Connected Home Security Device Market Growth, Size, Share, Trends, and Forecast 2032

Connected Home Security Device Market By Applications (Detection Devices, Sensors, Security Camera, Door locks, and Others) : Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

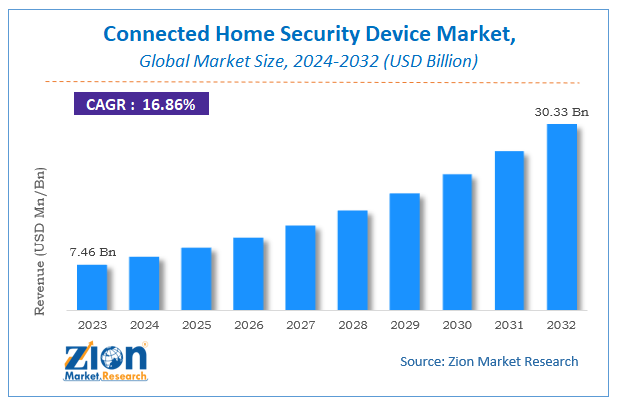

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.46 Billion | USD 30.33 Billion | 16.86% | 2023 |

Connected Home Security Device Market Insights

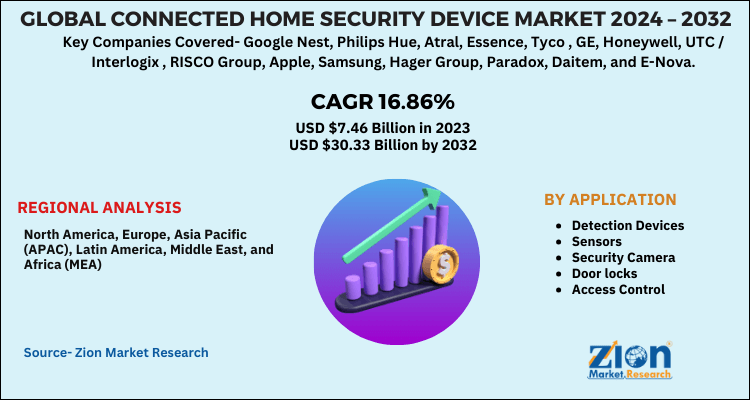

According to a report from Zion Market Research, the global Connected Home Security Device Market was valued at USD 7.46 Billion in 2023 and is projected to hit USD 30.33 Billion by 2032, with a compound annual growth rate (CAGR) of 16.86% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Connected Home Security Device Market industry over the next decade.

Connected Home Security Device Market Overview

Home security devices and systems include smart locks, cameras, smart lights, smart smoke alarms, and smart thermostats, automation devices, etc. connected home security devices market also include various components such as motion sensors, detectors, door sensors, smoke detectors, etc. Home security systems are deployed in homes and apartments for protecting property and insides from home intrusion, burglary, and different types of environmental disasters.

Connected home security devices integrate various types of security devices with Wi-Fi networks or internet connection. Connected home security devices helps in controlling and managing devices installed in homes through mobile phones or laptops. These devices can utilize internet of thing (IoT) technology for establishing connection between various security devices. Connected home security devices have become a valuable asset of home owners as these help in protecting household valuables, convenience savings, and reducing damage due to fire and smoke.

A connected home is one in which different devices work interactively and information relevant to the residents/owner is accessed via high-speed broadband network. A connected home creates a local area network (LAN) throughout entire house, cable hookups, bringing multiple telephone jacks and standard outlets to every room in home. Technology has become increasingly sophisticated and growing demand for easy accessibility for connected homes is making market more attractive. Increasing demand of connected home fuel the demand for various security devices for connected home.

Advancement in wireless standards, rapidly increased smartphone penetration and reduced hardware cost are the factors expected to boost the demand of security system for connected home in coming years. In addition, availability of well-positioned apps for operating different systems coupled with constant advent of new product with innovative technology is expected to fuel the growth of security devices for connected home market in forecast period. Furthermore, increase in the demand for home cloud technology is expected to impel the market potential for security device for connected home market. However, lack of awareness is expected to have adverse impact on growth of market in coming years. Nonetheless, technological advancement is expected to attract huge untapped area and likely to open new doors for the connected home security device market.

Growth Factors

Smart phone penetration has soared worldwide in recent years owing to decreasing smartphone prices and increasing consumer spending on consumer Security Camera. This rise in smartphone penetration around the world has paved the way for development of new internet of things (IoT) systems and devices in security systems. Internet of things (IoT) devices are being used for connecting various security devices to cloud, for integration of different security systems for monitoring and controlling of homes. Such development of new technologies has augmented the global connected home security device market growth.

Housing market worldwide has also experienced a steady growth owing to rising urban population and increasing number of individuals looking to buy new homes. This growth in housing sector has proliferated the deployment of home security systems in homes, villas, bungalows, and apartments, which has been bolstering market growth. Further, rising number of consumers are emphasizing on home safety to avoid mishaps owing to burglary and intrusion. Such increase in consciousness among consumers regarding home safety is anticipated to create new avenues for the global connected home security device market.

Connected Home Security Device Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Connected Home Security Device Market |

| Market Size in 2023 | USD 7.46 Billion |

| Market Forecast in 2032 | USD 30.33 Billion |

| Growth Rate | CAGR of 16.86% |

| Number of Pages | 150 |

| Key Companies Covered | Google Nest, Philips Hue, Atral, Essence, Tyco , GE, Honeywell, UTC / Interlogix , RISCO Group, Apple, Samsung, Hager Group, Paradox, Daitem, and E-Nova |

| Segments Covered | By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Application Segment Analysis Preview

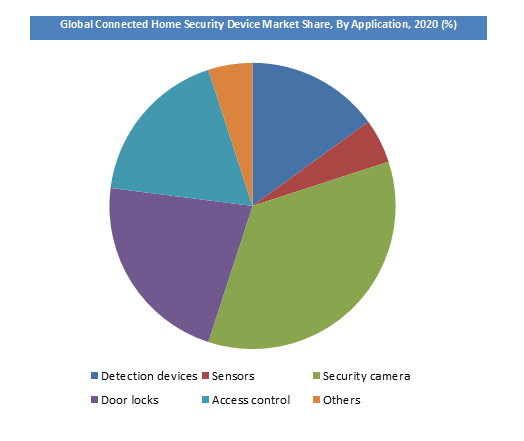

Based on applications, the security camera segment dominated the global connected home security device market in 2020. Home security camera has been a key device for home protection and surveillance. Home surveillance cameras can help in preventing intrusions before happening and can be helpful in gathering material evidence. Owing to these advantages, deployment of home security camera in houses and apartments has soared worldwide. Further, home owners are also emphasizing on gathering and monitoring home surveillance data when they are away from home. Such a trend in the industry has accelerated the demand for connected home security cameras.

The door locks segment is expected to register fastest growth rate over the forecasted period. Smart door locks have gained popularity among home owners owing to advanced features such as voice control, internet-based remove access. Utilization of smart door locks has been proliferated by rising deployment of smart home security systems. There has been rising trend of smart homes in urban parts of the world which has boosted the use of connected smart door locks, in turn, stimulating market growth.

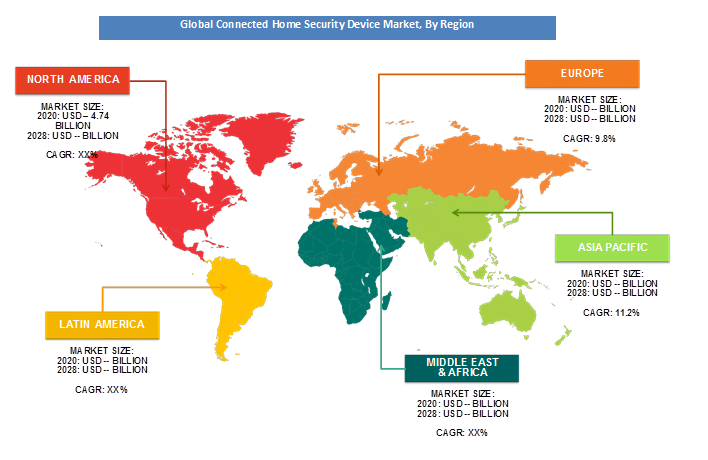

Regional Analysis Preview

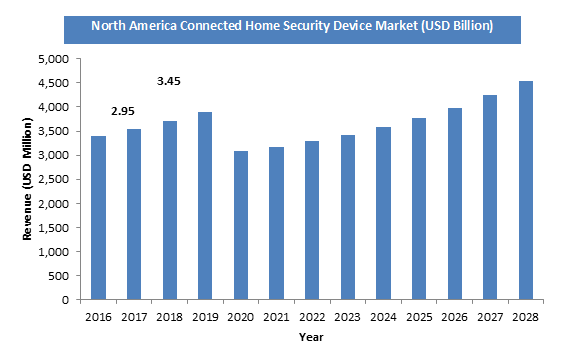

North America has dominated the global connected home security device market in 2020, constituting a market share of nearly 40%. Rapid adoption of advanced technologies in the region by home builders, integrators, and home owners has been one of the most crucial factors for North America market growth. Increasing incidents home intrusion, burglary, and theft in United States and Canada has influenced home owners to deploy home security systems for protection. This trend has been proliferating the North America connected home security device market.

Asia Pacific region is expected to record highest CAGR of over 18% during the projected period. Asia Pacific housing market has been soaring in last few years owing to growing urban population. Rising urban population has boosted the demand for urban houses and apartments among millennials, which has directly attributable to deployment of home security systems in new homes. Further, adoption of new IoT technologies has also accelerated the deployment of connected home security devices, in turn, driving the market growth.

North America was the largest market for connected home security devices due to the high technology adoption rate paired with better consumer awareness. Rising disposal income in countries like China, Japan and South Korea is projected to witness considerable growth over the forecast period in Asia Pacific region. Europe is expected to be one of the fastest growing regions in coming year. Western Europe is expected to experience significant growth for connected home security device market in coming years. Countries like South Africa, U.A.E., Saudi Arabia will show noteworthy growth in Middle East and Africa region.

Key Market Players & Competitive Landscape

Some of key players in connected home security device market are:

- Google Nest

- Philips Hue

- Atral

- Essence

- Tyco

- GE

- Honeywell

- UTC / Interlogix

- RISCO Group

- Apple

- Samsung

- Hager Group

- Paradox

- Daitem

- E-Nova.

The global connected home security device market is segmented as follows:

By Application Type

- Detection Devices

- Sensors

- Security Camera

- Door locks

- Access Control

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global connected home security device market was valued at USD 7.46 B in 2023.

The global connected home security device market is expected to reach USD 30.33 B by 2032, with a CAGR of around 16.86% between 2024-2032.

Smart phone penetration has soared worldwide in recent years owing to decreasing smartphone prices and increasing consumer spending on consumer Security Camera. This rise in smartphone penetration around the world has paved the way for development of new internet of things (IoT) systems and devices in security systems. Internet of things (IoT) devices are being used for connecting various security devices to cloud, for integration of different security systems for monitoring and controlling of homes. Such development of new technologies has augmented the global connected home security device market growth.

North America has dominated the global connected home security device market in 2023, constituting a market share of nearly 40%. Rapid adoption of advanced technologies in the region by home builders, integrators, and home owners has been one of the most crucial factors for North America market growth. Increasing incidents home intrusion, burglary, and theft in United States and Canada has influenced home owners to deploy home security systems for protection. This trend has been proliferating the North America connected home security device market.

Some of key players in connected home security device market are Google Nest, Philips Hue, Atral, Essence, Tyco , GE, Honeywell, UTC / Interlogix , RISCO Group, Apple, Samsung, Hager Group, Paradox, Daitem, and E-Nova.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed