Fermenters Market Size, Share, Trends, Growth & Forecast 2034

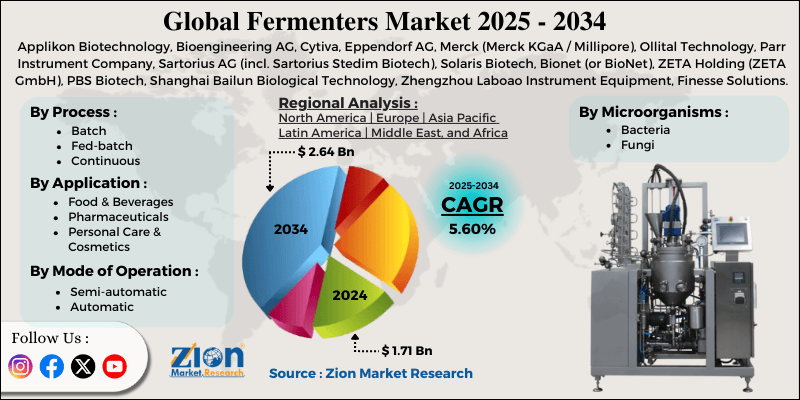

Fermenters Market By Process (Batch, Fed-batch, Continuous), By Microorganisms (Bacteria, Fungi, and Others), By Mode of Operation (Semi-automatic, Automatic), By Application (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

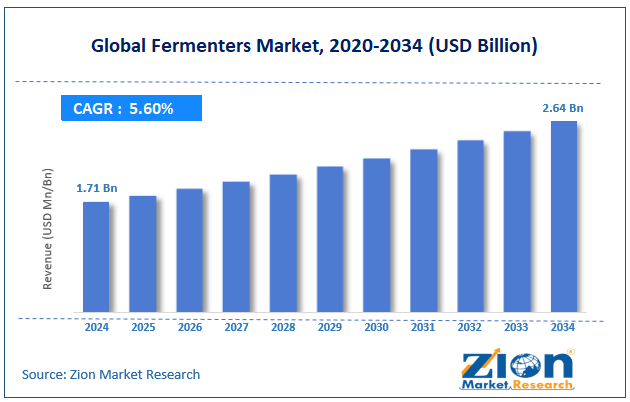

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.71 Billion | USD 2.64 Billion | 5.60% | 2024 |

Fermenters Industry Perspective:

What will be the size of the global fermenters market during the forecast period?

The global fermenters market size was around USD 1.71 billion in 2024 and is projected to reach USD 2.64 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.60% between 2025 and 2034.

Key Insights:

- Research projects the global fermenters market to grow at a 5.60% CAGR from 2025 to 2034.

- In 2024, the fermenters market was valued at USD 1.71 billion and is projected to reach USD 2.64 billion by 2034.

- The fermenters market is projected to grow significantly, driven by the expansion of biologics manufacturing, the rising adoption of single-use technologies, and the growing use of fermenters in food and beverage applications.

- Batch processes led by share; fed-batch will show strong growth.

- Among microorganisms, bacteria dominate, while fungi are projected to achieve significant revenue growth over the forecast period.

- The automatic segment dominates, while the semi-automatic segment is set for strong growth.

- Based on application, the pharmaceuticals segment is expected to lead the market, followed by the food & beverages segment.

- Asia Pacific is set to lead the global market, followed by North America.

Fermenters Market: Overview

Fermenters are specialized vessels used to grow cells or microorganisms under controlled conditions to produce beneficial products such as antibiotics, biofuels, fermented foods, and enzymes. They regulate factors such as pH, oxygen levels, nutrient supply, and temperature to optimize microbial yield and activity. The global fermenters market is projected to grow substantially, driven by increased biotechnology R&D, rising demand for fermented food and beverages, and the expansion of industrial biotechnology. Surging investments in biotechnology research in private companies and academic institutions are augmenting the global market. Fermenters are crucial tools for strain optimization, process development, and pilot-scale testing. Continuous innovation in biotech research sustains steady demand for bench-scale and laboratory fermenters.

Moreover, consumer interest in functional, probiotic, and fermented food products has increased worldwide. Food and beverage manufacturers rely on fermenters to promise consistent quality, flavor profiles, and safety. This trend fuels the adoption of fermentation equipment in industrial and artisanal production facilities. Furthermore, industrial sectors are largely using fermentation for producing enzymes, bio-based chemicals, and biofuels. Fermenters support sustainable manufacturing by allowing renewable substitutes to petroleum-based products. This widens the scope of application for fermenters beyond conventional pharmaceutical uses.

Although drivers exist, the global market faces challenges, including the technical complexity of operations and stringent regulatory requirements. Operating fermenters need strict process control and specialized knowledge. Minor deviations in parameters may lead to batch failure or affect product quality. This complexity surges training requirements and operational risks. Likewise, regulatory approval processes demand extensive validation and documentation of fermentation systems. Compliance can be costly and time-consuming for manufacturers. These difficulties slow down new installations and product introductions.

Even so, the global fermenters industry is well-positioned due to the growing adoption of single-use fermenters, personalized medicine, and small-batch production. Single-use fermenters are gaining prominence due to reduced validation and cleaning requirements. They improve operational flexibility and reduce contamination risk. This makes them particularly appealing for biopharmaceutical manufacturers. Additionally, the growth of personalized therapies surges demand for flexible fermentation solutions. Small-batch fermenters support high-precision, customized production. This trend offers fresh growth opportunities in specialized healthcare uses.

Fermenters Market: Dynamics

Growth Drivers

How is the adoption of single‑use and flexible fermentation technologies fueling the fermenters market?

Single-use fermenters are widely preferred for their lower contamination risk, faster batch changeovers, and reduced cleaning and validation downtime. These systems are mainly prominent among biotech startups, mid-sized companies focused on cost control and agility, and contract manufacturers. With a major share of fermenter installations now featuring disposable systems, the move towards flexible fermentation is transforming investment patterns. This trend also enhances technology adoption in developing regions.

How is the fermenters market driven by the growth in sustainable and bio‑based industrial applications?

Sustainability goals across industries are driving the use of fermenters for the production of bio-based chemicals, enzymes, biofuels, and alternative proteins. Companies are moving away from petrochemical processes to fermentation-derived materials, supporting the circular economy and net-zero objectives. Precision fermentation for plant and microbial proteins is gaining commercial popularity, thus creating new markets and revenue streams for fermenter suppliers. This broader industrial application supports long-term growth prospects, driving the fermenters market.

Restraints

The risk of contamination and batch failures negatively impacts market progress

Fermentation processes are highly sensitive to microbial contamination, as even minor intrusions can disrupt microbial growth, leading to batch failures and substantial product loss. Maintaining stringent aseptic conditions at an industrial scale is challenging and needs advanced sterilization, control systems, and monitoring. These precautions raise operational costs, insurance expenses, and risk premiums for manufacturers. Hence, contamination concerns remain a key limitation to effectively scaling up fermentation capacity.

Opportunities

How are we retrofitting legacy facilities with smart upgrades to create favorable conditions for the development of the fermenters market?

Several food processing and biomanufacturing plants have traditional fermenters with low monitoring and automation. Retrofitting these systems with IoT sensors, AI analytics, and advanced control software enhances efficacy and reduces downtime without full equipment replacement. Real-time data allows predictive maintenance, enhances yield consistency, and reduces batch failures. This trend enables facilities to modernize incrementally, extending asset life while remaining competitive. Equipment manufacturers offering retrofit solutions can capture a progressing secondary fermenters industry.

Challenges

Competitive pressure on pricing restricts the market growth

As fermenter technology becomes more standardized and new players enter the industry, price competition increases, and consumers demand high-performing systems at low prices, compressing profit margins for makers. Differentiation through service, automation, support, or custom design is steadily important. Global players face additional pressure from regional suppliers offering low-cost solutions. This competitive environment forces continuous innovation and operational efficiency to sustain industry share.

Fermenters Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fermenters Market |

| Market Size in 2024 | USD 1.71 Billion |

| Market Forecast in 2034 | USD2.64 Billion |

| Growth Rate | CAGR of 5.60% |

| Number of Pages | 216 |

| Key Companies Covered | Applikon Biotechnology, Bioengineering AG, Cytiva, Eppendorf AG, Merck (Merck KGaA / Millipore), Ollital Technology, Parr Instrument Company, Sartorius AG (incl. Sartorius Stedim Biotech), Solaris Biotech, Bionet (or BioNet), ZETA Holding (ZETA GmbH), PBS Biotech, Shanghai Bailun Biological Technology, Zhengzhou Laboao Instrument Equipment (LABAO), Finesse Solutions, and others. |

| Segments Covered | By Process, By Microorganisms, By Mode of Operation, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fermenters Market: Segmentation

The global market is segmented by process, microorganisms, mode of operation, application, and region.

Based on process, the global fermenters industry is divided into batch, fed-batch, and continuous. The batch fermentation segment registers nearly 40% of the total market, while fed-batch and continuous processes account for the remaining share. Batch fermentation is widely used for its flexibility, simplicity, and suitability for both large- and small-scale production, making it common in the food, pharmaceutical, and beverage industries, where precise control over product quality is vital.

On the other hand, the fed-batch segment holds 45% of the total market, compared to the batch segment. This method enables higher product yield and greater control over nutrient supply than the simple batch process. It is widely used in biopharmaceuticals to produce monoclonal antibodies, recombinant proteins, and vaccines.

Based on microorganisms, the global market is segmented into bacteria, fungi, and others. The bacteria segment dominates with 60% of the market share, firmly establishing it as the leading segment. Bacteria are relied upon for industrial and pharmaceutical applications, including the production of enzymes, antibiotics, biofuels, and probiotics. Their rapid growth rates and comparatively simple nutrient requirements enable large-scale fermentation, supporting their top position in the market.

Conversely, the fungi segment ranks second with 46% of the market share. While crucial for producing organic acids, antibiotics, alcoholic beverages, and specific enzymes, fungi lag behind bacteria because their growth and production processes are typically slower and more challenging. This limitation contributes to their second-place ranking in the market compared to the faster-growing bacterial systems.

Based on mode of operation, the global fermenters market is segmented into semi-automatic and automatic. The automatic fermenters segment leads with 65% of the total market. They are widely used in biotechnology, pharmaceuticals, and large-scale industrial fermentation due to their ability to accurately control temperature, aeration, pH, and nutrient supply. Automation reduces human error, enables 24/7 operations, and enhances reproducibility, making it the industry's dominant choice.

However, the semi-automatic fermenters segment captures 40% market share. These systems offer partial control over process parameters and need human intervention for some operations. While less expensive and suitable for small labs or pilot-scale setups, they are less efficient and slower than fully automatic systems, ranking them second in the market.

Based on application, the global market is segmented into food & beverages, pharmaceuticals, personal care & cosmetics, and others. The pharmaceuticals segment accounts for 50% of the market share, as fermenters are important for producing monoclonal antibodies, vaccines, and recombinant proteins. The high value of these products, along with stringent regulatory requirements for scalability and quality, is driving the leading share of the market towards pharmaceutical applications.

Nonetheless, the food & beverages segment accounts for 35% share, as fermenters are widely used to produce fermented foods, enzymes, probiotics, and alcoholic beverages. While significant in volume, the segment usually comprises low-value products and less stringent automation than pharmaceuticals, ranking it second.

Fermenters Market: Regional Analysis

What gives the Asia Pacific a competitive edge in the global Fermenters Market?

Asia Pacific is likely to sustain its leadership in the fermenters market, with an 8.5% CAGR, driven by large market share, rapid growth, expanding biotechnology and biopharmaceutical production, and surging food and beverage fermentation activities. APAC holds the leading share of the global market owing to its broader pharmaceutical and industrial fermentation activities. Expanding manufacturing capacity and speedy economic growth fuel strong regional demand. The market continues to grow faster than others, strengthening its dominance.

Moreover, the region has seen an increase in biotech and biopharmaceutical facilities producing vaccines, biologics, and enzymes. Increasing investments in cell-based and microbial fermentation back this growth. This expansion creates consistent demand for advanced fermenters in multiple sectors. Furthermore, growing populations and increasing spending power are driving the consumption of probiotic products and fermented foods. Industrial food and beverage manufacturers are steadily adopting fermenters to meet production and quality requirements. This trend majorly contributes to the regional dominance.

North America continues to hold the second-highest share, with a 7.9% CAGR in the fermenters industry, owing to a strong biopharmaceutical manufacturing base, an advanced research and development ecosystem, and high adoption of smart technologies and automation. North America has a well-developed biopharmaceutical industry, with extensive production of biologics, therapeutic proteins, and vaccines. This fuels a remarkable demand for high-performance fermenters to support large-scale, regulated manufacturing. The presence of leading global pharmaceutical companies helps maintain steady fermenter investment. The region’s strong R&D infrastructure, comprising biotech companies and leading academic institutions, drives continuous innovation in fermentation technologies. Fermenters are largely used in early-stage research, pilot production, and process development. This strong research focus sustains ongoing demand in scales.

Additionally, North American facilities prioritize fully automatic and digitally integrated fermenters to improve process efficiency and control. Advanced automation enhances reproducibility and reduces error in regulated environments. This technological dominance backs market growth and value.

Fermenters Market: Competitive Analysis

The leading players in the global fermenters market are:

- Applikon Biotechnology

- Bioengineering AG

- Cytiva

- Eppendorf AG

- Merck (Merck KGaA / Millipore)

- Ollital Technology

- Parr Instrument Company

- Sartorius AG (incl. Sartorius Stedim Biotech)

- Solaris Biotech

- Bionet (or BioNet)

- ZETA Holding (ZETA GmbH)

- PBS Biotech

- Shanghai Bailun Biological Technology

- Zhengzhou Laboao Instrument Equipment (LABAO)

- Finesse Solutions

What are the key trends in the global Fermenters Market?

Integration of automation and digital technologies:

Fermenters are now equipped with advanced automation, digital control systems, and sensors to improve process precision and reproducibility. Real-time data analytics, IoT applications, and AI are widely used to optimize conditions such as temperature, pH, and nutrient delivery for improved production. This digital shift reduces manual intervention, boosts efficacy, and supports strict quality control standards.

Customization and modular fermentation solutions:

Customizable, modular fermenter designs are gaining prominence as manufacturers seek systems that meet specific production needs and space constraints. These plug-and-play solutions enable easy capacity scaling without overhauling the entire facility. Their flexibility is majorly appealing to mid- and small-sized biotech companies and emerging industrial fermentation users.

The global fermenters market is segmented as follows:

By Process

- Batch

- Fed-batch

- Continuous

By Microorganisms

- Bacteria

- Fungi

- Others

By Mode of Operation

- Semi-automatic

- Automatic

By Application

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed