Construction Equipment Market Size, Share, And Growth Report 2032

Construction Equipment Market by Equipment Type (Earthmoving Equipment, Material Handling Equipment & Cranes, Concrete Equipment, Road Building Equipment, Civil Engineering Equipment, Crushing and Screening Equipment and Other Equipment), By Application (Residential, Commercial & Industrial), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

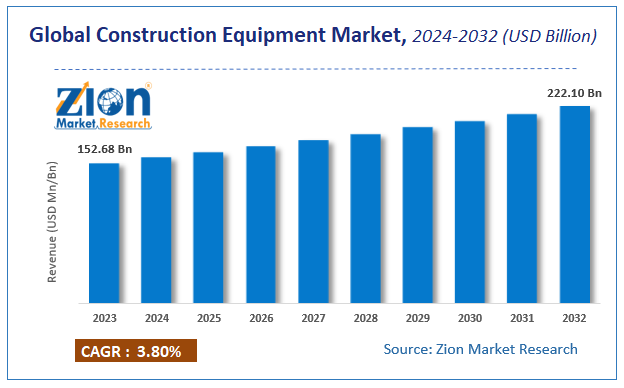

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 152.68 Billion | USD 222.10 Billion | 3.8% | 2023 |

Construction Equipment Market Size

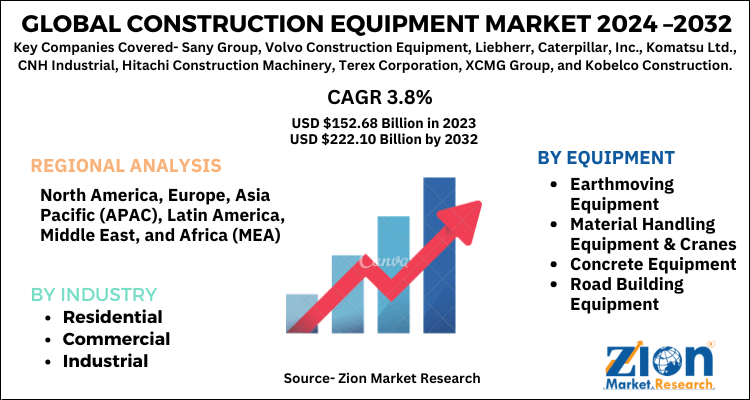

According to a report from Zion Market Research, the global Construction Equipment Market was valued at USD 152.68 Billion in 2023 and is projected to hit USD 222.10 Billion by 2032, with a compound annual growth rate (CAGR) of 3.8% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Construction Equipment Market industry over the next decade.

Construction Equipment Market: Overview

Construction equipment refers to heavy-duty vehicles which are designed specially for carrying out construction tasks, most common ones including earthwork operations. In industry Construction equipment are also known as engineering equipment, heavy machines, heavy hydraulics or heavy trucks. Construction equipment play a crucial role in the construction process. It ensures proper usage of energy and manpower contributing to economy, safety, quality, speed and timely completion of the project. The basic operations involved in this sector are digging large quantities of earth, leveling, excavation, grading, dozing etc. Various construction equipment used are excavators, bulldozers, loaders, trenchers, backhoe, wheel tractor scraper, pile boring machines, pavers, and many more.

Construction Equipment Market: Growth Factors

The ever-increasing infrastructure and growth in the country along with the rise in industrial, commercial, and residential activities are the driving growth factor for the construction equipment market. Moreover, the increase in GDP and boost in the economy also play a major role in the development of the infrastructure. Technology also played a crucial role in development. There is machinery that requires lesser labor and is more efficient. Construction equipment manufacturers and tech giants are developing autonomous machinery, making use of robotics which provide lucrative growth driving factors. These construction equipment manufacturers are integrating advanced technologies to reduce the overall operating cost which saves time and increases productivity.

Globalization, urbanization, and increased investment in basic infrastructure such as roads bridges, tunnels, railways, and ships have paved the way for the growth of the industry. According to a recent study, despite the COVID hindrance 8,169 kilometers of national highways were built between April 2020 and January 2021, averaging around 28.16 kilometers per day in India. So, these were the few growth factors driving the construction equipment market.

COVID-19 Impact Analysis

Covid is a pandemic that has hit almost every industry whether health, agriculture, education, or chemical in some or another way. With the implementation of the lockdown, there was a halt in the construction process across nations impacting the construction equipment market adversely. Covid has impacted the contractors, developers, supply chain vendors, owners, and many other numerous people involved in the process. Construction activities across the nations such as the USA, China, the UK, India, and various superpowers have been on hold which led to the shutting down of various construction projects. Like the other industries, COVID has impacted adversely the construction equipment market. With the disrupted supply chain and logistics it became very difficult for the companies to meet with the supply leading to price hikes in cement, tools, and construction equipment.

Construction Equipment Market: Segmentation

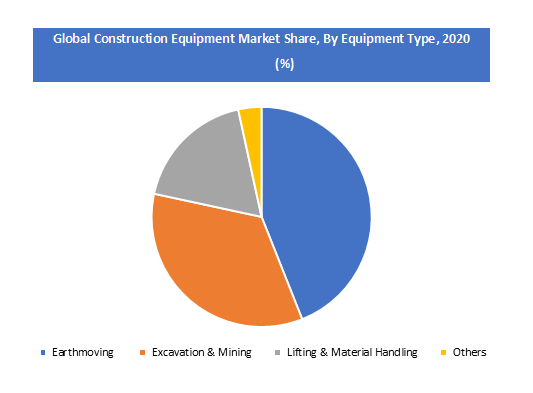

Equipment Type Segment Analysis Preview

Earthmoving and road building segment held about 55% share of the market. The segment demand is expected to be met by the government's rapid expansion of road-building projects and the development of public infrastructure. The mechanization of infrastructure construction activities to achieve high quality is providing opportunities for the sector to expand. Also, the material handling equipment segment is expected to have exponential growth due to the rising use of machinery across various domains. Forklift trucks, AGVs,s and telescopic handlers are the basic and most used machinery used in this domain. Concrete Equipment, Road Building Equipment, Civil Engineering Equipment, Crushing and Screening Equipment, and Other Equipment forms the Equipment Type segment.

Construction Equipment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Construction Equipment Market |

| Market Size in 2023 | USD 152.68 Billion |

| Market Forecast in 2032 | USD 222.10 Billion |

| Growth Rate | CAGR of 3.8% |

| Number of Pages | 170 |

| Key Companies Covered | Sany Group, Volvo Construction Equipment, Liebherr, Caterpillar, Inc., Komatsu Ltd., CNH Industrial, Hitachi Construction Machinery, Terex Corporation, XCMG Group, and Kobelco Construction Machinery Co., among others. |

| Segments Covered | By Product, By Distribution Channel, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

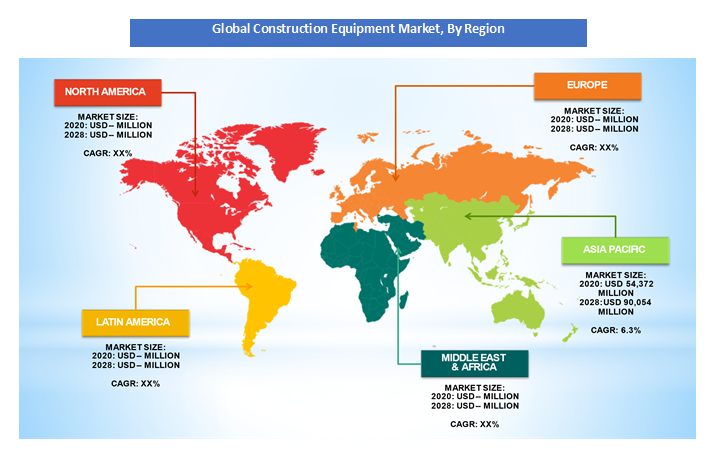

Construction Equipment Market: Regional Analysis

During the forecast period the European region has shown good growth. The North American region is also playing a crucial role in the market. This is due to the presence of the USA which has witnessed abrupt growth due to technical advancement. Also, with the idea of renting the machinery also made the companies to render the construction equipment more easily at a lower cost.

Construction Equipment Market: Competitive Players

Some of key players in construction equipment market are

- Sany Group

- Volvo Construction Equipment

- Liebherr, Caterpillar, Inc.

- Komatsu Ltd.

- CNH Industrial

- Hitachi Construction Machinery

- Terex Corporation

- XCMG Group

- Kobelco Construction Machinery Co.

To expand their business and gain a competitive advantage in this market, market participants are focusing on strategic partnerships with other industry players. As part of their strategic initiatives, equipment manufacturers are also emphasizing the expansion of their global footprint. For instance, Komatsu, a leader in the market announced in 2019 to set up a manufacturing facility in South Africa. This new set up will be installed by June 2020 whose primary focus is R&D along with the production of construction and mining equipment

The Global Construction Equipment Market is segmented as follows:

By Equipment

- Earthmoving Equipment

- Material Handling Equipment & Cranes

- Concrete Equipment

- Road Building Equipment

- Civil Engineering Equipment

- Crushing and Screening Equipment

- Other Equipment

By Industry

- Residential

- Commercial

- Industrial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Construction equipment refers to heavy machinery and tools used in construction projects for tasks like excavation, lifting, material handling, and paving. Examples include bulldozers, cranes, excavators, and loaders, designed to improve efficiency and reduce manual labor on job sites.

According to study, the Construction Equipment Market size was worth around USD 152.68 billion in 2023 and is predicted to grow to around USD 222.10 billion by 2032.

The CAGR value of Construction Equipment Market is expected to be around 3.8% during 2024-2032.

Asia Pacific has been leading the Construction Equipment Market and is anticipated to continue on the dominant position in the years to come.

The Construction Equipment Market is led by players like Sany Group, Volvo Construction Equipment, Liebherr, Caterpillar, Inc., Komatsu Ltd., CNH Industrial, Hitachi Construction Machinery, Terex Corporation, XCMG Group, and Kobelco Construction Machinery Co., among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed