Blockchain in BFSI Market Size, Share, Industry Analysis, Trends, Growth, Forecasts, 2032

Blockchain in BFSI Market By type (public blockchain, private blockchain, and consortium blockchain), By application (security, digital currency, smart contract, trade finance, record keeping, identity management, GRC management, and fraud detection) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

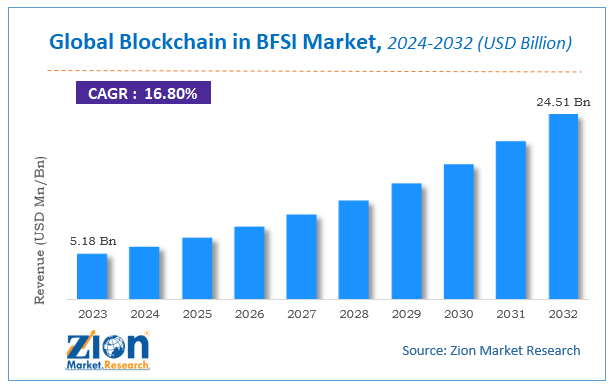

| USD 5.18 Billion | USD 24.51 Billion | 16.8% | 2023 |

Description

Blockchain in BFSI Market Insights

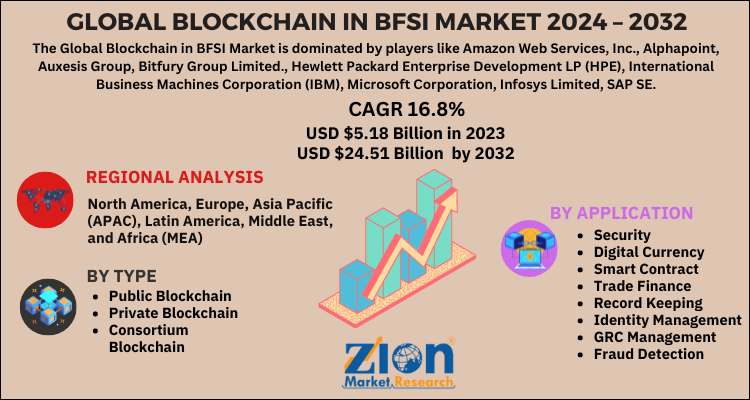

According to the report published by Zion Market Research, the global Blockchain in BFSI Market size was valued at USD 5.18 Billion in 2023 and is predicted to reach USD 24.51 Billion by the end of 2032. The market is expected to grow with a CAGR of 16.8% during the forecast period. The report analyzes the global Blockchain in BFSI Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Blockchain in BFSI industry.

Global Blockchain in BFSI Market: Overview

An explicit sort of database which is different from a typical database utilizing its data storage behavior is known as a blockchain. Such type of databases stores digital data in blocks which is then chained together to form a series of information. The input of fresh data in blockchain stored as fresh block data comes in it is entered into a fresh block. Once these blocks are occupied with data, they are chained onto the previous block, which forms the chronological data chain. Various types of digital information can be stored in blockchain. However, currently, it is widely used to keep records of transactions in the banking and finance sector.

Global Blockchain in BFSI Market: Growth Factors

The global blockchain in BFSI market is growing at a speedy rate. An increase in the necessity for systematic client identification, rise in incidences of hacking by cyber-criminals, and increase in adoption of blockchain in BFSI to lower the counterparty risks are some of the crucial factors that are contributing to the growth of the global market. Along with improvements in efficiency and security, blockchain offers added benefits to the banking and financial sectors such as quick transaction time, unchangeable records, and no third party association which ultimately decreases the overall process costs. Among all these factors blockchain offers some key advantages such as the history of immutable transactions.

Transaction records in the blockchain cannot be changed or modified, these factors promoting its adoption in the banking and finance sector. On the other hand, higher energy consumption by some blockchain solutions and high reliability on nodes to function properly may hamper the growth of the market. However, factors such as faster transaction time and improved transaction accuracy will offer better growth opportunities to the global blockchain in BFSI market over the forecast period.

COVID 19 pandemic conditions have triggered digital solutions in almost every sector. Strict regulations imposed by many governments to curb the spread of the infection have led to restrictions of movements. Hence digital banking transactions have increased at an enormous rate. This has resulted in higher demand for blockchain in the banking sector. Considering current pandemic situations rate of online transitions is expected to increase over the forecast period which in turn will boost the demand for blockchain in the banking and finance sector.

Global Blockchain in BFSI Market: Segmentation

The global blockchain in BFSI market is categorized by type, application, and region.

Based on the type, the global blockchain in BFSI market is bifurcated into the public blockchain, private blockchain, and consortium blockchain.

The application segment is divided into security, digital currency, smart contract, trade finance, record keeping, identity management, GRC management, and fraud detection. Digital currencies such as Bitcoin are largely utilizing blockchain in the process.

Blockchain in BFSI Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Blockchain in BFSI Market |

| Market Size in 2023 | USD 5.18 Billion |

| Market Forecast in 2032 | USD 24.51 Billion |

| Growth Rate | CAGR of 16.8% |

| Number of Pages | 200 |

| Key Companies Covered | Amazon Web Services, Inc., Alphapoint, Auxesis Group, Bitfury Group Limited., Hewlett Packard Enterprise Development LP (HPE), International Business Machines Corporation (IBM), Microsoft Corporation, Infosys Limited, SAP SE., and Oracle Corporation among others |

| Segments Covered | By Type, By Application And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Blockchain in BFSI Market: Regional Analysis

North America is expected to dominate the global blockchain in BFSI market over the forecast period. Also, it is expected to remain the largest revenue contributor in the global blockchain in BFSI market during the future period. North America has well-developed banking and finance sector which is continuously adopting newer digital technologies to improve their services. Also, the presence of key market players in the region is contributing to the growth of the market. Europe is expected to remain the second largest market for blockchain in BFSI market. Growing investments by banking sectors on digital solutions to improve the safety of the transactions are boosting the demand for blockchain databases. Asia Pacific is anticipated to be the most lucrative market for blockchain in BFSI. Some of the factors that fuel the demand for blockchain in BFSI include increasing concerns regarding frauds & hacking in banking sectors of emerging countries such as India & China, government regulations, and the large banking sector.

Global Blockchain in BFSI Market: Competitive Players

Key players operating the global blockchain in BFSI market include:

- Amazon Web Services, Inc.

- Alphapoint

- Auxesis Group

- Bitfury Group Limited.

- Hewlett Packard Enterprise Development LP (HPE)

- International Business Machines Corporation (IBM)

- Microsoft Corporation

- Infosys Limited

- SAP SE.

- Oracle Corporation among others.

The Global Blockchain in BFSI Market is segmented as follows:

By type

- public blockchain

- private blockchain

- consortium blockchain

By application

- security

- digital currency

- smart contract

- trade finance

- record keeping

- identity management

- GRC management

- fraud detection

Global Blockchain in BFSI Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

An increase in the necessity for systematic client identification, rise in incidences of hacking by cyber-criminals, and increase in adoption of blockchain in BFSI to lower the counterparty risks are some of the crucial factors that are contributing to the growth of the global market. Furthermore, factors such as faster transaction time and improved transaction accuracy will offer better growth opportunities to the global blockchain in BFSI market over the forecast period.

Key players operating the global blockchain in BFSI market include Amazon Web Services, Inc., Alphapoint, Auxesis Group, Bitfury Group Limited., Hewlett Packard Enterprise Development LP (HPE), International Business Machines Corporation (IBM), Microsoft Corporation, Infosys Limited, SAP SE., and Oracle Corporation among others.

North America is expected to dominate the global blockchain in BFSI market over the forecast period. Also, it is expected to remain the largest revenue contributor in the global blockchain in BFSI market during the future period. North America has well-developed banking and finance sector which continuously adopting newer digital technologies to improve their services. Also, the presence of key market players in the region is contributing to the growth of the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed