Molecular Diagnostics Market Size, Share, and Trends Analysis 2032

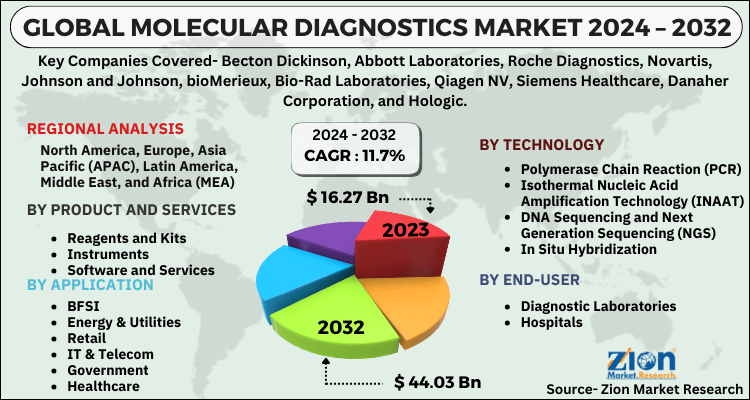

Molecular Diagnostics Market By Product & Services (Reagents and Kits, Instruments, and Software and Services), By Application (Genetic Tests, Infectious Diseases, Oncology, and Others), By Technology (PCR, INAAT, DNA Sequencing & NGS, In Situ Hybridization, DNA Microarrays, and Others), By End-User (Diagnostic Laboratories, Hospitals, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

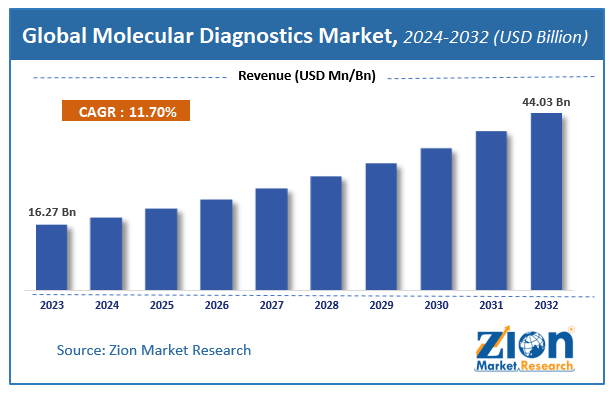

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.27 Billion | USD 44.03 Billion | 11.7% | 2023 |

Molecular Diagnostics Market: Industry Perspective

The global molecular diagnostics market size was worth around USD 16.27 billion in 2023 and is predicted to grow to around USD 44.03 billion by 2032 with a compound annual growth rate (CAGR) of roughly 11.7% between 2024 and 2032.

The report analyzes the global molecular diagnostics market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the molecular diagnostics industry.

Molecular Diagnostics Market: Overview

Molecular diagnostics includes the molecular biology techniques that are used for the detection of biomarkers present in genomes or proteomes. Molecular diagnostic consist of a family of techniques like PCR, DNA or gene microarray, INAAT, NGS, etc. Molecular diagnostics is the result of the fruitful interplay between genomics knowledge, laboratory medicine, and technology in the field of molecular genetics.

According to the WHO, cancer is the second leading mortality cause worldwide. The growing cancer prevalence worldwide is fueling the research activities for cancer treatment. As per the National Cancer Institute, in 2023, about 1,700,000 new cancer cases were diagnosed in the U.S. According to the Centers for Disease Control and Prevention, about 9,272 new cases of tuberculosis were registered in the U.S. in 2016. This growing incidence of infectious diseases and cancer is increasing the demand for molecular diagnostics techniques. The rapid advancements witnessed in the molecular biology technologies, development of molecular diagnostic technologies to automated processes, growing awareness about molecular diagnostics usage for the detection of different diseases in developing countries, and increasing government funding for research in molecular biology are driving the global molecular diagnostics market. However, the high cost of technologies and the lack of a skilled workforce to handle the instruments are hindering the global molecular diagnostics market growth.

Molecular Diagnostics Market: Segmentation

The molecular diagnostics market is fragmented into product and services, application, technology, and end-user.

Based on product and services, the molecular diagnostics market includes instruments, reagents and kits, and software and services. The application segment of the molecular diagnostics market includes genetic tests, infectious diseases (HIV, hepatitis, HPV, CT/NG, influenza, TB, and others), oncology (life breast cancer, lung cancer, colorectal cancer, prostate cancer, and other cancers), and others. The oncology segment is projected to show the highest growth rate in the molecular diagnostics market in the years ahead.

Based on technology, the market is fragmented into DNA microarrays, DNA sequencing and NGS, polymerase chain reaction, in situ hybridization, isothermal nucleic acid amplification technology, and others.

The end-user segment comprises diagnostic laboratories, hospitals, and others.

Molecular Diagnostics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Molecular Diagnostics Market |

| Market Size in 2023 | USD 16.27 Billion |

| Market Forecast in 2032 | USD 44.03 Billion |

| Growth Rate | CAGR of 11.7% |

| Number of Pages | 110 |

| Key Companies Covered | Becton Dickinson, Abbott Laboratories, Roche Diagnostics, Novartis, Johnson and Johnson, bioMerieux, Bio-Rad Laboratories, Qiagen NV, Siemens Healthcare, Danaher Corporation, and Hologic |

| Segments Covered | By Product And Services, By Application, By Technology, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Molecular Diagnostics Market: Regional Analysis

By region, North America dominated the market in 2023, owing to the early introduction of highly developed equipment for research activities, the presence of highly skilled workforce, and an increase in the number of projects for the development of new molecular diagnostic technologies. The Asia Pacific molecular diagnostics market is anticipated to show the highest year-to-year growth in the upcoming years, due to the rising investments by government and leading companies for R&D, high prevalence of infectious diseases in the developing countries of China and India, and growing awareness about molecular diagnostics usage for different disease detection.

Molecular Diagnostics Market: Competitive Analysis

Some of the major players in the global molecular diagnostics market include:

- Becton, Dickinson and Company

- Abbott Laboratories

- Roche Diagnostics

- Novartis

- Johnson and Johnson

- bioMerieux

- Bio-Rad Laboratories

- Qiagen NV

- Siemens Healthcare

- Danaher Corporation

- Hologic

The global molecular diagnostics market is segmented as follows;

Global Molecular Diagnostics Market: Product and Services Analysis

- Reagents and Kits

- Instruments

- Software and Services

Global Molecular Diagnostics Market: Application Analysis

- Genetic Tests

- Infectious Diseases

- Hepatitis

- HIV

- CT/NG

- HPV

- TB

- Influenza

- Others

- Oncology

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Other Cancers

- Others

Global Molecular Diagnostics Market: Technology Analysis

- Polymerase Chain Reaction (PCR)

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- DNA Sequencing and Next Generation Sequencing (NGS)

- In Situ Hybridization

- DNA Microarrays

- Others

Global Molecular Diagnostics Market: End-User Analysis

- Diagnostic Laboratories

- Hospitals

- Others

Global Molecular Diagnostics Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Molecular diagnostics is a branch of laboratory medicine that analyzes biological markers in a patient's genome and proteome to diagnose and monitor disease. It involves studying DNA, RNA, and proteins to identify genetic mutations, infectious agents, and other abnormalities associated with diseases. This technology is crucial for early disease detection, personalized medicine, and treatment monitoring.

According to a study, the global molecular diagnostics market size was worth around USD 16.27 billion in 2023 and is expected to reach USD 44.03 billion by 2032.

The global molecular diagnostics market is expected to grow at a CAGR of 11.7% during the forecast period.

North America is expected to dominate the molecular diagnostics market over the forecast period.

Leading players in the global molecular diagnostics market include Becton Dickinson, Abbott Laboratories, Roche Diagnostics, Novartis, Johnson and Johnson, bioMerieux, Bio-Rad Laboratories, Qiagen NV, Siemens Healthcare, Danaher Corporation, and Hologic, among others.

The molecular diagnostics market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed