Payment Service Provider Market Size, Share, Growth Report 2032

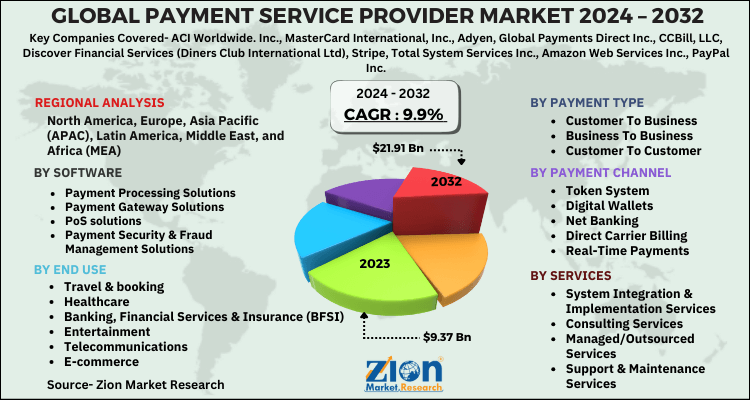

Payment Service Provider Market By Payment Type (Customer to Business, Business to Business, and Customer to Customer), By Payment Channel (Token System, Digital Wallets, Net Banking, Direct Carrier Billing, and Real-time Payments), By Software (Payment Processing Solutions, Payment Gateway Solutions, PoS Solutions, and Payment Security & Fraud Management Solutions), By Services (System Integration & Implementation Services, Consulting Services, Managed/ Outsourced Services, and Support & Maintenance Services), By End Use (Travel & Booking, Healthcare, Banking, Financial Services & Insurance (BFSI), Entertainment, Telecommunications, E-commerce, Retail, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

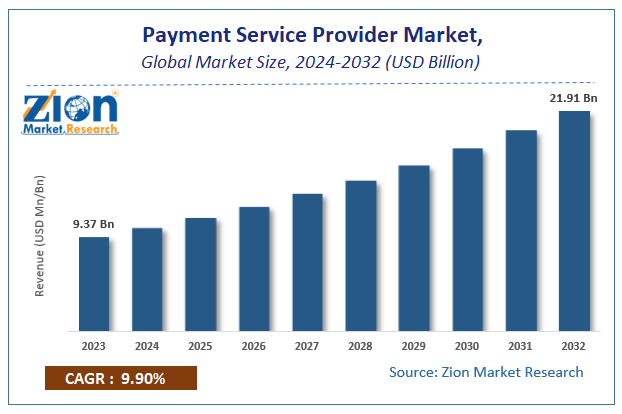

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.37 Billion | USD 21.91 Billion | 9.9% | 2023 |

Payment Service Provider Market Insights

According to Zion Market Research, the global Payment Service Provider Market was worth USD 9.37 Billion in 2023. The market is forecast to reach USD 21.91 Billion by 2032, growing at a compound annual growth rate (CAGR) of 9.9% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Payment Service Provider Market industry over the next decade.

Payment Service Provider Market: Overview

Payment service providers also known as merchant service providers or PSPs – are third parties that help organizations or merchants accept payments. Payment service providers enable businesses to accept credit/debit payments by connecting them to the broader financial world. They provide both a merchant account and a payment gateway, ensuring that businesses efficiently collect and manage their payments.

Payment service providers come along with high security, keeping the data of both the company and the customer safe and secure. The feature of transaction reporting is also available so that every transaction is reconciled efficiently.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly reduced the number of cash transactions globally. This has become a major opportunity as well as a change for the increasing number of online payments. Due to the non-availability of other options, customers adapted to the digital and contactless payment methods, which in turn derived the payment service provider market.

Thus, the pandemic contributed significantly towards the growth of the payment service provider market, and results of which are not expected to be short-term. As the pandemic continues, more and more customers as well as businesses may continue to contribute towards the market.

Payment Service Provider Market: Growth Factors

Several initiatives are being taken by different governments all over the world which may facilitate the growth of the payment service provider market. The increased focus and adoption of digitization in almost every sector is contributing toward growth on a significant level. The security and efficient features of online payment take over the need to stick to the traditional payment methods.

As the pandemic continues, the need for contactless payments may prevail and is also expected to increase. Thus, the growth of the payment service provider market is almost necessary for the world to cope with the pandemic. Also, the rise in online businesses, for instance, the e-commerce sector, is adding to the growth of the market.

Payment Service Provider Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Payment Service Provider Market |

| Market Size in 2023 | USD 9.37 Billion |

| Market Forecast in 2032 | USD 21.91 Billion |

| Growth Rate | CAGR of 9.9% |

| Number of Pages | 210 |

| Key Companies Covered | ACI Worldwide. Inc., MasterCard International, Inc., Adyen, Global Payments Direct Inc., CCBill, LLC, Discover Financial Services (Diners Club International Ltd), Stripe, Total System Services Inc., Amazon Web Services Inc., PayPal Inc |

| Segments Covered | By Payment Type, By Payment Channel, By Software, By Services, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Payment Service Provider Market: Segmentation Analysis

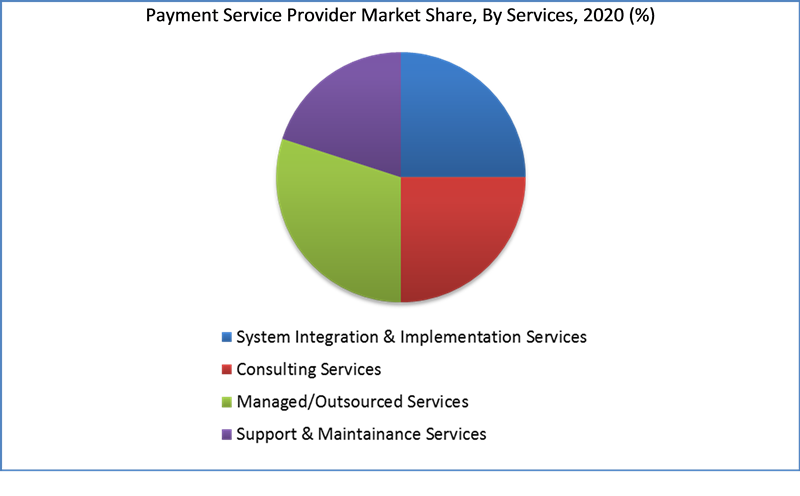

By Services Segment Analysis

The managed services segment is expected to grow over the coming years. Companies want to simultaneously focus on their core businesses and thus actively look forward to serving through managed services. Managed services help in reducing the infrastructure complexity along with the operational costs, thereby providing a safe and secure infrastructure. Companies providing managed services give a complete package of solutions to their customers, thus enabling excellent customer experience management.

By End-Use Segment Analysis

The Public Cloud segment held a share of over 45.4 % in 2023. The retail and e-commerce segment is the largest contributor to the payment service provider market. Both sectors offer customers a platform for payment that is time-efficient and easy to use. Customers are choosing the online payment option as it is safe and secure and, given the pandemic, contactless as well. As more online transactions take place, it will directly contribute to the payment service provider market. Since the pandemic began, the healthcare sector is also contributing to the market significantly as there has been an increase in spending on medicines, and other medical supplies and equipment.

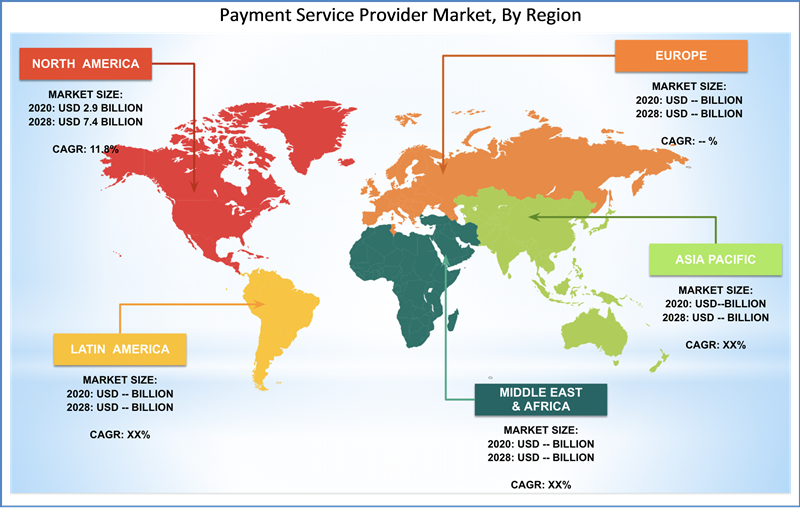

Payment Service Provider Market: Regional Analysis

The North American region is projected to grow at a CAGR of 27.5 % over the forecast period. North America is the biggest contributor to the payment service provider market. The region houses some small and large organizations that have adopted online payments as a primary payment method and are contributing directly toward the growth of the market. The biggest payment service provider players are based in the US and thus the adoption rate of these services is also very high in the region.

The Asia Pacific region is also expected to grow significantly over some time. Asia Pacific is the new hub for technology-driven businesses because of its high population and developing infrastructure. The region also saw a tremendous rise in the adoption of smartphones, both in the older and younger population. All these factors are going to contribute to the growth of the payment service provider market in the region.

Payment Service Provider Market: Competitive Analysis

Some of the key players in the payment service provider market are

- ACI Worldwide. Inc.

- MasterCard International, Inc.

- Adyen

- Global Payments Direct. Inc.

- CCBill, LLC.

- Discover Financial Services (Diners Club International Ltd)

- Stripe

- Total System Services, Inc.

- Amazon Web Services. Inc.

- PayPal. Inc.

These companies adopt various strategies to boost their presence and capitalization. For instance, PayPal has engaged in multiple partnerships and acquisitions to fight off competition from newer and bigger players entering the market. These engagements include partnerships with Mastercard / Visa, high-growth digital companies, such as Uber and Instagram, as well as acquisitions of Venmo and GoPay in China.

The payment service provider market is segmented as follows:

By Payment Type

- Customer To Business

- Business To Business

- Customer To Customer

By Payment Channel

- Token System

- Digital Wallets

- Net Banking

- Direct Carrier Billing

- Real-Time Payments

By Software

- Payment Processing Solutions

- Payment Gateway Solutions

- PoS solutions

- Payment Security & Fraud Management Solutions

By Services

- System Integration & Implementation Services

- Consulting Services

- Managed/Outsourced Services

- Support & Maintenance Services

By End Use

- Travel & booking

- Healthcare

- Banking, Financial Services & Insurance (BFSI)

- Entertainment

- Telecommunications

- E-commerce

- Retail

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global Payment Service Provider market size was worth around USD 9.37 billion in 2023 and is expected to reach USD 21.91 billion by 2032.

The global Payment Service Provider market is expected to grow at a CAGR of 9.9% during the forecast period.

Some of the key factors driving the payment service provider market growth are initiatives which are being taken by different governments all over the world and are facilitating the growth of the payment service provider market. The increased focus on and adoption of the digitization in almost every sector is contributing towards the growth on a significant level.

North America is expected to dominate the Payment Service Provider market over the forecast period.

Some of the major companies operating in the payment service provider market are ACI Worldwide, Inc., MasterCard International, Inc., Adyen, Global Payments Direct, Inc., CCBill, LLC., Discover Financial Services (Diners Club International Ltd), Stripe, Total System Services, Inc., Amazon Web Services, Inc., PayPal, Inc., among others.

Payment Service Providers (PSPs) are companies that enable consumers and organizations to accept and process electronic payments. These payments are often made through credit or debit cards, bank transfers, and other forms of digital payment methods. PSPs provide a variety of services to merchants, including payment processing, fraud prevention, and payment gateway integration. PSPs function as intermediates between the merchant and the payment networks, such as Visa, Mastercard, or PayPal.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed