Functional Flour Market Size, Share, Trends, Growth and Forecast 2034

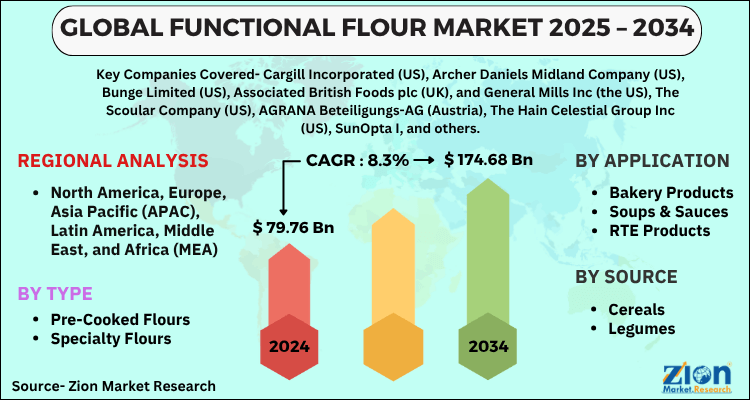

Functional Flour Market By Type (Pre-Cooked Flour, Specialty Flours, and Others (enriched flours, instant flour mixes, and composite flours)). By Application (Bakery Products, Soups & Sauces, RTE Products, and Others (seasoning bases, coatings & breadings, spreads & infant formula, special diet foods, and beverages)). By Source (Cereals and Legumes). and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

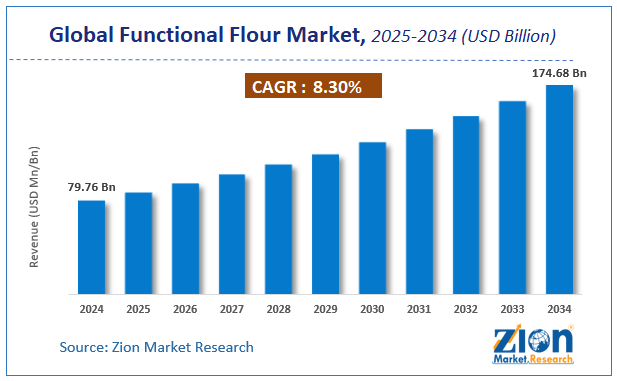

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 79.76 Billion | USD 174.68 Billion | 8.3% | 2024 |

Functional Flour Market: Industry Perspective

The global functional flour market size was worth around USD 79.76 Billion in 2024 and is predicted to grow to around USD 174.68 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.3% between 2025 and 2034. The report analyzes the global functional flour market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the functional flour industry.

Functional Flour Market: Overview

Functional flours are utilized in a wide range of food and beverage items to provide the appropriate organoleptic properties. These flours are heat-treated, protein treated, enzyme-treated, vitamin and mineral treated, or water treated to improve their stability, regularity, and other activities, as well as their nutritional content. The growing demand for functional flours is being driven by the food and beverage manufacturing industries. Functional flours are utilized in a variety of applications, including bakery items, soups and sauces, RTE products, and others.

In addition, rising gluten allergies are driving up demand for non-wheat flour. This is increasing demand for functional flours, which include soy flour, rye flour, and oat flour, among others. Rising consumer spending on ready-to-eat bread items in multigrain varieties is assisting the expansion of the functional flour market. Moreover, the demand for functional flour is predicted to expand due to an increase in the consumption of packaged and processed food products in both developing and established nations. The demand for luxury food products is increasing, which is projected to drive the functional flour market.

Key Insights

- As per the analysis shared by our research analyst, the global functional flour market is estimated to grow annually at a CAGR of around 8.3% over the forecast period (2025-2034).

- Regarding revenue, the global functional flour market size was valued at around USD 79.76 Billion in 2024 and is projected to reach USD 174.68 Billion by 2034.

- The functional flour market is projected to grow at a significant rate due to increasing consumer demand for gluten-free, high-protein, and fiber-enriched flours in the food industry.

- Based on Type, the Pre-Cooked Flour segment is expected to lead the global market.

- On the basis of Application, the Bakery Products segment is growing at a high rate and will continue to dominate the global market.

- Based on the Source, the Cereals segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Functional Flour Market: Driver

A key factor is the increasing usage of functional foods in a variety of industries. The usage of functional flour is increasingly common in many areas. They are utilized in bakeries and other ready-to-eat food shops. The rising need for functional flour in all of these industries will benefit this industry. Furthermore, the changing lifestyle of customers is a critical component driving demand. People's eating habits and lifestyles are improving. A low-carbohydrate diet with numerous advantages is known as functional food. It aids in weight management and overall bodily wellness. These are the aspects that will play a critical function in increasing market demand. Moreover, as people become more aware of the negative effects of gluten on the body, there is a greater need for healthy flour alternatives. The rising demand for functional flours will have a beneficial effect on the market. This market's overall profitability and supply will improve as demand rises. These are the variables that are driving the functional flours market.

Functional Flour Market: Restraints

Stringent market restrictions are a major market restraint. The market for functional flours is the most regulated. To enhance shelf life, the functional flours market employs a variety of chemicals and additions. Policies, however, limit the usage of such compounds. This puts a crimp in the manufacture of certain flours. All of these constraints may have a significant impact on the market's growth. Furthermore, the volatility of raw materials is another issue that may have an impact on the market's growth. Many reasons reduce market demand, including changes in raw material prices.

Functional Flour Market: Opportunities

As disposable income rises, so will market growth potential for high functional flours. Individuals' per capita income in several countries will rise in the future years. This will increase overall spending on the market for functional flours. These elements will result in a market with a high supply rate. Furthermore, increased demand for premium flours will open up new avenues for expansion. Demand for premium functional flours will drive market demand throughout the forecast period. In addition, the increased demand for low-fat alternatives will spur new developments.

Functional Flour Market: Challenges

The absence of infrastructure is a hurdle for the market of functional flours. The market for functional foods is still in its early stages. This market is expanding steadily. However, a lack of infrastructure complicates the manufacturing process. The price of these devices is considerable due to their various intricacies. All of these elements may provide a challenge to the functional flours market. Furthermore, the price can have an impact on the overall demand of the market in emerging countries. Due to its limitations, low expansion rates are common.

Functional Flour Market: Segmentation

The Functional Flour Market is segregated based on Type, Application, and Source.

By Type, the market is classified into Pre-Cooked Flour, Specialty Flours, and Others (enriched flour, instant flour mixes, and composite flours). In the forecast period, the Specialty Functional Flour Segment retained the greatest market share. This expansion is due to the increasing use of specialty flours in the manufacturing of infant food. The outstanding health benefits of specialty flours, together with their high nutritional content, are driving the expansion of the Specialty Functional Flour market.

By Application, the market is classified into Bakery Products, Soups & Sauces, RTE Products, and Others (seasoning bases, coatings & breadings, spreads & infant formula, special diet foods, and beverages). In the forecast period, the Ready-To-Eat Products Segment held the greatest market share. This increase is due to the ease of use and accessibility of ready-to-eat items. Working populations' hectic lifestyles necessitate on-the-go cuisine in order to save time that would otherwise be spent preparing food and beverages at home. As a result, a new class of RTE items has emerged, with different alternatives spanning from breakfast to supper, as well as healthier ones that give whole grain and other nutritional advantages that are in demand.

Functional Flour Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Functional Flour Market |

| Market Size in 2024 | USD 79.76 Billion |

| Market Forecast in 2034 | USD 174.68 Billion |

| Growth Rate | CAGR of 8.3% |

| Number of Pages | 166 |

| Key Companies Covered | Cargill Incorporated (US), Archer Daniels Midland Company (US), Bunge Limited (US), Associated British Foods plc (UK), and General Mills Inc (the US), The Scoular Company (US), AGRANA Beteiligungs-AG (Austria), The Hain Celestial Group Inc (US), SunOpta I, and others. |

| Segments Covered | By Type, By Application, By Source, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In 2021, To address Europe's inadequate dietary fiber intake, Limagrain Ingredients introduced "LifyWheat" flour, which is high in fiber. White wheat flour is said to be ten times more fiber-rich than regular wheat flour and contains resistant starch.

Functional Flour Market: Regional Landscape

North America dominates the industry with high knowledge of product efficiency and a need for luxury items. New trends in functional bars in the United States show that the country's desire for functional food products is expanding. Consumption of nutritive convenience and fortified food is increasing, as is health awareness, leading to increased consumption of healthier diets, boosting the market. Consumers in the country are embracing preventative healthcare measures, such as eating nutritious food, as the country's health care expenditure pattern grows by the day. This aspect is increasing overall sales in the country even further.

In the functional flour market, Europe is predicted to be the second-largest area. This is because consumers are more aware of the components in food products. Consumers in Europe are likely to double-check the ingredient list in food products, creating a need for functional flour products. Moreover, growing knowledge and a shift in eating patterns have resulted in a trend toward eating smaller meals throughout the day. These considerations have boosted the popularity of Functional Flour foods and the substitution of nutritional biscuits, snacks, and energy or protein bars for meals.

Functional Flour Market: Competitive Landscape

Some of the main competitors dominating the Functional Flour Market include -

- Cargill

- Incorporated (US)

- Archer Daniels Midland Company (US)

- Bunge Limited (US)

- Associated British Foods plc (UK)

- and General Mills

- The Scoular Company (US)

- AGRANA Beteiligungs-AG (Austria)

- The Hain Celestial Group

- SunOpta

- Parrish and Heimbecker

- Limited (Canada).

The Functional Flour Market is segmented as follows:

By Type

- Pre-Cooked Flours

- Specialty Flours

- Others (enriched flours, instant flour mixes, and composite flours)

By Application

- Bakery Products

- Soups & Sauces

- RTE Products

- Others (seasoning bases, coatings & breadings, spreads & infant formula, special diet foods, and beverages)

By Source:

- Cereals

- Legumes

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global functional flour market is expected to grow due to increasing demand for gluten-free and high-nutrition flours, rising consumer preference for clean-label and fortified food products.

According to a study, the global functional flour market size was worth around USD 79.76 Billion in 2024 and is expected to reach USD 174.68 Billion by 2034.

The global functional flour market is expected to grow at a CAGR of 8.3% during the forecast period.

Asia-Pacific is expected to dominate the functional flour market over the forecast period.

Leading players in the global functional flour market include Cargill Incorporated (US), Archer Daniels Midland Company (US), Bunge Limited (US), Associated British Foods plc (UK), and General Mills Inc (the US), The Scoular Company (US), AGRANA Beteiligungs-AG (Austria), The Hain Celestial Group Inc (US), SunOpta I, among others.

The report explores crucial aspects of the functional flour market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed