Global Hybrid Power Systems Market Size, Share, Growth Analysis Report - Forecast 2034

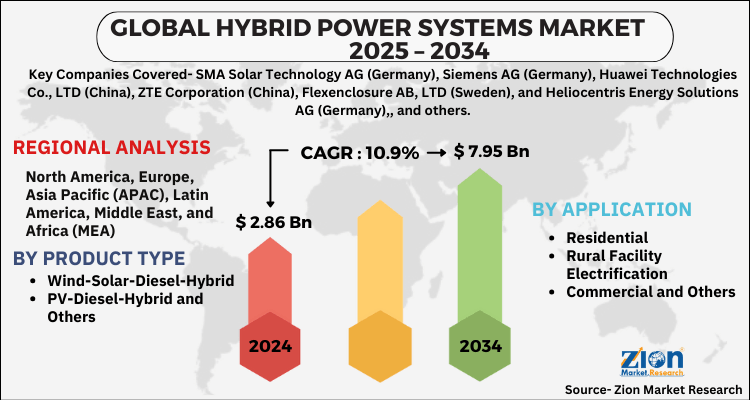

Hybrid Power Systems Market By Product Type (Wind-Solar-Diesel-Hybrid, PV-Diesel-Hybrid and Others), By Application (Residential, Rural Facility Electrification, Commercial and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

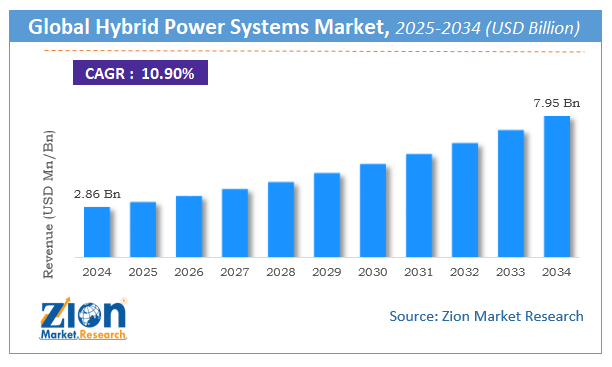

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.86 Billion | USD 7.95 Billion | 10.9% | 2024 |

Hybrid Power Systems Market Size

The global hybrid power systems market size was worth around USD 2.86 Billion in 2024 and is predicted to grow to around USD 7.95 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 10.9% between 2025 and 2034.

The report analyzes the global hybrid power systems market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the hybrid power systems industry.

Hybrid Power Systems Market: Overview

Hybrid power systems are developed and designed for the use and generation of electrical power. These systems are large and consist of centralized electricity grid including more than one type of power source. Hybrid power systems are ranging from large island power grids to individual household power supplies. One of the emerging technologies for supplying electric power in remote areas is hybrid power systems that deliver the alternating current of fixed frequency. Hybrid power systems minimize power loss by transforming the AC power to a higher voltage in transferring the power over long distance. A hybrid power system may also consist of additional renewable power sources such as photovoltaic panels, wind turbines, and storage.

The primary driving factor of hybrid power systems market is the ability of these systems to reduce the cost of power generation by cutting the diesel fuel consumption. A hybrid power system is designed to reduce the power generation cost by using natural resources such as river water flow. For example, a hydroelectric plant and the battery system generate power with the help of flowing river water. Increasing adoption of technologically advanced types of equipment such as electric propulsion system in power generation further anticipates driving the growth of global hybrid power systems market.

Electric propulsion system optimizes the loading of the prime movers for the gas turbine, diesel engine generators so as to reduce fuel consumption and achieve maximum efficiency. Furthermore, hybrid power systems help to reduce carbon emission and this factor has been propelling the growth of hybrid power systems market. Controlling carbon emission is one of the top priorities of many power generation companies and growing social responsibility and climate change have led numerous companies to adopt energy efficient technologies to produce energy. However, high installation cost and investments may hinder the growth of global hybrid power systems market.

Key Insights

- As per the analysis shared by our research analyst, the global hybrid power systems market is estimated to grow annually at a CAGR of around 10.9% over the forecast period (2025-2034).

- Regarding revenue, the global hybrid power systems market size was valued at around USD 2.86 Billion in 2024 and is projected to reach USD 7.95 Billion by 2034.

- The hybrid power systems market is projected to grow at a significant rate due to growing focus on reducing carbon emissions, increasing demand for reliable and sustainable energy solutions, rising adoption of renewable energy sources, and advancements in battery storage and microgrid technologies.

- Based on Product Type, the Wind-Solar-Diesel-Hybrid segment is expected to lead the global market.

- On the basis of Application, the Residential segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Hybrid Power Systems Market: Growth Drivers

The capacity of hybrid power systems to reduce pollution and carbon emissions is a major market driver. Another market driver is reducing the amount of fuel consumed in the power generation industry. A major driving force is the trend toward enhanced sustainable energy sources. China and the United States, for example, are in the forefront of sustainable renewable energy resource usage. Leading developed countries to accept alternative energy sources such as wind, sun, and hybrid power solutions in various circumstances.

Hybrid Power Systems Market: Restraints

Many market difficulties stand in the way of market expansion. Some of the key issues include high component prices and a disparity in the adoption of Hybrid Power Solutions. While affluent countries such as China and the United States have moved to this system in recent years, many developing and underdeveloped countries continue to rely on large-scale Hybrid Power Solutions. In the future, parity will be achieved by resolving the high pricing of hybrid power solution components.

Hybrid Power Systems Market: Opportunities

While the system is well-known in metropolitan regions, Market Trends indicate that hybrid power solutions will be expanded to rural areas. The necessity for hybrid power solutions is becoming more urgent in remote locations as they demand continuous electrical power delivery. This requirement can be utilized to broaden the Market's reach into new areas. Another option is to switch to cleaner fuels and more environmentally friendly engines for autos. The Market's revenue channels can expand as more popular automotive manufacturers migrate to hybrid engines.

Hybrid Power Systems Market: Challenges

The high price of the Hybrid Power Solutions components that go into creating the entire solutions is the key limitation that the Market faces. The high cost of the components reduces the system's affordability. As a result, hybrid power solutions are more accessible to smaller businesses and individuals. The Market Growth prospects are harmed by this limitation.

Hybrid Power Systems Market: Segmentation Analysis

The global Hybrid Power Systems market is segregated based on Product Type and Application.

By product type, the market is classified into Wind-Solar-Diesel-Hybrid, PV-Diesel-Hybrid and Others. This category had a significant share in 2021 and is expected to maintain its dominance throughout the forecast period. Due to increased awareness and installation of solar power systems around the world, particularly in developing nations, the wind-solar-diesel-hybrid segment is expected to be the largest market.

By application, the market is divided into Residential, Rural Facility Electrification, Commercial and Others. This category had a significant share in 2021 and is expected to maintain its dominance throughout the forecast period. Due to the growing number of small-to-medium scale industries in off-grid areas, the commercial market is the largest end-user of hybrid power solutions.

Hybrid Power Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Hybrid Power Systems Market |

| Market Size in 2024 | USD 2.86 Billion |

| Market Forecast in 2034 | USD 7.95 Billion |

| Growth Rate | CAGR of 10.9% |

| Number of Pages | 188 |

| Key Companies Covered | SMA Solar Technology AG (Germany), Siemens AG (Germany), Huawei Technologies Co., LTD (China), ZTE Corporation (China), Flexenclosure AB, LTD (Sweden), and Heliocentris Energy Solutions AG (Germany),, and others. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- The Hybrid Power Solutions Industry's primary stakeholders are involved in research and development as well as new product releases. Because the hybrid power industry is still expanding, there is a lot of room for small-scale, economical, and diverse product lines. Furthermore, the main players are going through their own struggles.

Hybrid Power Systems Market: Regional Analysis

The telecom industry in the United States has grown significantly in recent years. In the United States, the introduction of 5G has enhanced the telecoms industry's growth. As a result, North America's hybrid power system market is expected to grow at a healthy rate. Asia Pacific is the global market leader in hybrid power systems. Rising technology advancements and a focus on incorporating renewable energy output into the electricity mix are two major hybrid power solutions market trends. Furthermore, the availability of cost-effective, powerful technologies is a major driver of the hybrid power solutions market.

Hybrid power solutions market size is substantiated by increased government laws to lower car emissions, as well as the proliferation of hybrid automobiles. Furthermore, growing R&D efforts to develop new products and improve the performance of existing product lines boosts the market share of hybrid power solutions in the region.

Hybrid Power Systems Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the hybrid power systems market on a global and regional basis.

The global hybrid power systems market is dominated by players like:

- SMA Solar Technology AG (Germany)

- Siemens AG (Germany)

- Huawei Technologies Co.

- LTD (China)

- ZTE Corporation (China)

- Flexenclosure AB

- LTD (Sweden)

- and Heliocentris Energy Solutions AG (Germany)

The global hybrid power systems market is segmented as follows;

By Product Type

- Wind-Solar-Diesel-Hybrid

- PV-Diesel-Hybrid and Others

By Application

- Residential

- Rural Facility Electrification

- Commercial and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global hybrid power systems market is expected to grow due to increasing demand for reliable and sustainable power solutions, the integration of renewable energy sources, and the need for efficient energy storage in both on-grid and off-grid applications.

According to a study, the global hybrid power systems market size was worth around USD 2.86 Billion in 2024 and is expected to reach USD 7.95 Billion by 2034.

The global hybrid power systems market is expected to grow at a CAGR of 10.9% during the forecast period.

North America is expected to dominate the hybrid power systems market over the forecast period.

Leading players in the global hybrid power systems market include SMA Solar Technology AG (Germany), Siemens AG (Germany), Huawei Technologies Co., LTD (China), ZTE Corporation (China), Flexenclosure AB, LTD (Sweden), and Heliocentris Energy Solutions AG (Germany),, among others.

The report explores crucial aspects of the hybrid power systems market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed