Hog And Pig Farming Market Size, Growth, Global Trends, Forecast 2034

Hog And Pig Farming Market By Type (Leg/Ham, Shoulder/Boston Butt, Loin of Pork, Ribs, Belly/Side of Pork/Bacon, Picnic Shoulder/Hand, and Others), By Form (Fresh and Processed), By End-Use (Food Processing Industry, Household/Retail, and Food Service Providers), By Distribution Channel (B2B/Direct, Specialty Stores, Convenience Stores, Hypermarkets/Supermarkets, Butcher Shop/Wet Markets, and Online), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

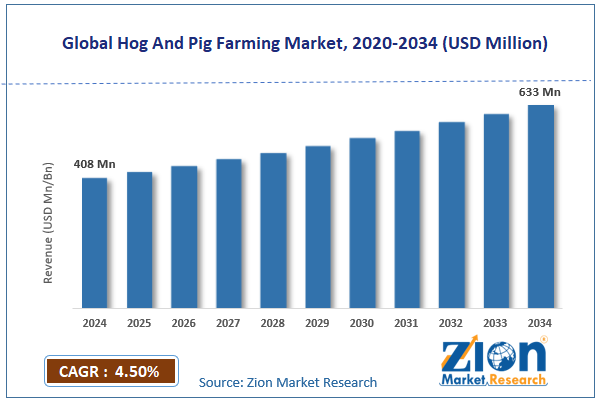

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 408 Million | USD 633 Million | 4.5% | 2024 |

Hog And Pig Farming Industry Perspective:

What will be the size of the global hog and pig farming market during the forecast period?

The global hog and pig farming market size was worth around USD 408 million in 2024 and is predicted to grow to around USD 633 million by 2034, with a compound annual growth rate (CAGR) of roughly 4.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global hog and pig farming market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2025-2034).

- In terms of revenue, the global hog and pig farming market size was valued at around USD 408 million in 2024 and is projected to reach USD 633 million by 2034.

- Regional policies, government intervention & trade flows are expected to drive the hog and pig farming market.

- Based on the type, the leg/ham is expected to capture the highest revenue share over the projected period.

- Based on the form, the processed form is expected to hold the largest market share over the projected period.

- Based on the end-use, the food processing industry segment is expected to capture a prominent revenue share over the analysis period.

- Based on the distribution channel, the B2B/Direct distribution channel holds a prominent market share.

- Based on region, the Asia Pacific is expected to lead the hog and pig farming market over the projected period.

Hog And Pig Farming Market: Overview

Swine farming, or hog farming, is the process of growing, caring for, and managing domesticated pigs to get meat (mostly pork), breeding stock, and other products like hides and dung. The industry is a significant part of the global livestock economy, as it supports the entire hog value chain, from processing to packing to sale. There are several types of farming systems, ranging from small backyard farms to large companies that provide everything from controlled housing to specialized feed, genetic growth plans, veterinary care, and biosecurity controls. Production is sometimes divided into farrow-to-finish, farrow-to-wean, or feeder pig operations based on the stage of growth that is being controlled. Raising pigs and hogs is important for food security worldwide, jobs in rural regions, and the trade of farm goods. This is especially true in North America, Europe, and the Asia-Pacific, where much of the pork comes from.

Hog And Pig Farming Market: Dynamics

Growth Drivers

Why does rising protein demand & dietary shifts drive the expansion of the hog and pig farming market?

The hog and pig farming business is growing because of rising demand for protein and changes in people's diets. Pork is still one of the most popular and affordable sources of animal protein worldwide. As populations grow and cities grow, household incomes tend to rise. This is especially true in growing nations, including those in the Asia-Pacific, Latin America, and parts of Africa. This leads people to move away from plant-based diets and toward higher-value, protein-rich foods like meat. This dietary change increases the amount of pork consumed per person, particularly in countries where pork is already culturally important.

Also, more and more middle-class people want easy-to-use, processed, and packaged pig products, which leads to large-scale production. As the food service business grows, modern retail expands, and cold-chain infrastructure improves, pork is becoming easier for city dwellers to access. Farmers respond to long-term increases in demand by growing their herds, investing in genetics and feed efficiency, and using new agricultural technologies. This leads to growth in the whole sector.

Restraints

Does feed supply & cost volatility hinder the growth of the hog and pig farming industry?

The hog and pig farming businesses can't grow very much because of problems with feed supplies and prices. In commercial swine farming, feed costs make up 60–70% of all production costs. This includes corn, soybean meal, and other grains. Farmers feel rapid margin pressure when global grain prices rise due to droughts, geopolitical tensions, export restrictions, currency fluctuations, or competition from biofuel production. Hog producers can't pass on rising costs to customers as quickly as other businesses may, since the prices of pigs are set by supply and demand and market cycles. Uncertainty in planning is also caused by volatility. When feed costs remain high for a long time, producers may delay herd expansion, lower stocking rates, or leave the market. Smaller, less connected farms are more at risk, since they often lack ways to protect themselves or long-term commitments to feed.

Also, a lack of feed or supply chain issues might slow pig weight gain, reduce productivity, and lower overall output. The fact that feed prices fluctuate significantly not only lowers profits but also makes it less likely that companies will invest in long-term capital, which is a big problem for sustainable industry growth.

Opportunities

How does the rising collaboration among countries for pig farming offer a development opportunity for the hog and pig farming market?

Pig farming is becoming more common, creating significant opportunities for market growth by facilitating trade among countries, technology sharing, disease control, and investment attraction. Countries cooperate to reduce tariffs and facilitate the export of pork and breeding stock through bilateral or multilateral trade agreements. This helps countries that import meat maintain a stable supply of protein and allows producers to access other markets, especially in countries that export a lot of pork. Sharing innovative genetics, feed formulations, veterinary treatments, and precision agricultural technology is also possible when people work together across borders. This makes developing markets more productive, healthier herds, and more efficient feed.

For instance, in October 2025, China and Denmark have been working together more and more in pig farming, leveraging their complementary skills to build long-term partnerships that benefit both countries. For a long time, Denmark has been one of China's most important sources of breeding stock. The China Animal Agriculture Association and customs officials said that more than 40% of China's breeding stock arrived from Denmark in 2022. The Danish Agriculture & Food Council says that Denmark would send 210,000 tons of pork to China in 2023. This demonstrates the strength of the two countries' agricultural business ties. China eats more pork than any other country, making up more than 45% of the world's total pork consumption. The government has sought to learn from Denmark's experience as farming becomes increasingly focused on efficiency and environmental protection.

Challenges

Environmental & social concerns pose a major challenge to the industry’s growth

Environmental and social issues are major problems that make it hard for the hog and pig farming industry to grow. Pig farming generates significant waste, including manure, wastewater, and greenhouse gases such as methane and ammonia. When waste is not handled properly, it can pollute water, land, and air, which is why many countries have stricter environmental laws. Meeting these requirements often requires businesses to spend a lot of money on waste treatment systems, odor control technologies, lagoon management, and emission mitigation equipment, thereby increasing their prices.

Also, large hog farms often face neighborhood criticism because people are worried about the smell, the effects on public health, the amount of water they use, and the damage to the soil. Animal rights activists have also looked more closely at how animals are kept, how they are transported, and how they are killed. These social pressures could lead to tougher zoning rules, production limits, lawsuits, and reputational damage to producers and integrated meat companies. Because of this, environmental compliance costs, stricter regulations, and a lack of public support can make it harder for farms to expand, discourage new investment, and limit opportunities for regional growth. This makes environmental and social issues a major obstacle to the sector's growth.

Hog And Pig Farming Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Hog And Pig Farming Market |

| Market Size in 2024 | USD 408 Million |

| Market Forecast in 2034 | USD 633 Mllion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 220 |

| Key Companies Covered | Smithfield Foods Inc., Vall Companys, Tyson Foods Inc., Cargill Incorporated, JBS USA, Hormel Foods Corporation, Seaboard Corporation, WH Group Limited (formerly Shuanghui International), MHP (Myronivsky Hliboproduct), Triumph Foods LLC, BRF S.A., Clemens Food Group, New Hope Group, The Maschhoffs LLC, Olymel L.P., and others. |

| Segments Covered | By Type, By Form, By End Use, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Hog And Pig Farming Market: Segmentation

Type Insights

What factor drives the leg/ham segment into a dominant position in the hog and pig farming market?

The leg/ham is expected to capture the highest revenue share over the projected period. The growth is due to increased consumption of pork and greater demand for processed meat worldwide. People eat a lot of ham, which comes from the pig's rear leg. It can be fresh or processed, like cured, smoked, or packaged and ready to eat.

Form Insights

Why processed form hold the largest share in the hog and pig farming market?

The processed form is expected to hold the largest market share over the projected period. The main reason for growth is that more customers want beef products that are easy to use, last longer, and provide value. Processed meats such as bacon, ham, salami, and sausages, as well as ready-to-cook or ready-to-eat pig products, are popular among city dwellers who lead busy lives and have limited time to prepare. The growth of modern retail chains, online grocery stores, and improved cold-chain logistics has helped increase sales of packaged pig products in both developed and developing countries.

End-Use Insights

Why does the food processing industry dominate the hog and pig farming market?

The food processing industry segment is expected to capture a prominent revenue share over the analysis period. The food processing business, a major end-use for hog and pig farming, converts pork into a variety of products. The demand for consistent, high-quality pork is prompting producers to adopt technological breakthroughs and sustainable practices to meet the industry's evolving needs.

Distribution Channel Insights

Why does the B2B/Direct segment dominate the hog and pig farming industry?

The B2B/Direct distribution channel holds a prominent market share. The surge is due to more meat processors, restaurant owners, distributors, and customers who buy meat for export wanting it. To ensure a steady, traceable, and cost-effective supply, large-scale processors and vertically integrated meat corporations purchase live hogs or substantial quantities of pork directly from farmers. The growth of quick-service restaurant chains, ready-to-eat food production, and processed meat processing has led institutions to buy many more hogs.

Regional Insights

Why does the Asia Pacific hold the largest share in the hog and pig farming market?

Asia Pacific is expected to drive industry growth. The growth is being fueled by increased consumption of pork, population growth, and higher disposable income. Countries like China, Vietnam, the Philippines, South Korea, and Japan have significant cultural preferences for pork as a main source of animal protein; they eat it every day. The demand for both fresh and processed pork products has increased as cities expand rapidly and the middle class expands. This has led to higher production levels and farm profits.

After outbreaks of African Swine Fever (ASF), rebuilding and modernizing herds have been important for expansion in the area, especially in China and Southeast Asia. Governments and private investors have invested more in large, biosecure, vertically integrated pig farms to stabilize supply and increase production. Automated housing systems, precision feeding, and genetic modification have improved feed conversion ratios and made operations more efficient, leading to increased revenue in the area.

Hog And Pig Farming Market: Competitive Analysis

The global hog and pig farming market is dominated by players like:

- Smithfield Foods Inc.

- Vall Companys

- Tyson Foods Inc.

- Cargill Incorporated

- JBS USA

- Hormel Foods Corporation

- Seaboard Corporation

- WH Group Limited (formerly Shuanghui International)

- MHP (Myronivsky Hliboproduct)

- Triumph Foods LLC

- BRF S.A.

- Clemens Food Group

- New Hope Group

- The Maschhoffs LLC

- Olymel L.P

The global hog and pig farming market is segmented as follows:

By Type

- Leg/Ham

- Shoulder/Boston Butt

- Loin of Pork

- Ribs

- Belly/Side of Pork/Bacon

- Picnic Shoulder/Hand

- Others

By Form

- Fresh

- Processed

By End Use

- Food Processing Industry

- Household/Retail

- Food Service Providers

By Distribution Channel

- B2B/Direct

- Specialty Stores

- Convenience Stores

- Hypermarkets/Supermarkets

- Butcher Shop/Wet Markets

- Online

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed