Global FMCG Packaging Market Size, Share, Growth Analysis Report - Forecast 2034

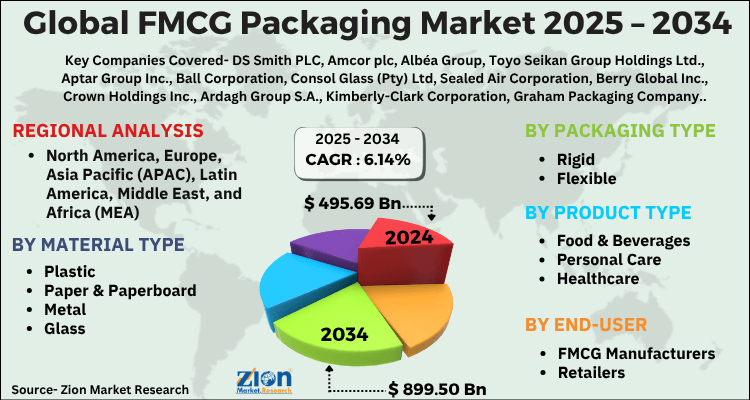

FMCG Packaging Market By Material Type (Plastic, Paper & Paperboard, Metal, Glass, Others), By Packaging Type (Rigid, Flexible), By Product Type (Food & Beverages, Personal Care, Healthcare, Home Care, Others), By End-user (FMCG Manufacturers, Retailers, Consumers), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

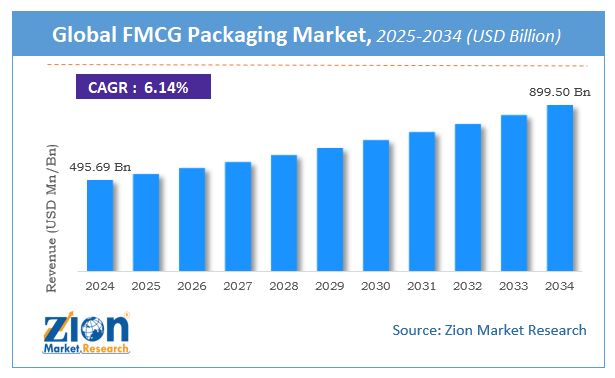

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 495.69 Billion | USD 899.50 Billion | 6.14% | 2024 |

FMCG Packaging Industry Perspective:

The global FMCG packaging market size was worth around USD 495.69 Billion in 2024 and is predicted to grow to around USD 899.50 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.14% between 2025 and 2034. The report analyzes the global FMCG packaging market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the FMCG packaging industry.

The market report is an indispensable guide on growth factors, challenges, restraints, and opportunities in the global marketspace. The FMCG packaging market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, PESTEL analysis, SWOT analysis, Porter’s five force analysis, and value chain analysis. Additionally, the FMCG packaging industry report explores the investor and stakeholder space to help companies make data-driven decisions.

FMCG Packaging Market: Overview

FMCG also referred to as fast-moving consumer goods are sold quickly at reduced costs. Some of the best examples of non-perishable FMCG include consumables, packaged foods, beverages, over-the-counter medicines, and toiletries. Moreover, FMCG packaging helps in retaining product quality, improves shelf life, and helps businesses in selling their products through sustainable packaging. Advanced packaging is being accepted by consumer goods manufacturers as the latter are allocating huge funds for coining visually appealing packaging designs.

Key Insights

- As per the analysis shared by our research analyst, the global FMCG packaging market is estimated to grow annually at a CAGR of around 6.14% over the forecast period (2025-2034).

- Regarding revenue, the global FMCG packaging market size was valued at around USD 495.69 Billion in 2024 and is projected to reach USD 899.50 Billion by 2034.

- The FMCG packaging market is projected to grow at a significant rate due to rising demand for packaged goods, convenience products, sustainability trends, and innovations in lightweight, durable, and recyclable packaging.

- Based on Material Type, the Plastic segment is expected to lead the global market.

- On the basis of Packaging Type, the Rigid segment is growing at a high rate and will continue to dominate the global market.

- Based on the Product Type, the Food & Beverages segment is projected to swipe the largest market share.

- By End-user, the FMCG Manufacturers segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

FMCG Packaging Market: Growth Factors

Escalating smart packaging demand will steer the global market trends

Smart packaging provides value-added services to the end-users, thereby translating into massive growth of the global FMCG packaging market trends. Surging demand for nutritive foods has helped the FMCG packaging firms in innovating packaging, thereby steering the expansion of the global market. In the first half of 2024, Aptar Food introduced sealed packaging for fresh-cut produce making use of new packaging technology that releases anti-pathogens for protecting the FMCG product against bacteria, viruses, and fungi. Such moves are likely to embellish the expansion of the market across the globe.

Moreover, extensive application of FMCG packaging in cosmetics, food & beverages, pharmaceuticals, and personal care sectors will spearhead the global market expansion. For the record, in December 2022, PepsiCo and L’Oréal introduced new packaging & labeling strategies that are likely to favorably impact the growth aspects across the value chain. Furthermore, in January 2023, Silafrica, the key FMCG packaging material manufacturer, announced the launch of foldable export fruit & vegetable crates for which it was awarded the Kenya Avocado Excellence Awards. The massive use of bio-degradable and sustainable raw components will prop up the scope of growth for the global market.

FMCG Packaging Market: Restraints

Restriction on the use of plastics by various governments can hamper the global industry expansion by 2030

Plastic packaging of fast-moving consumer goods is likely to restrict the expansion of the FMCG packaging industry across the globe. With strict laws governing the export & import of FMCG goods, it is more likely to inhibit the global industry surge in the years ahead.

FMCG Packaging Market: Opportunities

Massive preference for sustainable beverage packaging will open new growth opportunities for the global market

Rise in the sustainable beverage packaging and online food delivery has generated new growth avenues for the FMCG packaging market across the globe. Growing intake of dairy & non-alcoholic beverages will create new horizons of growth for the global market.

FMCG Packaging Market: Challenges

Lack of adoption of FMCG packaging in distant locations to be a challenging task for the global industry

Less acceptance of FMCG packaging in remote areas along with the rise in the costs of FMCG packaging has created a big challenge for the growth of the FMCG packaging industry across the globe.

FMCG Packaging Market: Segmentation

The global FMCG packaging market is sectored into type, application, and region.

In terms of type, the global FMCG packaging market is sectored into paper & paperboard, metal, plastic, and glass segments. Furthermore, the paper & paperboard segment, which accrued over 45% of the global market share in 2022, is slated to maintain its dominant status in the projected timeline. The segmental growth in the forecasting years can be subject to a rise in the demand for paper & paperboard packaging for the packing of fast-moving consumer goods.

On the basis of the application, the global FMCG packaging industry is divided into beverage, household & personal care, and food segments. Moreover, the beverage segment, which accumulated a major share of the global market in 2022, is forecast to dominate the application sphere over the forecast timeline. The growth of the segment over 2023-2030 can be subject to a rise in innovations in sustainable packaging. For instance, in the second half of September 2019, Macfarlane Packaging, a UK-based packaging supplier, introduced a biodegradable packaging protection solution for bottles and jars of wines. Reportedly, the product is manufactured from recycled products and bio-degradable as well as plastic-free materials.

On the basis of Packaging Type, the global FMCG packaging market is bifurcated into Rigid, Flexible.

In terms of End-user, the global FMCG packaging market is categorized into FMCG Manufacturers, Retailers, Consumers.

Recent Breakthroughs:

- In the first half of 2020, Ball Corporation, a key provider of sustainable aluminum packaging solutions for beverages, is projected to represent the firm’s aluminum cups in retail stores such as grocery stores, drug stores, food service stores, and mass channel stores in the U.S. The move is likely to leverage the expansion of the FMCG packaging industry in the U.S.

- In the first quarter of 2020, Amcor Company, a key player offering effective packaging solutions, joined hands with Moda Systems, a next-generation vacuum packaging system manufacturer in North America & Latin America. The move is likely to enhance the operational efficiency of the latter and reduce the overall cost savings. The initiative is predicted to enhance the growth of the FMCG packaging business in the Americas.

FMCG Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | FMCG Packaging Market |

| Market Size in 2024 | USD 495.69 Billion |

| Market Forecast in 2034 | USD 899.50 Billion |

| Growth Rate | CAGR of 6.14% |

| Number of Pages | 224 |

| Key Companies Covered | DS Smith PLC, Amcor plc, Albéa Group, Toyo Seikan Group Holdings Ltd., Aptar Group Inc., Ball Corporation, Consol Glass (Pty) Ltd, Sealed Air Corporation, Berry Global Inc., Crown Holdings Inc., Ardagh Group S.A., Kimberly-Clark Corporation, Graham Packaging Company, Tetra Pak International S.A., Mondi Plc, Huhtamaki Oyj, and Sonoco Products Company, and others. |

| Segments Covered | By Material Type, By Packaging Type, By Product Type, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

FMCG Packaging Market: Regional Insights

North American FMCG Packaging market to establish a leading position over the forecast timeframe

North America, which garnered more than 65% of the global FMCG packaging market revenue in 2024, is anticipated to record notable growth during the projected timespan. The regional market expansion over 2025-2034 can be subject to an increment in the demand for FMCG packaging in the food & beverages sector along with the rise in the demand for convenience foods in the countries such as Canada and the U.S. In addition to this, large-scale demand for cheese, yogurt, and milk will steer the expansion of the regional market in the years ahead. Reportedly, the U.S. is the largest consumer of wine across the globe and this will contribute notably to the regional market size.

Furthermore, the FMCG packaging industry in the Asia-Pacific region is anticipated to register the fastest CAGR in the anticipated timespan. The factors that are likely to favorably leverage the growth of the regional industry are thriving pharmaceutical and food & beverages sectors in the countries such as India and China. Apart from this, a prominent increase in the investments in personal care and food processing sectors will prompt regional industry expansion.

FMCG Packaging Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the FMCG packaging market on a global and regional basis.

The global FMCG packaging market is dominated by players like:

- DS Smith PLC

- Amcor plc

- Albéa Group

- Toyo Seikan Group Holdings Ltd.

- Aptar Group Inc.

- Ball Corporation

- Consol Glass (Pty) Ltd

- Sealed Air Corporation

- Berry Global Inc.

- Crown Holdings Inc.

- Ardagh Group S.A.

- Kimberly-Clark Corporation

- Graham Packaging Company

- Tetra Pak International S.A.

- Mondi Plc

- Huhtamaki Oyj

- and Sonoco Products Company

The global FMCG packaging market is segmented as follows;

By Material Type

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

By Packaging Type

- Rigid

- Flexible

By Product Type

- Food & Beverages

- Personal Care

- Healthcare

- Home Care

- Others

By End-user

- FMCG Manufacturers

- Retailers

- Consumers

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

FMCG also referred to as fast-moving consumer goods are sold quickly at reduced costs. Some of the best examples of non-perishable FMCG include consumables, packaged foods, beverages, over-the-counter medicines, and toiletries. Moreover, FMCG packaging helps in retaining product quality, improves shelf life, and helps businesses in selling their products through sustainable packaging.

The global FMCG packaging market is expected to grow due to rising demand for packaged goods, convenience products, sustainability trends, and innovations in lightweight, durable, and recyclable packaging

According to a study, the global FMCG packaging market size was worth around USD 495.69 Billion in 2024 and is expected to reach USD 899.50 Billion by 2034.

The global FMCG packaging market is expected to grow at a CAGR of 6.14% during the forecast period.

Asia-Pacific is expected to dominate the FMCG packaging market over the forecast period.

Leading players in the global FMCG packaging market include DS Smith PLC, Amcor plc, Albéa Group, Toyo Seikan Group Holdings Ltd., Aptar Group Inc., Ball Corporation, Consol Glass (Pty) Ltd, Sealed Air Corporation, Berry Global Inc., Crown Holdings Inc., Ardagh Group S.A., Kimberly-Clark Corporation, Graham Packaging Company, Tetra Pak International S.A., Mondi Plc, Huhtamaki Oyj, and Sonoco Products Company, among others.

The report explores crucial aspects of the FMCG packaging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed