Biopharmaceutical Excipients Market Size, Share, Growth Analysis, Forecast Report 2024-2032

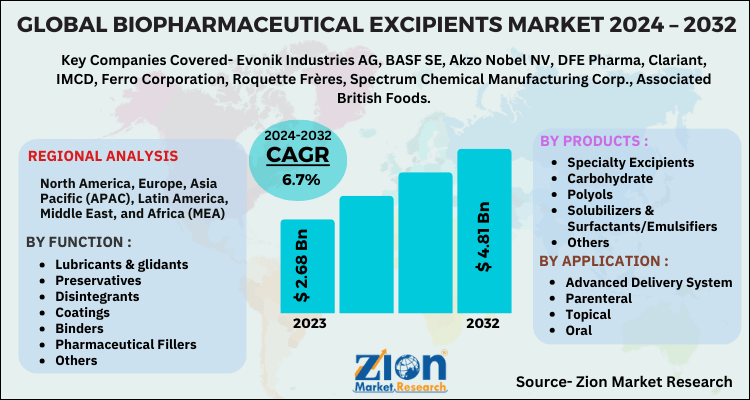

Biopharmaceutical Excipients Market By Products (Specialty Excipients, Carbohydrates, Polyols, Solubilizers & Surfactants/Emulsifiers, and Others), By Function (lubricants & glidants, Preservatives, Disintegrants, Coatings, Binders, Pharmaceutical Fillers, and Others), By Application (Advanced Delivery System, Parenteral, Topical, and Oral): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

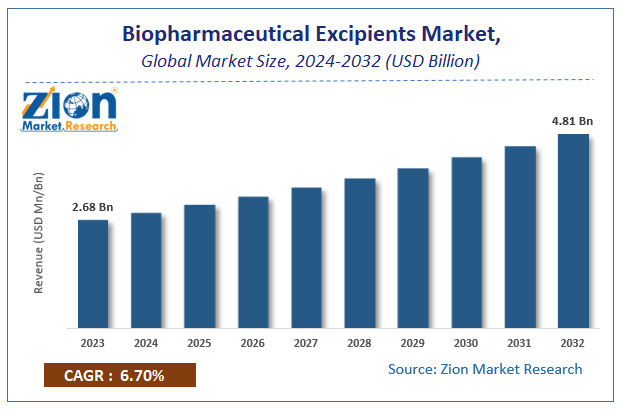

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.68 Billion | USD 4.81 Billion | 6.7% | 2023 |

Biopharmaceutical Excipients Market Insights

According to Zion Market Research, the global Biopharmaceutical Excipients Market was worth USD 2.68 Billion in 2023. The market is forecast to reach USD 4.81 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.7% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Biopharmaceutical Excipients Market industry over the next decade.

Market Overview

Biopharmaceutical excipients are macromolecular or cellular materials that are used in medicinal products such as blood and other genetically modified products. There are inert compounds that are mainly used as a carrier and do not have any therapeutic properties. To achieve the needed formulations, these are combined with other active pharmaceutical materials. It also increases the product's shelf life.

Since biopharmaceuticals are very unstable molecules, they must be used with precision and care to obtain the necessary combination of excipients in order to enhance the combination's stability. They are used to change the colour, taste, binding capacity, elegancy, and release rate of active pharmaceutical ingredients, among other things. Emulsifier agents, diluent excipients, co-processed excipients, carrier agents, binding agents, and other stabilising substances are all widely used.

COVID-19 Impact Analysis

The outbreak of an infectious disease that caused a severe respiratory problem resulted in a surge in demand for macromolecules for treatment. The rising demand for these macromolecules necessitates biopharmaceutical excipients to improve stability and shelf life, which is expected to aid market growth in the near future.

The pandemic has prompted major players to focus their efforts on developing genetically modified molecules for improved care of Covid-19 patients, which is expected to increase the use of pharmaceutical excipients in the immediate future.

Growth Factors

The major growth factors of Biopharmaceutical Excipients Market are: Supreme Properties of Biopharmaceutical Excipients, in recent years, the global demand for biopharmaceutical excipients has drawn substantial revenues. The capacity of biopharmaceutical excipients to have a degree of stability has been a major factor in the former's success. The presence of a unified pharmaceutical manufacturing industry is another development that has boosted the global market's growth trajectory.

Need for Improved Drug Delivery, the medical community has been emphasising the importance of developing new and improved drug lines. Biopharmaceutical excipients may be used to boost drug lines because they help to enhance the action of drugs. As a result, the global biopharmaceutical excipients market is expected to reach new heights in the coming years.

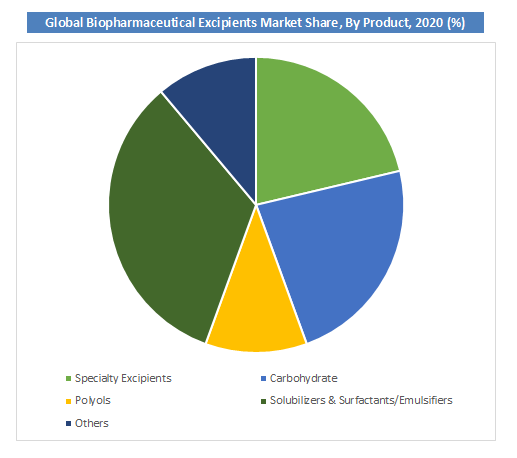

Product Type Segment Analysis

Products Type segment are Specialty Excipients, Carbohydrates, Polyols, Solubilizers & Surfactants/Emulsifiers, and Others. Carbohydrate-based excipient products dominated the market, and this trend is expected to continue during the forecast period. The dominance of the segment can be traced to the widespread use of starch, sucrose, and dextrose in different drug formulations. In addition, the growing use of carbohydrates as bulking agents in the lyophilization of biomolecules like proteins is fuelling segment development.

Function Segment Analysis

Pharmaceutical excipients are classified as fillers & diluents, binders, suspending & viscosity agents, flavouring agents & sweeteners, coating agents, colourants, disintegrants, lubricants & glidants, preservatives, emulsifying agents, and other functionalities, depending on their functionality. Fillers and diluents had the largest share of the market in 2020, based on functionality. As fillers and diluents are used in the production of tablets and capsules, there is a strong demand for them.

Biopharmaceutical Excipients Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Biopharmaceutical Excipients Market |

| Market Size in 2023 | USD 2.68 Billion |

| Market Forecast in 2032 | USD 4.81 Billion |

| Growth Rate | CAGR of 6.7% |

| Number of Pages | 130 |

| Key Companies Covered | Evonik Industries AG, BASF SE, Akzo Nobel NV, DFE Pharma, Clariant, IMCD, Ferro Corporation, Roquette Frères, Spectrum Chemical Manufacturing Corp., Associated British Foods |

| Segments Covered | By Products, By Function, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

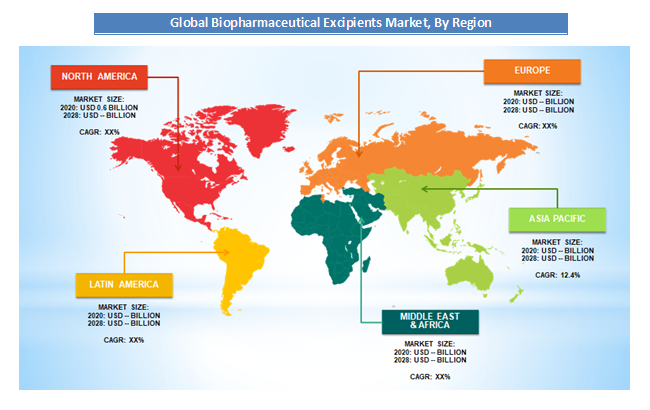

Regional Segment Analysis

North America had the largest market share of 31.2% in 2020, thanks to a number of factors including the involvement of major players, increased opioid production, and a massive population base. Collaborations are taking place in this area to establish biopharmaceutical excipients. For example, ReForm Biologics LLC and MilliporeSigma collaborated in February 2020 to commercialise the company's proprietary excipients used in biotherapeutic formulations. MilliporeSigma will finance R&D and commercialise ReForm Biologics' excipients for drug production under the terms of the collaboration.

The Asia Pacific region is projected to grow at a CAGR of 12.4% over the forecast period. Due to the disease incidences and the need for low-cost drugs, Asia Pacific is the fastest-growing area in the global biopharmaceutical excipients market. This is particularly true in countries like India and China. Several regions are undergoing expansion plans in order to increase manufacturing capacity and quickly scale up drug development standards. China, India, and South Korea, for example, are heavily involved in the production of biosimilars in this area. Affordability, a favourable regulatory environment, cost advantages, and the existence of a vast population base are all factors for the widespread production of biosimilars.

Key Market Players & Competitive Landscape

Some of key players in automated sortation system market are

- Evonik Industries AG

- BASF SE

- Akzo Nobel NV

- DFE Pharma

- Clariant

- IMCD

- Ferro Corporation

- Roquette Frères

- Spectrum Chemical Manufacturing Corp.

- Associated British Foods

The global Biopharmaceutical Excipients market is segmented as follows:

By Products

- Specialty Excipients

- Carbohydrate

- Polyols

- Solubilizers & Surfactants/Emulsifiers

- Others

By Function

- Lubricants & glidants

- Preservatives

- Disintegrants

- Coatings

- Binders

- Pharmaceutical Fillers

- Others

By Application

- Advanced Delivery System

- Parenteral

- Topical

- Oral

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Biopharmaceutical Excipients Market size is set to expand from $ 2.68 Billion in 2023

Biopharmaceutical Excipients Market size is set to expand from $ 2.68 Billion in 2023 to $ 4.81 Billion by 2032, with an CAGR of around 6.7% from 2024 to 2032.

Some of the key factors driving the global Biopharmaceutical Excipients market growth are Supreme Properties of Biopharmaceutical Excipients and Need for Improved Drug Delivery.

North America region held a substantial share of the Biopharmaceutical Excipients market in 2020. Asia Pacific is the fastest-growing area in the global biopharmaceutical excipients market. Several regions are undergoing expansion plans in order to increase manufacturing capacity and quickly scale up drug development standards. China, India, and South Korea, for example, are heavily involved in the production of biosimilars in this area.

Some of the major companies operating in the Biopharmaceutical Excipients market are Evonik Industries AG, BASF SE, Akzo Nobel NV, DFE Pharma, Clariant, IMCD, Ferro Corporation, Roquette Frères, Spectrum Chemical Manufacturing Corp., Associated British Foods, among others.

List of Contents

Market InsightsMarket OverviewCOVID-19 Impact AnalysisGrowth FactorsProduct Type Segment AnalysisFunction Segment AnalysisReport ScopeRegional Segment AnalysisKey Market Players Competitive LandscapeThe global market is segmented as follows:By Products By FunctionBy ApplicationBy RegionRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed