IoT Insurance Market Size, Share, Trends, Growth 2032

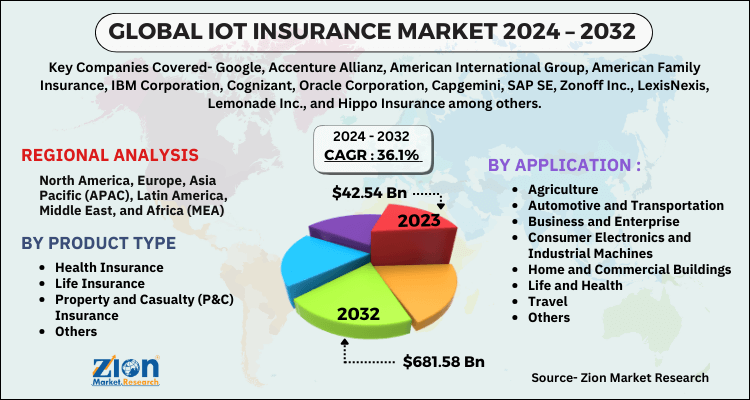

IoT Insurance Market By Product Type (Health Insurance, Life Insurance, Property and Casualty (P&C) Insurance, Others), By Application (Agriculture, Automotive and Transportation, Business and Enterprise, Consumer Electronics and Industrial Machines, Home and Commercial Buildings, Life and Health, Travel, Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

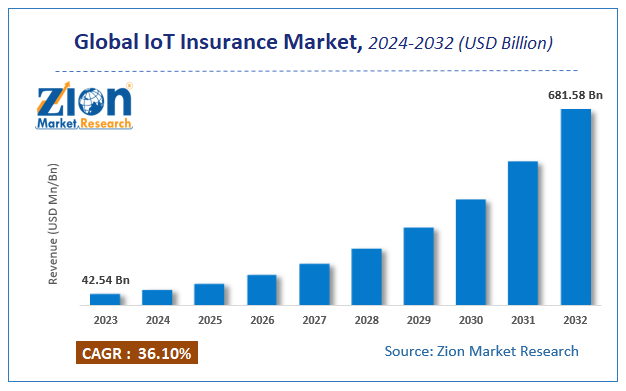

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 42.54 Billion | USD 681.58 Billion | 36.1% | 2023 |

IoT Insurance Market Insights

According to a report from Zion Market Research, the global IoT Insurance Market was valued at USD 42.54 Billion in 2023 and is projected to hit USD 681.58 Billion by 2032, with a compound annual growth rate (CAGR) of 36.1% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the IoT Insurance Market industry over the next decade.

IoT Insurance Market Perspective:

The report covers forecasts and analysis for the IoT insurance market on a global and regional level. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion). The study includes drivers and restraints for the IoT insurance market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities and various trends in the IoT insurance market on a global level.

IoT Insurance Market Growth Drivers

The IoT insurance market is predicted to be driven due to the rising adoption of IoT products globally. IoT helps in analytics of the products and hence provides more accurate data for assessment with effective pricing. The data collected by all the sources, internal and external, is used to provide maximum security and protection to the policyholders. Moreover, the insurance sector is growing at a high pace with the development of insurance models which is expected to drive the demand for this market.

Further, IoT insurance customers now feel safe and secure before buying any IoT-related product. This helps in reducing the risk and premium-related costs of a company which is another factor driving the demand of this market. However, the data collected is not secure and safety threats can restrain the growth of this market. Nevertheless, the data generated by these devices helps in enhancing the business intelligence of the insurance industry making it an opportunity for the IoT insurance market to grow.

IoT Insurance Market: Segmentation

The IoT insurance market is segmented on the basis of product type, application, and region.

The product type segment is further segmented into health insurance, life insurance, property and casualty (P&C) insurance, and others. Property and casualty insurance holds a good amount of market share owing to the data collected by this segment. This segment is applicable in auto, large commercial property, home and contents, and casualty insurance. A lot of data is generated which is used to analyze and make it beneficial for both the insurance company as well as policyholders. The growing use of wearables that are IoT-enabled is also a reason for this segment to grow. These wearables help in generating data and availing discounts to its customers.

Based on application, the IoT market is segmented into agriculture, automotive and transportation, business and enterprise, consumer electronics and industrial machines, home, and commercial buildings, life and health, travel, and others. Consumer electronics holds the maximum market share in this segment owing to the maximum use of IoT in these devices. These electronic devices use sensors that can be insured and hence attracts more customers. This helps build trust between the product and the customers. The sensors installed constantly sends information in the form of data which is gathered and monitored by the insurance company to grow their business.

IoT Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | IoT Insurance Market |

| Market Size in 2023 | USD 42.54 Billion |

| Market Forecast in 2032 | USD 681.58 Billion |

| Growth Rate | CAGR of 36.1% |

| Number of Pages | 110 |

| Key Companies Covered | Google, Accenture Allianz, American International Group, American Family Insurance, IBM Corporation, Cognizant, Oracle Corporation, Capgemini, SAP SE, Zonoff Inc., LexisNexis, Lemonade Inc., and Hippo Insurance among others |

| Segments Covered | By type, By application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

IoT Insurance Market: Regional Analysis

Geographically, North America is projected to hold the maximum market share in the IoT insurance market owing to the growing awareness and the increase in the adoption of IoT in this region. Many companies like Progressive, Liberty Mutual, and State Farm are dominating this market in the North American region. The developing segments which are likely to create demand for this market are consumer electronics and industrial machines, home, and commercial buildings, and life and health. Europe is another region that is predicted to follow the lead of the North American region owing to the automotive sector which is developing rapidly.

The automotive sector uses IoT to capture the driver’s behavior by using sensors. The insurance company uses this data to gain insights and provide a better plan and policy to its policyholders through which the customer, as well as the company, can be benefitted.

Key Market Players & Competitive Landscape:

Some of the key players in the IoT insurance market include

- Accenture Allianz

- American International Group

- American Family Insurance

- IBM Corporation

- Cognizant

- Oracle Corporation

- Capgemini

- SAP SE

- Zonoff Inc

- LexisNexis

- Lemonade Inc

- Hippo Insurance

The report segments of the global IoT insurance market are as follows:

Global IoT Insurance Market: Product Type Segment Analysis

- Health Insurance

- Life Insurance

- Property and Casualty (P&C) Insurance

- Others

Global IoT Insurance Market: Application Segment Analysis

- Agriculture

- Automotive and Transportation

- Business and Enterprise

- Consumer Electronics and Industrial Machines

- Home and Commercial Buildings

- Life and Health

- Travel

- Others

Global IoT Insurance Market: Regional Segment Analysis

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Internet of Things (IoT) insurance is a type of insurance policy that utilises IoT technology to improve risk assessment, monitoring, and management. IoT insurance endeavours to enhance underwriting accuracy, minimise claims, and provide personalised coverage by incorporating IoT devices and sensors into insurance processes, all of which are founded on real-time data.

The efficacy of IoT insurance solutions is improved by technological advancements in IoT devices, including enhanced sensors, connectivity, and data analytics capabilities.

According to a report from Zion Market Research, the global IoT Insurance Market was valued at USD 42.54 Billion in 2023 and is projected to hit USD 681.58 Billion by 2032.

According to a report from Zion Market Research, the global IoT Insurance Market a compound annual growth rate (CAGR) of 36.1% during the forecast period 2024-2032.

Geographically, North America is projected to hold the maximum market share in the IoT insurance market owing to the growing awareness and the increase in the adoption of IoT in this region. Many companies like Progressive, Liberty Mutual, and State Farm are dominating this market in the North American region.

Some of the key players in the IoT insurance market include Google, Accenture Allianz, American International Group, American Family Insurance, IBM Corporation, Cognizant, Oracle Corporation, Capgemini, SAP SE, Zonoff Inc., LexisNexis, Lemonade Inc., and Hippo Insurance among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed