Food Safety Testing Market Size, Share, Trends, Growth 2032

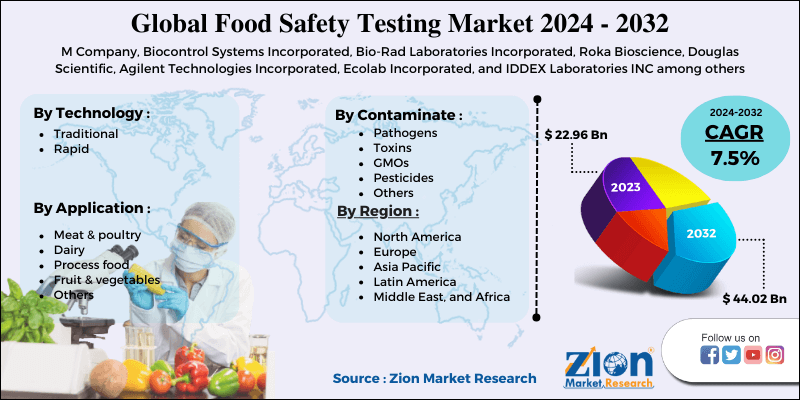

Food Safety Testing Market By Technology (Traditional and Rapid), Contaminate (Pathogens and Toxins, GMOs, Pesticides And Others), By Application (Meat & poultry, Dairy, Process food, Fruit & vegetables, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

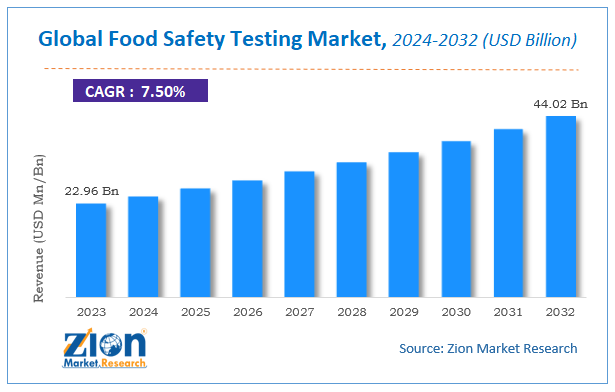

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.96 Billion | USD 44.02 Billion | 7.5% | 2023 |

Food Safety Testing Market Insights

According to a report from Zion Market Research, the global Food Safety Testing Market was valued at USD 22.96 Billion in 2023 and is projected to hit USD 44.02 Billion by 2032, with a compound annual growth rate (CAGR) of 7.5% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Food Safety Testing Market industry over the next decade.

Food Safety Testing Market: Overview

Food Safety Testing is a process of inspecting food products that are hazardous to human health. Various techniques are used to identify pathogens, chemicals, and genetically modified organisms. Food safety is a huge concern for users owing to the stable danger of food-borne diseases, thereby having a towering effect on the food safety testing market. Food safety testing is essential to attain a certificate of analysis of ready-to-eat foods and raw food items at various phases of food processing. Users are offered with food safety tags on food items to guarantee the safety and quality of food items. This in turn has elevated the significance of the global food safety testing market.

However, the outbreak of the novel coronavirus has slightly affected the growth of the Food Safety Testing market. The significant decrease in the global Food Safety Testing market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary contaminants and the current data available about the situation.

Food Safety Testing Market: Growth Factors

The global food safety testing market has been showing incredible development with rising food-borne diseases all over the world. The growth of the global food safety testing market is boosted by increasing user awareness related to food safety. Regions all over the world are experiencing food disease epidemic instances in addition to the due occurrence of chemical contaminants and microbial pathogens. The major players in the global food safety testing market are experiencing increasing requirements for food safety testing due to health concerns and elevating awareness among users. Mergers and acquisitions among market players are also major reason for market growth. For instance, in July 2018, Eurofins Scientific acquired Laboratorios Ecosur, a food testing firm with laboratories in Turkey and Spain.

Food Safety Testing Market: Segment Analysis Preview

The market is segmented into Traditional and Rapid. Rapid antioxidants accounted for the most dominant segment. Emerging economies mostly rely on Rapid antioxidants due to their lesser cost compared to Traditional antioxidants. However, Traditional antioxidants are gaining importance in the market and this segment is expected to grow with a higher CAGR compared to that of Rapid antioxidants.

By application, the market is segmented into Meat & poultry, dairy, Process food, Fruit & vegetables, and other applications. The market for Food Safety Testing is directly influenced by the increase in the purchasing power of the global population, owing to their use in applications such as prepared foods, prepared meat & poultry, Process food, dairy, Fruit & vegetables, and others. The application of Food Safety Testing in the prepared meat & poultry industry accounted for the largest share in 2020. Busier lifestyles, growth in disposable income, and more women entering the workforce are the key reasons driving the market for convenience-based products such as prepared meat & poultry. Prepared meat & poultry represents an opportunity for the key market players to invest in R&D and introduce Food Safety Testing for nutrient, flavor, and color stability of meat & poultry products.

Food Safety Testing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Food Safety Testing Market |

| Market Size in 2023 | USD 22.96 Billion |

| Market Forecast in 2032 | USD 44.02 Billion |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 110 |

| Key Companies Covered | M Company, Biocontrol Systems Incorporated, Bio-Rad Laboratories Incorporated, Roka Bioscience, Douglas Scientific, Agilent Technologies Incorporated, Ecolab Incorporated, and IDDEX Laboratories INC among others. |

| Segments Covered | By Technology, By Contaminate, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

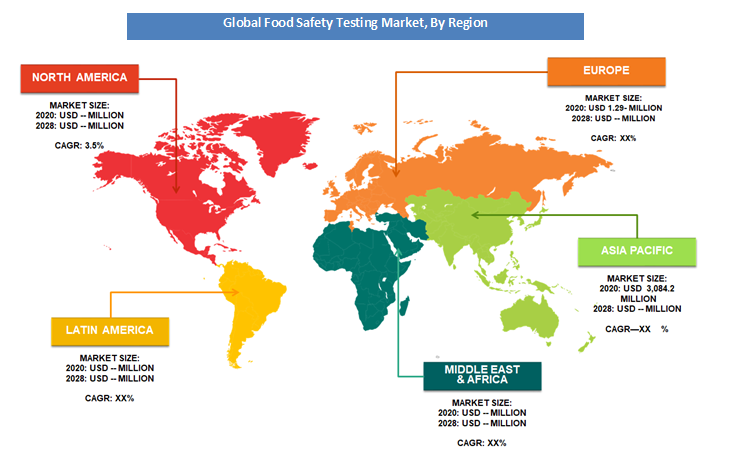

Food Safety Testing Market: Regional Analysis Preview

North America ruled the food safety testing market earlier in 2023. The largest piece of pie for this region can be credited to different factors such as increasing government regulations and elevated prevalence of food disease. Europe is one of the primary regions in the food safety testing market owing to elevated awareness about food safety policies by the government in this area. The Asia Pacific displays an area with a huge potential for food safety testing market owing to augmented stress on food securities in this area.

Food Safety Testing Market: Key Players & Competitive Landscape

Some of the key players in the Food Safety Testing market are

- M Company

- Biocontrol Systems Incorporated

- Bio-Rad Laboratories Incorporated

- Roka Bioscience

- Douglas Scientific

- Agilent Technologies Incorporated

- Ecolab Incorporated

- IDDEX Laboratories INC

The global Food Safety Testing market is segmented as follows:

By Technology

- Traditional

- Rapid

By Contaminate

- Pathogens

- Toxins

- GMOs

- Pesticides

- Others

By Application

- Meat & poultry

- Dairy

- Process food

- Fruit & vegetables

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a report from Zion Market Research, the global Food Safety Testing Market was valued at USD 22.96 Billion in 2023 and is projected to hit USD 44.02 Billion by 2032.

According to a report from Zion Market Research, the global Food Safety Testing Market a compound annual growth rate (CAGR) of 7.5% during the forecast period 2024-2032.

Some of the key factors driving the global Food Safety Testing market growth are incredible development with rising food-borne diseases and increasing user awareness related to food safety.

North America ruled the food safety testing market earlier in 2023. The largest piece of pie for this region can be credited to different factors such as increasing government regulations and elevated prevalence of food disease.

Some of the major companies operating in Food Safety Testing market are 3M Company, Biocontrol Systems Incorporated, Bio-Rad Laboratories Incorporated, Roka Bioscience, Douglas Scientific, Agilent Technologies Incorporated, Ecolab Incorporated, and IDDEX Laboratories INC among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed