Cervical Cancer Screening Market Size, Trend, Growth, Industry Analysis 2034

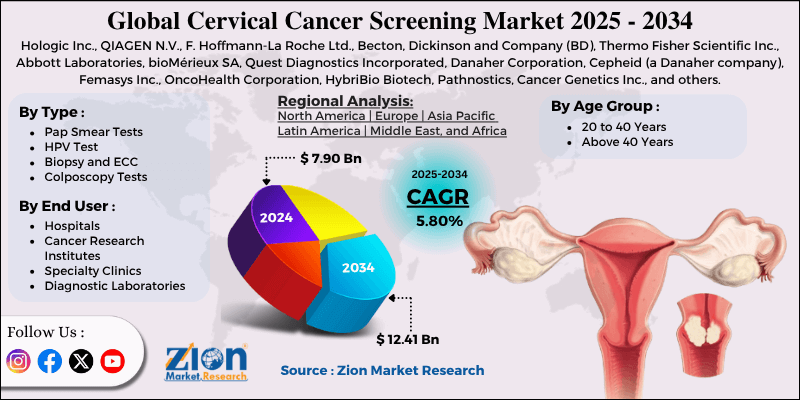

Cervical Cancer Screening Market By Type (Pap Smear Tests, HPV Test Biopsy and ECC, Colposcopy Tests, and Others), By Age Group (20 to 40 Years, Above 40 Years), By End-User (Hospitals, Cancer Research Institutes, Specialty Clinics, Diagnostic Laboratories), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

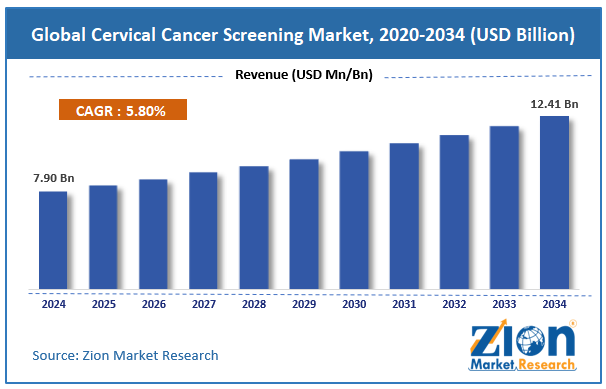

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.90 Billion | USD 12.41 Billion | 5.80% | 2024 |

Cervical Cancer Screening Industry Perspective:

The global cervical cancer screening market size was approximately USD 7.90 billion in 2024 and is projected to reach around USD 12.41 billion by 2034, with a compound annual growth rate (CAGR) of approximately 5.80% between 2025 and 2034.

Cervical Cancer Screening Market: Overview

Cervical cancer screening is a crucial preventive healthcare measure that detects precancerous changes and early stages of cervical cancer in females. It comprises human papillomavirus (HPV) and Pap smear testing to detect abnormal cervical cells and high-risk HPV strains. Early detection through screening majorly reduces cervical cancer rates and deaths by facilitating early and timely treatment. The global cervical cancer screening market is expected to expand rapidly, driven by the increasing number of screening programs and government initiatives, advancements in screening technologies, and growing educational campaigns and awareness. International and national health agencies are implementing cervical cancer screening programs, primarily in developing nations. These programs are gaining demand for diagnostic services and access.

Advancements such as dual-stain testing, molecular diagnostics, and liquid-based cytology are enhancing test accuracy and reducing the incidence of false positives. The incorporation of AI in image analysis and cytopathology improves early detection. These technological improvements enhance the accessibility and efficiency of screening.

Furthermore, public awareness campaigns by the governments and NGOs have enriched knowledge on cervical cancer risks and HPV. For example, events like Cervical Health Awareness Month encourage routine screening. Increased awareness is leading to higher demand for screenings. Also, public awareness campaigns by the government and NGOs have enriched knowledge on cervical cancer risks and HPV. For example, programs like Cervical Health Awareness Month encourage routine screening. Higher awareness is elevating the demand for more screenings.

Despite the growth, the global market is hindered by factors such as social and cultural barriers, as well as the high cost of advanced screening methods. Taboos, stigma, and a lack of female health professionals prevent women from undergoing screening methods. In conservative regions, discussions on reproductive health are still constrained. These factors majorly lessen participation in screening programs.

Additionally, advanced tests like liquid-based cytology and genotyping are more expensive than traditional Pap smears, which prevents patients and healthcare systems from adopting them. Cost is still a key barrier to scaling novel technologies in low-resource settings. Nonetheless, the global cervical cancer screening industry stands to gain from a few key opportunities, like the adoption of ML and AI and the development of budget-friendly POC tests. AI-based diagnostic tools can automate Pap smear analysis and accurately identify anomalies.

For instance, Hologic’s Genius Diagnostics platform utilizes artificial intelligence for image-guided screening. Tech-based screening presents new opportunities for providers. Moreover, affordable POC tests can reduce the gap in the underprivileged areas. Speedy HPV DNA tests are being utilized in resource-limited settings with limited laboratory infrastructure. Improvements may democratize screening worldwide.

Key Insights:

- As per the analysis shared by our research analyst, the global cervical cancer screening market is estimated to grow annually at a CAGR of around 5.80% over the forecast period (2025-2034)

- In terms of revenue, the global cervical cancer screening market size was valued at around USD 7.90 billion in 2024 and is projected to reach USD 12.41 billion by 2034.

- The cervical cancer screening market is projected to grow significantly due to increasing education programs and awareness, rising demand for preventive care and early detection, and advancements in diagnostic tools.

- Based on type, the Pap smear tests segment is expected to lead the market, while the HPV test segment is anticipated to experience significant growth.

- Based on age group, the '20 to 40 year' segment is the dominant segment, while the 'above 40 year' segment is projected to witness sizable revenue growth over the forecast period.

- Based on end-user, the hospitals segment is expected to lead the market compared to the diagnostic laboratories segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Cervical Cancer Screening Market: Growth Drivers

Growing integration with HPV vaccination programs propels the market growth

The rising adoption of HPV vaccination programs is closely associated with cervical cancer screening efforts. As more nations integrate screening and vaccination under a single reproductive health framework, the demand for long-term monitoring of vaccinated cohorts is driving the need for high-quality screening tests.

The WHO reported that nearly 140 countries had launched HPV vaccines, with several, such as the UK and Rwanda, achieving vaccination coverage of more than 80 percent among eligible females. These programs need ongoing screening to identify rare vaccine infections or breakthroughs with non-covered HPV strains.

Technological improvements in screening techniques notably fuel the market growth

The development and adoption of modernized screening technologies, such as AI-based image analysis, HPV DNA testing, and self-sampling kits, are significantly transforming the cervical cancer screening market. Conventional Pap tests are being progressively complemented and, in certain regions, substituted by high-sensitivity HPV molecular diagnostics.

For instance, the QIAreach HPV test by QIAGEN introduced a portable and low-priced digital screening solution that enhances early detection in low and middle-income countries.

Cervical Cancer Screening Market: Restraints

Inconsistent implementation and screening guidelines negatively impact market progress

The lack of standardized global screening protocols and inconsistencies in national guidelines are leading to variations in screening practices. Different nations still employ varying screening methods, ages, and intervals, resulting in inefficiency and confusion in the adoption process.

An IARC report (2024) highlighted that over 60 countries still lack a formal national screening policy, resulting in suboptimal coverage and inadequate monitoring. This regulatory fragmentation limits the harmonization and scalability of global cervical cancer screening efforts.

Cervical Cancer Screening Market: Opportunities

Bundled vaccination and diagnostic programs positively impact market growth

The opportunity to offer bundled services, integrating screening and follow-up diagnostics with HPV vaccinations, is gaining prominence as health systems and governments incline towards integrated care models. Bundling streamlines service delivery and enhances patient compliance.

In 2023, Unitaid and Gavi introduced a $30 million initiative to incorporate vaccination and screening in 9 African nations. Early results from Zambia and Rwanda showed that bundling leads to a 2.5-fold increase in follow-up compliance and a 40 percent decrease in missed cases compared to discrete programs, thereby impacting the cervical cancer screening industry.

Cervical Cancer Screening Market: Challenges

Logistical and supply chain constraints restrict the growth of the market

Supply chain and logistical issues, mainly in remote or rural areas, continue to disturb the continuous delivery of cervical cancer screening services. These problems include the lack of test kits, reagents, sample processing capacity, and transport systems, primarily in low- and middle-income countries. Political instability, natural disasters, and pandemics may further hinder access. For instance, recent political unrest in Sudan and floods in Bangladesh temporarily shut down cervical cancer screening campaigns in several regions in the past year. This underscored the instability of current supply systems.

Cervical Cancer Screening Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cervical Cancer Screening Market |

| Market Size in 2024 | USD 7.90 Billion |

| Market Forecast in 2034 | USD 12.41 Billion |

| Growth Rate | CAGR of 5.80% |

| Number of Pages | 215 |

| Key Companies Covered | Hologic Inc., QIAGEN N.V., F. Hoffmann-La Roche Ltd., Becton, Dickinson and Company (BD), Thermo Fisher Scientific Inc., Abbott Laboratories, bioMérieux SA, Quest Diagnostics Incorporated, Danaher Corporation, Cepheid (a Danaher company), Femasys Inc., OncoHealth Corporation, HybriBio Biotech, Pathnostics, Cancer Genetics Inc., and others. |

| Segments Covered | By Type, By Age Group, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cervical Cancer Screening Market: Segmentation

The global cervical cancer screening market is segmented based on type, age group, end user, and region.

Based on type, the global cervical cancer screening industry is divided into pap smear tests, HPV tests, biopsy and ECC, colposcopy tests, and others. The Pap smear test segment registered a substantial market share due to its simplicity, affordability, and long-standing clinical acceptance. They are usually the primary tests in the low-income and high-income nations, mainly where HPV testing is not standard. Their routine inclusion in national screening protocols fuels their dominance.

Based on age group, the global cervical cancer screening market is segmented into 20 to 40 years and above 40 years. The 20 to 40 segment holds a notable market share due to a strong public health focus on early detection and prevention. Women in this age group are expected to engage with reproductive health services, experience gynecological exams, undergo routine check-ups, and respond to awareness campaigns. Higher access to Pap smears and HPV co-testing, particularly in semi-urban and urban regions, supports the prominence of this age range.

Based on end-user, the global market is segmented into hospitals, cancer research institutes, specialty clinics, and diagnostic laboratories. The hospitals segment captures a larger share of the market due to their ability to offer comprehensive diagnostic tools, such as HPV DNA testing platforms, Pap smear labs, and colposcopy equipment, all under one roof. In several countries, routine screenings are conducted during gynecological check-ups in hospitals, primarily in urban settings. Their skilled health professionals, infrastructure, and incorporation with public health systems increase their industry dominance.

Cervical Cancer Screening Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is expected to maintain its leading position in the global cervical cancer screening market due to well-developed screening programs, robust healthcare infrastructure and expenditure, and rapid adoption of self-sampling kits and HPV testing. North America, mainly the U.S. and Canada, has well-developed and better-funded cervical cancer screening initiatives. For instance, the United States Preventive Services Task Force suggests routine Pap smears and HPV testing, adding to broader compliance.

Moreover, the region spends majorly on healthcare, allowing investment in digital screening technologies and advanced diagnostic tools. Diagnostic labs and hospitals are equipped with AI-driven cytology tools, HPV genotyping systems, and liquid-based cytology. This technological advantage facilitates large-scale and more precise screening programs. Canada and the United States are the early adopters of primary HPV testing, substituting Pap smears in several screening protocols. Additionally, companies like Nurx and Everlywell offer home HPV testing, which gained popularity following the pandemic. This advancement has increased access, mainly among the remote and younger populations.

Europe ranks as the second-largest region in the global cervical cancer screening industry, mainly due to the widespread implementation of national screening programs, early adoption of HPV screening, and a robust regulatory and research infrastructure. A majority of European nations have population-based and organized cervical cancer screening programs, which have better participation rates. These government-led programs promise routine HPV and Pap testing at regular intervals. Europe is also an early adopter of primary HPV testing, particularly in countries such as Finland, Germany, and the United Kingdom.

The European Guidelines for Quality Assurance now suggest HPV testing as the primary method, driving the demand for molecular diagnostics. Moreover, Europe's regulatory bodies, like the National Health Ministries and EMA, encourage quality control and evidence-based screening policies. Research initiatives partner with diagnostic companies to refine testing solutions. Initiatives like Horizon Europe fund innovation in cancer diagnostics, boosting the regional dominance.

Cervical Cancer Screening Market: Competitive Analysis

The key players profiled in the global cervical cancer screening market comprise:

- Luxottica Group S.p.A.

- EssilorLuxottica

- Safilo Group S.p.A.

- Marchon Eyewear Inc.

- Marcolin S.p.A.

- De Rigo Vision S.p.A.

- Kering Eyewear

- LVMH (Louis Vuitton Moët Hennessy)

- Chanel

- Prada Group

- Dolce & Gabbana

- Ray-Ban

- Maui Jim Inc.

- Oakley Inc.

- Tom Ford Eyewear

Cervical Cancer Screening Market: Key Market Trends

Growth of at-home HPV test kits and self-sampling:

The demand for self-sampling HPV testing kits is surging, mainly after the COVID-19 pandemic, which amplified the use of home diagnostics. Companies like Nurx, Everlywell, and LetsGetChecked are offering convenient home-based kits. This trend enhances access for underserved populations and increases screening rates.

Integration of digital cytology and AI:

AI-based digital cytology platforms and image analysis are changing laboratory workflows by automating the review of HPV and Pap smear samples. Leading companies, such as BD and Hologic, have launched AI-driven screening systems that enhance diagnostic efficiency and accuracy. This innovation decreases human error and supports early detection on a large scale.

The global cervical cancer screening market is segmented as follows:

By Type

- Pap Smear Tests

- HPV Test

- Biopsy and ECC

- Colposcopy Tests

- Others

By Age Group

- 20 to 40 Years

- Above 40 Years

By End User

- Hospitals

- Cancer Research Institutes

- Specialty Clinics

- Diagnostic Laboratories

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Cervical cancer screening is a crucial preventive healthcare measure that detects precancerous changes and early stages of cervical cancer in females. It comprises human papillomavirus (HPV) and Pap smear testing to detect abnormal cervical cells and high-risk HPV strains. Early detection through screening majorly reduces cervical cancer rates and deaths by facilitating early and timely treatment.

The global cervical cancer screening market is projected to grow due to rising adoption of HPV testing, escalating cases of cervical cancer, and the incorporation of digital health solutions and AI in diagnostics.

According to study, the global cervical cancer screening market size was worth around USD 7.90 billion in 2024 and is predicted to grow to around USD 12.41 billion by 2034.

The CAGR value of the cervical cancer screening market is expected to be approximately 5.80% from 2025 to 2034.

North America is expected to lead the global cervical cancer screening market during the forecast period.

The key players profiled in the global cervical cancer screening market include Hologic, Inc., QIAGEN N.V., F. Hoffmann-La Roche Ltd., Becton, Dickinson and Company (BD), Thermo Fisher Scientific Inc., Abbott Laboratories, bioMérieux SA, Quest Diagnostics Incorporated, Danaher Corporation, Cepheid (a Danaher company), Femasys Inc., OncoHealth Corporation, HybriBio Biotech, Pathnostics, and Cancer Genetics Inc.

The report examines key aspects of the cervical cancer screening market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed