Blockchain In Security Market, Size, Share, Growth, Trends, and Forecast 2032

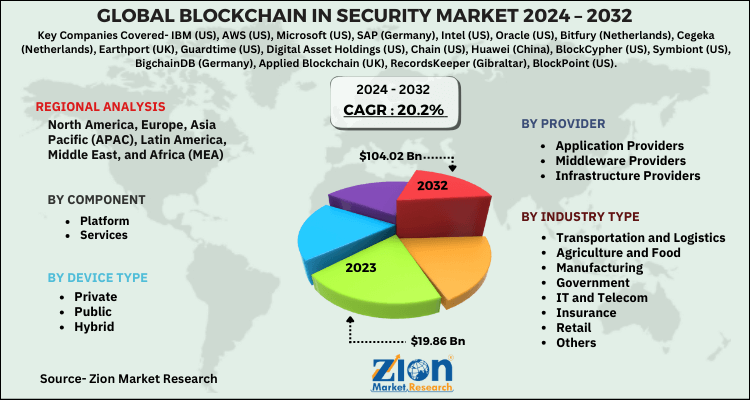

Blockchain In Security Market By Component (Platform and Services), By Device Type (Private, Public and Hybrid), By Providers (Application, Middleware, Infrastructure) and by Industry Type (Government, insurance, entertainment, automotive, retail, healthcare, education, manufacturing): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

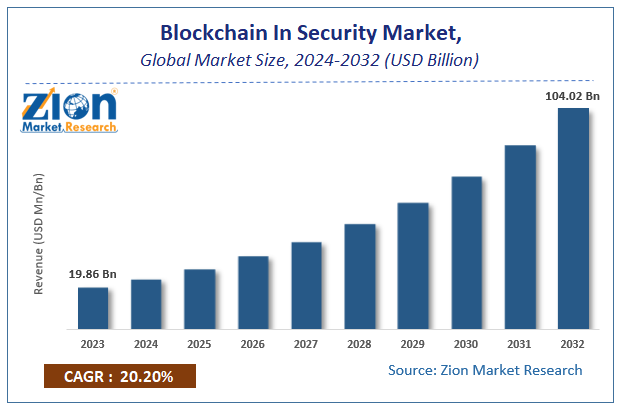

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 19.86 Billion | USD 104.02 Billion | 20.2% | 2023 |

Blockchain In Security Market Insights

According to Zion Market Research, the global Blockchain In Security Market was worth USD 19.86 Billion in 2023. The market is forecast to reach USD 104.02 Billion by 2032, growing at a compound annual growth rate (CAGR) of 20.2% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Blockchain In Security Market industry over the next decade.

Blockchain In Security Market: Overview

Blockchain in Security is a form of digital asset based on a network that is distributed across a large number of computers. This decentralized structure allows them to exist outside the control of governments and central authorities. Enhanced Experience, Security, Transparency, anonymity and fraud resistance are the major drivers of Blockchain. The implementation of VR helps reducing infrastructure costs as well as enhances transparency.

COVID-19 Impact Analysis

The outbreak of COVID-19 positively impacted the global virtual reality market. Lockdown significantly increased the demand for Blockchain. Nowadays, conferences, gatherings, exhibitions, virtual meets are driving the growth for Blockchain in security market. Furthermore, the pandemic is expected to grow the demand for its components and likely to stream the growth of Blockchain in security market.

Blockchain In Security Market: Growth Factors

It is due to the need for streamlining the business processes cost-effectively. The adoption of the Blockchain technology is currently in the experimentation phase in most of the segments however, the adoption rate is expected to increase significantly in the coming years, owing to the low infrastructure costs and transparency.

The Blockchain in Security Market is experiencing significant growth due to several key factors. The increasing frequency and sophistication of cyber threats have driven organizations to adopt advanced security technologies, with blockchain offering a decentralized and immutable approach to safeguarding data. The demand for enhanced transparency and traceability in supply chains and financial transactions is also fueling the adoption of blockchain-based security solutions. Furthermore, regulatory requirements for secure and tamper-proof systems in industries such as finance, healthcare, and government are propelling market expansion. Advances in blockchain interoperability and the integration of AI and IoT further boost its applicability in security frameworks, creating new opportunities for market growth.

Blockchain In Security Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Blockchain In Security Market |

| Market Size in 2023 | USD 19.86 Billion |

| Market Forecast in 2032 | USD 104.02 Billion |

| Growth Rate | CAGR of 20.2% |

| Number of Pages | 140 |

| Key Companies Covered | IBM (US), AWS (US), Microsoft (US), SAP (Germany), Intel (US), Oracle (US), Bitfury (Netherlands), Cegeka (Netherlands), Earthport (UK), Guardtime (US), Digital Asset Holdings (US), Chain (US), Huawei (China), BlockCypher (US), Symbiont (US), BigchainDB (Germany), Applied Blockchain (UK), RecordsKeeper (Gibraltar), BlockPoint (US), Auxesis Group (India), BTL Group (Canada), Blockchain Foundry (UK), AlphaPoint (US), NTT Data (Japan), Infosys (India), iXLedger (UK), and Stratis (UK) among others |

| Segments Covered | By Component, By Device, By Provider, By Industry And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

To know more about this report, request a sample copy.

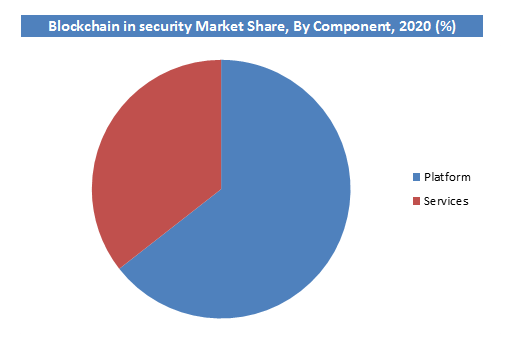

Component Segment Analysis Preview

Service segment functions like a sort of web host, running the back-end operation for a block-chain based app or platform. It acts as the catalyst that leads to the widespread adoption of Blockchain technology. Platform on the other hand provides a collaborative framework for sharing reliable data.

Device Type Segment Analysis Preview

Private Blockchain type is estimated to hold the largest market size in 2023. A private Blockchain is a shared database or ledger that is secured by traditional security techniques, such as limited user rights. A private Blockchain provides more opportunities to businesses in terms of leveraging the Blockchain technology for business-to-business use cases. Public and hybrid form this segment.

Industry Segment Analysis Preview

The banking and financial services application area is expected to hold the largest market size in the Blockchain market during the forecast period. The banking and financial services application area has realized the significance of the Blockchain technology which helps secure transactions for customers. The Blockchain technology in the banking and financial services is expected to experience rapid growth worldwide, due to various factors, such as high compatibility with the financial services industry ecosystem, rising Cryptocurrency and Initial Coin Offerings (ICOs), rapid transactions, and reduced total cost of Ownership

Regional Analysis Preview

North America accounted for a share of 35% in 2020. The rising growth of healthcare and educational sectors are the key drivers. Consumer application sector is also estimated to grow fast in the region. Government in the region is also heavily investing in VR technology to boost the market.

North America is projected to hold the largest market size in the Blockchain market. Early adoption of Blockchain technologies by the organizations in the region and the emergence of several Blockchain technology providers will contribute to the overall share of the market. Businesses in UK and India have recognized the potential of the Blockchain technology in delivering enhanced customer experiences; hence, they have started adopting the technology to develop business applications.

Key Market Players & Competitive Landscape

Some of key players in virtual reality market are

- IBM (US)

- AWS (US)

- Microsoft (US)

- SAP (Germany)

- Intel (US)

- Oracle (US)

- Bitfury (Netherlands)

- Cegeka (Netherlands)

- Earthport (UK)

- Guardtime (US)

- Digital Asset Holdings (US)

- Chain (US)

- Huawei (China)

- BlockCypher (US)

- Symbiont (US)

- BigchainDB (Germany)

- Applied Blockchain (UK)

- RecordsKeeper (Gibraltar)

- BlockPoint (US)

- Auxesis Group (India)

- BTL Group (Canada)

- Blockchain Foundry (UK)

- AlphaPoint (US)

- NTT Data (Japan)

- Infosys (India)

- iXLedger (UK)

- Stratis (UK)

- among others.

Companies are focusing on developing new products and developing strategic partnerships to enhance their market share. For instance, in February 2020, Microsoft integrated Lition Blockchain into Azure so that Microsoft Azure’s worldwide enterprise clients can develop, test, and deploy Lition side chains and applications with ease on its platform.

The Blockchain-in-security market is segmented as follows:

By Component

- Platform

- Services

By Device Type

- Private

- Public

- Hybrid

By Provider

- Application Providers

- Middleware Providers

- Infrastructure Providers

By Industry Type

- Transportation and Logistics

- Agriculture and Food

- Manufacturing

- Government

- IT and Telecom

- Insurance

- Retail

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Blockchain in security market was valued at USD 19.86 Billion in 2023.

The Blockchain in security market is expected to reach USD 104.02 Billion by 2032, growing at a CAGR of 20.2% between 2024 to 2032.

Some of the key factors driving the Blockchain in security market growth are enhanced experience., Security, Transparency, anonymity and fraud resistance are the major drivers of Blockchain.

North America region held a substantial share of the Blockchain in security market in 2023.Government in the region is heavily investing in the technology. Asia Pacific region is projected to grow at a significant rate owing to the rising demand for virtual reality in developing economies such as UK and India.

Some of key players in Blockchain in security market are IBM (US) AWS (US) Microsoft (US) SAP (Germany) Intel (US) Oracle (US) Bitfury (Netherlands) Cegeka (Netherlands) Earthport (UK) Guardtime (US) Digital Asset Holdings (US) Chain (US) Huawei (China) BlockCypher (US) Symbiont (US) BigchainDB (Germany) Applied Blockchain (UK) RecordsKeeper (Gibraltar) BlockPoint (US) Auxesis Group (India) BTL Group (Canada) Blockchain Foundry (UK) AlphaPoint (US) NTT Data (Japan) Infosys (India) iXLedger (UK) and Stratis (UK) among others.

List of Contents

Market InsightsMarket:OverviewCOVID-19 Impact AnalysisGrowth FactorsReport ScopeComponent Segment Analysis PreviewDevice Type Segment Analysis PreviewIndustry Segment Analysis PreviewRegional Analysis PreviewKey Market Players Competitive LandscapeThe Blockchain-in-securitymarket is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed