Global Insurance Analytics Market Size, Share, Growth, Forecast 2032

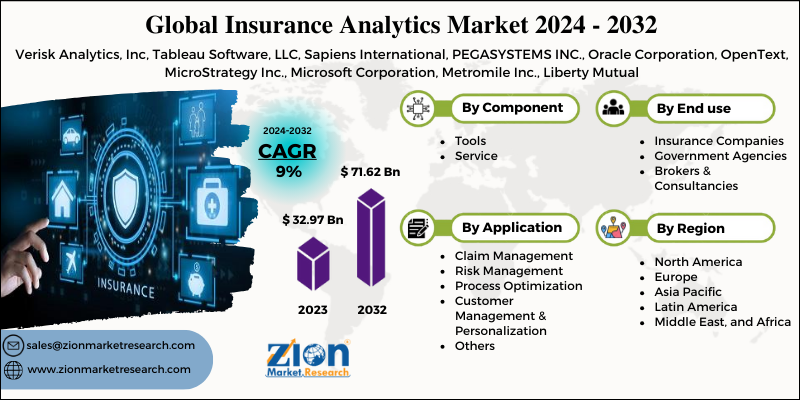

Insurance Analytics Market By Component (Tools and Services), By Application (Claim Management, Risk Management, Process Optimization, Customer Management & Personalization, and Others), By End Use (Insurance Companies, Government Agencies, and Brokers & Consultancies), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

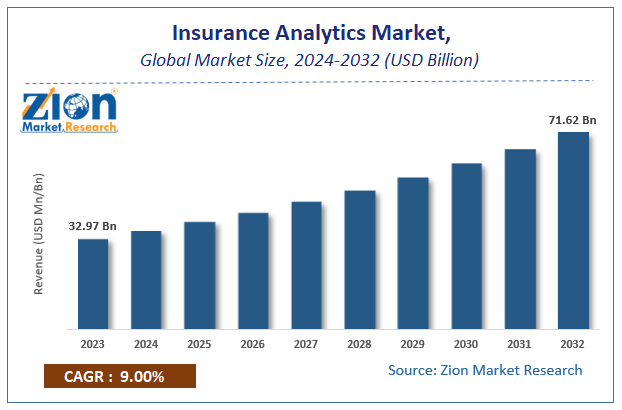

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 32.97 Billion | USD 71.62 Billion | 9% | 2023 |

Global Insurance Analytics Market Size

According to a report from Zion Market Research, the global Global Insurance Analytics Market was valued at USD 32.97 Billion in 2023 and is projected to hit USD 71.62 Billion by 2032, with a compound annual growth rate (CAGR) of 9% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Global Insurance Analytics Market industry over the next decade.

Insurance Analytics Market: Overview

Insurance analytics is widely utilized in the insurance industry to control risk in underwriting, pricing, rating, claims, marketing, and reserving. Furthermore, this analytic solution aids insurance businesses in risk management and the provision of better insurance contracts in domains such as health, life, and property and casualty. Furthermore, the primary goal of insurance analytics is to cut costs, improve customer interaction procedures, and provide credible reports across several product lines by using predictive analytics into insurance models.

COVID-19 Impact Analysis

Several insurance companies are stepping up their digital efforts and correcting holes in their business continuity plans. Integration of third-party data to reduce risk is becoming increasingly important. Customers are reminded of the need of insurance in their life during this whole period. Health insurance, for example, helps with medicines and treatment plans for the sick, employment insurance aids people affected by the economic downturn, and business interruption insurance aids firms that are unable to operate. Companies keep investing and provide access to clients while also ensuring that insurers are aware of potential hazards.

Emergencies like COVID-19 underscore the importance of insurers seamlessly integrating trustworthy data sources, actionable insights, and responsive control mechanisms to assist them manage the unpredictable terrain. Insurers can handle this difficult time and propel the sector ahead by utilizing data and investing in digitalization and analytics.

Insurance Analytics Market: Growth Factors

One of the major growth drivers for the Global Insurance Analytics Market is data driven decision-making techniques. Insurers may now exploit data and redefine their products to gold standards due to the expanding bulk of data and technological advancements. As a result, firms that use a data-driven strategy have been able to develop new business prospects, forecast future trends, increase revenue, provide actionable insights, and improve present operational operations. As a result, the insurance analytics market is developing due to insurers' increasing focus on data-driven decision-making processes and the use of sophisticated analytics solutions.

Another factor for the growth in this market is rise in the adoption of advanced analytics predictive modeling capabilities, which is driving the use of insurance analytics solutions. Predictive analytics has been helping organizations make the most of their data, which is one of the most important things an insurer can have. The capacity of predictive modelling in insurance software can aid in the more efficient definition and delivery of rate modifications and new products. Insurers may get important insights from predictive analytics and big data by anticipating consumer behaviour and assisting underwriting operations.

Insurance Analytics Market: Segmentation

Component Segment Analysis Preview

The market is divided into tools and services based on component. Professional services and managed services are sub-segments of the services segment. The increasing use of smartphones has resulted in a rise in demand for mobile-based insurance services all over the world. Furthermore, financial crime is exposed, demand for insurance analytics solutions is likely to rise throughout the projection period.

Insurers have been able to gain a better knowledge of client expectations as a result of the use of analytics and have been able to offer more tailored goods and services as a result. Insurers may now integrate data from insurance analytics solutions to further inform and enhance frictionless claims, risk exposure management, and underwriting processes. For both corporations and individuals, the insurance analytics tool improves security.

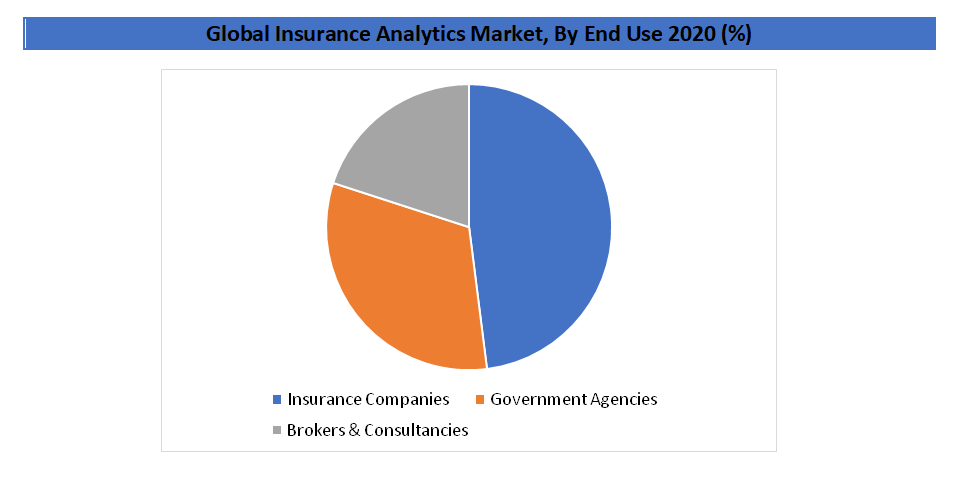

End Use Segment Analysis Preview

The market is divided into insurance companies, government organizations, and brokers and consultants based on end use. In 2020, the category of insurance companies dominated the market with 48% of share. Increasing demand for insurance services, as well as the need to prepare a vital fiscal year report, forces businesses to use sophisticated analytics technologies. The dissemination of third-party data sources reduces insurers' reliance on internal information. Data from cellphones, social media, computers, and other industrial and consumer devices has become the insurer's primary source of behavioral insights.

The market sector is likely to be driven by rising demand for online insurance solutions and enhanced online insurance services. Furthermore, the demand for analytics tools to provide customer-centric services is likely to rise as insurers' desire for personalized consultancy services grows. Companies may also use analytics to speed up procedures like policy issuance and post-sale communication, which helps them retain consumers. Furthermore, these analytics systems offer actionable information on potential consumers who are prone to conduct insurance fraud prior to the occurrence of the incident.

Global Insurance Analytics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Global Insurance Analytics Market |

| Market Size in 2023 | USD 32.97 Billion |

| Market Forecast in 2032 | USD 71.62 Billion |

| Growth Rate | CAGR of 9% |

| Number of Pages | 110 |

| Key Companies Covered | Verisk Analytics, Inc, Tableau Software, LLC, Sapiens International, PEGASYSTEMS INC., Oracle Corporation, OpenText, MicroStrategy Inc., Microsoft Corporation, Metromile Inc., Liberty Mutual |

| Segments Covered | By Component, By Application, By End use and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

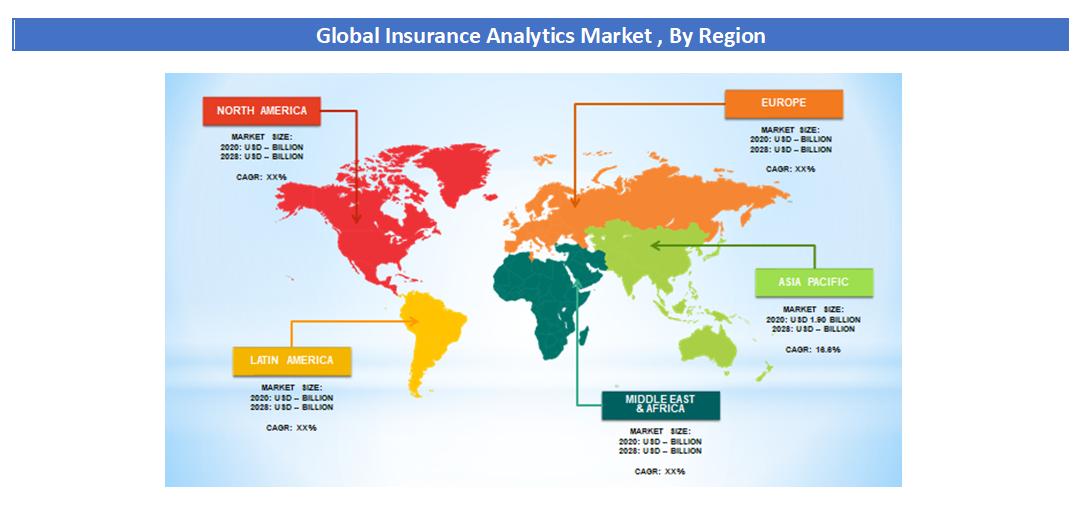

Insurance Analytics Market: Regional Analysis

The market has been divided into five regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa (MEA). North America was the most important regional market in 2020 and will continue to be so in the coming years. The increased usage of insurance analytics technologies, as well as the significant presence of large corporations in the region, may be credited for this increase. In addition, end-user businesses in the area, including as government agencies, insurance firms, and third-party administrators, are putting a strong emphasis on leveraging insurance analytics to provide customer-centric products.

Over the projection period, Asia Pacific is expected to have the highest CAGR. The growth of mobile and real-time insurance platforms across the region has boosted fraud incidences, driving up need for secure analytics technologies. The market in Asia Pacific is also likely to be driven by rising use of cloud-based technologies and more digitalization among insurance companies. A growing number of insurers and third-party administrators in the region are concentrating on delivering cheap plans, which is projected to help drive market development.

Insurance Analytics Market: Competitive Space

The global Insurance Analytics market profiles key players such as:

- Verisk Analytics, Inc

- Tableau Software, LLC

- Sapiens International

- PEGASYSTEMS INC

- Oracle Corporation

- OpenText

- MicroStrategy Inc

- Microsoft Corporation

- Metromile Inc

- Liberty Mutual

The Global Insurance Analytics Market is segmented as follows:

By Component

- Tools

- Service

By Application

- Claim Management

- Risk Management

- Process Optimization

- Customer Management & Personalization

- Others

By End use

- Insurance Companies

- Government Agencies

- Brokers & Consultancies

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Insurance analytics refers to the use of data analysis tools and techniques to assess risks, optimize pricing, improve customer experiences, and enhance decision-making in the insurance industry. It leverages technologies like AI, predictive modeling, and big data to drive efficiency and profitability.

According to study, the Insurance Analytics Market size was worth around USD 32.97 billion in 2023 and is predicted to grow to around USD 71.62 billion by 2032.

The CAGR value of Insurance Analytics Market is expected to be around 9.00% during 2024-2032.

North America has been leading the Insurance Analytics Market and is anticipated to continue on the dominant position in the years to come.

The Insurance Analytics Market is led by players like Verisk Analytics, Inc, Tableau Software, LLC, Sapiens International, PEGASYSTEMS INC., Oracle Corporation, OpenText, MicroStrategy Inc., Microsoft Corporation, Metromile Inc., Liberty Mutual.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed