Feed Acid Market Size, Growth, Industry Report 2034

Feed Acid Market By Product Type (Amino Acids, Antibiotics, Vitamins, Feed Enzymes, Antioxidant), By Animal Type (Ruminants, Poultry), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

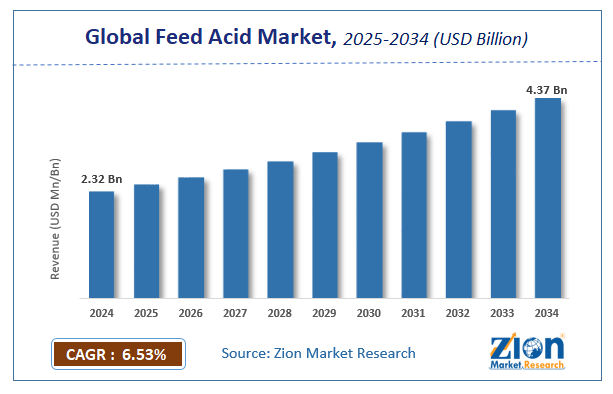

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.32 Billion | USD 4.37 Billion | 6.53% | 2024 |

Feed Acid Market: Industry Perspective

The global feed acid market size was worth around USD 2.32 billion in 2024 and is predicted to grow to around USD 4.37 billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.53% between 2025 and 2034. The report analyzes the global feed acid market's drivers, restraints/challenges, and the effect they have on the demand during the projection period. In addition, the report explores emerging opportunities in the feed acid industry.

Feed Acid Market: Overview

Feed acid offers a nutritionally balanced diet to the livestock. These include feed enzymes, amino acids, antioxidants, vitamins, as well as antibiotics that are essential for the proper growth of ruminants and poultry animals. Nowadays, farmers are mainly focusing on the use of methods that can enhance the yield and simultaneously maintain the health of the livestock at a lower cost. Feed acid can be a solution for all the concerns of the farmers due to its health benefits for the animals.

Key Insights

- As per the analysis shared by our research analyst, the global feed acid market is estimated to grow annually at a CAGR of around 6.53% over the forecast period (2025-2034).

- Regarding revenue, the global feed acid market size was valued at around USD 2.32 billion in 2024 and is projected to reach USD 4.37 billion by 2034.

- The feed acid market is projected to grow at a significant rate due to rising demand for animal protein, increasing awareness of feed efficiency and animal health, and stringent regulations limiting antibiotic use in livestock.

- Based on Product Type, the Amino Acids segment is expected to lead the global market.

- On the basis of Animal Type, the poultry segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Feed Acid Market: Growth Drivers

The increasing prevalence of the disease among animals drives market growth

The emergence of diseases such as avian influenza, BSE (ox-like spongiform encephalopathy), and SARS (extremely acute respiratory syndrome) has an impact on animal production and the economy, as well as posing a risk to human health. Pig producers suffered significant losses as a result of the emergence of pig runs in the United States.

Furthermore, because of the hot and sticky climatic circumstances, countries such as China, India, and Indonesia are constantly dealing with outbreaks of avian influenza and pig influenza. Meat merchants, meat processors, distributors, retailers, and, eventually, livestock growers suffer financial losses as a result of the separation of disease-affected animals, which causes a decline in creature usefulness, which in turn, will drive the growth of the global feed acid market during the forecast period.

Feed Acid Market: Restraints

Availability of substitutes and cost-effective products to limit the market growth

Feed acids can be found in a variety of foods, including dried distillers' grains, by-products of maize, and maize leaves. Soy meal is the most economical source of high-quality protein. It produces less methionine than is necessary for the dairy cow to give its best milk.

The saltwater algae known as seaweed are a sustainable source of protein for animal feed. Its high mineral, vitamin, and fatty acid content lowers expenses and raises feed quality. The oil that is extracted from the flower seeds is what makes sunflower seeds edible. Because it contains a lot of fiber, it is only used in limited amounts. Because of their high protein content and cost-effectiveness, these alternative sources might act as a roadblock to the expansion of the feed acid markets.

Feed Acid Market: Opportunities

The increasing use of feed acid blends favors the market expansion

Increased feed acid blending with various organic acids for better results is anticipated to present profitable prospects. When compared to the results that can be obtained by using single acid compounds, feed acid mixtures increase the favorable benefits. Blends of feed acids also improve gut health and help the digestive system regulate more pathogenic bacteria. Therefore, throughout the forecast period, the rising use of feed acids blends will boost the expansion of the global feed acids market.

Feed Acid Market: Challenges

Difficult production and high competition act as major challenges to market growth

The biggest barrier to market expansion is the difficult production process. The production of feed acids will also be expensive logistically, which will limit the market growth. On the other hand, it is projected that the availability of a wide range of feed acids would offer a growth opportunity for the sector globally.

However, the introduction of severe regulations for the selling of items containing amino acids presents a barrier to the market's growth. Because many of the market's established competitors are offering high-quality feed acid products, the severe competition among them creates a major barrier to entry for new businesses.

Feed Acid Market: Segmentation Analysis

The global feed acid market is segmented based on product type, animal type, and region

Based on the product type, the global market is bifurcated into amino acids, antibiotics, vitamins, feed enzymes, and antioxidants. The amino acid held the largest market share in 2021 and is expected to show its dominance over the forecast period. Amino acids are a crucial ingredient for improving the quality and production of animal products.

They are crucial for the expanding meat sector as well because of the rise in the demand for animal-derived protein, the public's growing concern about the safety and quality of meat, and recent outbreaks of livestock disease. Moreover, amino acid utilization in animal feed enables feed efficiency to be increased, hence lowering feed demand. Their use aids in lowering the proportion of soybean meal in feed formulation, which in turn lowers the demand for the ingredient and, as a result, the overall amount of arable land needed for feed production.

Based on the animal type, the global feed acid market is bifurcated into ruminants and poultry. The poultry segment is expected to dominate the market over the forecast period. The market for chicken feed acids has grown at an exponential rate as a result of greater concern about animal health and an increased understanding of the benefits of employing feed acids in feedstuffs. In 2021, the chicken feed sector consumed 44.4% of the world's feed amino acids, and this proportion is predicted to increase at a CAGR of 6.5% from 2022 to 2030, totaling 3.3 million metric tons.

On the other hand, the ruminants segment is expected to grow significantly over the forecast period. In ruminants, feed acids play an essential role in animal health, contributing to the maintenance of numerous metabolic functions, including maintenance and immune responses. If certain feed acids are missing from an animal's diet, it may experience reduced immune and metabolic responses, leaving its body more vulnerable to diseases, and, in severe cases, mortality. Thus, owing to the aforementioned facts ruminant segment driving the growth of the market.

Recent Developments:

- In January 2022, the DSM-Novozyme collaboration offers 'HiPhorius,' a novel technology aimed to assist chicken producers in achieving sustainable and profitable protein production.

- In March 2019, in Indonesia, BASF launched Natuphos E, a new product for the feed sector. Natuphos E has improved overall stability in premix and during the hard pelleting process, with a pelleting temperature range of up to 95°C and an 18-month shelf life.

Feed Acid Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Feed Acid Market |

| Market Size in 2024 | USD 2.32 Billion |

| Market Forecast in 2034 | USD 4.37 Billion |

| Growth Rate | CAGR of 6.53% |

| Number of Pages | 177 |

| Key Companies Covered | Trouw Nutritional International B.V., Novus International, Kemin Industries Inc., Provimi SA, ADA Alliance Nutrition Inc., Jefo Nutrition Inc., Evialis, BASF SE, Biomin GmbH, ADDCON GmbH, and others. |

| Segments Covered | By Product Type, By Animal Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Feed Acid Market: Regional Analysis

North America is expected to hold the largest market share during the forecast period

In the global feed acid market, North America is projected to hold the major market share in 2021 and it is also anticipated that it will maintain its dominance throughout the projected period. This is because feed acids are becoming more and more popular due to restrictions on the use of antimicrobials, the presence of key players, and the growing interest in meat in this region. For instance, according to the US Department of Agriculture, in 2021, 68.1 pounds of chicken per person were available for human consumption in the United States (on a boneless, edible basis), compared to 56.2 pounds of beef.

On the other hand, the Asia Pacific region is expected to grow at the highest CAGR during the forecast period. The growth in the region is attributed to the rising poultry farming and consumer preferences for natural meat and dairy products. Moreover, the Asia Pacific region's increasing industrialization and urbanization have raised the per capita income of the population.

The demand for foods high in protein has increased as a result of the rise in people's disposable income. In nations like India, South Korea, and Vietnam, there was a nearly 39%, 18%, and 13% decrease in the number of feed mills between the years 2020 and 2021, respectively. In 2021, this pattern became very evident. Despite the ongoing increase in the use of animal protein, the agriculture sector, which includes the creation of feed, has undergone consolidation. Thus, these facts supported the market growth of the Asia Pacific region.

Feed Acid Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the feed acid market on a global and regional basis.

The global feed acid market is dominated by players like

- Trouw Nutritional International B.V.

- Novus International

- Kemin Industries Inc.

- Provimi SA

- ADA Alliance Nutrition Inc.

- Jefo Nutrition Inc.

- Evialis

- BASF SE

- Biomin GmbH

- ADDCON GmbH

The global feed acid market is segmented as follows:

By Product Type

- Amino Acids

- Antibiotics

- Vitamins

- Feed Enzymes

- Antioxidant

By Animal Type

- Ruminants

- Poultry

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Feed acid offers a nutritionally balanced diet to the livestock. These include feed enzymes, amino acids, antioxidants, vitamins, as well as antibiotics that are essential for the proper growth of ruminants and poultry animals.

The global feed acid market is expected to grow due to increasing awareness of the benefits of feed acids in animal health, the rising global demand for meat and dairy products, a growing focus on animal welfare, and the adoption of modern farming practices.

According to a study, the global feed acid market size was worth around USD 2.32 billion in 2024 and is expected to reach USD 4.37 billion by 2034.

The global feed acid market is expected to grow at a CAGR of 6.53% during the forecast period.

Asia-Pacific is expected to dominate the feed acid market over the forecast period.

Leading players in the global feed acid market include Trouw Nutritional International B.V., Novus International, Kemin Industries Inc., Provimi SA, ADA Alliance Nutrition Inc., Jefo Nutrition Inc., Evialis, BASF SE, Biomin GmbH, ADDCON GmbH, among others.

The report explores crucial aspects of the feed acid market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed