Insect Protein Market Size, Share, Trends, Growth 2032

Insect Protein Market By Application (Animal Nutrition (Pet Food, Aquafeed, and Poultry Feed), Food & Beverages, and Pharmaceuticals & Cosmetics), By Insect Type (Black Soldier Flies, Crickets, Ants, Mealworms, and Grasshoppers), and By Region - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

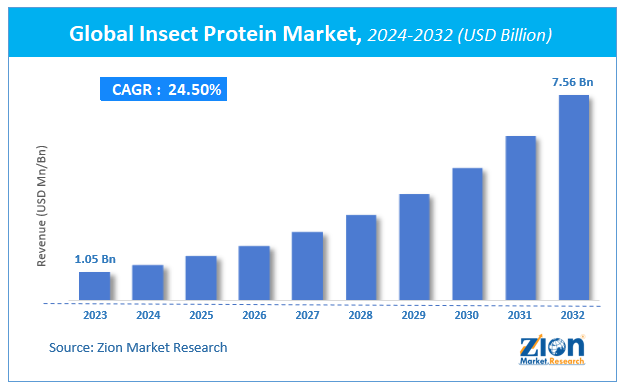

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.05 Billion | USD 7.56 Billion | 24.5% | 2023 |

Insect Protein Market Insights

According to Zion Market Research, the global Insect Protein Market was worth USD 1.05 Billion in 2023. The market is forecast to reach USD 7.56 Billion by 2032, growing at a compound annual growth rate (CAGR) of 24.5% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Insect Protein industry over the next decade.

Insect Protein Market: Overview

The report offers a valuation and analysis of the insect protein market on a global as well as regional level. The study offers a comprehensive assessment of the industry competition, limitations, revenue estimates, avenues, current & emerging trends, and industry-validated market data. The report offers historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on value (USD Billion).

With prominent inflation in the global population and large-scale demand for protein-based products from the end-users, the production of protein from fish, poultry, and livestock has become a daunting or formidable task. This has shifted the proclivity of the industry players towards producing insect species for protein. According to NCBI, nearly 1,900 species of insects are consumed across the globe and their demand is bulging in the emerging economies.

Insect Protein Market: Growth Dynamics

The insect protein market is expected to gain traction over the forthcoming years due to the high feed conversion ratios, reduced GHG emissions, and high feed quality. Apart from this, few of the insect species can be nurtured on organic side streams, thereby minimizing the environmental damage and transmuting waste into high-protein feed replacing fish in the diet. Furthermore reduced disposable charges of organic side streams will boost the scope of the business over the foreseeable future.

Furthermore, the escalating need for new food solutions having high nutritive value for both indirect as well as direct intake by humans will prompt the market demand. Apart from this, insects are used for feeding farmed animals due to their high nutritive value and this will also help in charting a profitable growth curve for the animal feed micronutrients sector. Apparently, the reduction in the land area usage for producing proteins through insect farming and the availability of techniques into nutritive protein products will offer new growth avenues for the market over the forthcoming years.

Additionally, insects are consumed in a diet for enhancing gut health as it consists of bioactive parts including lauric acid, chitin, and antimicrobial peptides having immune boosting features. Furthermore, thriving HI producing firms have also contributed lucratively towards the expansion of the insect protein market in the current years.

The favorable market trend is the indication of benefits accrued by the stakeholders through insect production for consumers requiring high value protein products. With insects becoming a part of the routine diet of fish and free-range poultry, it is most plausible that the insect proteins can be considered as the commercial source of animal feed over the coming years, thereby further accelerating the market growth. Several insects have been tried for animal feed and black soldier fly has proved to be the major potential source of animal feed. Apart from this, studies have revealed that mealworms have higher nutritive value in comparison to other traditional sources of diet. All these factors will further steer up the industry growth over the forthcoming years.

Insect Protein Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Insect Protein Market |

| Market Size in 2023 | USD 1.05 Billion |

| Market Forecast in 2032 | USD 7.56 Billion |

| Growth Rate | CAGR of 24.5% |

| Number of Pages | 110 |

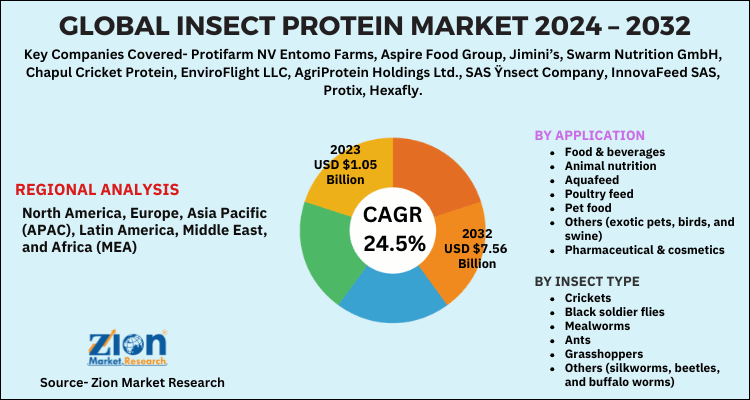

| Key Companies Covered | Protifarm NV Entomo Farms, Aspire Food Group, Jimini’s, Swarm Nutrition GmbH, Chapul Cricket Protein, EnviroFlight LLC, AgriProtein Holdings Ltd., SAS Ÿnsect Company, InnovaFeed SAS, Protix, Hexafly. |

| Segments Covered | By Application, By Insect Type, By End-Use Industry And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

North America & Europe To Make Major Contributions Towards Overall Market Share By 2032

According to NCBI, in 2019 nearly one-third of the U.S. population displayed an interest in purchasing insect-based food products. Apart from this, one out of five meat consumers have demonstrated their eagerness in acceptance of insect food in the U.S. Additionally, favorable feed legislations passed by regulatory authorities of the U.S. and Europe will further steer the growth of the market in North America and Europe.

For instance, the U.S. FDA passed a law referred to as FFDCA and as per the legislation GRAS or additive approval list was required for insects and the approval list also included HI larvae as an animal feed ingredient. Citing another such instance, the European Food Safety Authority of the EU has provided green signal towards the use of fat from insects in animal feed. All these aforementioned factors will unfurl new dimensions of growth for the insect protein industry over the forecasting years.

Insect Protein Market: Competitive Space

Key players profiled in the insect protein industry include

- Protifarm NV Entomo Farms

- Aspire Food Group

- Jimini’s

- Swarm Nutrition GmbH

- Chapul Cricket Protein

- EnviroFlight LLC

- AgriProtein Holdings Ltd.

- SAS Ÿnsect Company

- InnovaFeed SAS

- Protix

- Hexafly.

The global insect protein market is segmented as follows:

By Application

- Food & beverages

- Animal nutrition

- Aquafeed

- Poultry feed

- Pet food

- Others (exotic pets, birds, and swine)

- Pharmaceutical & cosmetics

By Insect Type

- Crickets

- Black soldier flies

- Mealworms

- Ants

- Grasshoppers

- Others (silkworms, beetles, and buffalo worms)

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Insect protein is a sustainable and nutritious alternative to conventional animal-based proteins that is derived from insects. Crickets, mealworms, grasshoppers, and black soldier insects are frequently employed as protein sources.

In comparison to conventional livestock farming, insect farming has a considerably smaller environmental impact. It generates fewer greenhouse gas emissions and necessitates less land, water, and sustenance. The demand for sustainable protein sources is being driven by the increasing concern regarding resource conservation and climate change.

According to Zion Market Research, the global Insect Protein Market was worth USD 1.05 Billion in 2023. The market is forecast to reach USD 7.56 Billion by 2032.

According to Zion Market Research, the global Insect Protein Market a compound annual growth rate (CAGR) of 24.5% during the forecast period 2024-2032.

For instance, the U.S. FDA passed a law referred to as FFDCA and as per the legislation GRAS or additive approval list was required for insects and the approval list also included HI larvae as an animal feed ingredient. Citing another such instance, the European Food Safety Authority of the EU has provided green signal towards the use of fat from insects in animal feed. All these aforementioned factors will unfurl new dimensions of growth for the insect protein industry over the forecasting years.

Protifarm NV Entomo Farms, Aspire Food Group, Jimini’s, Swarm Nutrition GmbH, Chapul Cricket Protein, EnviroFlight LLC, AgriProtein Holdings Ltd., SAS Ÿnsect Company, InnovaFeed SAS, Protix, Hexafly.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed