Insurance Telematics Market Size, Share, Growth & Trends 2032

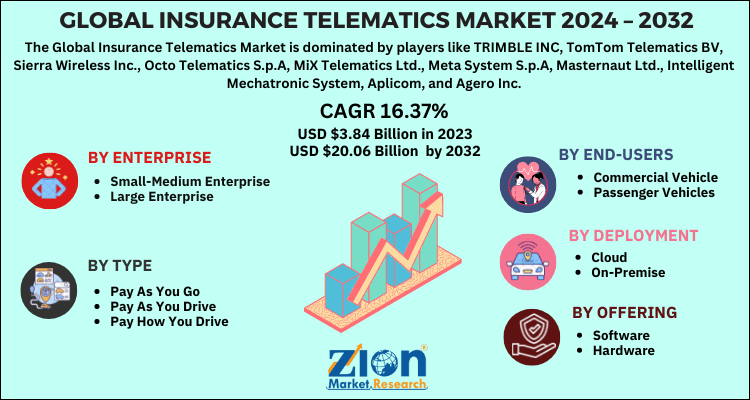

Insurance Telematics Market By end-user (commercial vehicle and passenger vehicles), By enterprise (small-medium enterprise and large enterprise), By deployment (cloud and on-premise), By type (pay as you go, pay as you drive, and pay how you drive), By offering (software and hardware) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

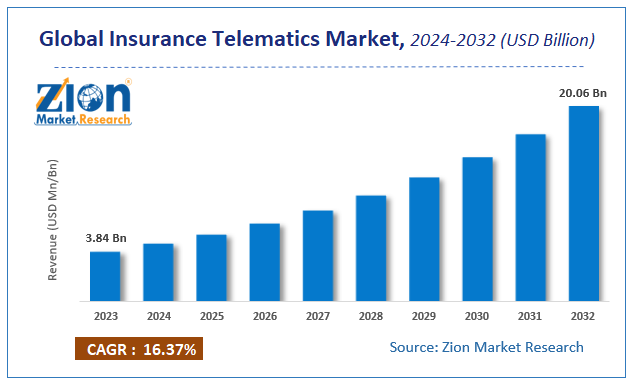

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.84 Billion | USD 20.06 Billion | 16.37% | 2023 |

Description

Insurance Telematics Market Insights

According to the report published by Zion Market Research, the global Insurance Telematics Market size was valued at USD 3.84 Billion in 2023 and is predicted to reach USD 20.06 Billion by the end of 2032. The market is expected to grow with a CAGR of 16.37% during the forecast period. The report analyzes the global Insurance Telematics Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Insurance Telematics industry.

Global Insurance Telematics Market: Overview

Telematics insurance facilitates the insurance providers to effectively monitor the driving habit of the driver and modify the car insurance premiums accordingly. The vehicles are equipped with a black box that helps in monitoring all the activities of drivers. The box can be a mobile phone app or plug & drive device. The insurance provider can track the driving speed, braking, and handling capabilities of corners. If a person drives the vehicle responsibly then the premium is likely to be very low in the future. Moreover, the driver can also view the driving score on the website or smartphone app. Telematic insurance helps in improving driving skills too. A wide range of telematics insurance like telematics app, black box insurance, and plug & drive device is available in the market.

Global Insurance Telematics Market: Growth Factors

The growing number of rules and regulations associated with driver safety and reduced cost of connectivity solutions are some of the major factors driving the growth of the global insurance telematics market. The technological advancements in the automotive insurance sector influenced by growing integrations with advanced telematics technology are likely to witness significant growth progressions in the market. The surging trends of ride-sharing, car-sharing, and carpooling are gaining immense traction among users. Governments are supporting telematics services in the developed countries, thereby launching several favorable policies to encourage the adoption of telematics insurance.

Telematic insurance companies are providing discounts on standard premiums based on real-time monitoring of vehicle drivers, which in turn is likely to significantly fuel the adoption of the insurance among people. Moreover, the composition of automatic insurances like third party insurance, liability, and collision insurance all across the globe is generating immense demand for telematics. The integration of the internet of things (IoT) and cloud computing technology in telematics insurance technology is further creating many lucrative growth opportunities in the global insurance telematics market.

Global Insurance Telematics Market: Segmentation

The global insurance telematics market can be segmented into end-user, enterprise, deployment, type, offering, and region.

By end-user, the market can be segmented into commercial vehicle and passenger vehicles. The passenger vehicle segment accounts for the largest share in the global insurance telematics market.

By enterprise, the market can be segmented into small-medium enterprise and large enterprise. The large enterprise segment dominates the global insurance telematics market due to the growing adoption of mobile telematics systems by giant organizations.

By deployment, the market can be segmented into cloud and on-premise deployment modes. The on-premise segment accounts for the largest share in the global insurance telematics market as UBI and telematic forms are a vital part of the auto insurance sector and therefore required an on-premise deployment method to deliver real-time insights.

By type, the market can be segmented into pay as you go, pay as you drive, and pay how you drive. The pay as you drive segment holds hegemony over others due to the growing adoption of UBI all across the globe.

By offering, the market can be segmented into software and hardware.

Insurance Telematics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Insurance Telematics Market |

| Market Size in 2023 | USD 3.84 Billion |

| Market Forecast in 2032 | USD 20.06 Billion |

| Growth Rate | CAGR of 16.37% |

| Number of Pages | 198 |

| Key Companies Covered | TRIMBLE INC, TomTom Telematics BV, Sierra Wireless Inc., Octo Telematics S.p.A, MiX Telematics Ltd., Meta System S.p.A, Masternaut Ltd., Intelligent Mechatronic System, Aplicom, and Agero Inc |

| Segments Covered | By end-user, By enterprise, By deployment, By type, By offering and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Insurance Telematics Market: Regional analysis

North America accounts for the largest share in the global insurance telematics market due to the presence of prominent market players in the region. Moreover, the ongoing technological advancements in the field of insurance telematics are further likely to propel the growth of the regional market in the forthcoming years. The surging demand for interconnected devices due to the growing disposable income of the people will also accentuate the growth of the regional market.

Asia Pacific is expected to witness a significant growth rate in the forthcoming years due to the high adoption of IoT and telematics technology in the region.

Global Insurance Telematics Market: Competitive Players

Some of the significant players in the global insurance telematics market are:

- TRIMBLE INC

- TomTom Telematics BV

- Sierra Wireless Inc.

- Octo Telematics S.p.A

- MiX Telematics Ltd.

- Meta System S.p.A

- Masternaut Ltd.

- Intelligent Mechatronic System

- Aplicom

- Agero Inc.

The Global Insurance Telematics Market is segmented as follows:

By end-user

- commercial vehicle

- passenger vehicles

By enterprise

- small-medium enterprise

- large enterprise

By deployment

- cloud

- on-premise

By type

- pay as you go

- pay as you drive

- pay how you drive

By offering

- software

- hardware

Global Insurance Telematics Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

The growing number of rules and regulations associated with driver safety and reduced cost of connectivity solutions are some of the major factors driving the growth of the global insurance telematics market. The technological advancements in the automotive insurance sector influenced by growing integrations with advanced telematics technology are likely to witness significant growth progressions in the market. The surging trends of ride-sharing, car-sharing, and carpooling are gaining immense traction among users.

Some of the significant players in the global insurance telematics market are TRIMBLE INC, TomTom Telematics BV, Sierra Wireless Inc., Octo Telematics S.p.A, MiX Telematics Ltd., Meta System S.p.A, Masternaut Ltd., Intelligent Mechatronic System, Aplicom, and Agero Inc.

North America accounts for the largest share in the global insurance telematics market due to the presence of prominent market players in the region. Moreover, the ongoing technological advancements in the field of insurance telematics are further likely to propel the growth of the regional market in the forthcoming years.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed