Global Fire Alarm System Market Size, Share, Growth Analysis Report - Forecast 2034

Fire Alarm System Market By Technology (Addressable, Conventional), By Type (Manual Call-Points Alarms, Heat Detectors, Visual Alarms, Audible Alarms, Smoke Detectors, Carbon Monoxide Detectors, Multi-sensor Detectors), By Application (Residential, Industrial, Commercial), By Service (Installation & Design Services, Maintenance Services, Monitoring Services, Managed Services), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

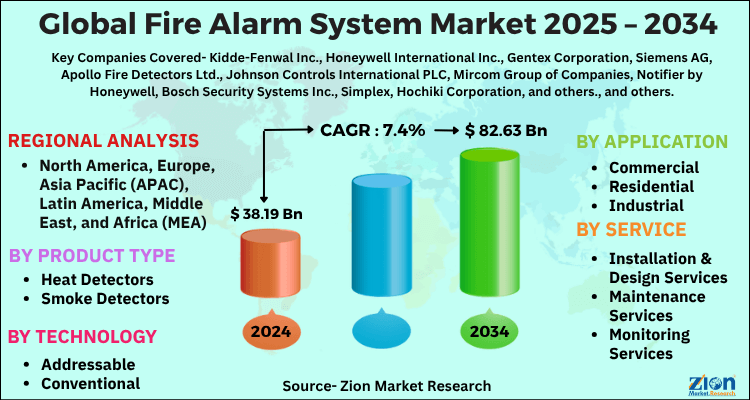

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 38.19 Billion | USD 82.63 Billion | 7.4% | 2024 |

Fire Alarm System Market: Industry Perspective

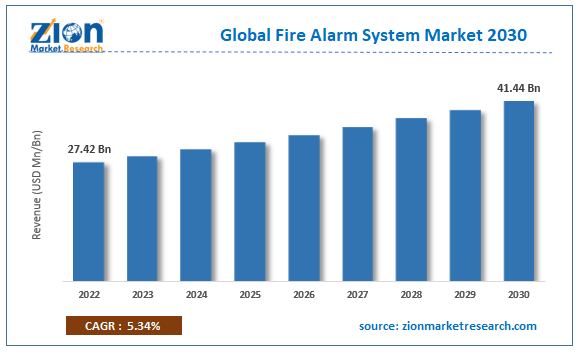

The global fire alarm system market size was worth around USD 38.19 Billion in 2024 and is predicted to grow to around USD 82.63 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.4% between 2025 and 2034. The report analyzes the global fire alarm system market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the fire alarm system industry.

Fire Alarm System Market: Overview

A fire alarm system is a warning device made of comprehensive units that allow people to look for safety covers to move to a safer location in the event of an emergency. The system uses audio and video signaling to alarm people about the possible outbreak of fire, carbon monoxide, or smoke that could lead to a life-threatening situation. Most fire alarm systems only detect smoke, fire, or carbon monoxide in the area as per their range and hence multiple fire alarms are used to cover a building including a residential, commercial, or industrial facility.

Modern fire alarms use additional techniques such as making a phone call or sending a voice message to ensure the safety of all the people in a building. There are several types of fire alarm systems available in the commercial market with each segment offering certain advantages over the other. For instance, conventional fire alarms may not provide the exact location of the fire, and further inspection is needed to ensure that the fire initiation point is covered. On the other hand, an automatic fire alarm needs the help of fire detectors and manual fire alarm systems have to be activated manually to inform the people in the vicinity. The fire alarm system industry is expected to grow at a steady rate during the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global fire alarm system market is estimated to grow annually at a CAGR of around 7.4% over the forecast period (2025-2034).

- Regarding revenue, the global fire alarm system market size was valued at around USD 38.19 Billion in 2024 and is projected to reach USD 82.63 Billion by 2034.

- The fire alarm system market is projected to grow at a significant rate due to Stringent fire safety regulations and rising awareness drive adoption in residential, commercial, and industrial buildings. Urbanization and smart building integration also contribute.

- Based on technology, the conventional segment is expected to lead the global market.

- On the basis of type, the manual call-points alarms segment is growing at a high rate and will continue to dominate the global market.

- Based on the application, the residential segment is projected to swipe the largest market share.

- By service, the installation & design services segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Fire Alarm System Market: Growth Drivers

Rising number of commercial buildings to drive market growth

The global fire alarm system market is projected to grow owing to the increasing number of commercial buildings across the globe. With rising globalization and inter-regional business transactions, more commercial centers are opening in several parts of the world. These units include facilities such as entertainment centers, theaters, corporate and industrial offices, malls, museums, state-of-the-art buildings for tourist attractions, and others. For instance, in March 2022, the United Arab Emirates (UAE) was reported to be investing in constructing Ciel Tower which is expected to be recorded as the world’s tallest stand-alone hotel with 365 meters in height. The country is a hub for international tourists as well as a large corporate headquarters. However, the construction of commercial centers with world-class facilities is not limited to one country only since all nations are steadily amping up their infrastructure investments to attract new businesses or tourists as both contribute significantly to the national economy.

Strict safety policies governing the use of safety alarms to create market demand

The demand and application of fire alarm systems will be further propelled by the existence of strict regulatory policies that govern the use of safety alarm systems in residential, commercial, and industrial centers. These policies have become more rigorous due to an increase in the number of fire incidents observed globally. Europe’s fire and rescue services attended nearly 620,758 incidents in 2022.

Fire Alarm System Market: Restraints

High cost of the system, installation, and maintenance may restrict the market growth

The global fire alarm system market growth may be restricted owing to the high cost of fire alarm systems. For instance, a 1-2 bedroom terraced house will require an alarm system powered by 6 batteries. Such a unit, on average, may cost between £250 to £600 or higher depending on several factors. Additionally, the expense associated with installing and maintaining fire alarm systems is equally high. As the inflation rate across the globe is rising rapidly, more people are limiting expenses and fire alarm systems may witness a dip in application during the forecast period.

Fire Alarm System Market: Opportunities

Rising technological innovation in fire alarm systems to create growth opportunities

Manufacturers of fire alarm systems have been investing in research and development to encompass the changing safety needs of modern housing. Additionally, these alarm systems are developed to not only improve their performance but also incorporate innovative ways to alarm people about a possible emergency. In August 2022, Honeywell, a leading player in the fire alarm system industry announced the launch of the Morley Max fire detection and alarm system, a high-performance and intelligent fire alarm control panel that offers user-friendliness. It comes with a 7-inch touchscreen panel and provides an ergonomic user interface (UI). In July 2023, the company launched the next version of the popular device and called it the Morley-IAS Max fire detection and alarm system. This is an indication of the increasing number of product verticals and rampant expansion of the existing verticals.

Some other developments with the highest innovation rate include the June 2023 launch of GridSolv Quantum by technology giant Wärtsilä. The launch is an energy storage system (ESS) and is claimed to be the most advanced fire alarm system currently available. It is also compliant with the NFPA 69 Standard laid down by the National Fire Protection Association (NFPA).

Fire Alarm System Market: Challenges

Product failure and late response time to challenge market growth

The fire alarm system industry expansion trajectory is challenged by several technical problems associated with the use of fire alarm systems. For instance, the device is vulnerable to failure due to wiring issues or internal system damage. There have been several incidents related to false alarms since other non-threatening factors can also trigger these systems including smoke released during cooking. In addition to this, the response time of certain variants such as manual fire alarm systems may be delayed leading to not enough time for occupants to leave the vicinity.

Fire Alarm System Market: Segmentation

The global fire alarm system market is segmented based on technology, type, application, service, and region.

Based on technology, the global market segments are conventional and addressable. In 2024, the highest demand was observed for addressable technology since it offers several advantages over its counterpart. The main benefit of the technology is that it provides unique identification to each unit allowing authorities to determine the exact area where fire or smoke is detected. Conventional technology divides fire alarms into zones and hence accurate fire location needs extensive investigation. China is known to have around 4000 skyscrapers.

Based on type, the global fire alarm system market is divided into manual call-points alarms, heat detectors, visual alarms, audible alarms, smoke detectors, carbon monoxide detectors, and multi-sensor detectors.

Based on application, the fire alarm system industry is segmented into residential, industrial, and commercial. In 2024, the highest revenue was generated by the commercial segment driven by the existence of several government laws and implementation policies requiring commercial centers to adhere to safety norms. Countries witnessing a rising investment in commercial sectors especially hotels, restaurants, corporate offices, and entertainment centers are launching new programs to ensure safety compliance. For instance, Spain has more than 19000 hotels and accommodation centers.

In terms of Service, the global fire alarm system market is categorized into installation & design services, maintenance services, monitoring services, managed services.

Fire Alarm System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fire Alarm System Market |

| Market Size in 2024 | USD 38.19 Billion |

| Market Forecast in 2034 | USD 82.63 Billion |

| Growth Rate | CAGR of 7.4% |

| Number of Pages | 226 |

| Key Companies Covered | Kidde-Fenwal Inc., Honeywell International Inc., Gentex Corporation, Siemens AG, Apollo Fire Detectors Ltd., Johnson Controls International PLC, Mircom Group of Companies, Notifier by Honeywell, Bosch Security Systems Inc., Simplex, Hochiki Corporation, and others., and others. |

| Segments Covered | By Product Type, By Technology, By Application, By Service, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fire Alarm System Market: Regional Analysis

North America to witness higher growth during the projected timeframe

The global fire alarm system market will witness the highest growth in North America mainly driven by the extensive use of fire alarm systems in the US and Canada regions. Nearly two-thirds of US homes are equipped with some variant of fire alarms. These countries have strict rules and governing guidelines that ensure fire safety in residential, commercial, and industrial centers. For instance, the US region is regulated by the Federal Fire Prevention and Control Act of 1974. It is also home to some of the pioneers in the field of fire alarm systems that are currently working toward adopting the latest technology to improve device performance. In March 2023, US-based Honeywell, a global leader in the fire and life safety industry, launched the NOTIFIER INSPIRE™ fire alarm system with Self-Test detectors. The launch has allowed Honeywell to digitize the firm alarm system market since the device offers higher protection along with efficient monitoring and scalability.

Fire Alarm System Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the fire alarm system market on a global and regional basis.

The global fire alarm system market is dominated by players like:

- Kidde-Fenwal Inc.

- Honeywell International Inc.

- Gentex Corporation

- Siemens AG

- Apollo Fire Detectors Ltd.

- Johnson Controls International PLC

- Mircom Group of Companies

- Notifier by Honeywell

- Bosch Security Systems Inc.

- Simplex

- Hochiki Corporation

The global fire alarm system market is segmented as follows:

By Technology

- Conventional

- Addressable

By Type

- Manual Call-Points Alarms

- Heat Detectors

- Visual Alarms

- Audible Alarms

- Smoke Detectors

- Carbon Monoxide Detectors

- Multi-sensor Detectors

By Application

- Residential

- Industrial

- Commercial

By Service

- Installation & Design Services

- Maintenance Services

- Monitoring Services

- Managed Services

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A fire alarm system is a warning device made of comprehensive units that allow people to look for safety covers to move to a safer location in the event of an emergency.

The global fire alarm system market is expected to grow due to Stringent fire safety regulations and rising awareness drive adoption in residential, commercial, and industrial buildings. Urbanization and smart building integration also contribute.

According to a study, the global fire alarm system market size was worth around USD 38.19 Billion in 2024 and is expected to reach USD 82.63 Billion by 2034.

The global fire alarm system market is expected to grow at a CAGR of 7.4% during the forecast period.

North America is expected to dominate the fire alarm system market over the forecast period.

Leading players in the global fire alarm system market include Kidde-Fenwal Inc., Honeywell International Inc., Gentex Corporation, Siemens AG, Apollo Fire Detectors Ltd., Johnson Controls International PLC, Mircom Group of Companies, Notifier by Honeywell, Bosch Security Systems Inc., Simplex, Hochiki Corporation, and others., among others.

The report explores crucial aspects of the fire alarm system market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed