Delivery Drones Market Size, Share, Trends, Growth & Forecast 2034

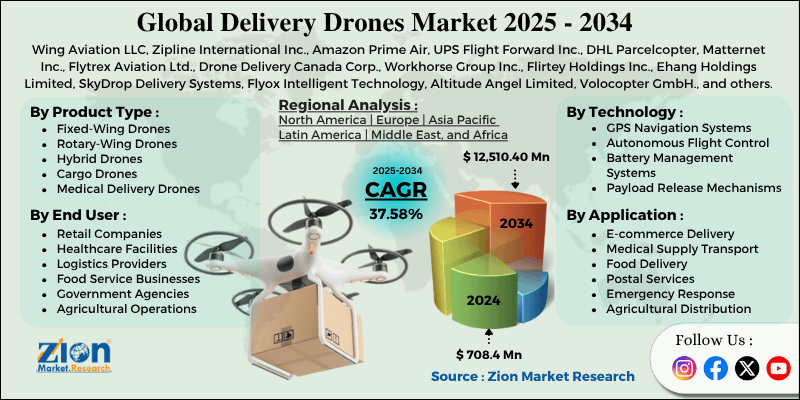

Delivery Drones Market By Product Type (Fixed-Wing Drones, Rotary-Wing Drones, Hybrid Drones, Cargo Drones, and Medical Delivery Drones, and Others), By Technology (GPS Navigation Systems, Obstacle Avoidance Technology, Autonomous Flight Control, Battery Management Systems, Payload Release Mechanisms, and Others), By Application (E-commerce Delivery, Medical Supply Transport, Food Delivery, Postal Services, Emergency Response, Agricultural Distribution), By End-User (Retail Companies, Healthcare Facilities, Logistics Providers, Food Service Businesses, Government Agencies, Agricultural Operations), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

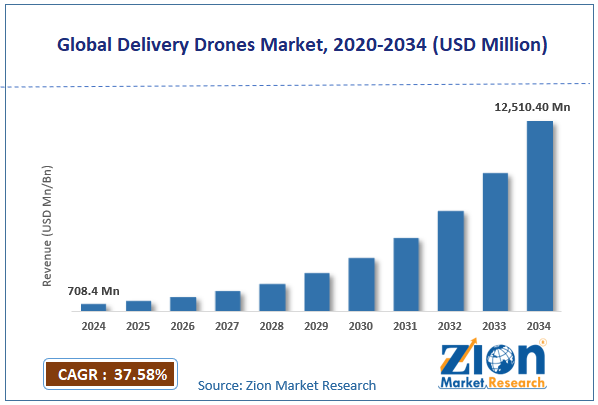

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 708.4 Million | USD 12,510.40 Million | 37.58% | 2024 |

Delivery Drones Industry Perspective:

The global delivery drones market size was worth approximately USD 708.4 million in 2024 and is projected to grow to around USD 12,510.40 million by 2034, with a compound annual growth rate (CAGR) of roughly 37.58% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global delivery drones market is estimated to grow annually at a CAGR of around 37.58% over the forecast period (2025-2034).

- In terms of revenue, the global delivery drones market size was valued at approximately USD 708.4 million in 2024 and is projected to reach USD 12,510.40 million by 2034.

- The delivery drones market is projected to grow significantly due to the increasing demand for rapid delivery solutions and last-mile logistics optimization.

- Based on product type, the rotary-wing drones segment is expected to lead the delivery drones market, while the hybrid drones segment is anticipated to experience significant growth.

- Based on technology, the autonomous flight control segment is expected to lead the delivery drones market, while the obstacle avoidance technology segment is anticipated to witness notable growth.

- Based on application, the e-commerce delivery segment is the dominating segment, while the medical supply transport segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the retail companies segment is expected to lead the market compared to the agricultural operations segment.

- Based on region, North America is projected to dominate the global delivery drones market during the estimated period, followed by Europe.

Delivery Drones Market: Overview

Delivery drones are small unmanned aerial vehicles (UAVs) used to carry and deliver packages, medicines, and goods from one place to another without a human pilot. They help businesses, hospitals, and retailers deliver items quickly, reach remote areas, and improve last-mile delivery. Modern drones use technologies like GPS navigation, obstacle sensors, precision landing systems, and real-time tracking to ensure safe and efficient deliveries. Companies are also working on improving their design, battery life, and carrying capacity while following safety rules and regulations. These drones are shaping the future of fast and contactless delivery systems. They reduce traffic congestion and carbon emissions by replacing traditional ground transport. With ongoing innovations, delivery drones are becoming a key part of smarter, greener logistics networks. Their expanding use across industries highlights their role in transforming global supply chains and enhancing delivery efficiency worldwide.

The increasing demand for faster delivery services and contactless distribution methods is expected to drive growth in the delivery drones market throughout the forecast period.

Delivery Drones Market Dynamics

Growth Drivers

Rising demand for fast delivery and last-mile logistics solutions

The delivery drones market is expanding as businesses globally strive to reduce delivery times while maintaining affordable operations in busy urban areas. E-commerce companies use drone delivery systems more often to meet consumer expectations for same-day or hourly deliveries without transportation delays. These drones give businesses faster delivery options, helping them avoid traffic jams and lower carbon emissions from ground vehicles. Rising online shopping and increasing consumer demands are putting extra pressure on logistics systems.

Urban growth and crowded cities create delivery challenges, prompting retailers to seek innovative solutions for navigating complex city routes. Environmental groups support clean, electric delivery options, encouraging companies to invest in aerial technologies. As consumers seek greater speed and convenience in shopping, the need for dependable drone delivery systems continues to rise. This growing shift toward automation is redefining how goods move through cities and transforming the future of urban logistics.

How are advancements in technology and improved operational capabilities driving the delivery drones market growth?

The global delivery drones market is expanding as companies develop advanced technologies to enhance flight time, carrying capacity, and navigation accuracy. These include strong battery systems, lightweight materials, and AI-based flight controls that boost efficiency and reliability. New autonomous drones feature multiple safety systems, longer flight ranges, and improved weather detection tools. Hybrid propulsion systems are becoming more efficient and practical for long-distance deliveries.

Collision sensors help detect obstacles with high precision, while secure payload release systems ensure accurate package drops. These advancements make delivery drones more attractive to logistics companies and retailers by offering dependable service, reduced risks of damage, and successful deliveries even in challenging conditions. Such innovations are setting new performance standards and driving the next phase of automation in aerial logistics.

Restraints

How are regulatory restrictions and airspace management challenges creating restraints for the delivery drones market?

A major challenge for the delivery drones market is dealing with complex rules for operating unmanned aircraft and fitting them into current airspace systems. Aviation authorities require long testing and certification processes before granting permission for commercial use, which slows down adoption. Airspace limits restrict drone flights near airports, government areas, and crowded zones, reducing where they can operate.

Privacy concerns add hesitation as people question data collection and the use of cameras during deliveries. Safety rules limit flights in poor weather or low visibility to prevent accidents. Different countries follow different regulations, making international operations difficult for logistics companies. Liability remains unclear in cases where accidents cause damage or injuries, further complicating insurance challenges. Public acceptance also differs, with concerns about noise, safety, and air traffic in residential areas affecting drone adoption.

Opportunities

How are expanding applications in medical supply delivery and emergency response creating new opportunities for the delivery drones market?

The delivery drones industry is expanding beyond retail use into medical transport, pharmaceutical delivery, and emergency response. Hospitals and clinics use drones to move blood samples, vaccines, and medical supplies quickly without traffic delays. Remote healthcare centers rely on them to receive medicines and test materials in areas with poor road access. Emergency teams use drones to deliver defibrillators, first aid kits, and medicines to accident sites before ambulances arrive.

Disaster relief groups use them to send food, water, and medical help to isolated areas during natural disasters. Organ transplant teams are testing drone delivery to reduce the time it takes to transport organs between donor and recipient hospitals. International aid groups are exploring aerial delivery as a means of relief efforts in conflict zones. These growing uses are creating new business opportunities and driving companies to design drones with temperature control and priority routes for fast, life-saving deliveries.

Challenges

Technical limitations and infrastructure requirements

The delivery drones industry faces major challenges due to battery limits and the need for strong ground infrastructure to run large-scale operations. Short battery life reduces flight range and forces frequent charging or swapping, lowering efficiency. Limited payload capacity prevents drones from carrying heavy items, restricting the types of items that can be delivered. Weather conditions like rain, wind, or extreme heat affect flight safety and reliability.

Drones also need clear landing zones, making deliveries to high-rise apartments difficult. Charging stations must be set up across service areas, increasing costs and setup complexity. Regular maintenance, inspections, and part replacements require skilled technicians and spare components. High startup costs make it hard for small companies to join the market, discouraging new investments in drone delivery systems.

Delivery Drones Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Delivery Drones Market |

| Market Size in 2024 | USD 708.4 Million |

| Market Forecast in 2034 | USD 12,510.40 Million |

| Growth Rate | CAGR of 37.58% |

| Number of Pages | 217 |

| Key Companies Covered | Wing Aviation LLC, Zipline International Inc., Amazon Prime Air, UPS Flight Forward Inc., DHL Parcelcopter, Matternet Inc., Flytrex Aviation Ltd., Drone Delivery Canada Corp., Workhorse Group Inc., Flirtey Holdings Inc., Ehang Holdings Limited, SkyDrop Delivery Systems, Flyox Intelligent Technology, Altitude Angel Limited, Volocopter GmbH., and others. |

| Segments Covered | By Product Type, By Technology, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Delivery Drones Market: Segmentation

The global delivery drones market is segmented based on product type, technology, application, end-user, and region.

Based on product type, the global delivery drones industry is classified into fixed-wing drones, rotary-wing drones, hybrid drones, cargo drones, medical delivery drones, and others. Rotary-wing drones lead the market due to their vertical takeoff and landing capabilities, precise hovering ability, and superior maneuverability in confined urban spaces for efficient package delivery operations worldwide.

Based on technology, the industry is segregated into GPS navigation systems, obstacle avoidance technology, autonomous flight control, battery management systems, payload release mechanisms, and others. Autonomous flight control leads the market due to its reliable navigation capability, reduced operator workload, and widespread acceptance among logistics providers for safe and efficient delivery operations.

Based on application, the global delivery drones market is divided into e-commerce delivery, medical supply transport, food delivery, postal services, emergency response, and agricultural distribution. E-commerce delivery is expected to lead the market during the forecast period due to its massive order volumes, growing consumer expectations, and continuous pressure for faster delivery times in competitive retail environments.

Based on end-user, the global market is segmented into retail companies, healthcare facilities, logistics providers, food service businesses, government agencies, and agricultural operations. Retail companies hold the largest market share due to their substantial delivery volumes, diverse product categories, and ongoing investment in logistics innovation to maintain competitive advantages.

Delivery Drones Market: Regional Analysis

What factors are contributing to North America's dominance in the global delivery drones market?

North America leads the delivery drones market because of its strong technology base, supportive regulations, and quick adoption of new delivery methods. The United States accounts for nearly half of global demand, supported by large e-commerce firms, flexible aviation rules, and major investments in drone technology. The region benefits from top aerospace companies, research institutions, and strong funding for startups. U.S. firms are building advanced systems with longer ranges, higher autonomy, and improved air traffic control integration.

Having key industry players and testing sites allows faster innovation and quicker regulatory approvals. Heavy spending on logistics and customer experience continues to drive demand growth. Supportive rules encourage safe innovation and expand commercial operations through pilot projects. Partnerships between tech firms and logistics providers help create reliable systems for real-world deliveries. Growing attention to eco-friendly transport and carbon reduction is boosting interest in electric drones.

Ongoing cooperation between private companies and government agencies is strengthening infrastructure, ensuring North America stays ahead in drone delivery development. Increased investments in AI-driven flight management and automated route optimization are further enhancing delivery efficiency. The rapid expansion of drone delivery trials across urban and suburban areas highlights the region’s readiness for large-scale commercial deployment.

Europe is experiencing steady growth.

Europe is seeing steady growth in the delivery drones market as countries work on clear regulations and respond to rising demand for sustainable logistics. Nations across the European Union are investing in drone delivery systems to enhance rural healthcare, support island regions, and reduce city traffic congestion while meeting environmental objectives. The region’s focus on green technology and emission reduction is pushing demand for electric drones, which offer cleaner delivery options.

European manufacturers are developing reliable and safe systems that comply with stringent regulations and enhance operational efficiency. Diverse landscapes and cross-border delivery needs require flexible aircraft that can handle different environments. Growing city populations are increasing the need for smart last-mile delivery solutions that solve road congestion issues. Cooperation among EU countries is helping standardize drone rules and expand service areas.

Research institutions are working with industries and regulators to develop advanced drone technologies. The growing use of automated warehouses and digital logistics systems supports the smooth integration of drone operations. Strong EU funding for clean transport projects is speeding up technology progress and strengthening Europe’s position in drone innovation. Emerging collaborations between drone companies and postal services are enabling faster and more reliable regional deliveries. The focus on AI-powered navigation and autonomous air traffic coordination is further boosting Europe’s leadership in safe and sustainable drone operations.

Recent Market Developments:

- In March 2025, Zipline announced its drones had flown more than 100 million miles and completed approximately 1.4 million deliveries.

- In June 2025, Deliveroo began a trial of drone food deliveries in the Blanchardstown area of Dublin in partnership with Manna Air Delivery, enabling orders from selected restaurants via aerial drop.

- In June 2025, Walmart and Wing (an Alphabet-owned drone company) announced they would expand their drone delivery service from the Dallas/Fort Worth region to 100 additional U.S. stores over the next year.

Delivery Drones Market: Competitive Analysis

The leading players in the global delivery drones market are:

- Wing Aviation LLC

- Zipline International Inc.

- Amazon Prime Air

- UPS Flight Forward Inc.

- DHL Parcelcopter

- Matternet Inc.

- Flytrex Aviation Ltd.

- Drone Delivery Canada Corp.

- Workhorse Group Inc.

- Flirtey Holdings Inc.

- Ehang Holdings Limited

- SkyDrop Delivery Systems

- Flyox Intelligent Technology

- Altitude Angel Limited

- Volocopter GmbH.

The global delivery drones market is segmented as follows:

By Product Type

- Fixed-Wing Drones

- Rotary-Wing Drones

- Hybrid Drones

- Cargo Drones

- Medical Delivery Drones

- Others

By Technology

- GPS Navigation Systems

- Obstacle Avoidance Technology

- Autonomous Flight Control

- Battery Management Systems

- Payload Release Mechanisms

- Others

By Application

- E-commerce Delivery

- Medical Supply Transport

- Food Delivery

- Postal Services

- Emergency Response

- Agricultural Distribution

By End-User

- Retail Companies

- Healthcare Facilities

- Logistics Providers

- Food Service Businesses

- Government Agencies

- Agricultural Operations

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Delivery drones are small unmanned aerial vehicles (UAVs) used to carry and deliver packages, medicines, and goods from one place to another without a human pilot.

The global delivery drones market is projected to grow due to increasing demand for rapid delivery services, rising adoption of autonomous logistics technologies, and growing emphasis on reducing last-mile delivery costs and environmental impact.

According to a study, the global delivery drones market size was worth around USD 708.4 million in 2024 and is predicted to grow to around USD 12,510.40 million by 2034.

The CAGR value of the delivery drones market is expected to be around 37.58% during 2025-2034.

North America is expected to lead the global delivery drones market during the forecast period.

The major players profiled in the global delivery drones market include Wing Aviation LLC, Zipline International Inc., Amazon Prime Air, UPS Flight Forward Inc., DHL Parcelcopter, Matternet Inc., Flytrex Aviation Ltd., Drone Delivery Canada Corp., Workhorse Group Inc., Flirtey Holdings Inc., Ehang Holdings Limited, SkyDrop Delivery Systems, Flyox Intelligent Technology, Altitude Angel Limited, and Volocopter GmbH.

The report examines key aspects of the delivery drones market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

In the delivery drones market, major players like Amazon Prime Air, Wing Aviation, and Zipline are expanding through partnerships, pilot projects, and regional launches while focusing on sustainable technologies, regulatory approvals, and infrastructure development to strengthen global operations.

In the delivery drones market, consumers are increasingly seeking faster, eco-friendly, and contactless deliveries. Businesses are responding by adopting electric, autonomous drones that reduce carbon emissions and improve last-mile logistics efficiency in both urban and remote areas.

In the delivery drones market, advancements such as AI-based flight control, obstacle avoidance systems, hybrid propulsion, and precision landing technologies are improving safety, range, and efficiency, making drone deliveries more reliable and scalable across industries.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed