Global Fintech-as-a-Service Platform Market Size, Share, Growth Analysis Report - Forecast 2034

Fintech-as-a-Service Platform Market By Technology (Artificial Intelligence, Blockchain), By Type (Funds Transfer, Payments, Personal Loans, Personal Finance, Others), Application (Compliance & Regulatory, KYC Verification, Fraud Monitoring), End-Use (Investment Banking, Retail Banking, Insurance, Stock Trading Firms, Hedge Funds, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 379.62 Billion | USD 2095.51 Billion | 18.63% | 2024 |

Fintech-as-a-Service Platform Market: Industry Perspective

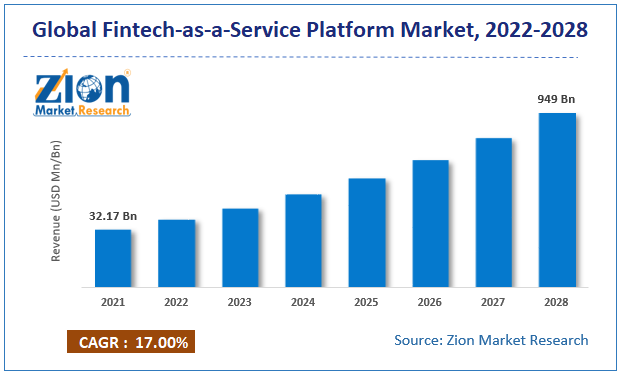

The global fintech-as-a-service platform market size was worth around USD 379.62 Billion in 2024 and is predicted to grow to around USD 2095.51 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 18.63% between 2025 and 2034.

The report analyzes the global fintech-as-a-service platform market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the fintech-as-a-service platform industry.

Fintech-as-a-Service Platform Market: Overview

Fintech refers to Financial technology and is the technology-driven segment of finance-related industries. It uses applications and software to enhance customer experience by automating processes that are related to financial transactions which result in easier operations for the end-user. Fintech is more widely used than we realize as it has been able to change the way financial transactions are dealt with. Fintech-as-a-service means providing financial technology as a service and the end goal is always to relieve customer problems as quickly and efficiently as possible. For example, Akurateco, a white-label payment gateway, offers a “Cashier platform” allowing merchants from various businesses to access multiple payment solutions with the aid of just one integration.

The benefits of fintech-as-a-service platforms are multifold. These platforms do not require maintenance fees. Since this is a service platform, a user does not necessarily have to pay for these services. It's the responsibility of the vendor to provide smooth processing. The services have been proven to reduce processing costs by at least 50% because users can route transactions via multiple payment service providers, and the users receive the benefit of choosing the lowest rates from a stack of providers. With the growing need for data and transactional security, many fintech-as-a-service platforms offer excellent prevention against fraud and chargeback. This is one of the major features of these services that are constantly attracting consumers and resulting in a higher user database in such a short period.

Key Insights

- As per the analysis shared by our research analyst, the global fintech-as-a-service platform market is estimated to grow annually at a CAGR of around 18.63% over the forecast period (2025-2034).

- Regarding revenue, the global fintech-as-a-service platform market size was valued at around USD 379.62 Billion in 2024 and is projected to reach USD 2095.51 Billion by 2034.

- The fintech-as-a-service platform market is projected to grow at a significant rate due to digital transformation in financial services, demand for scalable and flexible solutions, rising fintech startups, and enhanced customer experiences.

- Based on Technology, the Artificial Intelligence segment is expected to lead the global market.

- On the basis of Type, the Funds Transfer segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Compliance & Regulatory segment is projected to swipe the largest market share.

- By End-Use, the Investment Banking segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Fintech-as-a-Service Platform Market: Growth Drivers

Rising investments in the banking sector for better customer experience to propel market growth

The global fintech-as-a-service platform market size is expected to grow owing to the rising investments in the banking & finance sector to upgrade and enhance customer experience. In today’s digital world, almost all sectors have undergone intense technological advancements by leveraging the benefits offered by technology in easing operations while also providing excellent business output results. Banks and other financial institutions have been in existence for decades but their technological revolution is a recent event owing to higher customer demand for user-oriented service approaches. The shift of consumer preference towards digital technology is anticipated to aid global market growth. More and more financial service providers are undertaking serious and strategic approaches towards delivering as per customer demands, as a result, the global market is witnessing a rise in various partnerships amongst banks and Information technology (IT) service providers. This is also coupled with the need to provide excellent financial services even to the remotest places that were left untouched until a few years ago.

In 2020, the Indian banking sector spent over USD 11 billion on incorporating technology which is a 9.1% increase from the investments in 2019. Such a positive approach coupled with the rising number of fintech-as-a-service platform providers is anticipated to become a major global market growth driver.

Fintech-as-a-Service Platform Market: Restraints

Credibility issues along with regulation compliance to restrict market expansion

Since fintech-as-a-service platforms deal with huge sums of money, there is a tendency of general lack of trust amongst end-consumers towards the complete adoption of FaaS systems. The prevalent skepticism is expected to restrict the global market growth.

FaaS systems cater to financial entities and deal with monetary transactions. To gain higher credibility, they have to strictly follow the various regulations that are in place for finance or related institutes. These rules differ from one country to another as the government’s compliance rules. The problem rises in international transactions or when domestic companies try to expand into foreign countries. Such restricted growth is projected to withhold the global market from attaining its full potential.

Fintech-as-a-Service Platform Market: Opportunities

FaaS providers creating customized services to provide growth opportunities during the forecast period.

Due to the rising digitalization, consumer demands have shifted from conventional needs to modern ones. A such drastic change in consumer needs has encouraged fintech-as-a-service platform providers to deliver customized solutions to their clients. This trend is expected to provide ample and lucrative growth opportunities in the global market as consumer demands are ever-evolving which is also propelled by the constant innovations undertaken by financial institutes to stay ahead in the competition.

The increase in cross-border payments may also encourage the adoption of FaaS platforms. As per estimates, more than 40% of large enterprises use fintech-as-a-service platforms for real-time payments which is an indication of higher acceptance of these services.

Fintech-as-a-Service Platform Market: Challenges

Data privacy and security issues to challenge market cap

Since fintech initiatives, as well as FaaS platforms, deal with sensitive data related to money and user information, they are highly prone to security attacks. Since traditional banks were more physical, data privacy was not much of an issue, however, with all types of data being transferred to online systems, the security risk is higher. The fintech-as-a-service platform has to make sure that they use top-notch security systems to safeguard its clients' details. In case, platforms are unable to do so, a data breach may have huge negative implications which may result in large customers losing their trust in these services.

Fintech-as-a-Service Platform Market: Segmentation

The global fintech-as-a-service platform market is segmented based on technology, end-use, type, application, and region.

Based on technology, artificial intelligence and blockchain are the two main global market segments. Blockchain is more widely used by maximum players. Over 28% of the global market was dominated by blockchain technology in 2021 owing to its higher use by large-scale enterprises. Benefits associated with blockchain are expected to drive segmental growth during the forecast period.

Based on end-use, the global market segments are investment banking, retail banking, insurance, stock trading firms, hedge funds, and others. Insurance generated over 30% of the global market revenue in 2021 because of high applications for insurance companies to handle claim processing and risk assessment.

Based on type, the global market is divided into funds transfer, payments, personal loans, personal finance, and others. Payments held around 40.20 % of the global market revenue in 202 aided by the integration of AI technology and mobile-based payment methods instead of traditional banking.

Based on application, the global market segments are compliance & regulatory, KYC verification, and fraud monitoring. In 2021, compliance and regulatory support generated 31.9% of global market revenue which was propelled by the rise in online customer support provided by financial institutions to upgrade customer service and streamline their operations.

Fintech-as-a-Service Platform Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fintech-as-a-Service Platform Market |

| Market Size in 2024 | USD 379.62 Billion |

| Market Forecast in 2034 | USD 2095.51 Billion |

| Growth Rate | CAGR of 18.63% |

| Number of Pages | 214 |

| Key Companies Covered | Stripe, Adyen, PayPal, Square (Block), Plaid, Marqeta, Rapyd, Finastra, FIS, Fiserv, Temenos, Mambu, Solarisbank, Thought Machine, Synapse, and others. |

| Segments Covered | By Technology, By Type, By Application, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments:

- In April 2022, United States Agency for International Development (USAID) launched a digital investment program, to mobilize private capital to aid digital finance along with internet service providers in developing economies. This program aims to promote competition coupled with advancement in the use of secure network equipment while also reducing the gender digital divide with the help of inclusive, safe, and affordable digital services.

- In July 2021, Rapyd Financial Network Ltd. announced that it will acquire Iceland-based payment solution provider Valitor from Arion Bank. The transaction cost Rapyd industries USD 100 million. The acquisition is expected to empower customers from different industries to integrate omnichannel payments with complete streamlining. It will also assist the consumers to expand in new markets, and unlock revenue & growth potential while also flattening FX fees.

Fintech-as-a-Service Platform Market: Regional Analysis

North America to dominate market revenue in the coming years

The global fintech-as-a-service platform market was dominated by North America in 2021 with over 35.6% of the global market share and is anticipated to follow the same trend during the projection period. The rising trend of higher demand for digital financial services is anticipated to aid regional growth. As per a poll conducted by Mastercard, over 51% of USA citizens use contactless payment methods. The regional market growth may also be attributed to the presence of a higher number of service providers and increased investments in the financial sector.

Asia-Pacific is projected to register a high CAGR mostly driven by the increased adoption rate of fintech-as-a-service platforms in regions like India, Japan, China, and Singapore. The growth rate may be as high as 18% by 2028. The regions have witnessed a high rise in fintech companies which are backed by government policies and the higher rate of returns in these regions. In the 1st QN of 2022, the region registered investment of over USD 3.4 billion in fintech-related startups.

Fintech-as-a-Service Platform Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the fintech-as-a-service platform market on a global and regional basis.

The global fintech-as-a-service platform market is dominated by players like:

- Stripe

- Adyen

- PayPal

- Square (Block)

- Plaid

- Marqeta

- Rapyd

- Finastra

- FIS

- Fiserv

- Temenos

- Mambu

- Solarisbank

- Thought Machine

- Synapse

The global fintech-as-a-service platform market is segmented as follows;

By Technology

- Artificial Intelligence

- Blockchain

By Type

- Funds Transfer

- Payments

- Personal Loans

- Personal Finance

- Others

By Application

- Compliance & Regulatory

- KYC Verification

- Fraud Monitoring

By End-Use

- Investment Banking

- Retail Banking

- Insurance

- Stock Trading Firms

- Hedge Funds

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global fintech-as-a-service platform market is expected to grow due to increasing digital banking adoption, demand for scalable financial infrastructure, and regulatory support for open banking.

According to a study, the global fintech-as-a-service platform market size was worth around USD 379.62 Billion in 2024 and is expected to reach USD 2095.51 Billion by 2034.

The global fintech-as-a-service platform market is expected to grow at a CAGR of 18.63% during the forecast period.

North America is expected to dominate the fintech-as-a-service platform market over the forecast period.

Leading players in the global fintech-as-a-service platform market include Stripe, Adyen, PayPal, Square (Block), Plaid, Marqeta, Rapyd, Finastra, FIS, Fiserv, Temenos, Mambu, Solarisbank, Thought Machine, Synapse, among others.

The report explores crucial aspects of the fintech-as-a-service platform market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed