Foam Protective Packaging Market Size, Share, Industry Forecast, 2034

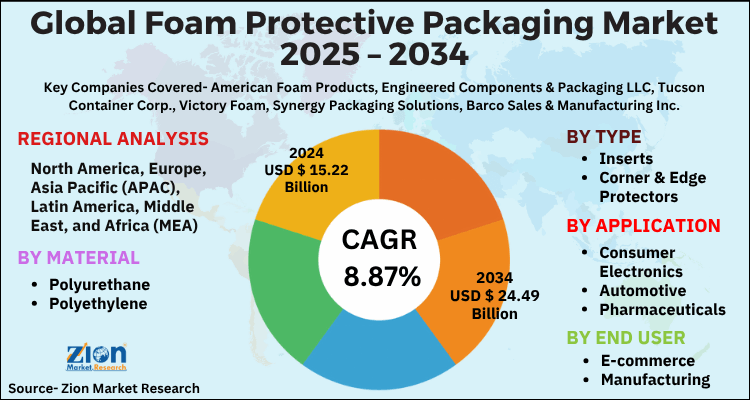

Foam Protective Packaging Market By Material (Polyurethane, Polyethylene, Polystyrene, and Others), By Type (Inserts, Corner & Edge Protectors, Anti-Static Foam, and Others), By Application (Consumer Electronics, Automotive, Pharmaceuticals, Industrial Goods, and Others), By End-user (E-commerce, Manufacturing, Logistics, and Retail), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.22 Billion | USD 24.49 Billion | 4.87% | 2024 |

Foam Protective Packaging Market: Industry Perspective

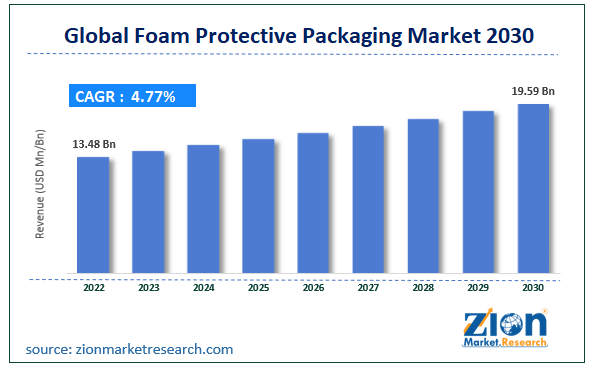

The global foam protective packaging market size was worth around USD 15.22 billion in 2024 and is predicted to grow to around USD 24.49 billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.87% between 2025 and 2034. The report analyzes the global foam protective packaging market's drivers, restraints/challenges, and the effect they have on the demand during the projection period. In addition, the report explores emerging opportunities in the foam protective packaging industry.

Foam Protective Packaging Market: Overview

Foam protective packaging refers to the kind of packaging material that is used to protect fragile or delicate items during storage and transportation. Such packaging is designed to offer shock absorption and cushioning, thereby protecting the items from vibrations and other such external forces. Such a kind of packaging is widely used in the consumer goods, aerospace, automotive, pharmaceutical, and electronics industries.

Key Insights

- As per the analysis shared by our research analyst, the global foam protective packaging market is estimated to grow annually at a CAGR of around 4.87% over the forecast period (2025-2034).

- Regarding revenue, the global foam protective packaging market size was valued at around USD 15.22 billion in 2024 and is projected to reach USD 24.49 billion by 2034.

- The foam protective packaging market is projected to grow at a significant rate due to a boom in e-commerce and the need for lightweight, shock-absorbing materials for shipping delicate items drives demand. Sustainability and recyclability trends also influence market dynamics.

- Based on Material, the Polyurethane segment is expected to lead the global market.

- On the basis of Type, the Inserts segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Consumer Electronics segment is projected to swipe the largest market share.

- By End-user, the E-commerce segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Foam Protective Packaging Market: Growth Drivers

An increase in global trade and export activities is likely to boost the growth of the global market.

Fast-growing international trade and export activities are one of the major factors for the high growth rate of the global foam protective packaging market. Companies are adopting reliable and sustainable packing solutions to protect their goods during long-distance transit. Such a landscape has significantly increased demand for foam protective packaging in the market. The era is witnessing a boom in e-commerce platforms, which is another driving force for the growth of the industry. With the increase in online shopping, the demand for reliable and secure packaging solutions has significantly increased. For instance, Recticel, in March 2021, acquired FoamPartner. The latter is a Swiss company offering premium technical foams. The acquisition is aimed at speeding up the commercialization of edge-cutting solutions in the global marketplace.

Foam Protective Packaging Market: Restraints

Cost of raw materials and competition from other packaging materials are likely to restrict the growth of the global market.

The cost of raw materials in the industry is more expensive than other available options, which is likely to limit the growth of the foam protective packaging industry. Additionally, the industry faces competition from other sectors like biodegradable or paper-based alternatives, which is also expected to slow down the growth of the industry in the forthcoming years.

Foam Protective Packaging Market: Opportunities

Growing industrial applications and increasing awareness regarding the brand reputation are expected to offer growth opportunities in the global market.

Foam protective packaging is gaining popularity among industrial applications like equipment and machinery. However, the constantly growing manufacturing and industrial industry is expected to widen the scope of the global foam protective packaging market. Additionally, companies are increasingly becoming aware of their brand reputation, which is likely to further accentuate their demand in the market. Companies are highly adopting foam protective packaging to ensure that ordered items reach the customer in good condition, thereby fostering positive customer satisfaction for the companies. For instance, Borealis AG successfully took over 50% of the stake in Nova Chemicals to expand its business across the North American region.

Foam Protective Packaging Market: Challenges

Economic factors and supply chain disruption are big challenges in the global market.

Economic fluctuations like inflation or recession highly influence the company's spending power and the demand from customers, which subsequently affect the requirement for packaging. Additionally, the fluctuations in the supply chain, like the unavailability of raw materials or transportation, also affect the production and distribution of foam packaging materials. Therefore, such a landscape is likely to create challenges in the growth of the foam protective packaging industry. Rules and regulations regarding packaging material and waste management are also a challenge in the industry.

Foam Protective Packaging Market: Segmentation Analysis

The global foam protective packaging market is segmented based on material, type, application, end-user, and region.

Based on Material, the global foam protective packaging market is divided into polyurethane, polyethylene, polystyrene, and others. The polyurethane segment is expected to swipe the largest share of the foam protective packaging industry during the forecast period. The segment witnessed around 45.3% of the total market revenue in 2024 and is likely to grow steadily further. The growing popularity of polyurethane foam is one of the major reasons for the growth of the segment. It is in much demand because of its ideal solution for shipping sensitive products. It offers excellent resistance to mildew properties, which makes it a perfect choice for protecting light and fragile products during the transportation process.

On the basis of Type, the global foam protective packaging market is bifurcated into inserts, corner & edge protectors, anti-static foam, and others. The inserts segment accounts for the largest share of the global foam protective packaging market during the forecast period. The segment swiped around 33.7% of the total market revenue in 2024. However, the corner & edge protectors offer a positive sealing for household, industrial, cosmetics, pharmaceuticals, beverages, food, and chemical industry products. Also, the increasing demand across all sectors, particularly food & beverage, is likely to further propel the growth of the segment in the coming years.

By Application, the global foam protective packaging market is split into consumer electronics, automotive, pharmaceuticals, industrial goods, and others. Consumer electronics is the fastest-growing segment in the global foam protective packaging industry, with around 28.9% of the market share. Consumer electronics like laptops, tablets, smartphones, and others are fragile and very susceptible to damage during handling and transportation. Therefore, packaging foam offers the best shock absorption and cushioning properties to ensure the safety of electronic devices throughout the supply chain.

In terms of End-user, the global foam protective packaging market is categorized into e-commerce, manufacturing, logistics, and retail.

Foam Protective Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Foam Protective Packaging Market |

| Market Size in 2024 | USD 15.22 Billion |

| Market Forecast in 2034 | USD 24.49 Billion |

| Growth Rate | CAGR of 4.87% |

| Number of Pages | 217 |

| Key Companies Covered | American Foam Products, Engineered Components & Packaging LLC, Tucson Container Corp., Victory Foam, Synergy Packaging Solutions, Barco Sales & Manufacturing Inc., UFP Technologies, Williams Foam, Polyformes Foam Solutions, Suzhou, INTCO Recycling, Anu Industries, Leenol, PAX Solutions, Sinkery Foam, ESD Goods, Foamtech, Vento Foam Pvt. Ltd., Snehal Packaging Industry, Flexipack Group, and Mefron Technologies, and others. |

| Segments Covered | By Material, By Type, By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Foam Protective Packaging Market: Regional Analysis

North America is likely to dominate the growth of the global market

North America accounts for the largest share of the foam protective packaging industry due to the growing commercial activities in the region. The rise of e-commerce platforms has significantly propelled the demand for secure and reliable packaging solutions to protect items during transit. Foam packaging has emerged as a popular choice for packaging sensitive products that are susceptible to damage. Additionally, the fast-expanding electronic appliances industry in the region is further paving a positive growth trajectory for the growth of the regional market. Companies are very conscious of food safety and customer satisfaction. Therefore, they are investing heavily in reliable packaging solutions to meet their demand and ensure a positive customer experience.

Asia Pacific is also expected to grow steadily during the forecast period due to the ongoing robust manufacturing and export activities in the region. The region is home to several manufacturing industries like consumer goods, automotive, electronics, and several others. Therefore, for domestic and international exports, companies require the best solutions to safeguard their products during transportation. Moreover, the growth in the healthcare and pharmaceutical sector has significantly widened the scope of foam protective packaging in the region. This packaging helps companies to ensure the integrity of this item during transportation. For instance, Flipkart, in May 2021, strengthened its grocery segment on its e-commerce platform to deliver exceptional service to the growing demand of consumers across India.

Foam Protective Packaging Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the foam protective packaging market on a global and regional basis. For instance, Flipkart, in April 2021, collaborated with a commercial alliance with Adani Group to improve data and logistics center capabilities.

The global foam protective packaging market is dominated by players like:

- American Foam Products

- Engineered Components & Packaging LLC

- Tucson Container Corp.

- Victory Foam

- Synergy Packaging Solutions

- Barco Sales & Manufacturing Inc

- UFP Technologies

- Williams Foam

- Polyformes Foam Solutions

- Suzhou

- INTCO Recycling

- Anu Industries

- Leenol

- PAX Solutions

- Sinkery Foam

- ESD Goods

- Foamtech

- Vento Foam Pvt. Ltd.

- Snehal Packaging Industry

- Flexipack Group

- Mefron Technologies

The global foam protective packaging market is segmented as follows:

By Material

- Polyurethane

- Polyethylene

- Polystyrene

- Others

By Type

- Inserts

- Corner & Edge Protectors

- Anti-Static Foam

- Others

By Application

- Consumer Electronics

- Automotive

- Pharmaceuticals

- Industrial Goods

- Others

By End-user

- E-commerce

- Manufacturing

- Logistics

- Retail

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Foam protective packaging refers to the kind of packaging material that is used to protect fragile or delicate items during storage and transportation. Such packaging is designed to offer shock absorption and cushioning, thereby protecting the items from vibrations and other such external forces. Such a kind of packaging is widely used in the consumer goods, aerospace, automotive, pharmaceutical, and electronics industries.

Fast-growing international trade and export activities are one of the major factors for the high growth rate of the global foam protective packaging market. Companies are adopting reliable and sustainable packing solutions to protect their goods during long-distance transit. Such a landscape has significantly increased demand for foam protective packaging in the market

According to a study, the global foam protective packaging market size was worth around USD 15.22 Billion in 2024 and is expected to reach USD 24.49 Billion by 2034.

The global foam protective packaging market is expected to grow at a CAGR of 4.87% during the forecast period.

North America is expected to dominate the foam protective packaging market over the forecast period.

Leading players in the global foam protective packaging market include American Foam Products, Engineered Components & Packaging LLC, Tucson Container Corp., Victory Foam, Synergy Packaging Solutions, Barco Sales & Manufacturing Inc., UFP Technologies, Williams Foam, Polyformes Foam Solutions, Suzhou, INTCO Recycling, Anu Industries, Leenol, PAX Solutions, Sinkery Foam, ESD Goods, Foamtech, Vento Foam Pvt. Ltd., Snehal Packaging Industry, Flexipack Group, and Mefron Technologies, among others.

The report explores crucial aspects of the foam protective packaging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed