Commercial Aircraft Aftermarket Parts Market Size, Share Report 2034

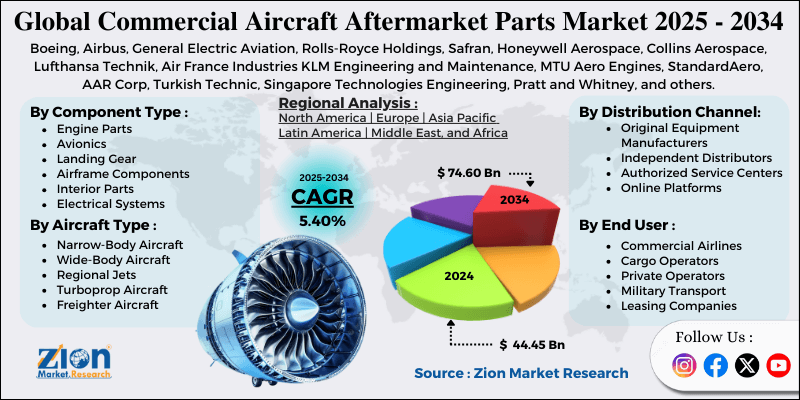

Commercial Aircraft Aftermarket Parts Market By Component Type (Engine Parts, Avionics, Landing Gear, Airframe Components, Interior Parts, Electrical Systems), By Aircraft Type (Narrow-Body Aircraft, Wide-Body Aircraft, Regional Jets, Turboprop Aircraft, Freighter Aircraft), By Distribution Channel (Original Equipment Manufacturers, Independent Distributors, Authorized Service Centers, Online Platforms, Third-Party Maintenance Providers), By End-User (Commercial Airlines, Cargo Operators, Private Operators, Military Transport, Leasing Companies, Maintenance Repair Organizations), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

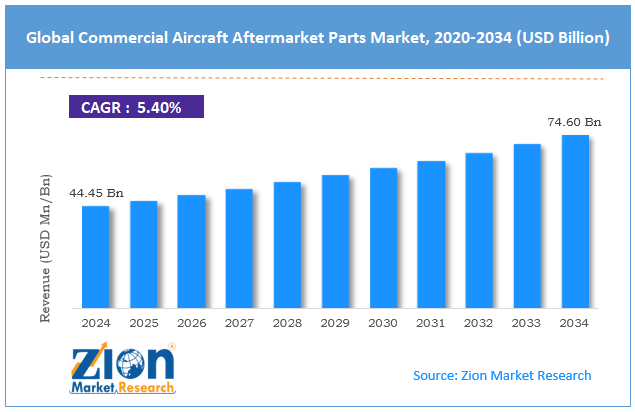

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 44.45 Billion | USD 74.60 Billion | 5.40% | 2024 |

Commercial Aircraft Aftermarket Parts Industry Perspective:

The global commercial aircraft aftermarket parts market size was valued at approximately USD 44.45 billion in 2024 and is expected to reach around USD 74.60 billion by 2034, registering a compound annual growth rate of roughly 5.40% during the period from 2025 to 2034.

Key Insights:

- According to analysis from industry research experts, the global commercial aircraft aftermarket parts market is estimated to expand annually at a growth rate of around 5.40% over the forecast period from 2025 to 2034.

- In terms of revenue, the global commercial aircraft aftermarket parts market size was valued at approximately USD 44.45 billion in 2024 and is projected to reach USD 74.60 billion by 2034.

- The commercial aircraft aftermarket parts market is projected to grow significantly due to increasing global air traffic, expanding commercial aircraft fleets, and rising maintenance requirements across established and emerging aviation markets.

- Based on component type, the engine parts segment is expected to lead the market, while the avionics segment is anticipated to experience substantial growth.

- Based on aircraft type, the narrow-body aircraft segment is expected to dominate the market, while the wide-body aircraft segment is anticipated to witness considerable expansion.

- Based on the distribution channel, the original equipment manufacturers segment is the dominating segment, while the independent distributors segment is projected to witness significant revenue over the forecast period.

- Based on end-user, the commercial airlines segment is expected to lead the market compared to other segments.

- Based on region, North America is projected to dominate the global commercial aircraft aftermarket parts market during the estimated period, followed by Europe.

Commercial Aircraft Aftermarket Parts Market: Overview

Commercial aircraft aftermarket parts are all replacement components and maintenance items used to keep an aircraft functioning safely and efficiently throughout its long service life after it is manufactured and delivered. These parts include major systems such as engines and avionics, as well as basic structural pieces and routine service materials needed to maintain airworthiness. Airlines and cargo operators depend on a steady supply of certified parts to support daily operations, comply with aviation regulations, and ensure passenger safety. Because most aircraft remain in service for twenty-five to thirty years or more, thousands of parts must be inspected, repaired, or replaced regularly due to wear, environmental conditions, or technological updates. The aftermarket system operates through a global network of manufacturers, distributors, repair centers, and approved suppliers that follow strict quality and certification standards. Original equipment manufacturers supply fully traceable components, while independent suppliers provide approved alternatives that meet the same safety requirements at competitive costs. Consistent access to reliable parts helps maintenance teams reduce delays, limit aircraft downtime, and support efficient operations for airlines worldwide.

The expanding global aviation industry and rising emphasis on aircraft reliability and operational efficiency are expected to fuel growth in the commercial aircraft aftermarket parts market throughout the forecast period.

Commercial Aircraft Aftermarket Parts Market Dynamics

Growth Drivers

How is rising global air travel demand driving the expansion of the commercial aircraft aftermarket parts market?

The commercial aircraft aftermarket parts market is growing quickly as passenger traffic increases steadily across domestic, regional, and international routes, creating higher demand for reliable aircraft support systems. Emerging economies in Asia, Africa, Latin America, and the Middle East are seeing strong growth in middle-income populations with rising interest in frequent air travel for business, family visits, and tourism. Budget airlines offer low fares, making flying accessible to a wider range of people who previously relied on road or rail travel for long-distance travel. Higher aircraft usage means planes fly for more hours each day, which increases wear on components and raises the need for regular inspections and replacements. Airlines keep older aircraft in service for longer periods to maximize investment, which leads to higher maintenance needs and greater use of replacement parts.

Passenger expectations for on-time flights encourage airlines to maintain strong parts inventories to avoid delays or cancellations due to maintenance issues. Growth in global cargo operations driven by e-commerce increases the number of freighter aircraft requiring steady parts support and maintenance. Fleet expansion programs add new routes and more flights, creating additional demand for maintenance activities and aftermarket parts supply.

Regulatory compliance and mandatory safety requirements

The commercial aircraft aftermarket parts market is growing strongly due to strict aviation safety regulations that require detailed maintenance schedules, thorough inspections, and the timely replacement of components that reach their certified service limits. International aviation authorities set clear airworthiness rules that require operators to follow manufacturer guidance and regulatory instructions for every maintenance task and parts installation.

Airworthiness directives issued by regulators instruct airlines to inspect certain systems and replace specific components within fixed timelines to address safety issues or design updates. Parts manufacturers obtain multiple certifications from different national authorities to sell components in global markets, which creates high-quality standards across the entire supply chain. Concerns about counterfeit parts entering aviation systems have increased demand for verified components supported by stronger documentation, supplier checks, and traceability processes.

Airlines maintain complete maintenance records for each aircraft with full traceability to meet regulatory inspections and insurance conditions. Aviation insurance policies require approved parts and strict compliance with maintenance programs to maintain operational coverage. Older aircraft face tighter regulatory oversight, with more frequent inspections and shorter intervals for replacements to ensure continued airworthiness.

Restraints

High costs and budget constraints are affecting procurement decisions

The commercial aircraft aftermarket parts market faces significant challenges because certified aviation components are expensive, placing heavy financial pressure on airlines operating on narrow profit margins in a highly competitive industry. Original equipment manufacturer parts carry premium prices due to extensive certification requirements, limited production volumes, intellectual property considerations, and exclusive control over proprietary components. Airlines must balance strict safety obligations with cost pressures during periods when passenger demand falls, and revenues decline while operational expenses remain stable. Low-cost carriers face greater difficulty purchasing costly genuine parts while maintaining extremely low fares that support their business models and competitive strategies. Exchange rate changes increase uncertainty for airlines buying parts priced in foreign currencies, which raises costs sharply when local currencies weaken.

Component obsolescence occurs when manufacturers stop producing parts for older aircraft, forcing airlines to purchase expensive alternatives from limited suppliers or specialized producers making small-batch replacements. Maintaining large parts inventories ties up working capital and creates financial strain for airlines with limited cash or restricted access to financing. Emergency parts purchases requiring urgent international shipping add substantial surcharges and significantly increase overall maintenance costs.

Opportunities

How is technological advancement creating new opportunities for the commercial aircraft aftermarket parts market?

The commercial aircraft aftermarket parts industry is undergoing major change as new technologies support predictive maintenance, smarter inventory systems, and stronger supply chain efficiency while lowering operational costs for airlines. Advanced sensors placed across modern aircraft monitor performance, vibration levels, temperature shifts, and other signals indicating possible component issues before failures occur. Powerful data analytics platforms study large volumes of operational information to identify patterns showing when specific components require maintenance or replacement. Blockchain systems provide secure tracking of parts through their entire lifecycle, from production through installation, creating trusted records useful for preventing counterfeit components. Online marketplaces link airlines with certified suppliers worldwide, increasing competition and expanding purchasing options for operators seeking specialized components.

Additive manufacturing enables on-demand production of selected parts through three-dimensional printing processes, reducing inventory needs and shortening lead times. Digital twin systems create virtual aircraft models to test maintenance scenarios and improve parts replacement planning. Artificial intelligence tools study fleet maintenance histories to predict consumption patterns and recommend ideal procurement timing for various components.

Challenges

How do supply chain complexities create challenges for the commercial aircraft aftermarket parts market?

The commercial aircraft aftermarket parts industry faces significant challenges in managing complex global supply networks that span continents, involve many intermediaries, and operate under different regulatory systems with unique certification rules. Parts procurement often requires coordination among original manufacturers, licensed producers, authorized distributors, and certified suppliers working in various time zones and regions. Lead times for specialized components can extend from several weeks to many months, forcing airlines to maintain costly inventory reserves or risk aircraft groundings when parts are unavailable.

Geopolitical tensions, trade disputes, and export controls sometimes restrict access to components from certain sources, pushing operators to identify alternative suppliers offering parts with identical specifications. Quality assurance becomes harder as components pass through multiple distribution layers, increasing the chance of substandard or fraudulent parts entering legitimate supply chains. Industry consolidation among parts manufacturers reduces competitive choices and gives remaining suppliers greater pricing power over airlines and maintenance providers.

Commercial Aircraft Aftermarket Parts Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Commercial Aircraft Aftermarket Parts Market |

| Market Size in 2024 | USD 44.45 Billion |

| Market Forecast in 2034 | USD 74.60 Billion |

| Growth Rate | CAGR of 5.40% |

| Number of Pages | 213 |

| Key Companies Covered | Boeing, Airbus, General Electric Aviation, Rolls-Royce Holdings, Safran, Honeywell Aerospace, Collins Aerospace, Lufthansa Technik, Air France Industries KLM Engineering and Maintenance, MTU Aero Engines, StandardAero, AAR Corp, Turkish Technic, Singapore Technologies Engineering, Pratt and Whitney, and others. |

| Segments Covered | By Component Type, By Aircraft Type, By Distribution Channel, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Commercial Aircraft Aftermarket Parts Market: Segmentation

The global commercial aircraft aftermarket parts market is segmented based on component type, aircraft type, distribution channel, end-user, and region.

Based on component type, the commercial aircraft aftermarket parts industry is divided into engine parts, avionics, landing gear, airframe components, interior parts, and electrical systems. Engine parts lead the market due to their mission-critical role in aircraft operations, frequent replacement cycles, substantial per-unit costs, and extensive maintenance requirements throughout the engine's operational lifespan.

Based on aircraft type, the market is segmented into narrow-body aircraft, wide-body aircraft, regional jets, turboprop aircraft, and freighter aircraft. Narrow-body aircraft dominate the market due to their overwhelming numerical prevalence in global commercial fleets, their intensive utilization on short- and medium-haul routes, and their widespread operation by airlines across all geographic markets.

Based on distribution channel, the global market is classified into original equipment manufacturers, independent distributors, authorized service centers, online platforms, and third-party maintenance providers. Original equipment manufacturers are expected to lead during the forecast period due to airlines' preference for certified genuine parts that offer guaranteed quality, full regulatory compliance, and full manufacturer warranty support.

Based on end-user, the global market is divided into commercial airlines, cargo operators, private operators, military transport, leasing companies, and maintenance, repair organizations. Commercial airlines hold the largest market share due to their extensive aircraft fleets, continuous operational requirements, and substantial maintenance budgets supporting passenger service commitments.

Commercial Aircraft Aftermarket Parts Market: Regional Analysis

What factors contribute to North America leading the global commercial aircraft aftermarket parts market?

North America leads the commercial aircraft aftermarket parts market because the region supports the world’s largest aviation industry, strong manufacturing hubs, extensive maintenance facilities, and efficient distribution networks that supply parts across wide geographic areas. The United States operates one of the most expansive commercial aviation fleets, with major network airlines, low-cost carriers, regional operators, and cargo companies that maintain thousands of aircraft, requiring steady maintenance and reliable access to replacement components. Well-developed maintenance, repair, and overhaul organizations across the region provide services ranging from routine inspections to major structural work, creating consistent demand for a broad range of aftermarket parts. Major aerospace manufacturers, including Boeing, maintain headquarters, engineering centers, production plants, and distribution operations within North America, enabling quick support for airline requirements.

Strong airline profitability during growth periods supports investment in maintenance programs, parts inventories, and fleet reliability efforts. Advanced logistics systems with overnight freight services and regional distribution centers allow rapid parts delivery to maintenance locations nationwide. Robust research and development across aerospace companies and universities strengthens innovation in materials, manufacturing techniques, and component designs. Continuous expansion of digital maintenance tools and predictive analytics further enhances operational efficiency and strengthens the region’s aftermarket capabilities.

Europe is seeing significant market growth.

Europe is the second-largest region in the commercial aircraft aftermarket parts market, driven by its strong aviation ecosystem, well-established regulatory framework, and dense network of airlines operating large, diverse fleets. The region hosts several major flag carriers, low-cost airlines, regional operators, and charter companies, all of which maintain extensive fleets requiring continuous maintenance support and the steady availability of certified replacement components.

Europe’s aviation landscape is also shaped by the presence of major aerospace manufacturers, engineering centers, and component suppliers, which contribute to a highly integrated aftermarket supply chain. Airbus, one of the world’s largest commercial aircraft manufacturers, maintains significant production facilities, engineering hubs, and parts distribution centers across Europe, supporting local demand for original equipment and aftermarket components. Strong infrastructure, including advanced logistics networks, regional distribution centers, and efficient freight systems, enables timely parts delivery to maintenance bases across Europe.

Additionally, aging aircraft fleets, high passenger traffic, and fleet expansion programs across major European airlines continue to drive consistent demand for aftermarket parts. Continuous investment in research, sustainability technologies, digital maintenance solutions, and predictive analytics further supports Europe’s growing role in the global aftermarket landscape. Growing collaboration between airlines, MRO providers, and technology partners also strengthens the region’s long-term competitiveness.

Recent Market Developments:

- In March 2025, Boeing announced the expansion of its worldwide parts distribution network, establishing additional regional warehouses in strategic locations to reduce delivery times and improve parts availability for international airline customers.

- In June 2025, Airbus and Safran announced a joint development program focused on creating advanced predictive maintenance technologies that utilize artificial intelligence to optimize component replacement schedules and reduce unnecessary parts changes.

Commercial Aircraft Aftermarket Parts Market: Competitive Analysis

The leading players in the global commercial aircraft aftermarket parts market include:

- Boeing

- Airbus

- General Electric Aviation

- Rolls-Royce Holdings

- Safran

- Honeywell Aerospace

- Collins Aerospace

- Lufthansa Technik

- Air France Industries KLM Engineering and Maintenance

- MTU Aero Engines

- StandardAero

- AAR Corp

- Turkish Technic

- Singapore Technologies Engineering

- Pratt and Whitney

The global commercial aircraft aftermarket parts market is segmented as follows:

By Component Type

- Engine Parts

- Avionics

- Landing Gear

- Airframe Components

- Interior Parts

- Electrical Systems

By Aircraft Type

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Jets

- Turboprop Aircraft

- Freighter Aircraft

By Distribution Channel

- Original Equipment Manufacturers

- Independent Distributors

- Authorized Service Centers

- Online Platforms

- Third-Party Maintenance Providers

By End User

- Commercial Airlines

- Cargo Operators

- Private Operators

- Military Transport

- Leasing Companies

- Maintenance Repair Organizations

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed