Distributed Ledger Market Trend, Share, Growth, Size, Analysis and Forecast 2032

Distributed Ledger Market Analysis By Component (Software, Hardware, and Services), By Technology (Holochain, Hashgraph, Blockchain, and Others), By End-User Industry (Media & Entertainment, Manufacturing, Government & Public, Energy & Utilities, BFSI, Healthcare, and Others), By Application (Compliance Management, Smart Contracts, Payment Gateway, Trade Finance, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

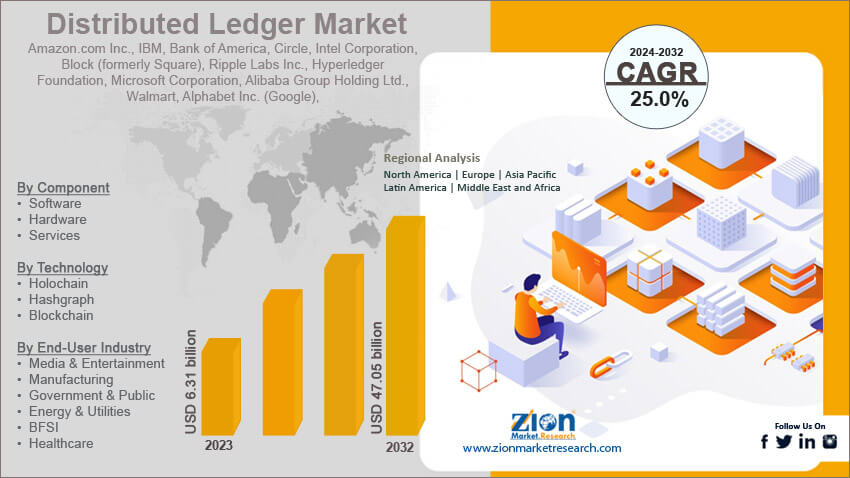

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.31 billion | USD 47.05 billion | 25% | 2023 |

Distributed Ledger Industry Perspective:

The global distributed ledger market size was worth around USD 6.31 billion in 2023 and is predicted to grow to around USD 47.05 billion by 2032 with a compound annual growth rate (CAGR) of roughly 25.00% between 2024 and 2032.

Distributed Ledger Market: Overview

A distributed ledger is defined as a database that is voluntarily synchronized and shared across multiple platforms, geographies, institutions, and other domains. Distributed ledgers can be accessed by multiple people thus in a way promoting public witnesses for transactions. Each participant at multiple nodes has access to the information stored and updated in a distributed ledger. Additionally, stakeholders or participants can also have an identical copy of the recordings that are being shared across the network. Any modifications including additions or changes to the existing data get reflected across the network thus providing more transparency for business-related transactions. Distributed ledger discourages the need to create a centralized authority for continuous checking of changes or modifications in company-related information. The principle backing distributed ledgers is the same as the one powering blockchain technology. Distributed ledgers can be considered the most recent or latest development of traditional ledgers that deal with keeping or recording economic transactions of a company including data such as moving property or assets, buy-sell deals, and recording information related to contracts. The industry for distributed ledger has witnessed acceptance across crucial domains globally including supply chain, finance, media & entertainment, and other sectors. The forecast period holds exceptional growth opportunities for the market growth rate.

Key Insights:

- As per the analysis shared by our research analyst, the globally distributed ledger market is estimated to grow annually at a CAGR of around 25.00% over the forecast period (2024-2032)

- In terms of revenue, the global distributed ledger market size was valued at around USD 6.31 billion in 2023 and is projected to reach USD 47.05 billion, by 2032.

- The market is projected to grow at a significant rate due to the increasing use of distributed ledger technology across banks and financial institutions

- Based on the component, the software segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the end-user industry, the BFSI segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Distributed Ledger Market: Growth Drivers

Increasing use of distributed ledger technology across banks and financial institutions will drive the market growth rate

The global distributed ledger market is expected to witness high growth due to the increasing use of distributed ledger technology (DLT) across financial institutions, especially banks. Experts consider DLT as a secure and efficient way to handle transactions and other forms of business-related information. Among several other benefits offered by distributed ledger, the one that stands out and is considered widely important among banks and other financial institutions is its ability to reduce or cut down fraud-related events. Since information updated in distributed ledgers is accessible to all assigned stakeholders, any discrepancy in the information can be easily tracked or verified. Banks and financial companies use DLT for successful payments especially when dealing with cross-border transactions. The growing financial transactions globally will encourage more financial institutions to opt for solutions that deliver higher security and payment efficiency. The rapid expansion of businesses in international markets to tap into unexplored market groups and strengthen their foothold in the global space has led to an exponential rise in cross-border transactions among businesses. Moreover, the growing partnerships between regional governments aimed at sharing knowledge and crucial technology thus creating more demand for transparency by secure means of sharing information and payments. For instance, in 2023, as per the Indian Ministry of Commerce and Industry India’s bilateral trade with Africa grew by 9.26% in the fiscal year 2022-2023. Similar numbers were posted by other countries. The growing global trade is likely to prompt higher demand for DLT.

Growing need to reduce business costs may trigger higher adoption of distributed ledgers

The globally distributed ledger market is projected to be impacted positively by the increasing demand for solutions that can help reduce business-related expenses. DLT is a streamlined process and does not promote the assistance of intermediaries for carrying out business operations. This in turn eliminates the need to make payments to facilitators that are generally a part of traditional forms of payments. Businesses across the globe are seeking solutions that can help reduce overall business costs while ensuring that business operations do not suffer. This can be achieved using distributed ledger systems.

Distributed Ledger Market: Restraints

Reports of inefficiencies related to DLT could restrict the market adoption rate

The global industry for distributed ledger is expected to be restricted due to several reported incidents of the technology becoming inefficient as the network becomes too congested. Inefficiency can be registered in the form of reduced processing speed. It can also translate to higher transaction fees. In addition to this, transactions carried out through distributed ledger systems cannot be reversed. This can pose a significant concern in case of fraud since the sender will have no means to recover the money.

Distributed Ledger Market: Opportunities

Growing awareness, increasing government acknowledgments, and higher development of DLT platforms will create more expansion possibilities

The globally distributed ledger market is projected to generate high growth opportunities due to several factors working in its favor. The foremost is the growing acknowledgment of regional governments toward incorporating distributed ledger systems in the economy. For instance, in November 2023, the Registration Authority (RA) of Abu Dhabi Global Market (ADGM) announced new rules under the Distributed Ledger Technology (DLT) Foundations Regulations 2023. This move helped the economy mark a significant milestone as the country witnessed a swift change in digital assets regulatory frameworks. The DLT Foundation Regulations 2023 will help Decentralized Autonomous Organizations (DAOs) and DLT Foundations work under comprehensive and well-established frameworks, In 2018, the European Commission established a novel strategy that emphasized data protection, environment sustainability, cybersecurity, digital identity, and interoperability as the region is aggressively moving toward become a digital economy. This can be enabled using the offerings of distributed ledgers.

Surging demand for distributed ledger systems in the media industry may prompt higher growth during the forecast period

Distributed ledgers are effective tools that work against data piracy and intellectual property (IP) rights infringement. Distributed ledgers are actively used by medical companies to track the unauthorized distribution of creative content. As per recent reports, pirated videos garner more than 220 billion views annually thus putting content producers at a loss. Furthermore, the globally distributed ledger market can be used by media companies for distributing payments among content creators and rightful owners of the art.

Distributed Ledger Market: Challenges

Risk of a 51% attack is a crucial challenge that needs higher attention

The global distributed ledger industry is expected to be challenged since the sector is vulnerable to 51% attack. It is a concept in the blockchain industry that discusses the risks associated with more than 50% of the entire network being controlled by one group or entity. In case an entity gains more than 50% control, it effectively gains the power to modify the entire blockchain.

Distributed Ledger Market: Segmentation

The global distributed ledger market is segmented based on component, technology, end-user industry, application, and region.

Based on the components, the global market segments are software, hardware, and services. In 2023, the highest growth was witnessed in the software segment. Distributed ledger adoption is facilitated by a range of software applications that take the connection and the features of the distributed ledger network. The services segment is likely to witness steady growth as well as the hardware segment. The cost of using a private blockchain can reach around USD 1500 a month.

Based on technology, the global industry is divided into holo-chain, hashgraph, blockchain, and others.

Based on the end-user industry, the global distributed ledger industry is fragmented into media & entertainment, manufacturing, government & public, energy & utilities, BFSI, healthcare, and others. In 2023, the highest growth was witnessed in the BFSI sector. The growing banking transactions across the globe especially the rising cross-border transactions are driving the segmental growth. In 2023, the global BFSI industry was valued at over USD 60.5 billion.

Based on application, the global market segments are compliance management, smart contracts, payment gateway, trade finance, and others.

Distributed Ledger Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Distributed Ledger Market |

| Market Size in 2023 | USD 6.31 Billion |

| Market Forecast in 2032 | USD 47.05 Billion |

| Growth Rate | CAGR of 25.00% |

| Number of Pages | 211 |

| Key Companies Covered | Amazon.com Inc., IBM, Bank of America, Circle, Intel Corporation, Block (formerly Square), Ripple Labs Inc., Hyperledger Foundation, Microsoft Corporation, Alibaba Group Holding Ltd., Walmart, Alphabet Inc. (Google), JPMorgan Chase & Co., Siemens AG and R3., and others. |

| Segments Covered | By Component, By Technology, By End-User Industry, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Distributed Ledger Market: Regional Analysis

Growth in North America will be a result of the dominance shown by the US in the industry

The global distributed ledger market will be dominated by North America during the forecast period with the US acting as the lead revenue generator. The country is the point of origin for more than 45% of the total blockchain technology market and has made tremendous growth in generating awareness and acceptance of distributed ledger systems. In 2023, the US witnessed the launch of the Novel Activities Supervision Program through which the Federal Reserve is expected to supervise new activities registered across banking companies including projects that leverage the advantages offered by DLT. Furthermore, most regional giants including IBM, Amazon, and Microsoft have incorporated distributed ledger systems in their information technology infrastructure. The growing financial transactions in the US including international buying and selling of goods or services have been an influential factor in the regional industry. Moreover, the US is focusing on integrating safer solutions that are resistant to cyber attacks such as distributed ledger systems. Asia-Pacific is expected to generate high revenue in the coming years. Singapore is the world’s largest consumer of blockchain technology. Other Asian countries including India are establishing regulatory frameworks that could assist in the seamless deployment of distributed ledger systems.

Distributed Ledger Market: Competitive Analysis

The global distributed ledger market is led by players like:

- Amazon.com Inc.

- IBM

- Bank of America

- Circle

- Intel Corporation

- Block (formerly Square)

- Ripple Labs Inc.

- Hyperledger Foundation

- Microsoft Corporation

- Alibaba Group Holding Ltd.

- Walmart

- Alphabet Inc. (Google)

- JPMorgan Chase & Co.

- Siemens AG and R3.

The global distributed ledger market is segmented as follows:

By Component

- Software

- Hardware

- Services

By Technology

- Holochain

- Hashgraph

- Blockchain

By End-User Industry

- Media & Entertainment

- Manufacturing

- Government & Public

- Energy & Utilities

- BFSI

- Healthcare

By Application

- Compliance Management

- Smart Contracts

- Payment Gateway

- Trade Finance

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A distributed ledger is defined as a database that is voluntarily synchronized and shared across multiple platforms, geographies, institutions, and other domains.

The global distributed ledger market is expected to witness high growth due to the increasing use of distributed ledger technology (DLT) across financial institutions, especially banks.

According to study, the global distributed ledger market size was worth around USD 6.31 billion in 2023 and is predicted to grow to around USD 47.05 billion by 2032.

The CAGR value of distributed ledger market is expected to be around 25.00% during 2024-2032.

The global distributed ledger market will be dominated by North America during the forecast period with the US acting as the lead revenue generator.

The global distributed ledger market is led by players like Amazon.com Inc., IBM, Bank of America, Circle, Intel Corporation, Block (formerly Square), Ripple Labs Inc., Hyperledger Foundation, Microsoft Corporation, Alibaba Group Holding Ltd., Walmart, Alphabet Inc. (Google), JPMorgan Chase & Co., Siemens AG and R3.

The report explores crucial aspects of the distributed ledger market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed