Aviation Insurance Market Size, Share, Trends, Growth 2034

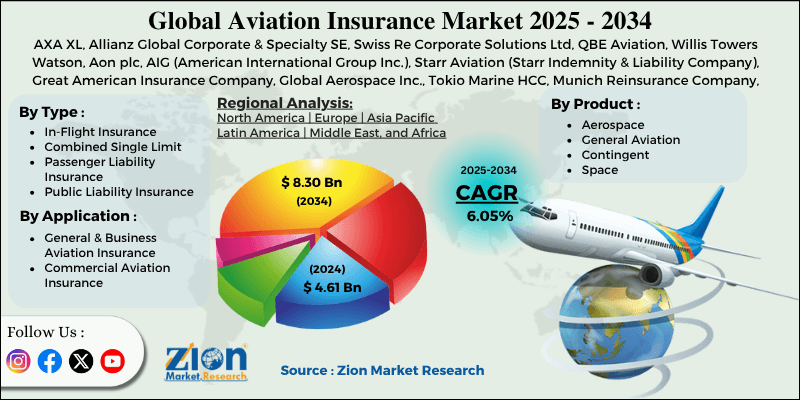

Aviation Insurance Market By Type (In-Flight Insurance, Combined Single Limit (CSL), Passenger Liability Insurance, Public Liability Insurance, and Others), By Application (General & Business Aviation Insurance, Commercial Aviation Insurance, and Others), By Product Type (Aerospace, General Aviation, Contingent, Space, and Airlines), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

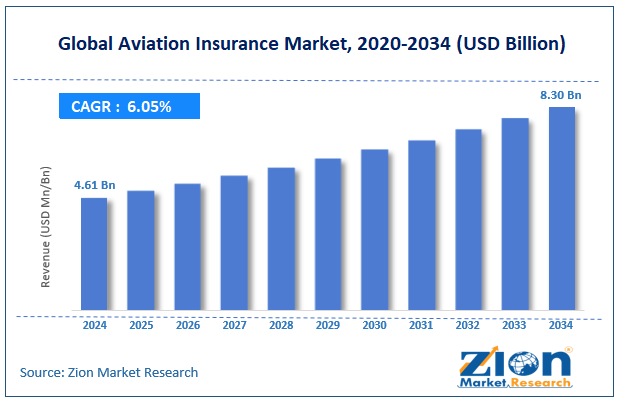

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.61 Billion | USD 8.30 Billion | 6.05% | 2024 |

Aviation Insurance Industry Perspective:

The global aviation insurance market size was worth around USD 4.61 billion in 2024 and is predicted to grow to around USD 8.30 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.05% between 2025 and 2034.

Aviation Insurance Market: Overview

Aviation insurance is a financial risk-minimizing and management policy specially designed for the aviation industry. In recent times, the surge in the number of aircraft-related accidents and other events has highlighted the susceptibility to risk of the aerospace industry. Aviation insurance is specialized insurance that covers several aspects of aircraft flying and other business operations.

For instance, comprehensive aviation insurance can protect companies from undergoing severe financial losses in case of an accident during in-flight events. Aviation insurance also delivers cushioning against property damage due to business operations or claims from passengers. Certain aviation insurance is also designed to cover cases related to environmental damage caused by flying machines.

According to industry research, aviation insurance is critical for all private aircraft owners, airlines, airports, flight schools, helicopter providers, and maintenance, repair, & overhaul (MRO) providers, among other entities connected to the aviation sector.

During the forecast period, the aviation insurance industry is expected to deliver a higher CAGR than in previous years due to higher undertakings from the consumer group. However, risk concerns over inflation may impact the final revenue generated by the industry.

Key Insights:

- As per the analysis shared by our research analyst, the global aviation insurance market is estimated to grow annually at a CAGR of around 6.05% over the forecast period (2025-2034)

- In terms of revenue, the global aviation insurance market size was valued at around USD 4.61 billion in 2024 and is projected to reach USD 8.30 billion by 2034.

- The aviation insurance market is projected to grow at a significant rate due to the growing rate of air traffic and accidents in the aviation sector.

- Based on the type, the Combined Single Limit (CSL) segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the product type, the airline segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Aviation Insurance Market: Growth Drivers

Growing rate of air traffic and accidents in the aviation sector to propel market growth rate

The global aviation insurance market is expected to be led by increasing air traffic across the globe. The surge in the number of air travelers is driven by increasing travel & tourism, a rise in disposable income, access to discount codes or other subsidies, and the addition of low-cost carriers. On the other hand, the number of accidents in the aviation industry has also increased over the last few years.

For instance, in May 2025, a small plane crashed into a residential area in the south of California in the US. According to official reports, two people onboard the aircraft were killed on impact.

In December 2024, South Korea witnessed a fatal accident related to the Jeju Air plane crash. Around 179 people onboard the aircraft flying from Thailand to Muan in South Korea were killed. Similarly, reports of aircraft going missing from the radar in the last few years have led to an increase in air travel anxiety among passengers.

During such events, airline or aircraft management companies incur severe financial losses. Aviation insurance can help aircraft carriers reduce the monetary impact of business operation failure. In February 2025, India’s most prominent airline, Air India, finalized an insurance of USD 20 billion for its fleet.

Introduction of modern and novel aircraft to create more avenues for further growth in the industry

The global aviation industry is witnessing a steady shift toward more modern aircraft offering improved safety and performance. In June 2023, researchers at the Massachusetts Institute of Technology (MIT) launched a breakthrough technology in the form of a megawatt motor to power electric aircraft. Several technology companies worldwide are working on developing future aircraft that are environmentally friendly and equipped with cutting-edge technologies. The introduction of novel aircraft will create avenues for the global aviation insurance market to expand.

Aviation Insurance Market: Restraints

High premiums and growing inflation worldwide impact the final market revenue

The global aviation insurance industry is expected to be restricted due to the high cost of insurance premiums. For instance, in March 2025, Virgin Atlantic, one of the globally dominating airlines from the US, reported an increase of over 9% in its insurance premium.

The inflation rate worldwide has been growing in the last few years and is anticipated to reach higher values in the coming years. The several risks associated with inflation can impact final market revenue in the long run.

Aviation Insurance Market: Opportunities

Increasing launch of the latest and comprehensive insurance plans to generate growth opportunities

The global aviation insurance market is expected to generate growth opportunities due to the increasing launch of consumer comprehensive plans.

In December 2024, Redline Underwriting, a leading coverholder specialty underwriting firm, announced the introduction of a new General Aviation Insurance solution. The company has developed the plan in association with Allianz Commercial from the UK region.

According to official reports, the solution is designed for the Caribbean and Latin American market, covering pleasure, private, business rotor, and fixed-wing aircraft. The product will leverage the cutting-edge distribution network.

In March 2025, Rokstone, a UK-based managing general agent (MGA) working under Aventum Group, launched a new aviation program for the Middle Eastern market.

The company aims to deliver its services to a larger number of manufacturers and cover increased aviation risks. As per official data, the company will offer a limit of USD 50 million for liability and USD 10 million for hull.

Aviation Insurance Market: Challenges

Growing risk of cybercrimes to challenge market expansion in the coming years

The global aviation insurance industry faces challenges due to the risk of growing cybercrimes. In recent times, aviation insurance providers have become increasingly dependent on advanced digital technologies such as cloud infrastructure and artificial intelligence (AI).

However, excessive digitization also poses the risk of a cyberattack, which can cause monumental losses to the relevant stakeholders.

Aviation Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aviation Insurance Market |

| Market Size in 2024 | USD 4.61 Billion |

| Market Forecast in 2034 | USD 8.30 Billion |

| Growth Rate | CAGR of 6.05% |

| Number of Pages | 215 |

| Key Companies Covered | AXA XL, Allianz Global Corporate & Specialty SE, Swiss Re Corporate Solutions Ltd, QBE Aviation, Willis Towers Watson, Aon plc, AIG (American International Group Inc.), Starr Aviation (Starr Indemnity & Liability Company), Great American Insurance Company, Global Aerospace Inc., Tokio Marine HCC, Munich Reinsurance Company, Hallmark Financial Services Inc., Old Republic Aerospace Inc., Chubb Limited., and others. |

| Segments Covered | By Type, By Application, By Product Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aviation Insurance Market: Segmentation

The global aviation insurance market is segmented based on type, application, product type, and region.

Based on the type, the global market segments are in-flight insurance, Combined Single Limit (CSL), passenger liability insurance, public liability insurance, and others. In 2024, the highest growth was listed in the Combined Single Limit (CSL) segment. This type of insurance eliminates the need to generate coverage for each type of risk. CSL encompasses all forms of insurance under one roof and hence witnesses a higher adoption rate. According to industry research, most private aircraft owners opt for insurance policies offering USD 1.1 million in terms of liability coverage.

Based on application, the global aviation insurance industry is divided into general & business aviation insurance, commercial aviation insurance, and others.

Based on the product type, the global market segments are aerospace, general aviation, contingent, space, and airlines. In 2024, the highest revenue was generated by the airline segment. Aircraft carriers generally own large fleets and a high frequency of flight operations. For instance, Etihad Airways owns around 98 aircraft equipped with different facilities. Moreover, airlines are more vulnerable to financial losses in case of an accident or an unwanted situation.

Aviation Insurance Market: Regional Analysis

North America to continue leading the market during the forecast period

The global aviation insurance market will be led by North America during the projection period. In 2024, it was the most dominant region, with the US leading the regional market revenue.

According to industry analysis, the US is home to one of the world’s most prominent aviation industries, with a wide range of airlines connecting global travelers. In addition to this, strict government safety regulations have further helped the region thrive. The growing demand for private aircraft and recreational flying machines will help the region generate massive revenue during the projection period.

Europe is projected to emerge as a crucial player in the global aviation insurance industry. The growing air traffic across European nations, primarily as a result of increased tourism, will promote regional expansion.

Furthermore, European safety standards are becoming stricter, creating the need for effective aviation insurance policies.

In 2025, the European Union announced a mandatory regulation requiring all aircraft operators in the region to carry liability insurance coverage concerning cargo, baggage, passengers, and third parties when the aircraft are operational in the European Union (EU) Member State territory.

Aviation Insurance Market: Competitive Analysis

The global aviation insurance market is led by players like:

- AXA XL

- Allianz Global Corporate & Specialty SE

- Swiss Re Corporate Solutions Ltd

- QBE Aviation

- Willis Towers Watson

- Aon plc

- AIG (American International Group Inc.)

- Starr Aviation (Starr Indemnity & Liability Company)

- Great American Insurance Company

- Global Aerospace Inc.

- Tokio Marine HCC

- Munich Reinsurance Company

- Hallmark Financial Services Inc.

- Old Republic Aerospace Inc.

- Chubb Limited.

The global aviation insurance market is segmented as follows:

By Type

- In-Flight Insurance

- Combined Single Limit (CSL)

- Passenger Liability Insurance

- Public Liability Insurance

- Others

By Application

- General & Business Aviation Insurance

- Commercial Aviation Insurance

- Others

By Product Type

- Aerospace

- General Aviation

- Contingent

- Space

- Airlines

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aviation insurance is a financial risk-minimizing and management policy specially designed for the aviation industry.

The global aviation insurance market is expected to be led by increasing air traffic across the globe.

According to study, the global aviation insurance market size was worth around USD 4.61 billion in 2024 and is predicted to grow to around USD 8.30 billion by 2034.

The CAGR value of the aviation insurance market is expected to be around 6.05% during 2025-2034.

The global aviation insurance market will be led by North America during the projection period.

The global aviation insurance market is led by players like AXA XL, Allianz Global Corporate & Specialty SE, Swiss Re Corporate Solutions Ltd, QBE Aviation, Willis Towers Watson, Aon plc, AIG (American International Group Inc.), Starr Aviation (Starr Indemnity & Liability Company), Great American Insurance Company, Global Aerospace Inc., Tokio Marine HCC, Munich Reinsurance Company, Hallmark Financial Services Inc., Old Republic Aerospace, Inc., and Chubb Limited.

The report explores crucial aspects of the aviation insurance market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed