High-Performance Adhesives Market Size, Share, Trends, Growth 2034

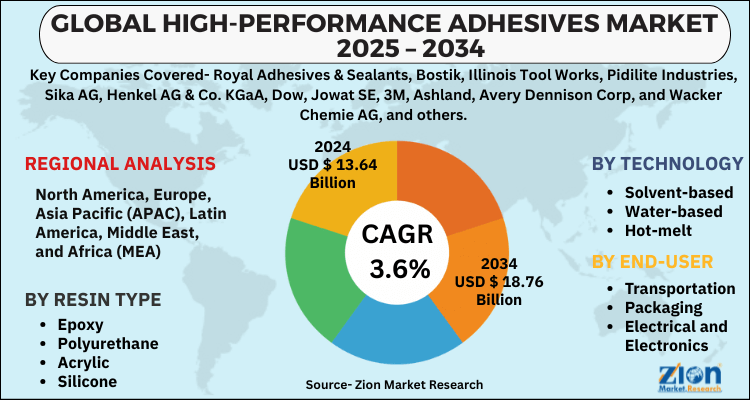

High-Performance Adhesives Market By Resin Type (Epoxy, Polyurethane, Acrylic, Silicone, and Other Resin Types), By Technology Type (Solvent-based, Water-based, Hot-melt, and UV Curable), By End-user Industry (Transportation, Packaging, Electrical & Electronics, Building & Construction, Healthcare, and Other End-user Industries), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

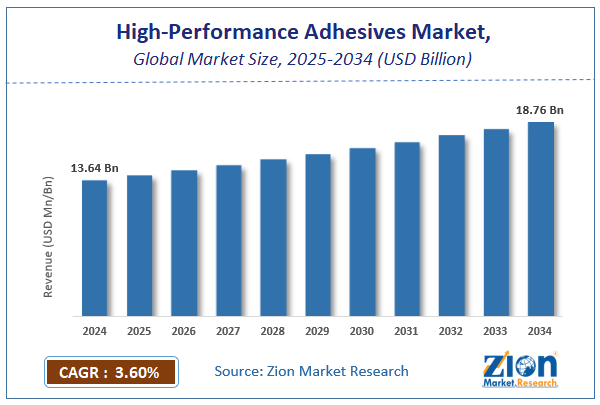

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 13.64 Billion | USD 18.76 Billion | 3.6% | 2024 |

High-Performance Adhesives Industry Perspective:

The global high-performance adhesives market size was worth around USD 13.64 Billion in 2024 and is predicted to grow to around USD 18.76 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 3.6% between 2025 and 2034. The report analyzes the global high-performance adhesives market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the high-performance adhesives industry.

High-Performance Adhesives Market: Overview

Adhesive bonding methods have reduced the time and cost of joining automobile components, lowering total weight and fuel consumption while increasing efficiency. Rising federal and state regulations on carbon emissions are expected to augment product uses in the automobile industry.

The low curing time, high thermal resistance, good adhesion, more chemical tolerance, elasticity, and excellent water resistance are key factors driving the global high-performance adhesives market forward. Low costs, flexibility, solvent-free, high fatigue, less vibration, and thermal shock bearing, as well as reduced waste and high productivity, have all contributed to the product's increased use in the automobile industry. Traditional elements like fasteners used in dashboards, doors, roof panels, and deck lid flanges, as well as other car parts, are being largely replaced by the product.

Key Insights

- As per the analysis shared by our research analyst, the global high-performance adhesives market is estimated to grow annually at a CAGR of around 3.6% over the forecast period (2025-2034).

- Regarding revenue, the global high-performance adhesives market size was valued at around USD 13.64 Billion in 2024 and is projected to reach USD 18.76 Billion by 2034.

- The high-performance adhesives market is projected to grow at a significant rate due to growing demand in industries such as automotive, aerospace, electronics, and construction, advancements in adhesive technologies, increasing need for durable and efficient bonding solutions, and the rising trend towards lightweight and energy-efficient ma.

- Based on Resin Type, the Epoxy segment is expected to lead the global market.

- On the basis of Technology Type, the Solvent-based segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-user Industry, the Transportation segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

To know more about this report, request a sample copy.

High-Performance Adhesives Market: Growth Drivers

Increasing demand from several end-use industries is likely to drive market growth.

Over the next several years, the market is expected to grow at a rapid pace due to increased demand from the packaging industry and the growing automobile segment, primarily in emerging markets. The market is expected to expand in the future due to rising packaging demands from various end-use industries such as pharmaceuticals, food & beverages, and cosmetics. Over the next several years, the product is expected to be driven by the expansion of the e-commerce commodities call, in which packaging is a big element.

Polyols, vinyl acetate monomer, toluene, diisocyanate, and other crude oil derivatives are widely employed in the production of industrial adhesive raw materials. The global healthcare industry has been driven by a growing population, an increasing frequency of chronic illnesses, and important technological advancements. Furthermore, increased healthcare expenditures in developing nations are expected to increase the demand for medical equipment. Global population growth, along with an increase in severe illnesses and technological improvements, is increasing the high-performance adhesives industry.

High-Performance Adhesives Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | High-Performance Adhesives Market |

| Market Size in 2024 | USD 13.64 Billion |

| Market Forecast in 2034 | USD 18.76 Billion |

| Growth Rate | CAGR of 3.6% |

| Number of Pages | 150 |

| Key Companies Covered | Royal Adhesives & Sealants, Bostik, Illinois Tool Works, Pidilite Industries, Sika AG, Henkel AG & Co. KGaA, Dow, Jowat SE, 3M, Ashland, Avery Dennison Corp, and Wacker Chemie AG, and others. |

| Segments Covered | By Resin Type, By Technology Type, By End-user Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

High-Performance Adhesives Market: Restraints

Fluctuations in raw material prices may hinder the market growth.

Crude oil prices play a crucial role in the manufacturing of high-performance adhesives. However, crude oil prices fluctuated due to several reasons in the past few years. The major factors played by the COVID-19 pandemic, along with those present conflicts between European nations and supply gaps from the Middle East region are primarily affecting the fluctuations in crude oil prices. The changes in the cost of crude oil negatively affect the raw material prices, hence resulting in high pricing of the product. This is probable to hamper the global high-performance adhesives market expansion over the future years.

High-Performance Adhesives Market: Opportunities

Increasing demand from the healthcare and aerospace sector is likely to offer better growth opportunities for the market growth.

High-performance adhesives have exceptional physical and mechanical qualities, making them ideal for use in elevated medical and aerospace applications. During the forecast period, strong demand from the aerospace and healthcare industries is expected to be a significant driver of the global market for high-performance adhesives. During the projected period, both of these end-user industrial categories are expected to increase rapidly. Furthermore, high-performance adhesives are used in both skin and non-skin areas in the medical industry.

Owing to this, the medical section of the global high-performance adhesives market is expected to grow rapidly, thanks to an aging population and a growing focus on advanced healthcare treatments. The market for high-performance adhesives has a lot of room to grow owing to advances in the medical industry. The rising healthcare business is hence estimated to drive the industry for high-performance adhesives in the future years.

High-Performance Adhesives Market: Challenges.

Incompatibility with specific packaging applications poses a major challenge to market growth.

Since several adhesive manufacturers promise that their materials are suited for food packaging applications, the adhesive may merely fulfill the package's physical performance criteria without being evaluated for the application. Contamination caused by the use of untested adhesives in packaging and labeling can result in significant unfavorable media attention, litigation, long-term public condemnation, and irreversible harm to brand reputation. These factors affect the use of high-performance adhesives in many food packaging applications.

High-Performance Adhesives Market: Segmentation

The global high-performance adhesives market is categorized into resign type, technology, end-user, and region. Based on resin type, the market is fragmented into epoxy, polyurethane, acrylic, silicone, and others. The technology type segment of the market is bifurcated into solvent-based, hot-melt, water-based, and UV curable. The end-user segment is divided into transportation, packaging, healthcare, building & construction, electrical & electronics, and others.

Recent Developments

- In March 2022, Conagen, a biotechnology company, announced the discovery of highly sought-after dependable hot melt adhesives built from high-performance polymers derived from natural and sustainable biomolecules.

- Sept 2021, Weir Minerals, the maker of Linatex, the world's most popular premium natural rubber, has teamed up with Henkel, the world's largest adhesive maker, and its team of LOCTITE sealant, adhesive, and coating experts to develop a mining industry-first solvent-free adhesive for rubber liner applications that emits no volatile organic compounds.

High-Performance Adhesives Market: Regional Landscape

Asia Pacific to lead the global market growth during the forecast period.

Asia Pacific is the most extensive and fastest-growing regional market for high-performance adhesives. The growing usage of these adhesives in the transportation, construction, and medical end-use industries is expected to provide new growth prospects for the market. Furthermore, due to increased technical & infrastructural improvements and customer awareness in the area, Asia-Pacific accounts for a considerable portion of the global high-performance adhesives market.

Research laboratories and manufacturers are collaborating to develop long-lasting, low-cost, high-performance adhesives and to improve the characteristics of these adhesives for end-user enterprises. Moreover, rapid economic growth, manufacturing business development, low-cost labor availability, expanding end-use markets, and the global movement of manufacturing facilities from developed to developing countries are some of the biggest aspects propelling the high-performance adhesives market in the Asia Pacific.

High-Performance Adhesives Market: Competitive Landscape

Some of the major players operating in the global high-performance adhesives market include

- Royal Adhesives & Sealants

- Bostik

- Illinois Tool Works

- Pidilite Industries

- Sika AG

- Henkel AG & Co. KGaA

- Dow and 3M

- Jowat SE

- Ashland

- Avery Dennison Corp

- and Wacker Chemie AG.

The global high-performance adhesives market is segmented as follows:

By Resin Type

- Epoxy

- Polyurethane

- Acrylic

- Silicone

- Resin Types

By Technology

- Solvent-based

- Water-based

- Hot-melt

- UV Curable

By End User

- Transportation

- Packaging

- Electrical and Electronics

- Building and Construction

- Healthcare

- Other

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global high-performance adhesives market is expected to grow due to increasing demand from various end-use industries like automotive, aerospace, construction, and electronics, which require strong, durable, and reliable bonding solutions.

According to a study, the global high-performance adhesives market size was worth around USD 13.64 Billion in 2024 and is expected to reach USD 18.76 Billion by 2034.

The global high-performance adhesives market is expected to grow at a CAGR of 3.6% during the forecast period.

Asia-Pacific is expected to dominate the high-performance adhesives market over the forecast period.

Leading players in the global high-performance adhesives market include Royal Adhesives & Sealants, Bostik, Illinois Tool Works, Pidilite Industries, Sika AG, Henkel AG & Co. KGaA, Dow, Jowat SE, 3M, Ashland, Avery Dennison Corp, and Wacker Chemie AG, among others.

The report explores crucial aspects of the high-performance adhesives market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

List of Contents

Industry Perspective:OverviewKey InsightsGrowth DriversIncreasing demand from several end-use industries is likely to drive market growth.Report Scope RestraintsFluctuations in raw material prices may hinder the market growth.OpportunitiesIncreasing demand from the healthcare and aerospace sector is likely to offer better growth opportunities for the market growth.Challenges.Incompatibility with specific packaging applications poses a major challenge to market growth.SegmentationRecent DevelopmentsRegional LandscapeAsia Pacific to lead the global market growth during the forecast period. Competitive Landscape The global high-performance adhesives market is segmented as follows:By Resin TypeBy TechnologyBy End UserBy RegionRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed