Plastic Packaging Market Size, Share, Trends, Growth and Forecast 2032

Plastic Packaging Market by Product (Rigid and Flexible), by Application (Industrial, Food & Beverages, Automotive, Personal Care, Medical and Other Applications): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

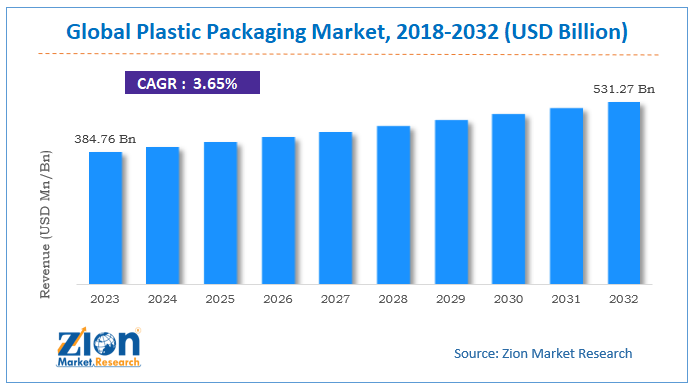

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

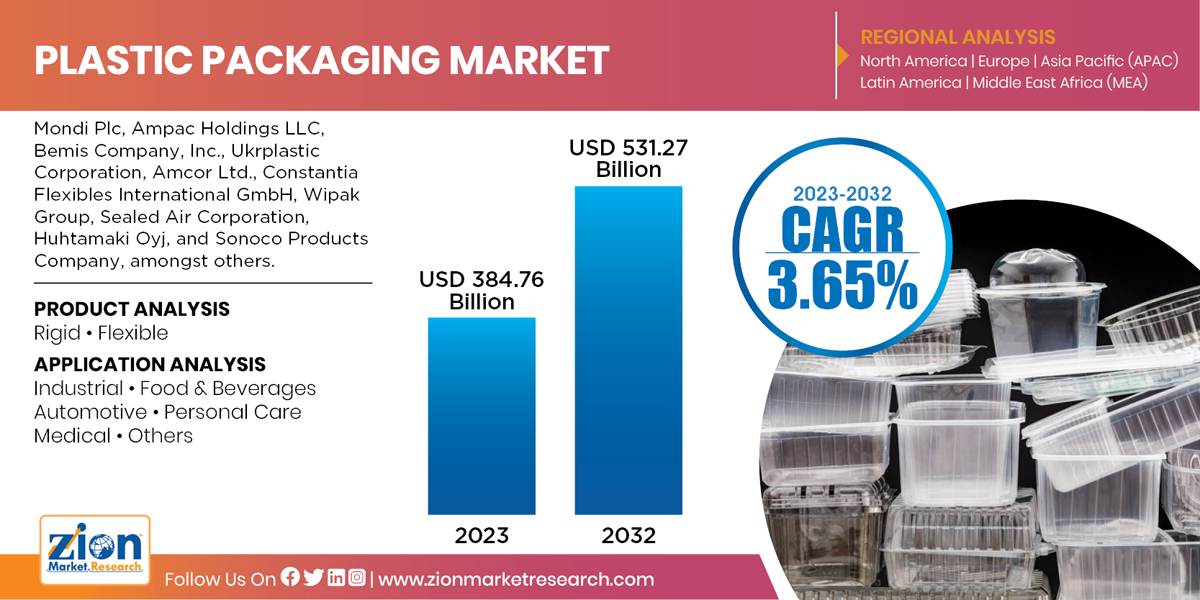

| USD 384.76 Billion | USD 531.27 Billion | 3.65% | 2023 |

Plastic Packaging Industry Perspective:

The global Plastic Packaging Market size was worth around USD 384.76 Billion in 2023 and is predicted to grow to around USD 531.27 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 3.65% between 2024 and 2032. The report encloses the forecast and current estimate for plastic packaging market size on a global and regional level. The study provides the data from previous years 2018 to 2022 and the forecast period from 2024 to 2032 based on volume and revenue.

Key Insights

- As per the analysis shared by our research analyst, the plastic packaging market is anticipated to grow at a CAGR of 3.65% during the forecast period (2024-2032).

- The global plastic packaging market was estimated to be worth approximately USD 384.76 billion in 2023 and is projected to reach a value of USD 531.27 billion by 2032.

- The growth of the plastic packaging market is being driven by rising demand for packaged foods and beverages, expanding e-commerce and retail sectors, and increasing urbanization, particularly in emerging economies.

- Based on the product, the rigid segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the industrial segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Global Plastic Packaging Market: Overview

Plastics are derived from the organic (carbon-containing) compounds and it exhibits the property of malleability. Due to this property, it is in great demand particularly in the packaging industry across the globe. Plastic is mainly derived synthetically from petrochemicals. The raw material is easily available and has a low production cost. Thus, the production of plastic is high, especially in the Asia Pacific region. Plastic packaging finds numerous applications in several sectors such as in the food & beverages, automotive, medical, personal care, and industrial sectors, among others.

The global plastic packaging market is primarily driven by numerous parameters, which majorly includes growing demand for plastic packaging in the food and beverages industry. Moreover, escalating demand for plastic packaging in the personal care industry is another driving force which is expected to drive the market for plastic packaging in the coming years. However, stringent rules and regulations over the use of plastic products may slow down the growth of the market. Nonetheless, emerging food and beverages industry in developing countries such as China, India, Brazil, and South Africa may provide the new avenues for the plastic packaging industry in the years to come.

The volume of the plastic packaging market is in kilotons and the revenue is measured in USD million. The study also provides the impact and the descriptive analysis of major drivers, restraints, and opportunities of the global plastic packaging market.

The study also offers the market attractiveness and Porter’s Five Forces model analysis to gauge the competitive landscape of major vendors in the global plastic packaging market. This comprehensive study also provides you the detailed analysis and overview of each segment included in the study.

Global Plastic Packaging Market: Growth Drivers

The plastic packaging market is experiencing solid growth, with experts pointing to a range of drivers that push demand in both established and developing nations. Digitization and increased urbanization are driving rapid changes in consumer lifestyles, leading to higher demand for convenience and cost-saving products that can only be effectively delivered by flexible yet strong plastic packaging.

Additionally, the global trend toward eco-friendly product packaging is fuelling demand for sustainable alternatives such as biodegradable plastics which provide an improved environmental profile without sacrificing functionality. Finally, rising awareness about food safety is playing an important role in driving the uptake of smarter plastic packaging materials that extend shelf life or improve temperature control to reduce food waste. All of these factors combine to support strong further growth in the plastics packaging industry.

With more consumers seeking sustainability and convenience when it comes to their shopping habits, plastic packaging has seen a surge in growth across many industries. The ability for plastic to keep food fresh longer and to easily protect products during shipping are two major factors driving the growth of the market. Additionally, advancements in technology have allowed companies to produce thinner packaging which reduces transportation costs. Furthermore, with recycling initiatives and production processes requiring fewer resources than other sorts of packaging, plastic is becoming increasingly popular among both manufacturers and consumers alike.

As the world has become increasingly reliant on convenience, the plastic packaging market has experienced a surge in demand. This is due to its multiple advantages, including cost-effectiveness, lightness, durability, and convenience. Global population growth has also played a key role in the market’s growth as it leads to an increase of food and beverage consumption - resulting in a higher demand for packaging products such as bottles, boxes, and wraps. Additionally, many countries have enacted regulations that favor using plastic over other packaging materials due to its recyclability.

The rise of e-commerce operations has further driven the plastic packaging market growth as they need lightweight and protective containers. With technological advancements such as increased automation and the use of biodegradable material, the global plastic packaging industry is expected to continue experiencing positive progress in coming years.

Global Plastic Packaging Market: Segmentation

The report includes the major product types, applications, and regional bifurcation.

Based on the types, the plastic packaging market is bifurcated into rigid plastic packaging and flexible plastic packaging. Among these two types, flexible plastic packaging dominated the global plastic packaging market in 2023. Furthermore, the flexible plastic packaging is predicted to be the fastest growing segment of the market over the next few years. Flexible plastic packaging has a great demand in various application sectors such as the food industry, household appliances, textile industry, etc. Whereas, the rigid plastic packaging is likely to exhibit exponential growth over the coming years due to the immense growth in pharmaceutical, beverages, and personal care products industry across the world.

Based on applications, the plastic packaging market is bifurcated into Industrial, food & beverages, automotive, medical, and personal care, among others are some of the major applications of the global plastic packaging market. Among these, the food and beverages sector was the most lucrative segment of the global plastic packaging market in 2023. Moreover, it is also predicted to witness the highest CAGR over in the coming future. Growing demand for convenience and the packed food is a major driving force which will accelerate the profit margin of the food and beverages application segment of the market in the near future. Personal care and automotive segments are the important outlets that are projected to witness significant growth within the forecast period. The industrial and medical segment is expected to experience moderate growth in the next few years.

Recent Development

In November 2024, Amcor announced its planned $8.4 billion acquisition of Berry Global, a deal expected to finalize in mid-2025. The transaction will create a global leader in plastics and healthcare packaging, further solidifying Amcor’s position as a dominant market player.

In October 2023, Greif Inc., a U.S. manufacturer of industrial packaging products and services, acquired PACKCHEM Group SAS, a French manufacturer of small plastic containers and barrier & non-barrier jerrycans, for a transaction value of USD 538 billion, thereby enhancing its product portfolio through horizontal expansion.

Global Plastic Packaging Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Plastic Packaging Market Size Report |

| Market Size in 2023 | USD 384.76 Billion |

| Market Forecast in 2032 | USD 531.27 Billion |

| Growth Rate | CAGR of 3.65% |

| Number of Pages | 188 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Mondi Plc, Ampac Holdings LLC, Bemis Company, Inc., Ukrplastic Corporation, Amcor Ltd., Constantia Flexibles International GmbH, Wipak Group, Sealed Air Corporation, Huhtamaki Oyj, and Sonoco Products Company, amongst others. |

| Segments Covered | By Product ,By Application, By end-user, and By region |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Plastic Packaging Market: Regional Analysis

Regional segmentation covers all the major regions and countries such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Furthermore, it is segmented into major countries including the U.S., the UK, Germany, France, China, India, Japan, and Brazil. In terms of regions, the global plastic packaging market was dominated by the Asia Pacific in 2023. The emerging demand for plastic packaging especially from the food & beverages industry and personal care industry in China, India, Korea, Indonesia, and Thailand is expected to propel the growth of the market. The Asia Pacific was followed by North America and Europe in the same year. Moreover, Latin America and the Middle East & Africa are likely to experience a noteworthy growth of the market within the forecast period.

Global Plastic Packaging Market Players Analysis

Key industry participants analyzed and profiled in this study includes -

- Mondi Plc

- Ampac Holdings LLC

- Bemis Company

- Ukrplastic Corporation

- Amcor Ltd.

- Constantia Flexibles International GmbH

- Wipak Group

- Sealed Air Corporation

- Huhtamaki Oyj

- Sonoco Products Company

- amongst others.

The Global Plastic Packaging Market has been segmented as follows:

Plastic Packaging Market: Product Analysis

- Rigid

- Flexible

Plastic Packaging Market: Application Analysis

- Industrial

- Food & Beverages

- Automotive

- Personal Care

- Medical

- Others

Plastic Packaging Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

Methodology

FrequentlyAsked Questions

Plastic Packaging Market: Product Analysis- Rigid, Flexible

Plastic Packaging Market: Application Analysis- Industrial, Food & Beverages, Automotive, Personal Care, Medical, Others

compound annual growth rate (CAGR) of roughly 3.65% between 2024 and 2032.

is predicted to grow to around USD 531.27 Billion by 2032

The global Plastic Packaging Market size was worth around USD 384.76 Billion in 2023

Leading companies hold the market share in the Plastic Packaging market are Mondi Plc, Ampac Holdings LLC, Bemis Company, Inc., Ukrplastic Corporation, Amcor Ltd., Constantia Flexibles International GmbH, Wipak Group, Sealed Air Corporation, Huhtamaki Oyj, and Sonoco Products Company, amongst others.

Digitization and increased urbanization are driving rapid changes in consumer lifestyles, leading to higher demand for convenience and cost-saving products that can only be effectively delivered by flexible yet strong plastic packaging.

Regional segmentation covers all the major regions and countries such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Furthermore, it is segmented into major countries including the U.S., the UK, Germany, France, China, India, Japan, and Brazil.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed