Global Fintech-as-a-Service Platform Market Size to Surpass USD 2095.51 Billion at a CAGR of 18.63% Growth By 2034

03-Jun-2025 | Zion Market Research

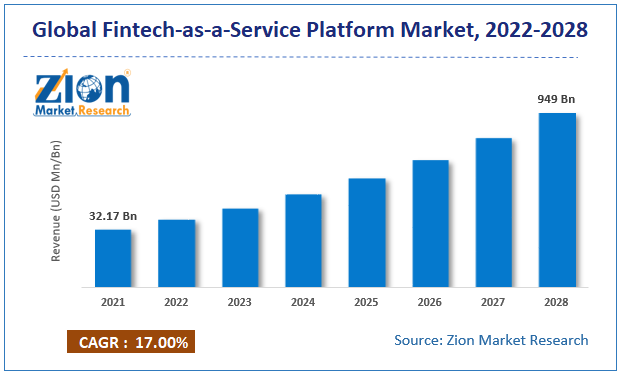

According to the report, the global fintech-as-a-service platform market size was valued at approximately USD 379.62 Billion in 2024 and is predicted to reach around USD 2095.51 Billion by the end of 2034, expanding at a CAGR of around 18.63% from 2025 to 2034.

The fintech-as-a-service platform allows a company to utilize a fintech application programming interface (APIs) to embed various financial capabilities into the company’s already existing products, applications, and other services. FaaS platforms enable white-labeled payment acceptance, card issuing, e-wallet platforms, identity verification, payouts & remittances, merchant services, virtual accounts, fraud detection, and other customer-oriented services. With the aid of a fintech-as-a-service platform, organizations load to develop infrastructure, licensing & compliance, integration of disparate financial systems, and other related activities are undertaken by a third party thus improving the company’s operational efficiency. FaaS platforms have managed to change the traditional banking methods and have propelled them towards a more future-oriented approach.

A lot of fintech players are now offering their APIs to other key players in the global market which has resulted in higher growth in the field of fintech-as-a-service platforms. Leveraging from the benefits offered by these systems has proven to aid companies to enhance their end-to-end processes and systems. Since FaaS platforms allow complete management and delivery of final results, the global market has managed to leave a long-lasting impact on the international finance industry. Many leading research papers have emphasized the importance of adopting FaaS platforms, especially for financial institutions.

The advanced technology is capable of automating the entire lending process where minimum human intervention is needed to complete the protocol. The systems also allow streamlining of the documentation process which is an integral part of safe financial transitions. These are processes that take a long time but are important at the same time. By making use of technology to automate these processes, leaving no room for error, organizations will be capable of reducing the turnaround time for the entire procedure and staying in the competition.

Covid-19 left a positive impact on the global market cap. This was propelled by the regulations laid down by governments to maintain social distancing. Since the majority of the banks or financial institutions were physically closed for operations, there was a rise in demand for digitizing almost all segments of the banking and financial institutions. The higher FaaS adoption rate was witnessed in 2020 and 2021 because of stringent regulations restricting the transportation and movement of people.

Market Growth Factors

The global fintech-as-a-service platform market is expected to grow owing to the rising number of users utilizing mobile applications for financial transactions. The increase is aided by the rise in the number of smartphone manufacturers offering intelligent phones at reasonable prices which in turn has aided the global market penetration by increasing customer reach even at remotest locations. According to Emizentech statistics, more than 44% of the global transactions were carried out through mobile applications. Tipalti Inc. stated that more than 64.2% of the consumers in the finance sector use some form of fintech-as-a-service platform. Looking at the high potential of the global market, more FaaS platform providers can be witnessed entering the market. As of 2022, India has more than 6,600 FaaS-related startups and the number is predicted to grow further in the coming years. In November 2021, the USA had over 10,755 fintech unicorns as per reports published by Statista.

The credibility issues along with regulation compliance may restrict global market expansion. The FaaS providers creating customized services are expected to provide global market growth opportunities during the forecast period. The data privacy and security issues are anticipated to challenge global market cap growth

Market Segmentation

The global fintech-as-a-service platform market is segmented based on end-use, technology, application, type, and region.

Based on end-use, the global market segments are investment banking, retail banking, insurance, stock trading firms, hedge funds, and others. Insurance generated over 30% of the global market revenue in 2021 because of high applications for insurance companies to handle claim processing and risk assessment.

Based on technology, artificial intelligence and blockchain are the two main global market segments. Blockchain is more widely used by maximum players. Over 28% of the global market was dominated by blockchain technology in 2021 owing to its higher use by large-scale enterprises. Benefits associated with blockchain are expected to drive segmental growth during the forecast period.

Based on application, the global market segments are compliance & regulatory, KYC verification, and fraud monitoring. In 2021, compliance and regulatory support generated 31.9% of global market revenue which was propelled by the rise in online customer support provided by financial institutions to upgrade customer service and streamline their operations.

Based on type, the global market is divided into funds transfer, payments, personal loans, personal finance, and others. Payments held around 40.20 % of the global market revenue in 202 aided by the integration of AI technology and mobile-based payment methods instead of traditional banking.

North America is projected to dominate the global fintech-as-a-service platform market owing to the presence of multiple players in this region. In the USA, 9 out of every 10 citizens use FaaS platforms for their financial transactions. The percentage of consumers in the USA grew by 88% in 2021 as compared to 58% in 2020, as per Plaid’s survey published in Fortune. The 105 fintech unicorns in this region comprise more than 45% of the global fintech unicorns. Such numbers are indicative of the potential this region holds for global market growth.

Asia-Pacific may also register high revenue majorly driven by India being claimed as the region with the highest adoption rate as of 2021. This is propelled by excellent government initiatives to drive the fintech market in the Indian territory while also assisting them to improve the global hold which is expected to drive regional growth in the coming years.

Key Market Players

The global fintech-as-a-service platform market is dominated by players like

- Mastercard Incorporated

- Rapyd Financial Network

- PayPal Holdings. Inc.

- Solid Financial Technologies. Inc.

- Railsbank Technology Ltd.

- Block. Inc.

- Synctera Inc.

- Upstart Holdings. Inc.

- Envestnet. Inc.

- Braintree

Recent Developments:

- In July 2021, Railsbank technology, an API developer, raised around USD 70 million during a fundraising event held by Anthos Capital, a leading US-based investment firm. With the raised funds, the company aims to dive into the fintech-as-a-service sector and improve customer experience with excellent solutions.

- In July 2022, Finalis, a USA-based investment banking platform enabling private market participants in executing deals with complete compliance, managed to raise USD 10.7 million through seed funding with the help of various venture capital firms namely The Fund, Chaac Ventures, ANIMO Ventures, Ulu Ventures, and Tribe Capital. The raised capital is projected to propel the expansion of Finalis while also helping the development of a deal-making technologically advanced platform.

Browse the full “Global Fintech-as-a-Service Platform Market Segmentation By Technology (Artificial Intelligence, and Blockchain), By End-Use (Investment Banking, Retail Banking, Insurance, Stock Trading Firms, Hedge Funds, and Others), By Type (Fund Transfer, Payments, Personal Loans, Personal Finance, and Others), By Application (Compliance and Regulatory Support, KYC Verification, and Fraud Monitoring) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 – 2034.” Report at https://www.zionmarketresearch.com/report/global-fintech-as-a-service-platform-market

The global fintech-as-a-service platform market is segmented as follows:

By Technology

- Artificial Intelligence

- Blockchain

By End-Use

- Investment Banking

- Retail Banking

- Insurance

- Stock Trading Firms

- Hedge Funds

- Others

By Type

- Fund Transfer

- Payments

- Personal Loans

- Personal Finance

- Others

By Application

- Compliance and Regulatory Support

- KYC Verification

- Fraud Monitoring

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

About Us:

Zion Market Research is an obligated company. We create futuristic, cutting-edge, informative reports ranging from industry reports, the company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client’s needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us—after all—if you do well, a little of the light shines on us.

Contact Us:

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll-Free No.1-855-465-4651

Email: sales@zionmarketresearch.com

Website: https://www.zionmarketresearch.com

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed