Global Food Hydrocolloids Market Size, Share, Growth Analysis Report - Forecast 2034

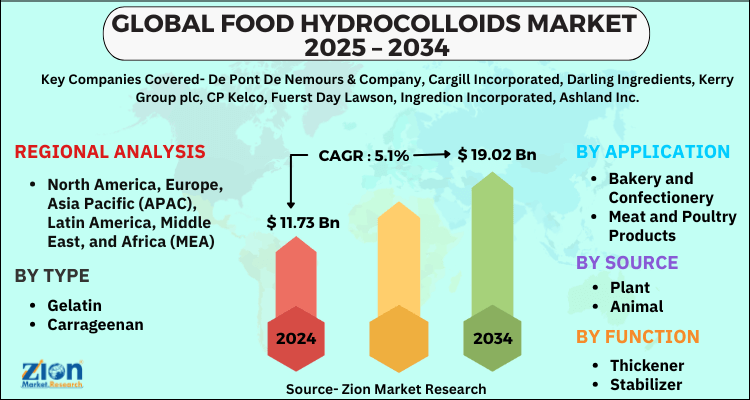

Food Hydrocolloids Market By Type (Gelatin, Carrageenan, Xanthan Gum, Alginates, Agar, Pectin, Gum Arabic, Locust Bean Gum, and Others), By Application (Bakery and Confectionery, Meat and Poultry Products, Beverages, Dairy Products, Sauces and Dressing, and Others)), Source (Plant, Animal, Microbial, Seaweed, and Synthetic), Function (Thickener, Stabilizer, Coating Material, Fat Replacer, and Gelling Agent), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

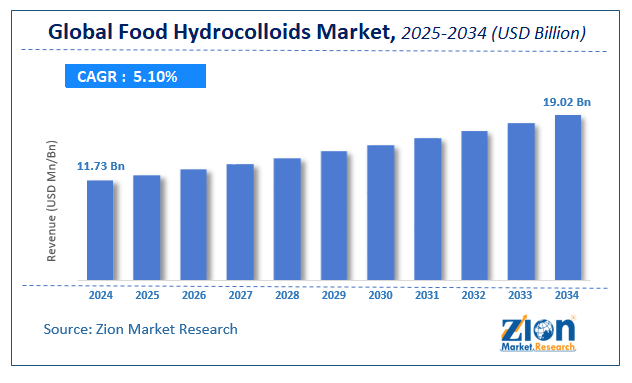

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.73 Billion | USD 19.02 Billion | 5.1% | 2024 |

Food Hydrocolloids Market: Industry Perspective

The global food hydrocolloids market size was worth around USD 11.73 Billion in 2024 and is predicted to grow to around USD 19.02 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.1% between 2025 and 2034. The report analyzes the global food hydrocolloids market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the food hydrocolloids industry.

Food Hydrocolloids Market: Overview

Food hydrocolloids are food additives that are used in food processing to increase the quality and shelf life of the product. The increased customer preference for convenience foods indirectly adds to the rising demand for hydrocolloids, which are used as stabilizers, binding agents, and thickening agents in convenience foods. In addition, due to the customers' hectic lifestyles, the processed food business is driven by a higher need for convenience. As a result, the need for hydrocolloids rises.

The food hydrocolloid market is expected to grow over the forecast period due to an increase in consumer disposable income. Developing nations, particularly those in the Asia Pacific area with an emerging economy, are rising individual per capita income, which will fuel the industry's expansion. Moreover, the diverse applications of hydrocolloids in food, new techniques, or sophisticated phases in food processing have been introduced. Food manufacturers are using novel food processing processes and are looking for new hydrocolloids that can perform the desired functionalities.

Key Insights

- As per the analysis shared by our research analyst, the global food hydrocolloids market is estimated to grow annually at a CAGR of around 5.1% over the forecast period (2025-2034).

- Regarding revenue, the global food hydrocolloids market size was valued at around USD 11.73 Billion in 2024 and is projected to reach USD 19.02 Billion by 2034.

- The food hydrocolloids market is projected to grow at a significant rate due to rising demand for food texture enhancement, stabilization, and clean-label ingredients in processed foods.

- Based on Type, the Gelatin segment is expected to lead the global market.

- On the basis of Application, the Bakery and Confectionery segment is growing at a high rate and will continue to dominate the global market.

- Based on the Source, the Plant segment is projected to swipe the largest market share.

- By Function, the Thickener segment is expected to dominate the global market.

- Based on region, Europe is predicted to dominate the global market during the forecast period.

Food Hydrocolloids Market: Driver

The global food hydrocolloids market is expanding due to increased demand for processed foods. Demand for convenient (processed) foods is being driven by rapid urbanization, rising salaries, and increased employment options for women. The move toward the production of processed foods and distribution through supermarkets and local convenience stores, particularly in metropolitan areas, has altered supply chains. Processed food manufacturers primarily focus on product differentiation in order to compete in the market. Furthermore, food hydrocolloids are utilized to thicken and stabilize compositions in processed foods in technical and regulated applications. This collection of components contributes to the viscosity, texture, and body of processed meals. As a result, rising demand for processed food products will propel the projection period.

Food Hydrocolloids Market: Restraint

Manufacturers in the hydrocolloid market confront obstacles such as changing environmental rules, pricing policies, and infrastructure improvements. In addition, adherence to international quality standards and regulations, as well as harsh conditions caused by the COVID-19 pandemic, are projected to stymie the hydrocolloids market's growth. Moreover, the global market is changing toward sugar-free or low-sugar food products. The bulk of food processing and manufacturing units today use new sweeteners or salts to generate these food products. Pectin is used in food processing to lower sugar, which is considered to replace hydrocolloids at a considerable rate.

Food Hydrocolloids Market: Segmentation

The global food hydrocolloids market is segmented based on Type, Application, Source, Function, and region.

By Type, the market is classified into Gelatin, Carrageenan, Xanthan Gum, Alginates, Agar, Pectin, Gum Arabic, Locust Bean Gum, and Others. During the projection period, the gelatin gum segment will see significant market share growth. The huge increase in processed food demand will fuel the expansion of the gelatin gum segment and, as a result, the market in focus over the forecast years.

By Application, the market is classified into Bakery and Confectionery, Meat and Poultry Products, Beverages, Dairy Products, Sauces and Dressing, and Others. The Bakery and Confectionery Segment is expected to dominate the market in the forecast period. Hydrocolloids are used in bakeries and confectionery to prevent staling and improve food freshness even after freezing. The structural changes in wheat aid in the storage of bread by boosting water retention capacity and preventing ice crystal formation during frozen storage. These products do not interfere with the flavor and aroma of baked and confectionery products, and they have the added benefit of being low in fat.

By Source, the market is classified into Plant, Animal, Microbial, Seaweed, and Synthetic. The animal source sector is projected to emerge as the most widely used source because of the extensive availability of animal by-products as raw materials for manufacturing hydrocolloids. It is made from the skin, bones, and hides of animals such as cows, pigs, and fowl. It is the preferable source of choice since it encourages the full usage of animals grown primarily for meat, resulting in zero waste generation. Nowadays, producers are developing goods that enable full traceability and encourage animal welfare, which aids in the delivery of safe products and provides attractive chances for the industry to grow.

In terms of Function, the global food hydrocolloids market is categorized into Thickener, Stabilizer, Coating Material, Fat Replacer, and Gelling Agent.

Food Hydrocolloids Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Food Hydrocolloids Market |

| Market Size in 2024 | USD 11.73 Billion |

| Market Forecast in 2034 | USD 19.02 Billion |

| Growth Rate | CAGR of 5.1% |

| Number of Pages | 190 |

| Key Companies Covered | De Pont De Nemours & Company, Cargill Incorporated, Darling Ingredients, Kerry Group plc, CP Kelco, Fuerst Day Lawson, Ingredion Incorporated, Ashland Inc., Koninklijke DSM N.V., Rico Carrageenan, Archer Daniels Midland Company, Hispanagar, S.A, CEAMSA, FMC Corporation, Lubrizol Corporation, Jungbunzlauer, B&V SRL, Tate, Lyle PLC, Fiberstar Inc, and others. |

| Segments Covered | By Type, By Application, By Source, By Function, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Food Hydrocolloids Market: Regional Landscape

During the projected period, North America will be the fastest-growing market for hydrocolloids. Given the region’s food habits and eating habits, there is a specific demand for chemicals for oil and fat reduction. It works as a barrier for oil and fat in breaded/fried foods that are widely consumed in the region. Calorie-dense fat and oil can be substituted with what is effectively structured water by employing hydrocolloids. As a result, consumers would like products that are low in oil and fat, which is achievable with the right use of hydrocolloids. The United States is one of the most important markets for hydrocolloids. With the large growth in the number of health-conscious consumers, the country's market for hydrocolloids is likely to expand further.

Asia-Pacific is one of the fastest-growing markets for food hydrocolloids. The region's demand for processed meals and fast foods is expected to rise as a result of increased demand. The product's functional and clean-label perspective has led to its use as a stabilizing and texturizing component, as well as its adoption as an ingredient by numerous food and beverage producers. The expanding demand for clean-label and natural food components such as stabilizers and thickening agents, as well as the growing population, have raised the need for hydrocolloids. Furthermore, hydrocolloid manufacturing bases in Thailand, India, China, and Indonesia help to drive regional prosperity.

Recent Developments

- In 2020, CP Kelco introduced GENU Pectin YM-FP-2100, a clean-label ingredient with a medium-to-high viscosity in fruited drinking yogurt and ease of pumpability during the fruit preparation stage.

Food Hydrocolloids Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the food hydrocolloids market on a global and regional basis.

The global food hydrocolloids market is dominated by players like:

- De Pont De Nemours & Company

- Cargill Incorporated, Darling Ingredients

- Kerry Group plc

- CP Kelco

- Fuerst Day Lawson

- Ingredion Incorporated

- Ashland Inc.

- Koninklijke DSM N.V.

- Rico Carrageenan

- Archer Daniels Midland Company

- Hispanagar

- S.A, CEAMSA

- FMC Corporation

- Lubrizol Corporation

- Jungbunzlauer

- B&V SRL

- Tate, Lyle PLC

- Fiberstar, Inc.

The Food Hydrocolloids Market is segmented as follows:

By Type

- Gelatin

- Carrageenan

- Xanthan Gum

- Alginates

- Agar

- Pectin

- Gum Arabic

- Locust Bean Gum

- Other

By Application

- Bakery and Confectionery

- Meat and Poultry Products

- Beverages

- Dairy Products

- Sauces and Dressing

- Others

By Source

- Plant

- Animal

- Microbial

- Seaweed

- Synthetic

By Function

- Thickener

- Stabilizer

- Coating Material

- Fat Replacer

- Gelling Agent

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Food hydrocolloids are food additives that are used in food processing to increase the quality and shelf life of the product.

The global food hydrocolloids market is expected to grow due to increasing demand for texture modification in food processing, rising consumer preference for natural food stabilizers.

According to a study, the global food hydrocolloids market size was worth around USD 11.73 Billion in 2024 and is expected to reach USD 19.02 Billion by 2034.

The global food hydrocolloids market is expected to grow at a CAGR of 5.1% during the forecast period.

Europe is expected to dominate the food hydrocolloids market over the forecast period.

Leading players in the global food hydrocolloids market include De Pont De Nemours & Company, Cargill Incorporated, Darling Ingredients, Kerry Group plc, CP Kelco, Fuerst Day Lawson, Ingredion Incorporated, Ashland Inc., Koninklijke DSM N.V., Rico Carrageenan, Archer Daniels Midland Company, Hispanagar, S.A, CEAMSA, FMC Corporation, Lubrizol Corporation, Jungbunzlauer, B&V SRL, Tate, Lyle PLC, Fiberstar Inc, among others.

The report explores crucial aspects of the food hydrocolloids market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed