Global Industrial Detonator Market Size, Share, Growth Analysis Report - Forecast 2034

Industrial Detonator Market By Application (Building, Mining, Other Applications), By Product Type (Delay Detonator, Prompt Detonator), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

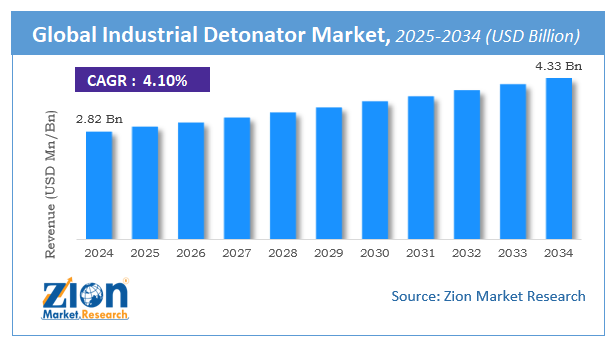

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.82 Billion | USD 4.33 Billion | 4.1% | 2024 |

Industrial Detonator Market: Industry Perspective

The global industrial detonator market size was worth around USD 2.82 Billion in 2024 and is predicted to grow to around USD 4.33 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.1% between 2025 and 2034.

The report analyzes the global industrial detonator market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the industrial detonator industry.

Industrial Detonator Market: Overview

An industrial detonator is a device used for triggering or initiating controlled explosions in an industrial setting. The largest and most prominent applications of industrial detonators are in the mining and building or construction industry. These explosives are different from other explosion-causing tools since they are used under the guidance of explosion experts and are intended only for industrial purposes. When handled properly after meeting all safety requirements, industrial detonators do not lead to explosions that may cause any harm to animals or humans around the detonation site.

Industrial detonators typically consist of loaded shells or small tubes containing sensitive explosives such as lead styphnate or lead azide. During the forecast period, several factors are expected to drive the demand for efficient industrial detonators but companies must continue to focus on improving safety features associated with these explosion-triggering components. In earlier times, silver fulminate was an essential component of blasting caps; however, with time, it has been replaced with safer alternatives but silver fulminate continues to have certain applications which can be harmful for the market growth.

Key Insights

- As per the analysis shared by our research analyst, the global industrial detonator market is estimated to grow annually at a CAGR of around 4.1% over the forecast period (2025-2034).

- Regarding revenue, the global industrial detonator market size was valued at around USD 2.82 Billion in 2024 and is projected to reach USD 4.33 Billion by 2034.

- The industrial detonator market is projected to grow at a significant rate due to rising mining and construction activities, infrastructure development, and increasing demand for controlled blasting technologies.

- Based on Application, the Building segment is expected to lead the global market.

- On the basis of Product Type, the Delay Detonator segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Request Free Sample

Request Free Sample

Industrial Detonator Market: Growth Drivers

Increasing mining activities to drive market growth

The global industrial detonator market is expected to grow owing to the increasing mining activities across the globe. Industrial detonators are one of the standard business tools used by companies operating in the mining sector since they are used for most industry-specific applications such as drilling & tunneling, blasting during ore extraction, cutting through hard rock & concrete surfaces, and quarrying. The increasing mining rate for all essential raw materials that form the basis of the modern world has resulted in surging demand for safe and effective industrial detonators. Mining is technically considered a manufacturing unit with the difference in the tools used during the process and the end goods produced. For instance, mining focuses on the extraction of important and high-value geological materials such as ores, salt, gravel, sand, oil & natural gas, gemstones, industrial minerals, cobalt, and many more raw materials. All the products extracted by mining companies are used extensively in the commercial world.

In addition to this, companies across industries are working toward developing applications of newly discovered products while also investing in expanding the applications of well-known geological materials. For instance, while silver remains a prominent raw material for the jewelry industry, it has been studied extensively to develop silver coating for implantable medical devices since silver can protect against infection.

On the other hand, mining companies are expanding resource allocation for the discovery of new mining sites that could directly impact the global market demand during the projection period. In September 2023, Norge Mining announced that it had discovered a new mining site in Norway and insisted that the discovery could shape the global future, especially focusing on clean energy. The mining site has a rich deposit of 77 billion-ton phosphate that has the capacity to meet global energy demand for the next 50 years.

Industrial Detonator Market: Restraints

Tough competition from modern alternate solutions to restrict market growth

The industrial detonator industry growth will be restricted due to the tough competition that market players face from alternate methods used for safe, controlled, and supervised explosions across end-user verticals. For instance, the proliferation application of non-blasting agents consisting of chemicals to assist the breaking of rocks or hydraulic breakers may result in stunted demand for industrial detonators. Another popular method to break through hard rocks and other materials is abrasive water jet cutting using water jets under pressure as high as 200–300 MPa suspended with abrasive powder. Mining and building industry players are increasingly moving toward deploying methods that do not require blasting as it is often associated with high risk in terms of ecosystem damage.

Industrial Detonator Market: Opportunities

Increasing launch of new industrial detonators to provide growth opportunities

The global industrial detonator market growth prospects appear promising due to the increasing development and launch of advanced industrial detonators with higher security and functional attributes. For instance, in September 2023, Orica, a global leader and the world’s only producer of non-electric detonators in the Nordic region, launched the Neo range of Exel™ non-electric detonators, its premium segment in the existing range. These variants are lead-free and hence more sustainable. The company has worked toward ensuring that performance consistency is not impacted by this change. The newly launched range has applications in surface and underground mining operations as well as the civil infrastructure segment.

Rising demand for digital detonators to push market revenue in a positive direction

The rising innovation and development of digital detonators will help the market witness a higher growth rate during the projection period. These detonators work on microelectronic chips instead of electronic or chemical components for delay. Digital detonators are considered safer since they are highly accurate in terms of timing thus reducing the risk of error.

Integration of 3-D printing technology and industrial detonators will create additional expansion possibilities

Research indicates that scientists are increasingly using 3-D printing technology to learn more about the way in which explosives work. Integrating 3-D printing technology and industrial detonator manufacturing can help in controlling the release of energy. This could be made possible by investing more resources in industrial-grade 3-D printers. The technology is already in use to print complex spare parts for several military applications. However, this segment needs more brainstorming and discussion within the market to witness higher applications.

Industrial Detonator Market: Challenges

Strict government regulations governing detonator production and use to challenge market growth

The industrial detonator industry growth trend may face several hindrances since the production and use of industrial detonators are subject to severe regulatory guidelines laid down by regional and international government bodies keeping in view the impact of these detonators on humans, animals, and the ecosystem in general. Furthermore, even though the explosion-assisting devices are produced with safety as a primary concern, their storage, transportation, and use are extremely complex and require strict adherence to safety protocols.

Industrial Detonator Market: Segmentation

The global industrial detonator market is segmented based on application, product, and region.

Based on application, the global market segments are building, mining, and other applications. In 2022, the mining sector was the largest revenue generator due to the rapid proliferation of the global mining industry. In 2022, more than 25000 metric tons of silver was produced. The growing demand for precious gemstones and ores is likely to push segmental growth during the projection period.

Based on type, the industrial detonator industry segments are delay detonator and prompt detonator. The latter segment generated high demand across end-user verticals. These variants trigger explosions when electro-mechanical, shock, or heat is applied. It provides efficient and quick results while being highly reliable. Delay detonators, on the other hand, have a time delay between the explosion request and the final explosion. Most delay variants are available in the delay range of 0 to 10 with 1-6 being a delay of 25 milliseconds.

Industrial Detonator Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Detonator Market |

| Market Size in 2024 | USD 2.82 Billion |

| Market Forecast in 2034 | USD 4.33 Billion |

| Growth Rate | CAGR of 4.1% |

| Number of Pages | 206 |

| Key Companies Covered | MNK, AEL Mining Services, Sasol Limited, Davey Bickford, Orica, Yahua Industrial, Austin, Dyno Nobel, and others. |

| Segments Covered | By Application, By Product Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Detonator Market: Regional Analysis

Asia-Pacific to witness the highest growth rate during the assessment period

The global industrial detonator market will witness the highest growth in Asia-Pacific driven by increasing urban infrastructure development projects as well as mining activities. India has over 1300 mining sites while China boasts of over 40,000 mines. Some of the richest mines in China include Shaxi Copper Mine, CSH Gold Mine, and Sanshandao Gold Mine, among many others. The countries have a rising industrial segment leading to more demand for essential raw materials in end-user verticals such as the jewelry industry and semiconductors market. Furthermore, a growing number of industrial detonator manufacturers and consistent expansion in new territories is expected to drive market growth. However, one of the key setbacks for industrial detonators is expected to emerge in India as the country recently announced its intention to phase out the use of electric detonators. In October 2023, the Department of Promotion of Industry and Internal Trade (DPIIT) named the device as dangerous and put a ban on its manufacturing, possession, or trade starting in April 2025. The Africa region is projected to continue growing at a steady pace. The regional market driving force is the abundant existence of crucial and highly valuable geological materials including precious stones and minerals. In 2018, over 66.6 million carats of diamonds were mined in Africa.

Industrial Detonator Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the industrial detonator market on a global and regional basis.

The global industrial detonator market is dominated by players like:

- MNK

- AEL Mining Services

- Sasol Limited

- Davey Bickford

- Orica

- Yahua Industrial

- Austin

- Dyno Nobel

The global industrial detonator market is segmented as follows;

By Application

- Building

- Mining

- Other Applications

By Product Type

- Delay Detonator

- Prompt Detonator

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed