion Market Research has published a report on the global Oil Pipeline Infrastructure Market, estimating its value at USD 675.19 Billion in 2023, with projections indicating that it will reach USD 920.21 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 3.5% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Oil Pipeline Infrastructure industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Oil Pipeline Infrastructure Market: Overview

Oil pipeline infrastructure help in transportation of crude oil and refined oil products in a safe way to the destined location along with retention of flow conditions & standard pressure.

Oil Pipeline Infrastructure Market: Growth Drivers

Massive demand for fuel energy with rise in the number of vehicles on the roads along will drive the market trends. Globalization has contributed substantially towards the global trade and this has resulted in escalating demand for robust infrastructure facility, thereby prompting the business growth. Apparently, key economies of the Middle East region including Saudi Arabia and Iran are investing huge funds for developing strong oil pipeline infrastructure through collaboration with the countries like India for exporting oil and this is going to create huge growth opportunities for the market over the forthcoming years.

Furthermore, growing need for crude oil transport and requirement of long term supply of oil at distant locations will accentuate the growth of the market within the next few years. Apart from this, renovation & refurbishment of aging or outdated oil & gas infrastructure will embellish the market trends. Nonetheless, strict laws governing ecological safety will hinder the market growth over the forthcoming years.

Oil Pipeline Infrastructure Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Oil Pipeline Infrastructure Market |

| Market Size in 2023 | USD 675.19 Billion |

| Market Forecast in 2032 | USD 920.21 Billion |

| Growth Rate | CAGR of 3.5% |

| Number of Pages | 110 |

| Key Companies Covered | Kinder Morgan, Welspun Corporation, PetroChina, National Oil Varco, CRC Evans, CNPC, Chelpipe, Petrobras, TransCanada, Europipe, Jindal Group, Enbridge, Bechtel, and Pembina |

| Segments Covered | By Diameter, By Product, By Operation, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

North America To Account For Major Chunk of Market Size Over 2024-2032

The growth of the market in the sub-continent over the estimated timespan is due to adding of new features to the current oil pipeline units for improving the oil flow and speed of the flow. Apart from this, need for enhancing the operations will further drive the regional market growth. In addition to this, a large number of airports in North America depend on incessant jet fuel supply from pipelines, thereby resulting in huge product penetration in the region and this lucratively impacts the business growth.

Oil Pipeline Infrastructure Market: Competitive Analysis

The global oil pipeline infrastructure market is led by players like:

- Kinder Morgan

- Welspun Corporation

- PetroChina

- National Oil Varco

- CRC Evans

- CNPC

- Chelpipe

- Petrobras

- TransCanada

- Europipe

- Jindal Group

- Enbridge

- Bechtel

- Pembina

The global oil pipeline infrastructure market report categorizes the global market on the basis of:

By Diameter

- 24 inches or higher

- 8-24 inches

- 8 inches or lesser

By Product

- Petroleum product

- Crude oil

By Operation

- Gathering

- Transmission

By Application

- Offshore

- Onshore

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The system of interconnected pipelines, storage facilities, and related equipment known as oil pipeline infrastructure is intended to transport crude oil, refined petroleum products, and other liquid hydrocarbons from production sites to refineries, distribution centres, or export terminals. This infrastructure is essential for the efficient, safe, and cost-effective transportation of oil over vast distances, which is a critical component of the global oil supply chain.

The demand for energy on a global scale, particularly in developing countries, is persistently increasing, necessitating the expansion of oil pipeline infrastructure to ensure the efficient transportation of crude oil and refined petroleum products.

Zion Market Research has published a report on the global Oil Pipeline Infrastructure Market, estimating its value at USD 675.19 Billion in 2023, with projections indicating that it will reach USD 920.21 Billion by 2032.

The market is expected to expand at a compound annual growth rate (CAGR) of 3.5% over the forecast period 2024-2032.

The growth of the market in the sub-continent over the estimated timespan is due to adding of new features to the current oil pipeline units for improving the oil flow and speed of the flow. Apart from this, need for enhancing the operations will further drive the regional market growth. In addition to this, a large number of airports in North America depend on incessant jet fuel supply from pipelines, thereby resulting in huge product penetration in the region and this lucratively impacts the business growth.

Key players leveraging the market growth include Kinder Morgan, Welspun Corporation, PetroChina, National Oil Varco, CRC Evans, CNPC, Chelpipe, Petrobras, TransCanada, Europipe, Jindal Group, Enbridge, Bechtel, and Pembina.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed