Food Antioxidant Market Size, Share, Trends and Analysis 2032

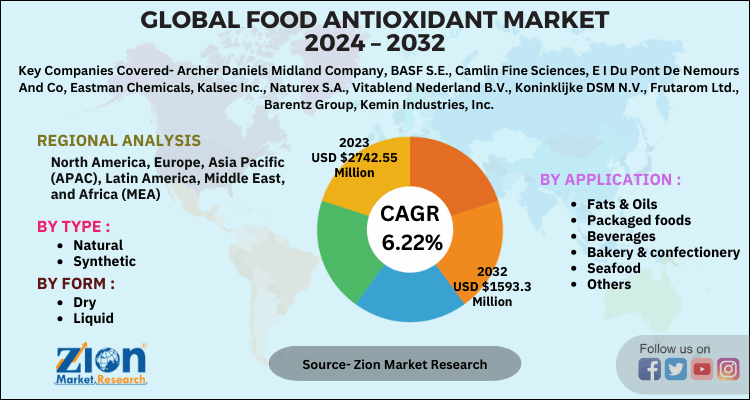

Food Antioxidant Market By Type (Natural and Synthetic), By Form (Dry and Liquid), By Application (Fats & Oils, Packaged foods, Beverages, Bakery & confectionery, Seafood, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

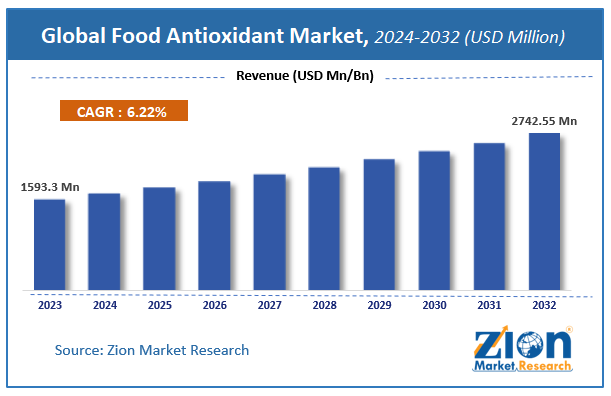

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1593.3 Million | USD 2742.55 Million | 6.22% | 2023 |

Food Antioxidant Market Insights

Zion Market Research has published a report on the global Food Antioxidant Market, estimating its value at USD 1593.3 Million in 2023, with projections indicating that it will reach USD 2742.55 Million by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 6.22% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Food Antioxidant Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Food Antioxidant Market: Overview

Antioxidants are the substance that prolongs the shelf life of foods by preventing oxidation by saving the food product from deteriorating. Apart from food, antioxidants are used in cosmetics and animal feed additives to reduce singlet oxygen. Antioxidants prevent fat rancidity and color changes in the food.

It helps in destroying some of the free radicals that would harm or damage the body cells. They are used to increase shelf life of the food items. Moreover, natural ingredients such as color, flavor, among others serve as powerful antioxidants, which have high demand in various applications of the bakery ingredient market, which drive the growth of the market during the forecast period.

The major players in the global food antioxidant market is emphasizing in the merger & acquisition in order to surge the product portfolio and also to increase the presence across the globe. The companies in the market are focusing in expanding business across all the region and developing strategies to size up production capability and strengthen global presence.

Although the out-of-house consumption of food & beverages witnessed a standstill, the at-home consumption of food has significantly increased; thereby, observing a significant share in the global food & beverages market. Furthermore, the demand for staple and packaged food has witnessed an upward trend recently, which is attributed to the active lockdown, absence of convenient home delivery options, and precautionary action taken by people to prevent getting infected by the coronavirus.

However, the outbreak of the novel coronavirus has slightly affected the growth of the food antioxidants market. According to the American Bakers Association, in the U.S., the baking industry employs almost 800,000 skilled individuals, generates over $44 billion in direct wages, and has an overall economic impact of over $153 billion. The significant decrease in the global food antioxidants market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary Forms and the current data available about the situation.

Food Antioxidant Market: Growth Factors

The food antioxidant market is expected to witness substantial growth within the forecast period. The food antioxidants market has been gaining importance due to its extensive use of the prepared foods & beverages industry. An increase in the purchasing power of the global population can also be attributed to the growth of the food antioxidants market. The food antioxidants market is projected to grow at a CAGR of 6.3%. The market is mainly driven due to increasing end-user applications of food antioxidants. The high cost of food antioxidant and safety issues with synthetic food antioxidants are hindering the market growth. Growing demand in emerging economies is anticipated to set new growth opportunities in the near future.

Food Antioxidant Market: Segment Analysis

The market is segmented into natural and synthetic food antioxidant. Synthetic antioxidants accounted for the most dominant segment. Emerging economies mostly rely on synthetic antioxidants due to their lesser cost compared to natural antioxidant. However, natural antioxidants are gaining importance in the market and this segment is expected to grow with a higher CAGR compared to that of synthetic antioxidants.

By application, the market is segmented into fats & oils, prepared foods/meat/poultry, beverages, bakery & confectionery, seafood and other food antioxidant applications. The market for food antioxidants is directly influenced by the increase in the purchasing power of the global population, owing to their use in applications such as prepared foods, prepared meat & poultry, beverages, fats & oils, bakery & confectionery, and seafood. The application of food antioxidants in the prepared meat & poultry industry accounted for the largest share in 2023.

Food Antioxidant Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Food Antioxidant Market |

| Market Size in 2023 | USD 1593.3 Million |

| Market Forecast in 2032 | USD 2742.55 Million |

| Growth Rate | CAGR of 6.22% |

| Number of Pages | 160 |

| Key Companies Covered | Archer Daniels Midland Company, BASF S.E., Camlin Fine Sciences, E I Du Pont De Nemours And Co, Eastman Chemicals, Kalsec Inc., Naturex S.A., Vitablend Nederland B.V., Koninklijke DSM N.V., Frutarom Ltd., Barentz Group, Kemin Industries, Inc. |

| Segments Covered | By Type, By Form, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

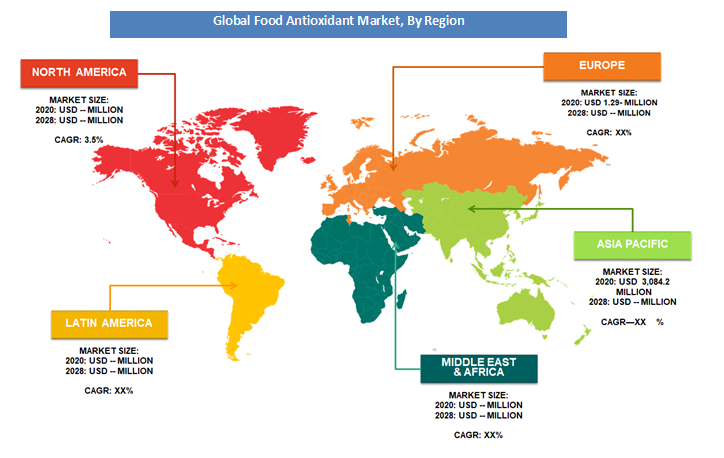

Food Antioxidant Market: Regional Analysis

Asia-Pacific is projected to be the fastest-growing regional market between 2018 and 2022. The emerging economies of the Asia-Pacific region are a major market for food antioxidants and are increasingly contributing to their demand, due to rise in disposable income, increase in population, and growth in the demand for processed foods; owing to which, the food antioxidants market is projected to grow at the highest rate in this region.

Key Market Players & Competitive Landscape

Some of key players in Food Antioxidant market are

- Archer Daniels Midland Company

- BASF S.E.

- Camlin Fine Sciences

- E I Du Pont De Nemours And Co

- Eastman Chemicals

- Kalsec Inc.

- Naturex S.A.

- Vitablend Nederland B.V.

- Koninklijke DSM N.V.

- Frutarom Ltd

- Barentz Group

- Kemin Industries, Inc

The global Food Antioxidant market is segmented as follows:

By Type

- Natural

- Synthetic

By Form

- Dry

- Liquid

By Application

- Fats & Oils

- Packaged foods

- Beverages

- Bakery & confectionery

- Seafood

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Zion Market Research has published a report on the global Food Antioxidant Market, estimating its value at USD 1593.3 Million in 2023, with projections indicating that it will reach USD 2742.55 Million by 2032.

The market is expected to expand at a compound annual growth rate (CAGR) of 6.22% over the forecast period 2024-2032.

Some of the key factors driving the global Food Antioxidant market growth are Growth in demand for food & beverages, animal feed additives, and pharmaceuticals and Declining cost of Antioxidants.

Asia-Pacific was the biggest area for Food Antioxidant market in 2023 and is likely to sustain its position in the years to come. The Food Antioxidant market is majorly boosted by the rising in disposable income, increase in population, and growth in the demand for processed foods.

Some of the major companies operating in Food Antioxidant market are Archer Daniels Midland Company, BASF S.E., Camlin Fine Sciences, E I Du Pont De Nemours And Co, Eastman Chemicals, Kalsec Inc., Naturex S.A., Vitablend Nederland B.V., Koninklijke DSM N.V., Frutarom Ltd., Barentz Group, Kemin Industries, Inc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed