Global Industrial Adhesives Market Size, Share, Growth Analysis Report - Forecast 2034

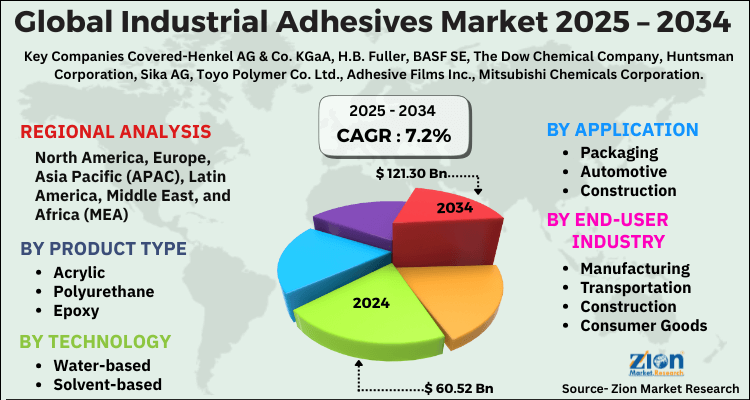

Global Industrial Adhesives Market By Product Type (Acrylic, Polyurethane, Epoxy, EVA, Silicone, Others), By Technology (Water-based, Solvent-based, Hot-melt, Reactive & Others), By Application (Packaging, Automotive, Construction, Woodworking, Electronics, Footwear & Leather, Healthcare), By End-user Industry (Manufacturing, Transportation, Construction, Consumer Goods, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

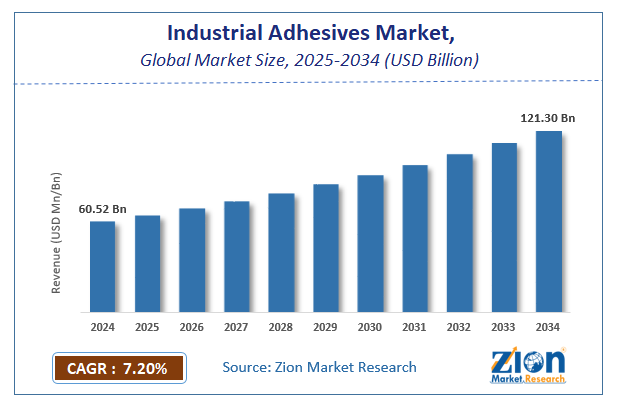

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 60.52 Billion | USD 121.30 Billion | 7.2% | 2024 |

Global Industrial Adhesives Market: Industry Perspective

The global industrial adhesives market size was worth around USD 60.52 Billion in 2024 and is predicted to grow to around USD 121.30 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.2% between 2025 and 2034.

The report analyzes the global industrial adhesives market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the industrial adhesives industry.

Global Industrial Adhesives Market: Overview

One of the major growth drivers for the Global Industrial Adhesives Market is increasing demand for adhesives from the building & construction industry. Residential development is being driven by population growth and urbanization in developing countries such as China, India, Indonesia etc. In these countries, there is a growing need for permanent housing, which is driving demand for adhesives. Adhesives are used in a variety of building uses, including carpet, tiling, wallpapers, and external insulation systems. As a result, the construction industry's growing demand for adhesives is a major market driver.

Another factor for the growth in this market is Growth in the Packaging, Woodworking & Transportation Market. Over the forecasted timeframe, increasing packaging demand from various end-use industries such as healthcare, food & beverages, and cosmetics is expected to drive market growth. Over the next few years, the market for industrial adhesives is expected to be driven by the growth in e-commerce commodities demand, which requires packaging.

Key Insights

- As per the analysis shared by our research analyst, the global industrial adhesives market is estimated to grow annually at a CAGR of around 7.2% over the forecast period (2025-2034).

- Regarding revenue, the global industrial adhesives market size was valued at around USD 60.52 Billion in 2024 and is projected to reach USD 121.30 Billion by 2034.

- The industrial adhesives market is projected to grow at a significant rate due to Growth in automotive, construction, and packaging industries fuels demand. Shift toward sustainable, high-performance adhesives is a key trend.

- Based on Product Type, the Acrylic segment is expected to lead the global market.

- On the basis of Technology, the Water-based segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Packaging segment is projected to swipe the largest market share.

- By End-user Industry, the Manufacturing segment is expected to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Global Industrial Adhesives Market: Segmentation Analysis

The global industrial adhesives market is segmented based on Product Type, Technology, Application, End-user Industry, and region.

Based on Product Type, the global industrial adhesives market is divided into Acrylic, Polyurethane, Epoxy, EVA, Silicone, Others.

On the basis of Technology, the global industrial adhesives market is bifurcated into Water-based, Solvent-based, Hot-melt, Reactive & Others.

By Application, the global industrial adhesives market is split into Packaging, Automotive, Construction, Woodworking, Electronics, Footwear & Leather, Healthcare.

In terms of End-user Industry, the global industrial adhesives market is categorized into Manufacturing, Transportation, Construction, Consumer Goods, Others.

Global Industrial Adhesives Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Global Industrial Adhesives Market |

| Market Size in 2024 | USD 60.52 Billion |

| Market Forecast in 2034 | USD 121.30 Billion |

| Growth Rate | CAGR of 7.2% |

| Number of Pages | 140 |

| Key Companies Covered | Henkel AG & Co. KGaA, H.B. Fuller, BASF SE, The Dow Chemical Company, Huntsman Corporation, Sika AG, Toyo Polymer Co. Ltd., Adhesive Films Inc., Mitsubishi Chemicals Corporation, and Hitachi Chemical Company Ltd., and others. |

| Segments Covered | By Product Type, By Technology, By Application, By End-user Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Industrial Adhesives Market: Regional Analysis

In 2020, Asia Pacific was the leading region, accounting for 8.9% CAGR. Due to low labour costs and friendly government legislation, major automobile firms have relocated their manufacturing operations to China, India, Thailand, and Vietnam. Over the next seven years, rising per capita income among the middle class in countries like China and India is expected to boost vehicle sales. In the coming years, these trends are likely to fuel product demand.

In North America, growing demand from the packaging industry is projected to remain a core driver of business growth over the forecast period. The growth of the packaging industry, which absorbs a vast number of industrial adhesives, is responsible for changes in customer tastes toward simplicity, expanded shelf life, quick-serve, and portability of goods. This will almost certainly propel business demand in the coming years.

Global Industrial Adhesives Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the industrial adhesives market on a global and regional basis.

The global industrial adhesives market is dominated by players like:

- Henkel AG & Co. KGaA

- H.B. Fuller

- BASF SE

- The Dow Chemical Company

- Huntsman Corporation

- Sika AG

- Toyo Polymer Co. Ltd.

- Adhesive Films Inc.

- Mitsubishi Chemicals Corporation

- and Hitachi Chemical Company Ltd.

The global industrial adhesives market is segmented as follows;

By Product Type

- Acrylic

- Polyurethane

- Epoxy

- EVA

- Silicone

- Others

By Technology

- Water-based

- Solvent-based

- Hot-melt

- Reactive & Others

By Application

- Packaging

- Automotive

- Construction

- Woodworking

- Electronics

- Footwear & Leather

- Healthcare

By End-user Industry

- Manufacturing

- Transportation

- Construction

- Consumer Goods

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global industrial adhesives market is expected to grow due to Growth in automotive, construction, and packaging industries fuels demand. Shift toward sustainable, high-performance adhesives is a key trend.

According to a study, the global industrial adhesives market size was worth around USD 60.52 Billion in 2024 and is expected to reach USD 121.30 Billion by 2034.

The global industrial adhesives market is expected to grow at a CAGR of 7.2% during the forecast period.

Asia-Pacific is expected to dominate the industrial adhesives market over the forecast period.

Leading players in the global industrial adhesives market include Henkel AG & Co. KGaA, H.B. Fuller, BASF SE, The Dow Chemical Company, Huntsman Corporation, Sika AG, Toyo Polymer Co. Ltd., Adhesive Films Inc., Mitsubishi Chemicals Corporation, and Hitachi Chemical Company Ltd., among others.

The report explores crucial aspects of the industrial adhesives market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed